The american consumer remains unchanged and drives growth

Link

- Markets had so far shown little reaction to events in the Middle East, although some segments, such as the oil market, had benefited from a slight risk premium. In part, this sense of calm seemed to be reinforced by calls for restraint from the Israeli authorities in the face of their potential entry into Gaza. President Biden had even decided to visit the region to try and find a "just" way out, while supporting Israel. Unfortunately, a missile hit a hospital in Gaza, killing hundreds. Arab leaders, including those from the Palestinian Authority, Jordan and Egypt, who were due to meet President Biden, cancelled the meeting, holding Israel responsible for the attack. Israel, for its part, claimed that a defective missile launched by Hamas was responsible. Nevertheless, this underscores the far greater likelihood than previously estimated of the conflict spreading in the event of an Israeli ground attack into Gaza, as civilian casualties will be inevitable. The next few days will be crucial in determining whether the conflict will remain limited or not. Short-term caution is likely to dominate.

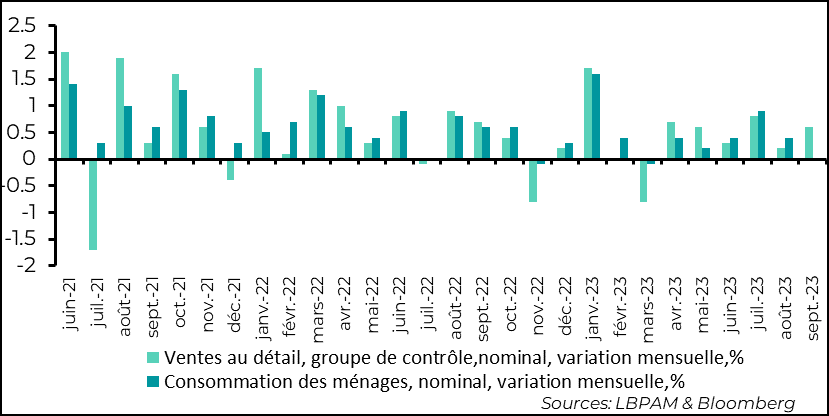

- While this conflict could have serious consequences, particularly in the event of a conflagration leading to a surge in oil prices, the market remained focused on economic dynamics, particularly in the United States. US statistics on household consumption, with the publication of retail sales for the month of September, once again surprised on the upside. They rose by 0.6% over the month for the control group used to estimate consumption of goods. In real terms, given the evolution of consumer prices over the month, this represents an increase of almost 1%! The American consumer is continuing to resist, and is certainly reducing his level of savings. For the Fed, this is certainly not the most reassuring message regarding inflationary pressures. Indeed, the bond market reacted very negatively to these figures. We still believe that the Fed will not move at the end of the month, but these figures reinforce the idea that it will maintain its restrictive bias and the threat of a possible further hike.

