US inflation resists

Link

-

The US inflation figures are very bad. Total inflation is slowing less than expected and remains above 3%, as underlying inflation is stagnating at close to 4%, twice the Fed's target. What's more, inflation is accelerating again on a sequential basis, and the rise in prices is coming from the least volatile categories (housing and services excluding housing).

-

We mustn't overreact to a single data point, especially inflation in January, which is heavily impacted by annual price revisions. And we continue to think that underlying inflation will slow further in the coming months. That said, the risk that the slowdown in inflation will be slower than expected is increasing, and our fear that US inflation will stabilise at around 3% rather than 2% from the second half of the year is reinforced. This would be a disappointment for the consensus and the markets, which see inflation returning to target by the end of this year.

-

Clearly, this report should encourage the Fed to remain cautious before easing monetary policy. Our scenario remains that the Fed will start cutting rates in May and for a total of 100bp this year, bringing the key rate down to 4.35% by the end of 2024. But the risk of a later, smaller rate cut is increasing. Indeed, the market has sharply reduced its expectations of a rate cut by the Fed, so that the market's scenario finally seems reasonable to us.

-

In Europe, the latest data remain mixed. The ZEW indicators on current conditions in the German economy fell again in February, reinforcing the risk of recession. But the leading indicator continues to recover, which is encouraging for the months ahead. In addition, while the labour market may weaken slightly in France at the end of 2023, it remains solid in the other major countries. We continue to forecast that the Eurozone will continue to stagnate until mid-2024, but should avoid a full-blown recession.

-

In the UK, the labour market also remains resilient, with employment having returned to slight growth since the end of 2023 and the unemployment rate falling to just 3.8% at the end of the year. Against this backdrop, the easing in wage pressures remains slow, with wages still growing by more than 6% at the end of 2023. This should prompt the Bank of England to remain cautious and wait for the first rate cuts from the ECB and the Fed before starting to loosen its monetary policy.

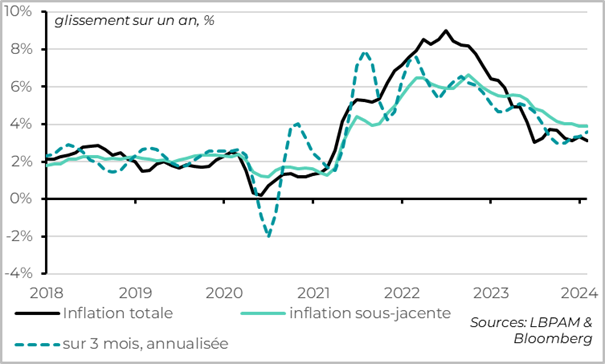

Fig.1 United States: underlying inflation does not slow down in January

- Overall inflation

- Core inflation

- Over 3 months, annualised

US inflation was 0.2pt above expectations in January and is accelerating again on a sequential basis.

Headline inflation fell from 3.4% to 3.1% thanks to lower energy prices, but remains above 3%, contrary to consensus expectations.

This comes from core inflation, which does not fall, remaining at 3.9% year-on-year. In fact, underlying inflation is picking up sequentially, with prices rising at an annualised rate of 3.6% over 6 months, 4.0% over 3 months and 4.8% over one month.

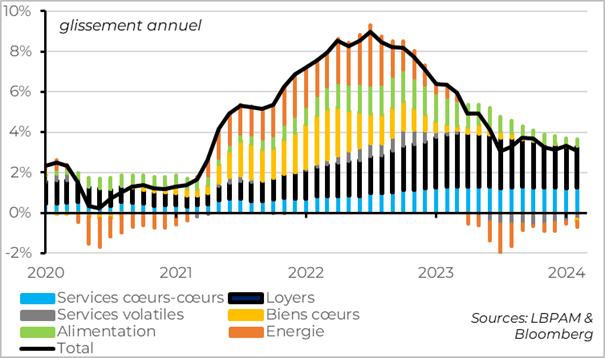

Fig.2 United States: less volatile parts of inflation remain high

- Heart-to-heart services

- Volatile services

- food

- Rents

- Good hearts

- Energy

The breakdown of January's inflation is disappointing, as the upward surprise comes from the less volatile prices, while disinflation in goods continues.

Disinflation in goods is continuing, although it is now expected to contribute less to the fall in inflation. Apart from energy prices (which are falling) and food prices (which are now rising at a normal rate), industrial goods inflation was negative in January for the first time since mid-2020. And this is not just due to the adjustment in second-hand car prices.

