A breath of post-election euphoria

Link

Check out our market analysis from November 18, 2024, by Xavier Chapard.

In summary

► Market optimism eased a little last week, with U.S. equities reversing half of their rally that followed D. Trump's election. This is partly due to the fact that the policies to be implemented by the new Trump administration are still uncertain in scope and timing, and not all of them are positive for the economy. The proposed policies are pro-business in the US, but also inflationary, bullish for rates and negative for the rest of the world. This is reflected in the tightening of monetary conditions in the United States, with US long rates close to their highest level in 4 months, before the Fed's first rate cuts, and the dollar at its highest level in a year.

►Markets are also beginning to question the Fed's ability to cut rates in December, especially after Powell said the Fed should be “cautious” in its monetary easing. This change in tone comes not from speculation about what policies the new administration might implement in the coming quarters, but from economic data. Indeed, the unemployment rate is 0.3pt below and core inflation is likely to be 0.3pt above the Fed's year-end forecasts. While these data make the Fed's decision in December uncertain, we still believe that the Fed will cut rates in December, and that caution will instead translate into more limited rate cuts next year, depending on the policies implemented.

►Against this backdrop, we believe that the consolidation of risky assets represents a breath of fresh air after the post-election euphoria, and that the outlook for the markets remains positive for the coming weeks. Especially since, beyond US politics, the economic surprises are quite promising.

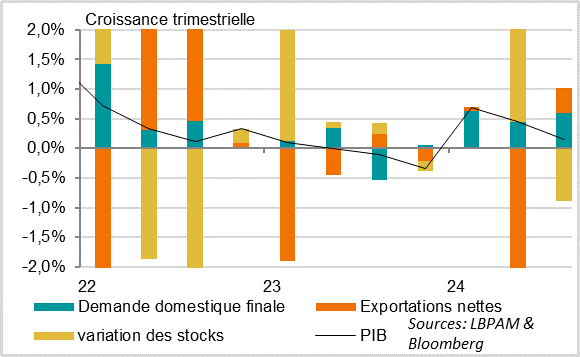

►In the United States, activity eased slightly in October, partly due to the autumn strikes and hurricanes. But the momentum remains solid as we approach the end of the year, with growth above 2%.

►In China, October data confirm the stabilization of the economy following the support measures announced by the authorities since mid-September. This is reassuring after the sharp slowdown of the summer, and reduces the risks for the global cycle in the short term, even if the medium-term outlook for China remains weak without more significant measures.

►In Europe, UK growth slowed more than expected this summer, due to volatile factors and budget uncertainty. But consumption continues to pick up, as in the rest of the developed world, which is positive for the cycle. We still expect growth in Europe to remain limited but positive over the coming quarters.

To go deeper

United States: post-election euphoria in equities subsides, partly due to high rates and dollar

United States: Activity slightly more limited in October, due to temporary factors

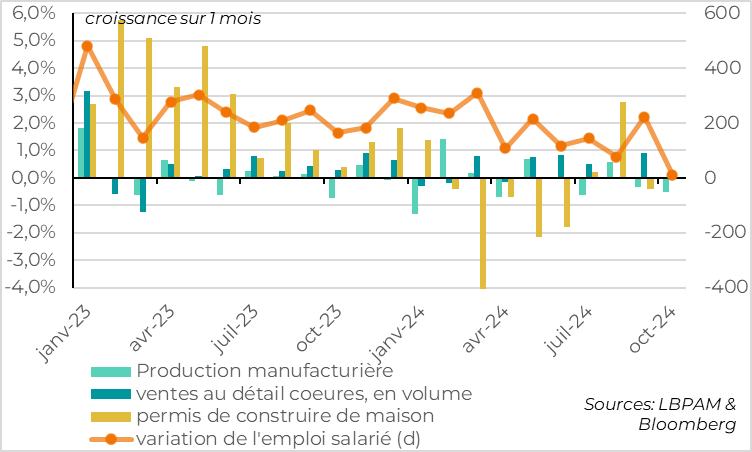

Activity data for October show that activity was slightly less buoyant at the start of Q4 after a very strong Q3, but remains well oriented for the end of the year.

Retail sales rose by 0.4% in October after 0.8% in September, driven by a strong increase in car sales. Core retail sales, which are used to calculate consumption for GDP purposes, fell unexpectedly (-0.1% over the month). But this follows a rise twice as strong as initially estimated in September (+1.2% instead of 0.7%), so the sales trend remains solid. It should also be noted that the drop in core sales in October is explained by the fall in the price of goods over the month, resulting in stagnant rather than falling sales volumes.

Industrial production fell again in October, by 0.3% after -0.5% in September. This was largely due to the temporary impact of the autumn hurricanes and the strike at Boeing, which, according to the Fed, reduced industrial output by 0.5% over the last two months. Overall, industrial activity remains stagnant in the US, which is weak but not alarming.

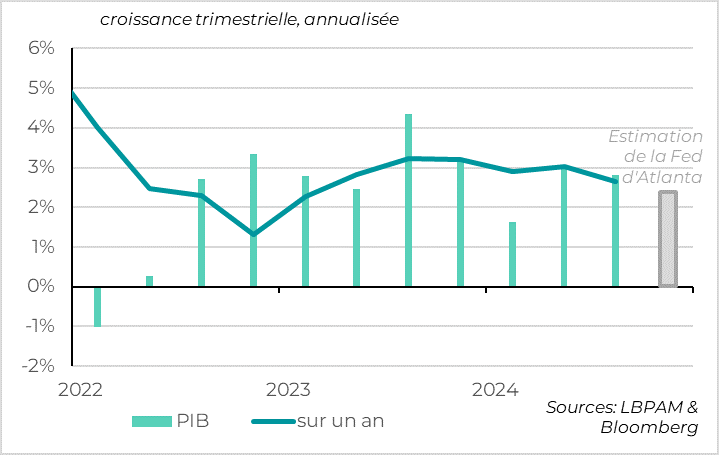

United States: growth slows slightly but remains high in early Q4

Following this quarter's initial activity data, the Atlanta Fed's GDP estimate forQ4 stands at 2.5%, lower than the mid-year figure of 3%, but still above the US trend growth rate of around 2%. The economy thus remains solid, even if it is slowing somewhat.

