A False Sense of Calm

Link

After the announcements of "reciprocal" tariffs by D. Trump on April 2 and a week of violent market reactions, have we entered a period of calm?

Summary

►After the tumultuous week we just experienced, a slight calm seems to be emerging, partly due to the concessions made by D. Trump. On Friday, electronic products (phones, computers, semiconductors, etc.) were exempted from bilateral tariffs, followed by the automotive sector at the beginning of the week. Despite the president's warnings about the temporary nature of these measures, the market seems to be breathing a little easier.

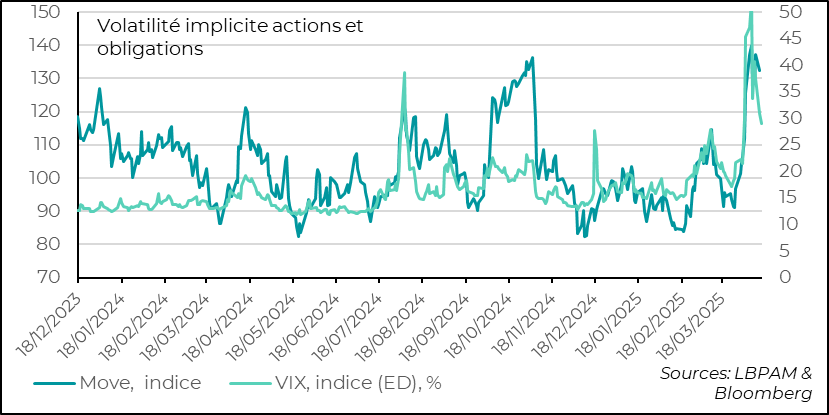

►The fact that there is no escalation in the trade war for now is good news and a source of relief. However, the economic reality does not yet reflect what numerous sentiment indicators, which have significantly deteriorated, are telling us. We will have to wait to observe the effects on activity. Thus, some market tension indicators are easing, such as the VIX, often referred to as the fear index, which reached its highest level in 20 years, after the 2008-2009 crisis and the emergence of Covid in 2020.

► Nevertheless, we must not forget that the Trump administration, despite the chaos caused last week, continues to believe in the validity of its protectionist strategy. S. Bessent, the Treasury Secretary, has embarked on a world tour to obtain trade concessions. We will see how successful this will be. However, the shock imposed on the world by these protectionist policies will not generate prosperity anywhere, especially in the United States. Surely, S. Bessent believes that we are all wrong in significantly revising down the economic outlook for the United States. If these forecasts come true, we must prepare for more volatility.

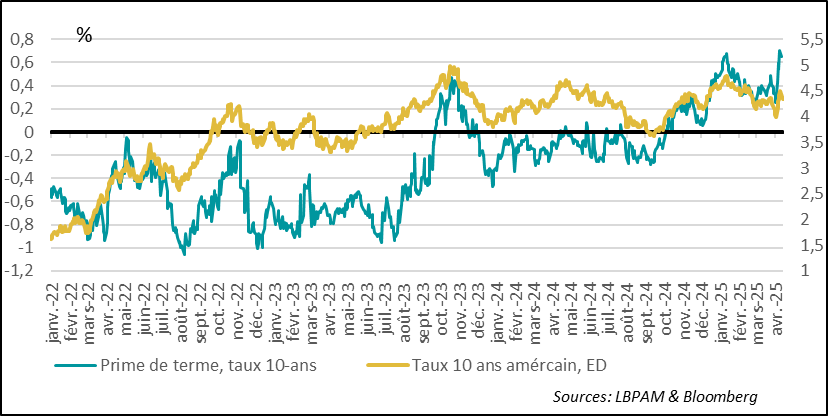

►For now, let's hope that tensions on American assets ease compared to recent days. Besides the sharp decline in the stock market, the dynamics of long-term U.S. sovereign rates have been worrying this week, with a very sharp rise. It is still difficult to determine the causes. But one of the most striking elements has been the sharp rise in the term premium, reaching its highest level in 20 years. Is it simply technical factors behind this rise, or a lack of confidence in American assets, including the inability of authorities to counter the budgetary slippage across the Atlantic? We will see in the coming weeks if this spike in long-term U.S. rates dissipates. For now, we remain very cautious in our positioning.