On the other hand, rents are not slowing as quickly as had been hoped. While we do not believe that the trend towards a slowdown in rents is in doubt, there is an increasing risk that it will be a slow one. Given that rents account for more than a third of CPI, this reduces the chances that underlying inflation will return to around 2% soon. The rise in rental prices in January (+0.6%) was the strongest for almost a year. Year-on-year, rents are slowing only marginally and remain above 6%.

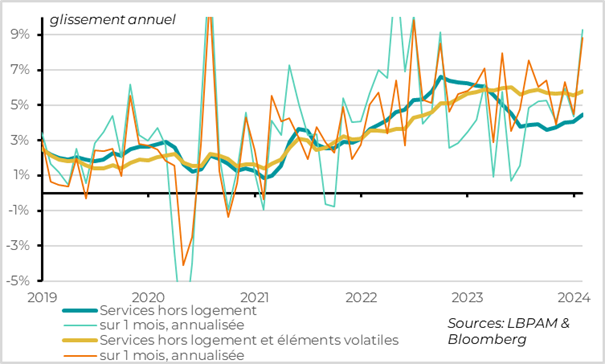

Fig.3 United States: inflation in services excluding housing remains persistent

- Services outside accommodation

- Over 1 month, annualised

- Services excluding housing and volatile items

- Over 1 month, annualised

Above all, inflation in services excluding housing picks up sharply at the start of 2024 and remains very high. While the acceleration in January should not be exaggerated, the fact that inflation is most closely linked to inflationary pressures from domestic demand and wage costs is a problem for the Fed.

The price of services excluding housing rose by 0.7% in January following a 0.4% increase in December, which is the biggest rise since mid-2022. This pushes up inflation in services excluding housing over one year from 4.1% to 4.5% year-on-year, a 9-month high.

This acceleration is exaggerated by specific factors, such as the adjustment in the prices of certain services at the start of the year and the end of the normalisation of prices in services that have been heavily impacted by covid and the 2022 energy shock (transport, tourism, etc.).

But this confirms our view that domestic inflationary pressures are not really easing and remain too high. The price of core services, excluding volatile items, has been broadly stable over the past year at around 5.5-6%, and shows no sign of slowing.

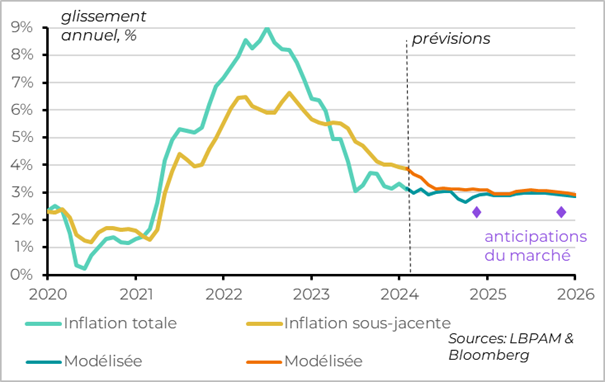

Fig.4 United States: disinflation unchallenged, but more questions about landing

- Total inflation

- Modelled

- Underlying inflation

- Modelled

Above all, inflation in services excluding housing picks up sharply at the start of 2024 and remains very high. While the acceleration in January should not be exaggerated, the fact that inflation is most closely linked to inflationary pressures from domestic demand and wage costs is a problem for the Fed.

The price of services excluding housing rose by 0.7% in January following a 0.4% increase in December, which is the biggest rise since mid-2022. This pushes up inflation in services excluding housing over one year from 4.1% to 4.5% year-on-year, a 9-month high.

This acceleration is exaggerated by specific factors, such as the adjustment in the prices of certain services at the start of the year and the end of the normalisation of prices in services that have been heavily impacted by covid and the 2022 energy shock (transport, tourism, etc.).

But this confirms our view that domestic inflationary pressures are not really easing and remain too high. The price of core services, excluding volatile items, has been broadly stable over the past year at around 5.5-6%, and shows no sign of slowing.

