A busy back-to-school season

26.08.2024

Link

Sebastian PARIS HORVITZ's August 26, 2024 Market Decrypt provides an in-depth analysis of the markets after the summer period.

In summary

►Obviously, J. Powell's statements at the Jackson Hole conference last week not only supported most assets, but will largely dominate traders' behavior in the months ahead. Indeed, the Fed Chairman sounded the tocsin for the start of monetary easing in the USA, scheduled to begin in September. We've been waiting for this, as have most of the market.

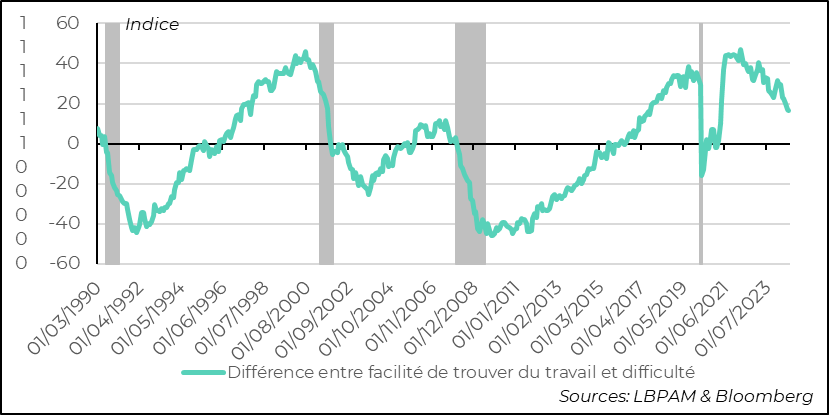

►Above all, J. Powell gave his reading grid for the reaction function of monetary policy in this phase of adjustment to lower key rates. From now on, the labor market situation will be his main compass. We were already expecting a gradual deterioration in the labor market, which justifies our three rate cuts between now and the end of the year. However, J. Powell seems to have little tolerance for a further rise in the unemployment rate, which could lead to an over-reaction in monetary policy. This surely explains, in part, the expectations of more aggressive rate cuts supported by the market.