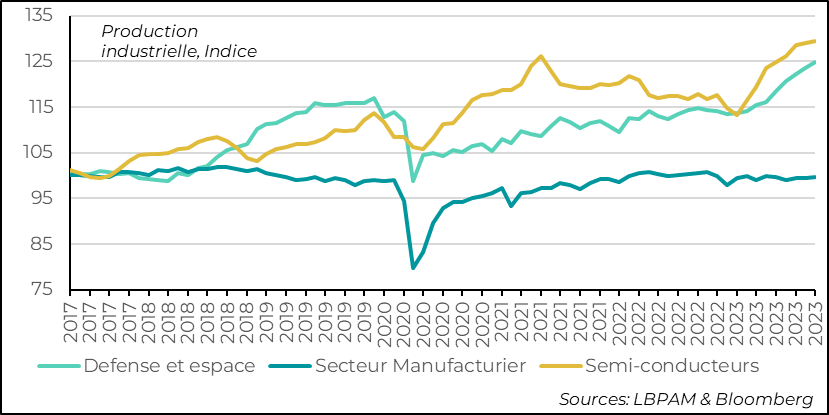

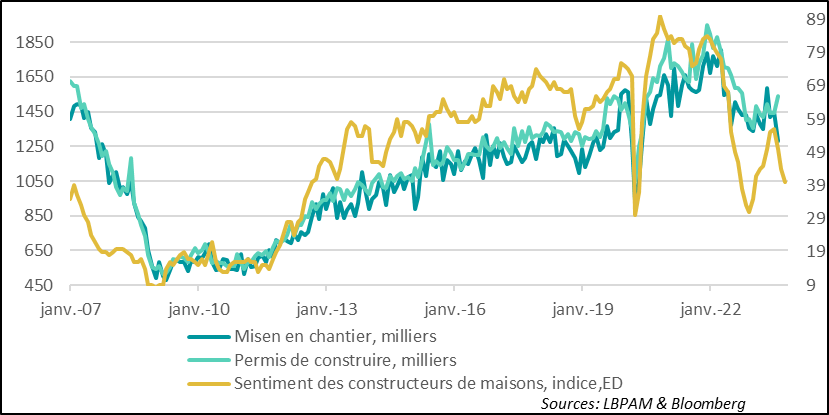

- The message from US industrial production was also rather positive, with a higher-than-expected rise of 0.3% over the month. Above all, some sectors maintained a very robust uptrend, notably, unsurprisingly, the energy sector, but also the defense and semiconductor sectors. This better performance corroborates the improvement in the ISM manufacturing index in recent months. Meanwhile, on the construction side, while factory construction (notably associated with the government's CHIPS and IRA incentive schemes) has been robust, homebuilder confidence continues to wane. This is consistent with the sharp rise in mortgage rates, with the 30-year rate close to 8%, the highest since 2000.

- In China, as the data seemed to indicate, growth appears to be stabilizing. Indeed, GDP expansion in 3Q23 was slightly better than expected at 4.9%. This is a reassuring factor for the authorities, who should be able to achieve their 5% target this year. However, momentum for 2024 remains very moderate. If consumption growth was higher than expected year-on-year in September, based on retail sales, at 5.5%, this is mainly due to base effects, as monthly expansion is clearly decelerating. In addition, the real estate sector remains weighed down. Nevertheless, industrial production remains buoyant, undoubtedly supported by public-sector projects. All in all, the outlook remains for weaker growth in 2024, unless greater public stimulus is provided.

- In Europe, after the final results of the Polish parliamentary elections, the most likely outcome is that Donald Tusk, leader of the Civic Platform, should be appointed Prime Minister. Although the ruling PiS (Law and Justice Party) won the most votes (35.6%), this will not be enough to secure a majority in Parliament. D. Tusk will be able to create a broad coalition with the centrist party (Third Way) and have a sufficient majority in Parliament. This is good news for Europe, as it will ease tensions with Poland arising from the government's reform of the legal framework. D. Tusk should be able to recover the 36 billion euros that have been blocked as a result of reforms that were deemed contrary to European law. However, a new government will have to wait until December.

The American consumer surprised again in September. Retail sales statistics came in well above expectations, up 0.7% in nominal terms. For the control group, i.e. the categories that allow us to estimate the evolution of goods consumption within GDP, the increase was just as robust at 0.6%. In real terms, given that prices of goods excluding energy and food fell in September, the increase was 1%!

Consumption therefore continues to drive growth, even if it was moderate in 2Q23.

Fig.1 United States: Retail sales in September were much stronger than expected, showing that the consumer continues to drive growth

This acceleration in consumption should further translate into a fall in the household savings rate and, in our view, continues to show that the US economy remains overheated. In addition, this shows that the very strong support from public spending for growth in 2023, estimated at almost 2 points of GDP, has indeed helped to maintain this momentum.

In part, this strength in consumption also supported production, as shown by the evolution of industrial output over the month, which rose by more than expected, to 0.3%. This is consistent with the gradual improvement in the ISM manufacturing index over recent months.

However, some sectors continue to post very strong growth, boosted by public spending and technological change. This is the case of the defense and semiconductor sectors, which are maintaining year-on-year growth of 9%. The strike in the automotive sector is likely to have a negative impact on growth in October, as the sector continues to catch up.

For the Fed, these data cannot reassure it about the disinflation dynamic. Thus, seeing consumption so robust does not bode well for seeing inflationary pressures dissipate as quickly as it would like.

We maintain our view that the monetary authorities' message of caution will remain in place, and that key rates will remain unchanged at the end-October meeting. However, these very robust activity figures, which should translate into GDP growth in 3Q23 that is much stronger than we had expected, perhaps in excess of 4% annualized, should prompt the Fed to maintain a restrictive bias and continue to raise the risk of a further rise in key rates.

