25bp or 50bp Fed rate cut, that's always the question

09.09.2024

Link

Xavier Chapard's in-depth analysis of the Fed rate cut is featured in the September 09, 2024 market review.

In summary

►August's long-awaited jobs reports failed to provide a definitive answer as to the extent of the slowdown in the US labour market. This leaves open the question of whether the Fed will start cutting rates next week with a classic 25bp cut, or a more aggressive 50bp cut.

►The employment trend continues to slow markedly, with 142,000 new jobs created in August, after just 89,000 in July. And the rise in the unemployment rate over the last few months is large enough to indicate a significant risk of recession according to the Sahm rule. That said, employment remains positive and the unemployment rate fell slightly in August from 4.3% to 4.2%. Also, wage income rose sharply in August, thanks to higher average wages and hours worked. All in all, this does not suggest, as things stand, that a decisive cyclical turnaround towards recession is underway.

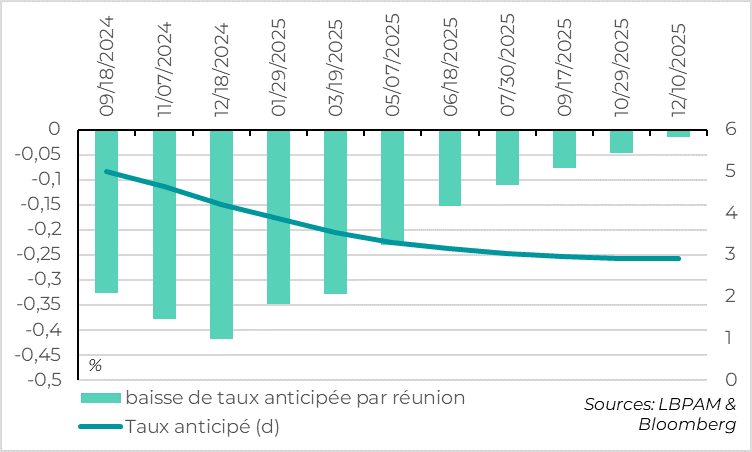

►The latest figures remain consistent with our scenario of a significant slowdown in the US economy over the coming months, but with the risk of recession still limited. With inflation slowing but still above target, we expect the Fed to cut rates by 25bp at its three meetings between now and the end of the year. But Powell's very accommodating speech at Jackson Hole, which was not clearly contradicted by the other Fed members, increases the chances of an initial 50bp cut.

►The market revised its expectations little after Friday's figures, and gives a 50bp cut next week a one-in-three chance, which seems reasonable given the uncertainties. On the other hand, market expectations for the rest of the year seem very aggressive, with over 100bp of rate cuts by the end of the year and 125bp next year. For risky assets, Fed rate cuts are positive. However, too aggressive a cut could be negative, as it would suggest that the economic situation is worse than anticipated.

►This week, while the Fed is in its silent period, Wednesday's US inflation data will be the last piece of data before its next meeting that could impact the decision. But given the Fed's great confidence in disinflation at the moment, it would take a big surprise for this to have an impact.

►Beyond that, the macro calendar is fairly light this week, apart from the ECB meeting on Thursday. The ECB is almost certain to cut rates to 3.5%. But it is unlikely to make a clear commitment as to what will happen next, as macro forecasts are unlikely to be significantly revised and fears about persistent inflation in services and wages remain high.

To go deeper

United States: employment slows but remains positive

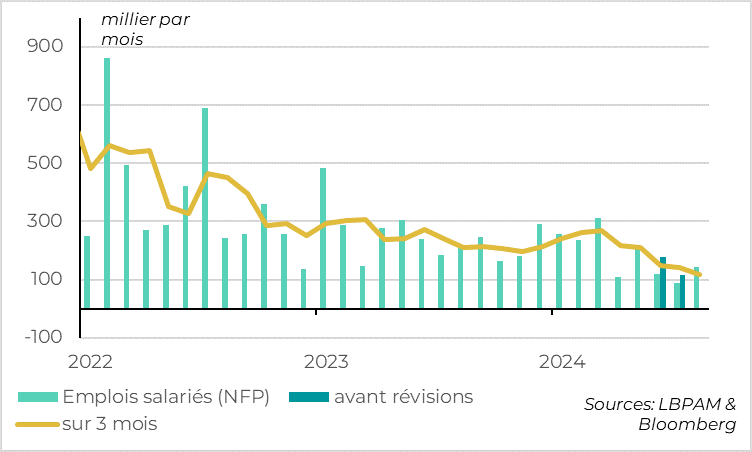

Payroll employment in the USA rose by 142,000 in August, a little less than the consensus forecast (165) but more than in the last two months (89 in July). This pace of job creation is close to equilibrium for the US economy.

But job creations continue to be revised downwards for previous months and are clearly on a downward trajectory. Indeed, the US economy created just 89,000 jobs in July, its lowest level since the post-Covid recovery. And while monthly figures can be volatile due to weather effects (such as the hurricanes in July), the 3-month average confirms the fairly clear slowdown in employment since the spring. It reached 116,000 in August, its lowest level since mid-2020.