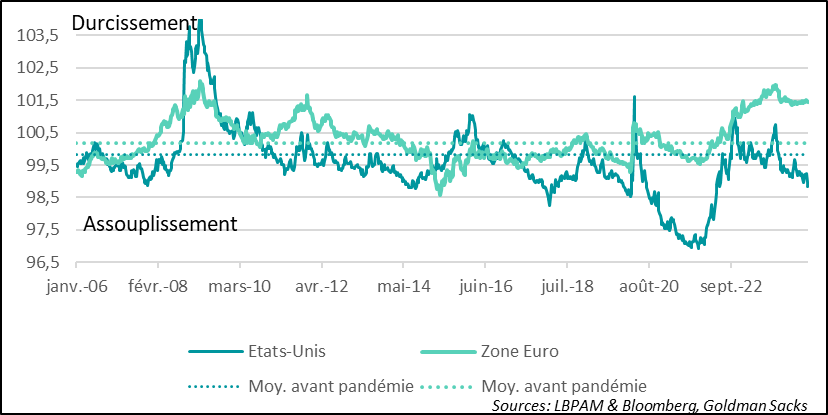

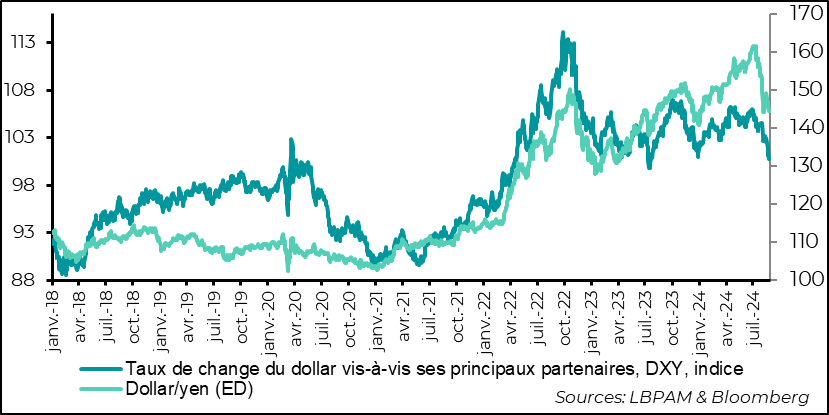

►Nevertheless, it's important to stress that the appreciation of most major asset classes (with the stock market rising and sovereign bond yields falling sharply) has largely eased financial conditions for the US economy. In fact, they haven't been this flexible since early 2022. Another factor contributing to this easing has been the dollar's depreciation. This has been very abrupt, with the dollar reaching its lowest level in just over a year. As a result, the US economy is already being stimulated even before rate cuts begin. This should limit the risk of an abrupt downturn in growth.

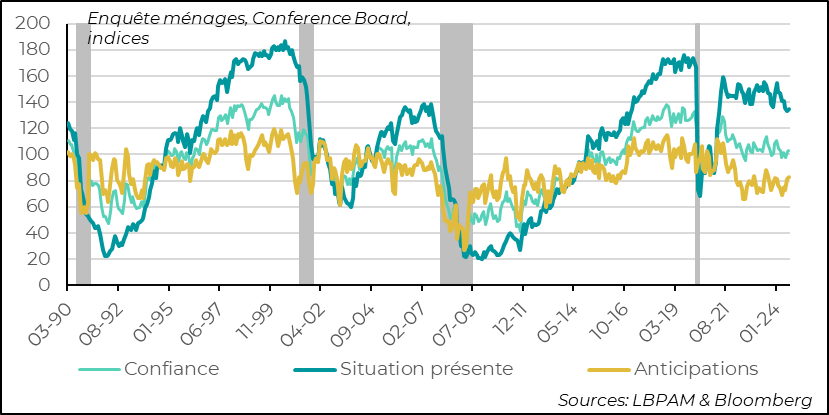

►In the face of recent fears of a rapid deterioration in the US economy, it is reassuring to see that consumer confidence as measured by the Conference Board survey continued to recover in August, returning to its February level. This is thanks in particular to a more favorable outlook, supported by expectations of price rises that are moderating. On the other hand, positive opinions on the employment situation continued to decline, although still at a high level.

►In the Eurozone, the IFO survey for August in Germany confirmed the message of the PMI surveys, i.e. an economy that has lost momentum in recent months compared with the start of the year. Details of contributions to GDP growth in 2Q2024 also confirmed the weakness of domestic demand, particularly investment, which fell sharply. Together with the contraction in consumption, this explains the 0.1% decline in GDP in 2Q2024. All in all, the German economy remains the weak link in Eurozone growth, affected in particular by a global industrial cycle that continues to stall.

J. Powell's remarks at Jackson Hole last week reinforced the market's view of Fed support. Indeed, in addition to confirming the conviction that we will have a first rate cut in September, expectations of rate cuts in the quarters ahead were reinforced. Expectations that the Fed would provide strong support for the economy in the near future have bolstered most asset classes.

As a result, we note that financial conditions have eased remarkably in the US over the past period. They have been the most accommodating since the beginning of 2022, a factor which should ease fears of an abrupt slowdown in the US economy, but without of course eliminating this risk.

To go deeper

Financial conditions: Strong easing of financial conditions in the United States, reinforced by statements from J. Powell

Obviously, the continuing rise in the stock market, which wiped out the lightning correction of the beginning of the month, and the very sharp fall in US sovereign interest rates across all maturities were the major factors in this easing of financial conditions. However, we also witnessed an equally marked fall in the dollar (particularly against the yen), which fuelled this improvement in financial conditions and potentially stimulated growth across the Atlantic.

Dollar: Strong depreciation of the dollar

The dollar's depreciation is also welcome in a number of countries, notably emerging markets, but also in Europe, to give monetary authorities more leeway to ease monetary policy.

In the face of fears about US growth, it was reassuring to see that consumer confidence continued to recover in August. Indeed, the confidence index from the Conference Board's household survey returned to the levels seen at the start of the year.