Of course, some segments of the US economy still seem to be suffering from rising interest rates. This is particularly true of the real estate sector, at least according to the Home Builders Survey (NHAB), which has once again fallen sharply. In general, this indicator is fairly closely correlated with housing starts and building permit applications. We shall see today whether the figures in these areas confirm the negative message of this indicator. Nevertheless, mortgage rates approaching 8% for 30-year loans are bound to dampen demand.

Fig.3 United States: Homebuilder confidence indicator plunges again... see if housing starts and building permits follow suit

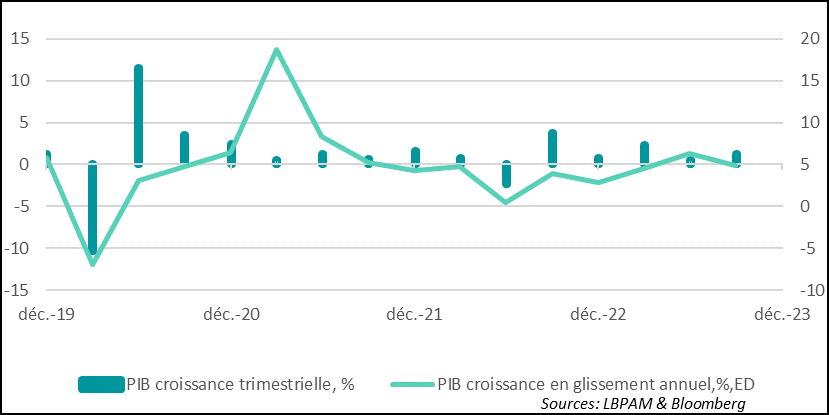

In China, GDP growth in 3Q23 was better than expected. Indeed, GDP grew by 4.9% year-on-year and 1.3% over the quarter, against 4.5% and 0.9% respectively expected by the consensus of economists. This seems to confirm the latest data indicating a stabilization of the Chinese economy.

As we believe, this dynamic activity should enable the authorities to achieve their target of 5% growth by 2023.

Fig.4 GDP growth came in stronger than expected in 3Q23, with quarterly growth of 1.3%.

Nevertheless, it would be premature to say that the Chinese economy is in a very solid recovery phase. Indeed, the real estate sector, which once accounted for almost a quarter of the Chinese economy, is still adjusting. Activity in the sector continued to decline year-on-year in September.

What's more, while industrial production seems to be driven mainly by public spending, when we look at consumption, we can't be completely reassured. Although retail sales were stronger than expected year-on-year and accelerated on the previous month, to 5.5%, monthly momentum is slowing. This is consistent with confidence having taken a serious hit. At the same time, and more encouragingly, the unemployment rate fell in September to 5%, from 5.2% in August.

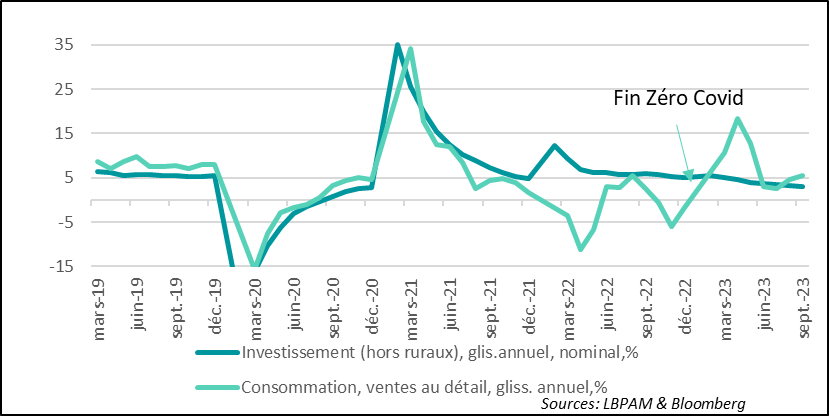

Fig.5 China: In September, retail sales accelerated year-on-year, but this is partly due to base effects, as monthly sales are slowing.

We still believe that the current growth momentum of the Chinese economy means that the 5% target set by the authorities for 2024 cannot be achieved without a more substantial stimulus package. This still does not seem to be on the agenda.