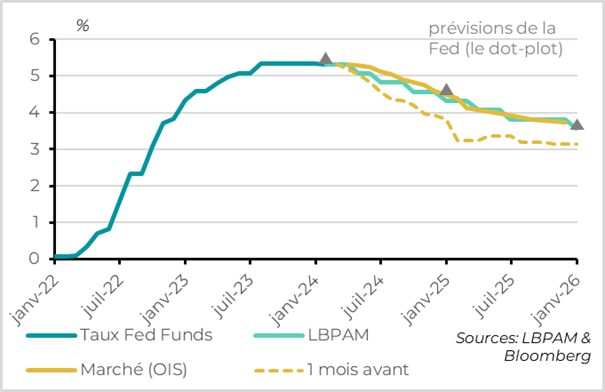

Fig.5 United States: the market is in line with our scenario and that of the Fed

- Fed Funds rate

- Market (OIS)

- LBP AM

- 1 month before

Our scenario for the Fed remains that it starts cutting rates in May and for a total of 100bp this year, bringing the key rate down to 4.35% by the end of 2024. Of course, the bullish surprise on inflation adds to the signs of resilience in the US economy and increases the chances that the Fed will be more cautious, delaying the start of rate cuts and their amplitude. That said, we believe that the Fed could still start to ease monetary policy gradually in the spring, as wages begin to slow gradually, SMEs point to a gradual easing of domestic tensions, inflation expectations are well anchored and prices are slowing a little faster in the indicator that the Fed tracks (the consumer price deflator or CPI).

The market sharply reduced its expectations of rate cuts by the Fed after the inflation figure, so that the market's scenario finally seems reasonable to us. For the first time since November, the market is attaching a probability of less than 50% to a rate cut before June and pricing in less than 100bp of rate cuts for this year

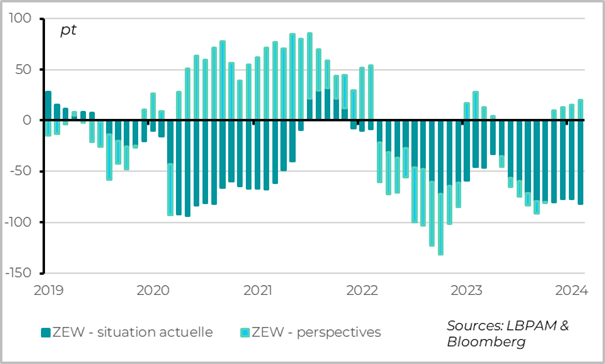

Fig.6 Germany: Zew survey again mixed in February

- ZEW - current situation

- ZEW - outlook

Business activity in the Eurozone remains depressed at the start of 2024, but the outlook continues to suggest a slight recovery in the months ahead.

The ZEW survey of investors (not businesses or households) should be treated with caution, but it has historically been a fairly good leading indicator of cyclical downturns.

Consequently, the continued rise in the outlook in February, after returning to positive territory at the end of 2023, is encouraging. The good employment situation in Germany and the prospect of a rate cut are supporting confidence. That said, the component on the current state of the German economy fell quite sharply in February to its lowest level since the Covid shock. This suggests that the malaise in industry (output fell by a further 1.6% in December) continues to weigh on the economy in early 2024, increasing the risk that German GDP will fall again in Q1 after dropping by 0.3% in Q4 2023.

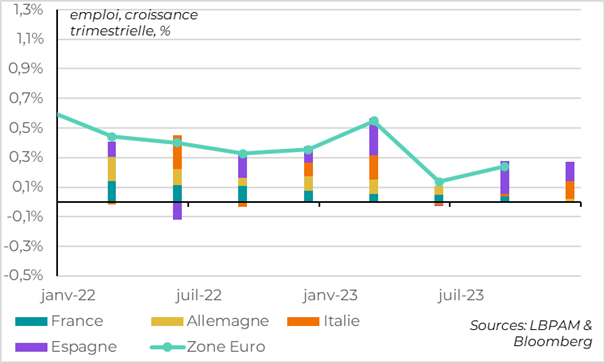

Fig.7 Eurozone: employment still holding up well outside France at the end of 2023

- France

- Spain

- Germany

- Euro zone

- Italy

Employment continues to hold up well in the Eurozone, even if it is gradually slowing. Combined with the fact that inflation is falling faster than wages, this should support household purchasing power in 2024.

The latest data on the French labour market is a little disappointing. The unemployment rate rose in mainland France at the end of 2023 (to 7.3% from a low of 6.9% at the start of 2023). And private employment stagnated in Q4 for the first time since the Covid.

But this is offset by persistently positive data from the zone's other main economies. The unemployment rate remains stable in Germany at the end of 2023, and continues to fall in Italy and Spain. Employment is also rising in Q4 in these four countries, suggesting a continuation of the rise in employment in the Zone.