We know that the relationship between confidence and consumption is far from perfect, but the improvement in sentiment about the future should be seen as a positive factor. In part, this improvement seems to stem from a further moderation in expectations of price rises in the year ahead.

United States: US household confidence improves...

However, the survey also reveals that we do indeed have a lull in the job market, with very favorable opinions on the ability to find a job continuing to fall, while remaining at a high level. This is consistent with what we had anticipated, i.e. a reduction in tensions on the labor market, which would translate into a further deceleration in wage growth.

United States: ...even if positive views on the job market are moderating

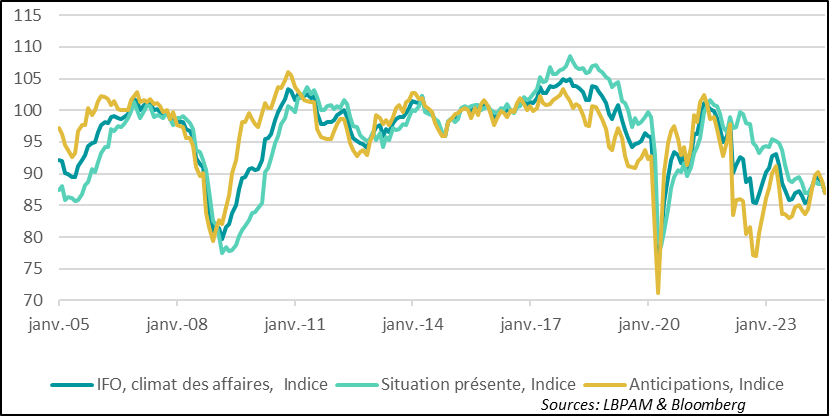

Unfortunately, in the Eurozone, the IFO survey for Germany in August confirmed the message of the PMI surveys, i.e. that the economy is in the doldrums. Indeed, the overall business climate index continued the downward slide it began in June. Both the opinion on current conditions and the outlook were down over the month.

Obviously, this does not bode well for the near future, and underlines the importance of ECB monetary easing in the months ahead. Nevertheless, we note that Germany is suffering more than its partners from a global industrial cycle that remains depressed, and from the lack of momentum in the Chinese economy.

Germany: IFO survey confirms worsening business situation in 3Q24

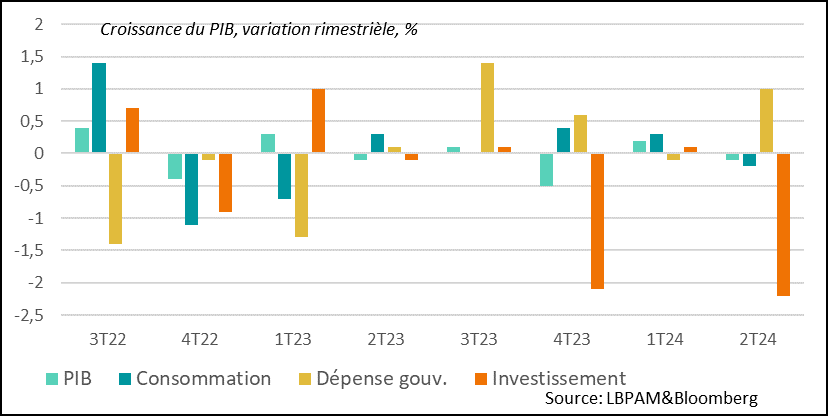

In fact, the lack of dynamism in German domestic demand was underlined by the details of GDP trends in 2Q2024. Indeed, the 0.1% contraction is explained by suffering private demand. Consumption contracted, as did investment. The latter extremely sharply.

Despite the positive contribution of public spending to growth in 2Q2024, we can only conclude that Germany's self-imposed budgetary constraints prevent it from triggering a more favorable dynamic for the economy, all the more so as the authorities have very ambitious plans, notably on the energy transition.

At this stage, we'll be relying more on the ECB and the hope of an upturn in the global industrial cycle, which is so far slow to materialize, for the German economy to regain its momentum.

Germany: Details of GDP growth in 2Q24 do not bode well, with weak consumption and a sharp contraction in investment

Sebastian PARIS HORVITZ

Head of Research