China: activity picks up slightly at the start of Q4

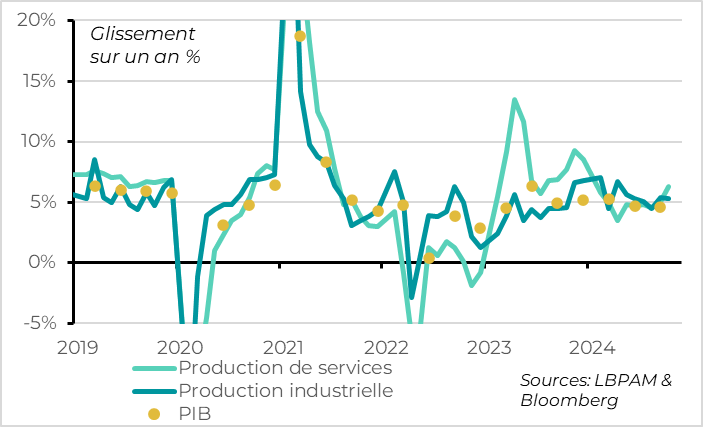

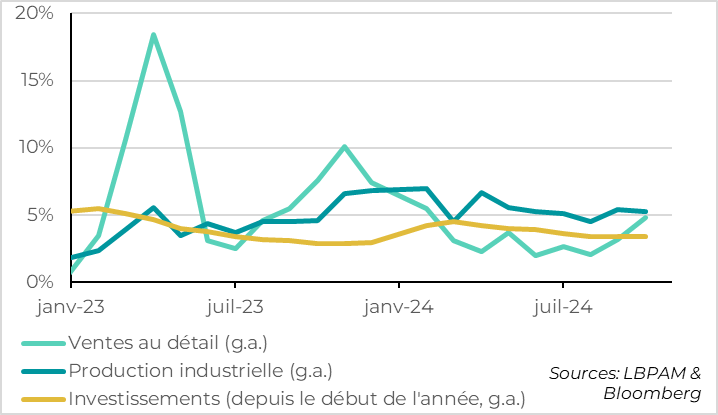

In China, activity data for October point to a slight recovery at the end of 2024 thanks to support for consumption and the property market, which should stabilize growth close to the 5% target in the short term.

The main piece of good news is that retail sales rebounded from 3.2% to 4.8% year-on-year, their highest level for 8 months. This suggests that consumption is responding somewhat to government support, even if this remains limited. It is benefiting from the targeted subsidies introduced to support the purchase of household goods and cars, and from the increase in public spending, which is a short-term support. It is also benefiting from the slight downturn in the real estate market, with prices falling half as fast as the previous month (-0.5% over the month) and sales stabilizing somewhat.

China: Consumption picks up as investment stabilizes

Industrial production was slightly less dynamic than in September, but more robust than in the summer, with growth of 5.3%. Yet it still benefited from strong external demand in October. This probably reflects investment, which remains limited, with growth stable at 3.4%. Investment continues to be weighed down by the decline in real estate investment, which is falling by more than 2022 and 2023 this year (-10.3%), while infrastructure investment is just beginning to pick up after the high level of public debt issuance over the past 2 months.

Chinese growth should remain satisfactory over the coming months, thanks to a temporary rebound in consumption, a slight upturn in public investment and solid external demand, especially if companies anticipate trade tensions next year.

That said, the measures taken by the authorities are so far insufficient to allow a sustainable re-acceleration of the Chinese economy beyond the winter, especially if trade tensions intensify. Hence our view that China should no longer be a drag on global growth at the turn of the year, but will continue to slow in trend over the medium term.

United Kingdom: growth slows but domestic demand remains solid

In the UK, growth slowed sharply this summer after a very dynamic first half, but domestic demand remains fairly buoyant. This shows that the rebound in activity at the start of the year exaggerated growth, but that the outlook is slightly positive. The recovery should continue at a limited pace next year, helped by less restrictive fiscal and monetary policies, but constrained by reduced domestic potential and risks to world trade.

UK GDP grew by just 0.1% in Q3, after rebounding by more than 0.5% in the first two quarters of the year. This slowdown is more marked than expected, as activity fell by 0.1% in September, whereas it had risen by 0.2% in the previous two months, which also implies a weaker result for the current quarter. That said, this fairly generalized drop in activity over the month probably stems in part from budgetary uncertainty prior to the presentation of the new government's budget in mid-October, which would also explain the decline in household and business confidence over the past 2 months. If this is the case, this effect should be reversed over the rest of the year, allowing growth to remain positive in Q4.

Especially as the Q3 GDP breakdown is more encouraging than the growth figure. Indeed, the sharp slowdown in GDP is due to a very negative contribution from inventories (-0.9pt), which is only partially offset by the fall in net imports. In fact, domestic demand remains solid, with household consumption up 0.5% and business investment up 1.2%. While investment is volatile quarter by quarter, it is up year-on-year for the first time this year, while the upturn in consumption suggests that the purchasing power shock is fading.

Xavier Chapard

Strategist