Markets gradually confirm central bankers' cautious stance

Link

-

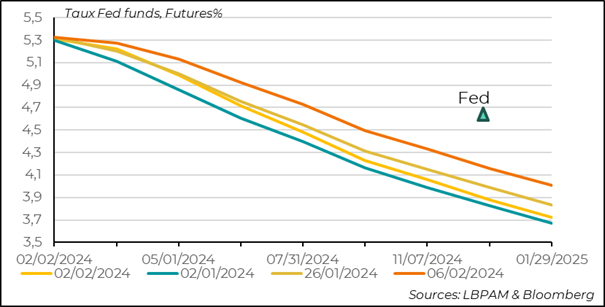

The market continues to reduce its expectations of key rate cuts in both the US and Europe. But, particularly for the US, they remain above our projections and those of the Fed.

-

These revisions come on the back of better-than-expected US economic figures, which show that the economy is not landing and are therefore fuelling the possibility that inflationary pressures will persist.

-

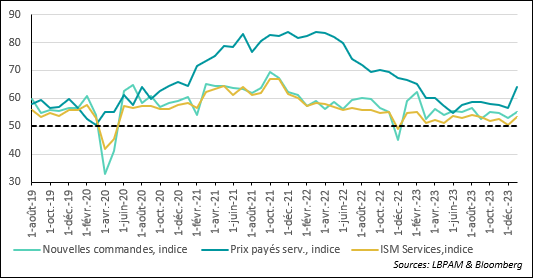

Across the Atlantic, the ISM services survey for January showed an acceleration in activity, with the index recovering the ground lost in 4Q24. New orders are accelerating, while price pressures are rising sharply, justifying the Fed's cautious stance on rate cuts.

-

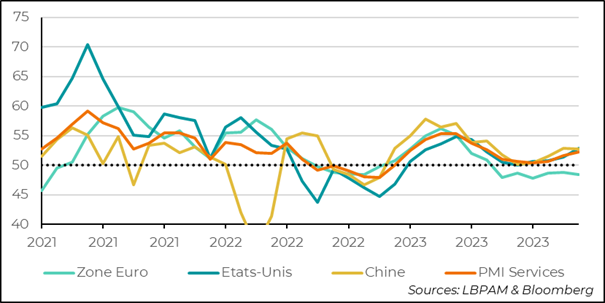

In fact, the S&P composite PMI (services and industry) compiled by JP Morgan continued to rise in January, driven by the US, but also by some emerging countries. The Eurozone is lagging behind, although activity is deteriorating less. Overall, global growth appears to be stabilising.

-

In the United States, the Fed's survey of bank lending shows that banks are continuing to adopt a very cautious policy. This is particularly evident in commercial property, echoing the difficulties of NY Community Bancorp. Bank lending is likely to remain constrained, helping to calm activity, as the Fed wants.

-

In China, the authorities are continuing to try to support the stock market. The MSCI China index has fallen to its lowest level for 10 years, in stark contrast to most world indices. President Xi seems to be worried about the loss of investor confidence in China. For the time being, government intervention is bearing fruit, with stock prices recovering. Nevertheless, it will take weeks to see whether confidence returns rather than a few days.

-

In view of the resilience of the US economy, and despite our view that monetary policy is likely to ease more slowly than the market expects, we are seeking broad diversification in our allocations, with few strong bets between major asset classes, but with stronger bets within them, such as selectively in HY in credit and quality stocks, with reasonable valuations in equities.

The process of reducing expectations of rate cuts by the major central banks for 2024 has continued. Indeed, for both the ECB and the Fed, almost two rate cuts that had been expected until recently have been eliminated from the low points that had been reached. Moreover, the idea of very rapid rate cuts as early as the first quarter of 2024 has disappeared.

This is partly due to the more cautious stance taken by central bankers. Indeed, most are insisting on the need for vigilance in the path of monetary policy easing, while inflation is still well above target.

In the eurozone, given the weakness of growth, we believe that the disinflation process should continue, even if wage pressures remain an unknown factor, in a context where the unemployment rate remains historically low. A fortnight ago, Mrs Lagarde indicated that, according to the ECB's wage monitoring statistics for the eurozone, wage growth appeared to be moderating. It should be remembered that negotiated wages were still growing at 4.7% in 3Q23.

