A benign correction

Link

-

The markets have probably been too hasty in anticipating rapid rate cuts by the major central banks. This is particularly true in the United States, where the Fed's minutes and the statements made by some members of the Monetary Policy Committee seem to indicate that the US central bank is not yet in a position to start easing its monetary policy. In addition, US employment data, particularly wage trends, are also pointing in this direction. As a result, we are seeing interest rates on all maturities retrace part of the downward path seen at the end of the year.

-

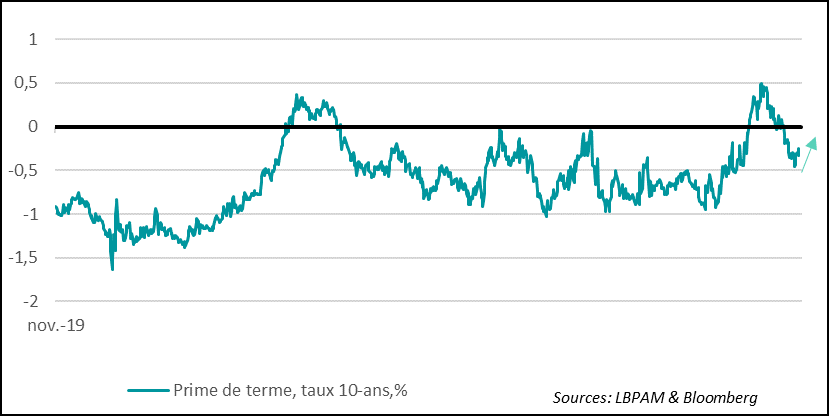

This rise seems to be associated with the expectation of smaller cuts in key rates in 2024, but also with rising term premiums, reflecting, in part, uncertainties about the economic outlook. This change from the market dynamic that prevailed until the end of the year seems to us, as we have already indicated, to be one of the sources of market hesitation since the start of the year. At the same time, issuers of private debt are making a strong comeback to the market to take advantage of financing conditions that are a little more advantageous than those that prevailed just a few months ago. So liquidity still seems ample in the financial markets.