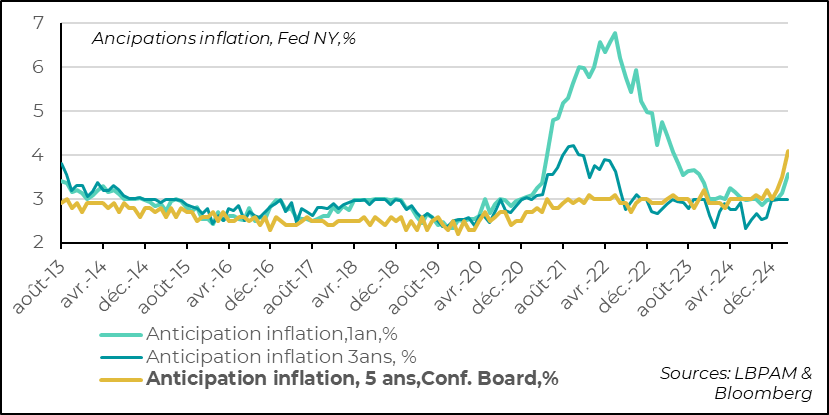

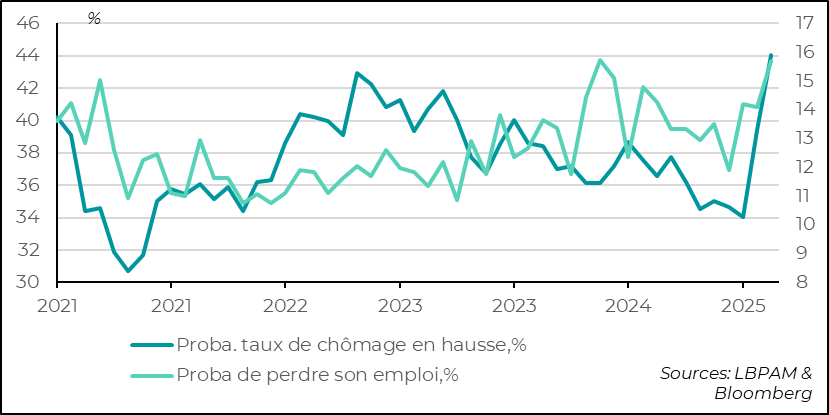

►Although inflation expectations reflected in the bond market remain well anchored, the latest household surveys, notably from the University of Michigan, show a sharp rise in inflation expectations, which is concerning. On the other hand, the New York Fed's survey for March offers a more moderate perspective. Certainly, one-year inflation expectations are rising, but in the medium term, they remain stable compared to the previous month. Meanwhile, household concerns about labor market prospects are deteriorating.

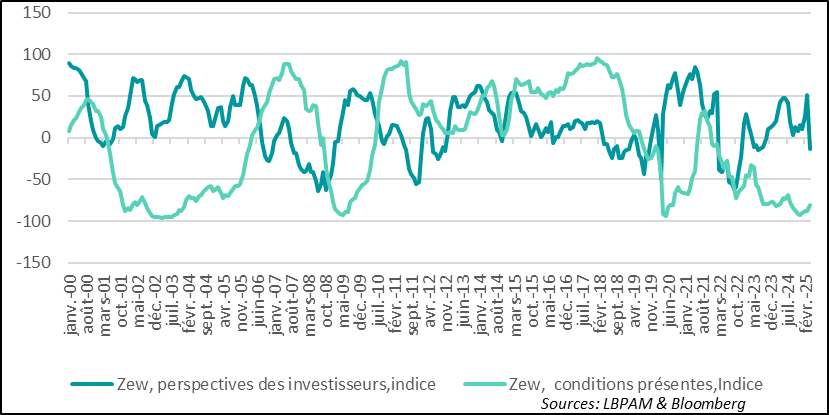

►In the eurozone, while investor confidence had been on a strong upward trend over the past two months in Germany, the cold shower of American tariffs reversed the trend. Indeed, expectations in the ZEW survey collapsed in April.

►It is in this context that the ECB will have to decide tomorrow whether to lower its key rates or keep them unchanged. The Governing Council may not want to disappoint the market, which expects a cut. But there is no real consensus within the council on a cut. Many are pushing for more caution in the easing trajectory. Ms. Lagarde could try to please everyone by maintaining the status quo but indicating that cuts will continue.

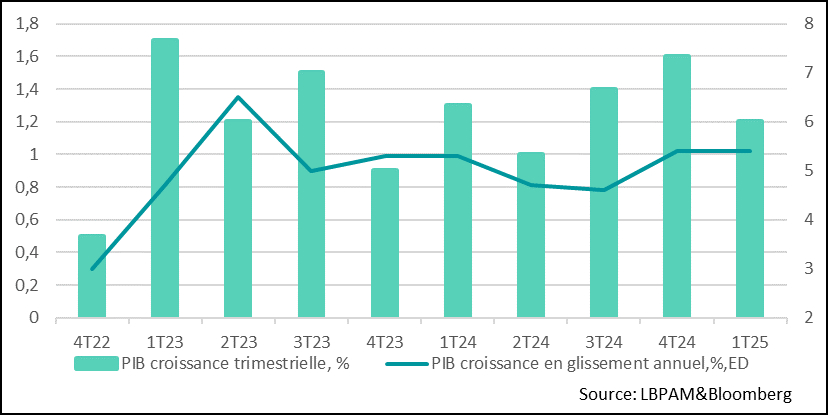

► In China, the beginning of the year was marked by strong demand, particularly from the United States, due to expectations of upcoming tariff increases. Indeed, in March, exports grew by more than 12% year-on-year. This increase in exports, with imports lagging, allowed for solid GDP growth in the first quarter of 2025 of 5.4% year-on-year. Domestic demand also rebounded strongly in March with retail sales (5.9% year-on-year) and investment (4.2%). But for the rest of the year, without stimulating demand, the American protectionist shock will force the economy to slow down.