In the United States, after the cautious comments made by Fed Chairman Jay Powell at the press conference following the January monetary policy meeting and repeated in his interview on the abc channel this weekend, other members of the monetary policy committee stressed the need for patience before cutting rates. Cleveland Fed President L. Mester said yesterday that she thought rate cuts might be appropriate, but only later in the year.

These remarks by the US central bankers also come against a backdrop of much stronger than expected economic data. Instead of seeing a landing for the economy, we are seeing more robust growth, with the potential for increased inflationary pressures persisting in certain sectors of the economy.

Fig.1 Fed: The market has continued to review its plans for rate cuts in 2024.

We continue to believe that there will be fewer rate cuts by the Fed and, above all, that they will begin in the spring at the earliest.

In fact, the latest economic statistics have surprised on the upside, which suggests that the Fed should be patient. At the start of the week, activity in the services sector proved much stronger than expected. Indeed, the ISM services survey rose much more than expected in January. At 53.4, the index erased the moderation seen in 4Q23. This better performance came from most of the components, notably new orders, but also employment, which is not surprising given the figures in January's employment report.

On the other hand, this robustness in activity seems to be translating into new inflationary pressures. Indeed, the price sub-index is rising quite sharply. We will have to wait and see over the coming months whether these pressures persist, which could complicate the Fed's work.

Fig.2 United States: Activity in services picks up, but also translates into greater pressure on prices

In fact, this improved performance in services has been visible in many economies around the world. Even in the Eurozone, there has been an improvement. Nevertheless, although there has been a slight improvement in France and Germany, both countries are still seeing activity contract. This contrasts with peripheral countries such as Spain and Italy, where activity remains in the expansion zone.

Fig.3 PMIs: Services rebound globally according to JP Morgan composite indicator

All in all, the January PMI surveys give a positive message for the global economy, in that activity (services and industry) seems to be stabilising, even if the differences between countries remain significant, with the Eurozone in particular still lagging behind.

Fig.4 PMIs : The composite global PMI index (services and industry) is rising, continuing to indicate that economic activity is stabilising.

Despite this positive growth dynamic, particularly in the United States, we cannot continue to ignore those segments of the economy that remain fragile and continue to suffer the effects of monetary rigour.

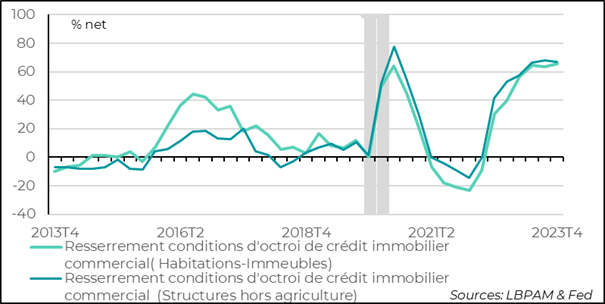

In this respect, the Fed's latest survey for 4Q24 on lending conditions for businesses, in particular, reveals that banks are still cautious. Banks are continuing to tighten credit conditions, albeit to a lesser extent than in the previous quarter. Nonetheless, these conditions remain among the tightest seen in the last three decades. This remains a drag on businesses, even if the improving economic situation, past government aid, and access to finance via the financial markets mean that the situation of businesses in general seems less constrained than is reflected by this indicator.

Fig.5 United States: In 4Q23, banks continued to indicate that they were tightening credit conditions for businesses, but less so than in the previous quarter.

At the same time, more specifically, the survey highlights what we already knew, but which remains one of the authorities' major concerns: the fragility of the commercial property sector. This concern has been amplified by the losses incurred by NY Community Bancorp, which has revealed heavy losses due to past provisions in this segment, to which it is highly exposed.

As a result, banks are continuing to restrict credit to this sector, part of which is in dire straits. It seems clear that this is one of the segments to be monitored for potential financial risks associated with monetary tightening and the structural changes that seem to be affecting the commercial property sector, with very sharp falls in property values.

Fig.6 United States : Commercial real estate lending remains the segment where banks are most cautious.