All in all, job creation is clearly slowing down, and has returned to a level consistent with the increase in the active population, a sign that the labor market is easing, even if it is not deteriorating abruptly.

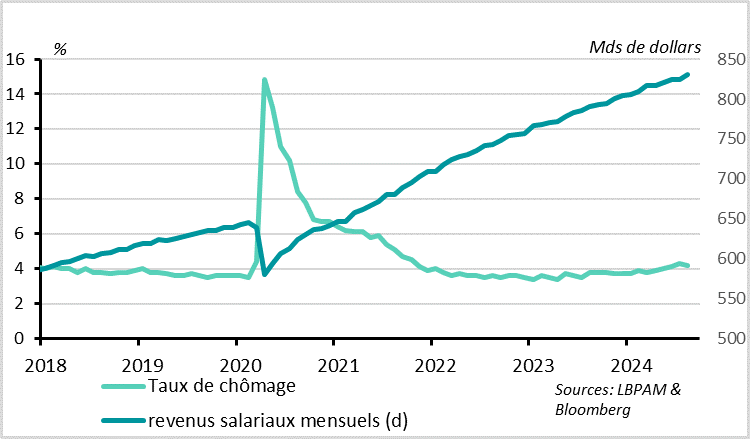

United States: unemployment rate stabilizes at a still low level

The unemployment rate eased back a little in August, remaining fairly low at 4.2%, which is reassuring after its 0.2pt rise to 4.3% in July. This drop in the unemployment rate is in fact limited, from 2.25 to 4.22%, and stems from the volatility of short-time working, which had risen sharply in July due to the hurricanes, and normalized in August. But it is reassuring to see that the unemployment rate remains low thanks to the rise in employment in the household survey (+168 thousand in August), while the labor market participation rate remains stable.

Another reassuring factor is the rise in wage income in August after stagnating in July, which is encouraging for consumption. Hourly wages accelerated slightly in August, from 3.6% to 3.8%, a level that does not reinforce inflationary pressures but does support household purchasing power. Combined with longer average working hours and rising employment, wage income rose by 0.9% over the month in August, after stagnating in July. If inflation figures published tomorrow rise by 0.2% in August, as expected, this would imply that household income is buoyant. This is encouraging for consumption, which remains the main engine of growth in the US.

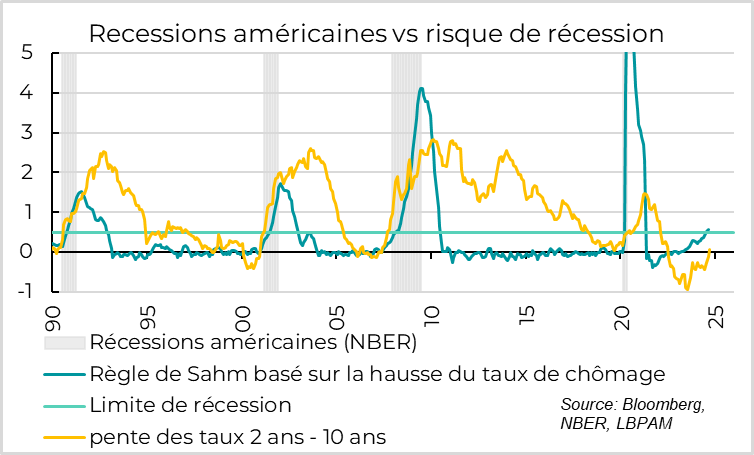

United States: Sahm's rule and the slope of the yield curve point to the risk of recession

Although the unemployment rate eased a little in August, the risk of recession has not gone away. Two rules of thumb which have often been a good indicator of recession for the US are currently sending out a negative message.

For the second month running, the unemployment rate is up by more than 0.5pt on its twelve-month low, which is the limit that has historically always marked the start of a recession. This is the rule of thumb found by economist Sahm. It makes economic sense, as employment is the most important variable for the US economy, which depends mainly on consumption. But this 0.5pt level is empirical, and many historical relationships have not been respected since the Covid shock.

Furthermore, 10-year interest rates climbed back above 2-year rates last week after nearly two years of inverted yield curves. Curve disinversion has often been an indicator of the onset of recession, although why this has been the case is much debated.

We are not minimizing the signs of deterioration in the US economy, of which employment and the yield curve are among the most important variables. And these elements may cause the Fed to worry that it has kept rates too high for too long, and that it needs to cut rates aggressively to quickly bring them back into expansive territory.

But as it stands, we believe these figures are in line with our scenario of a net slowdown but not a collapse in the US economy. Especially as consumer spending remains solid and business confidence remains positive. And the Fed's much more accommodating rhetoric this summer has already resulted in a net easing of financial conditions, even before the Fed actually starts cutting rates.

United States: the market is torn between a 25bp or 50bp rate cut in September

Xavier Chapard

Strategist