-

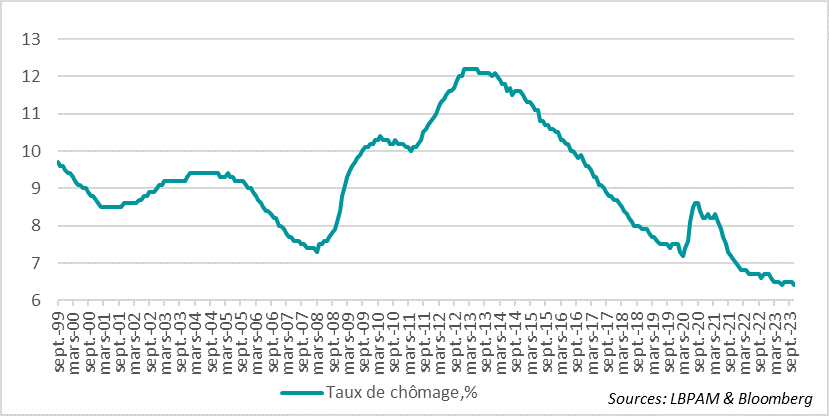

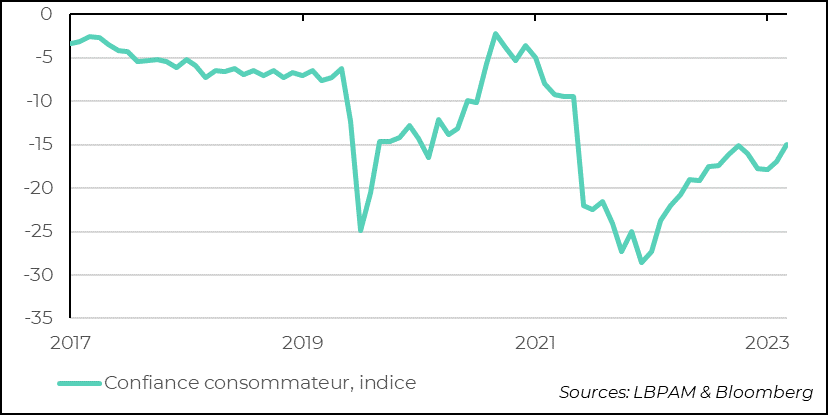

As new data is published, stronger convictions about the direction of the economies in the quarters ahead will emerge. We know that economic growth in Europe remains relatively mediocre. We are still expecting stagnation in 1H24. At the same time, we can see that activity is no longer deteriorating as sharply according to the latest PMI surveys. Also, and this is an important variable in our assumptions, it seems that the consumer should continue to resist this phase of weak growth. Indeed, the unemployment rate remains historically low and the European Commission's latest household confidence survey showed an increase in December, albeit at a low level.

-

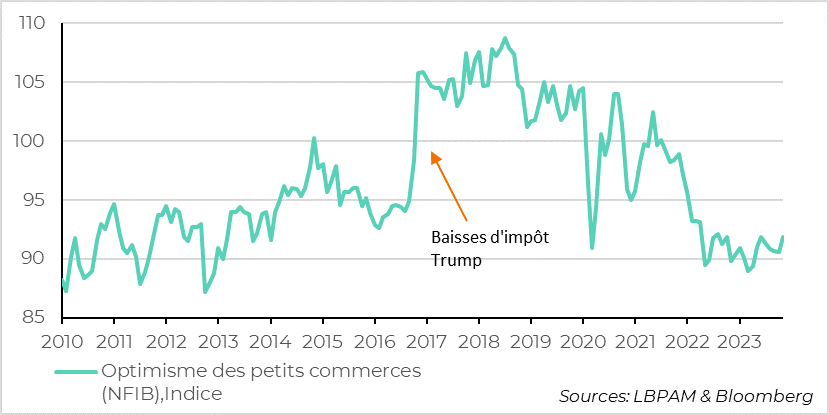

In the United States, while the ISM survey of activity in the services sector deteriorated sharply in December, the survey of small businesses rebounded slightly. This may be reassuring, even if the level of optimism among these players remains historically low. At the same time, the survey reveals that concerns about inflation remain high, while, at the same time, wage rises persist, even if it is difficult to determine their extent. Be that as it may, this remains a reminder that, at least for some players, the inflationary episode has not yet dissipated.

-

Against the backdrop of Israel's continuing intervention in Gaza, tensions in the Red Sea remain very high, with fresh attacks by Houthi rebels in Yemen. These rebels, backed by Iran, have launched a new wave of drone attacks on cargo ships. The American and British armies patrolling the region have reportedly intercepted them. In addition to the risk of escalating conflict in the Middle East, these attacks are likely to disrupt world trade (12-15% of trade passes through the Suez Canal), potentially creating bottlenecks and price rises.

The start of the year continues to be marked by the change in expectations of a cut in key rates in 2024. We thought these expectations were too high, especially as we noted that the US economy was still fairly resilient, showing that demand did not seem to be easing at a sufficient pace to reduce the inflationary pressures that still persist in certain segments of the economy, particularly in services.In our view, in a scenario of a sharper economic slowdown, the Fed should be able to cut its key rates to accompany the ensuing fall in inflation. We are still maintaining our scenario of 3-4 key rate cuts in 2024.

The Fed's minutes last week, as well as labour market data with wages accelerating over the last two months and the unemployment rate remaining historically low, have cooled the most aggressive expectations.

Compared with the low point, the expected cuts in key rates have already been reduced by around twenty basis points for the end of 2024. In our view, the number of cuts is still fairly aggressive, particularly given the current economic climate.

This adjustment in the reduction in key rates has affected the yield curve as a whole, but also seems to have corrected somewhat the very sharp reduction in the term premium on the longer parts of the yield curve for US sovereign bonds.

This can be attributed to greater uncertainty among market participants about the very strong conviction that had dominated the market, that the Fed would act quickly in 2024 to ease monetary policy. As we know, this belief was partly exacerbated by J. Powell's rather accommodating comments.

Since then, several Fed members, including W. Bostic and M. Bowman, who, while confirming that rate hikes were surely over, indicated that possible rate cuts were not necessarily on the cards in the near future. What's more, the economic data still show the economy to be fairly resilient.

All in all, uncertainty about the future path of monetary policy, which in turn depends on questions about the path of the economy and inflation in particular, has eroded market certainty. This has affected interest rates across the yield curve on US sovereign debt, particularly the term premium. According to the estimate of the New York Fed, which attempts to calculate this unobservable variable, the haemorrhaging is over. The term premium, while still negative, is rising. This upward movement could continue if the US economy proves more resilient than expected. This could further slow the convergence of inflation towards the Fed's target.

Fig.1 United States : The term premium, which collapsed at the end of last year, is stabilising and even starting to rise again.

As we have already indicated, the fact that the central banks are not going to support the economies rapidly in 2024, as the market seemed to think, is surely one of the major factors behind the halt in the very strong asset appreciation dynamic at the end of 2023.

In the Eurozone, economic momentum remains mediocre, as the latest PMI surveys for the zone in December showed. However, the loss of momentum seems to be slowing. So, at this stage, our assumption of stagnant growth in the eurozone remains the most likely scenario.

This scenario is still based on a degree of consumer resilience. In addition to persistently high savings rates, the fact that inflation is well underway, while wages are slowing slightly, should give households a little more power, enabling consumption to hold up.

In addition to this prognosis, we remain surprised by the resilience of the labour market in this rather mediocre economic climate. Indeed, the unemployment rate remains historically low in the region. This is another shield against a further weakening of the European economy. Nevertheless, it is likely that the labour market will deteriorate over the course of 1H24.

Fig.2 Eurozone: Surprising resilience in employment, with unemployment still very low despite mediocre economic growth

The resilience of employment also seems to be reflected in the resilience of household confidence. Indeed, the European Commission's latest consumer survey confirmed that household confidence had recovered in December. Nevertheless, it remains well below its historical average.

Fig.3 Eurozone: Household confidence recovers in December, although still well below its historical average

In the United States, the December survey of small retailers showed a slight upturn in confidence. Nevertheless, the level of confidence remains close to the lowest levels of the last ten years. However, the upturn is very limited (+1.3 points on the index), especially as sentiment remains relatively mediocre regarding the outlook for the US economy in 2024.

Fig.4 United States : Small business confidence in the USA has picked up slightly, although it remains relatively low

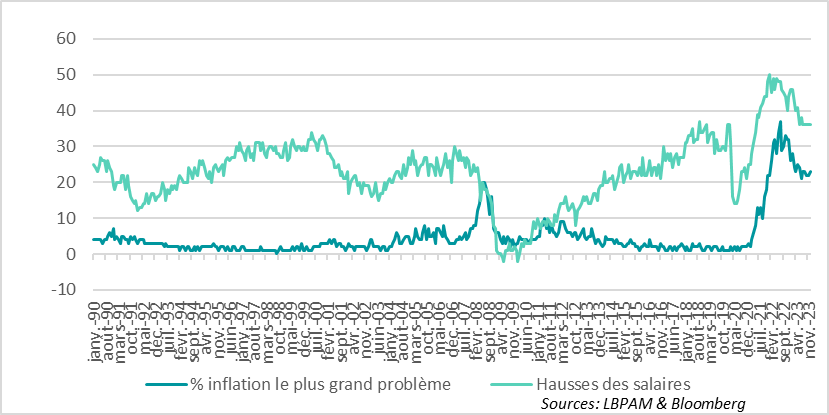

In detail, we can see that the issues surrounding inflation and wage pressures remain important and do not really seem to be improving. In particular, inflation is still the sector's main problem, and its tendency to dissipate seems to have come to a halt. Also, in terms of employment, they are still having difficulty finding qualified staff and continue to have to increase wages, even though the survey does not reveal the extent of the pay rises.

Fig.5 United States : Small retailers still worried about inflationary pressure

Overall, the survey highlights that inflationary pressures are still present, which is in line with the Fed's policy of remaining patient before embarking on a rate-cutting cycle.