To go deeper

After the announcements of "reciprocal" tariffs by D. Trump on April 2 and a week of violent market reactions, it seems that we have entered a period of calm. This is largely due to the new concessions made by the American president on a number of products (electronics and the automotive sector), which were added to the 90-day suspension of initial tariffs, replaced by a uniform rate of 10% for all countries, except China.

The market seems to have interpreted these changes as a willingness by the American government to adjust its policy to avoid adverse effects on the economy.

As a result, we have observed a resurgence in stock indices, particularly on both sides of the Atlantic. Additionally, some usual market anxiety measures have begun to ease.

For example, the VIX index, often called the fear index, which measures volatility on the S&P500, the flagship American index, and which had reached its highest levels in 20 years, except during the 2008-2009 crisis and the arrival of Covid, has finally started to ease, although it remains very high. This is also the case for the Move index, which measures volatility on long-term American bonds.

United States: Volatility indices on major asset classes in the United States are easing slightly

Nevertheless, it would be wrong to think that we have entered a new phase with a more conciliatory strategy from D. Trump. Proof of this is the new constraints imposed on NVIDIA for its chip exports to China.

The American president and his economic advisers, including S. Bessent, the Treasury Secretary, still seem convinced that their protectionist strategy will lead to greater prosperity in the United States, at the expense of the rest of the world.

We have already said it enough, this strategy is not only wrong but also risks being very costly for the American economy.

Restoring market confidence in the face of the shocks imposed by this policy will not be simple. Thus, we believe that we should expect more turbulence, hence our very cautious asset allocation positioning.

Among the questions investors are asking, we note the emergence of distrust in the market towards American assets. By distrust, we mean the willingness to reduce exposure to these assets due to a loss of confidence in American economic policy as well as in the role of the United States as a reliable partner in international relations.

It seems to us that at this stage, we are still far from this situation, although it is clear that there is a certain shock in the financial community regarding the strategies pursued by the government led by D. Trump.

The sharp decline in the dollar since the beginning of the year, with an acceleration since early March, cannot go unnoticed. It reflects, in our opinion, largely the anticipation of a rather negative shock on American growth relative to the rest of the world. It is remarkable to see that expectations of a possible recession in the United States in 2025 are multiplying, while the economy was showing almost insolent robustness before the arrival of the new administration.

At the same time, this decline also reflects a desire by countries and financial actors to diversify their currency holdings, moving away from the dollar. It is possible that such movements exist, but this hypothesis seems a bit too extreme.

The rise in long-term U.S. rates in recent days, while U.S. growth projections were being revised downwards, has also been seen as another indication of this distrust towards American assets. Thus, the world's most demanded risk-free asset would be losing its role.

This hypothesis is also a bit extreme.

What is certain is that the policies pursued in the United States, due to their destructive nature, are alarming. But at this stage, they primarily create uncertainty about the direction of American economic policy and the economy.

Thus, we see that the term premium on long maturities, i.e., the additional compensation that investors would demand to hold these assets, has increased significantly in recent days. In fact, it is the highest in 10 years.

It is difficult to say that this premium reflects distrust in U.S. Treasury bonds. Nevertheless, the Republican Congress's budget proposal, which is expected to significantly increase the U.S. government's debt, is not a reassuring message for investors.

United States: the term premium measured by the NY Fed on the 10-year American rate has reached a 10-year high

The coming weeks will reveal whether American leaders will attempt to calm market anxiety. On the one hand, market indicators, particularly those of the bond markets, show that inflation expectations remain well anchored. However, the University of Michigan survey of households in April revealed a worrying signal: their 5-10 year inflation expectations reached 4.4%, a record level since the early 1990s.

On the other hand, the New York Fed survey of households in March gave a more reassuring message. Medium-term expectations remain stable, although short-term expectations are rising sharply. We will see in the April survey if this reassuring trend is confirmed.

What is certain is that the Fed will be very vigilant on this issue.

United States: Household inflation expectations according to the New York Fed survey remained relatively stable in the medium term in March

The New York Fed survey also revealed that households were much more concerned about the labor market. Thus, expectations regarding the unemployment rate or the risk of losing one's job in a year have risen sharply.

This reflects the concern caused by current policies and is not good news for consumption if households reduce their spending out of fear for the future.

United States: Households are worried about the labor market according to the New York Fed survey

In the eurozone, a negative reaction from investors to the American protectionist shock was expected. This is what happened according to the ZEW survey of German market participants. However, the reaction was much worse than anticipated.

The improvement brought about by the German government's budget announcements was completely nullified by the trade war initiated by the United States.

Eurozone: The improvement brought about by the German authorities' shift in public spending is nullified by the trade war

We will see if this negative impact on investor confidence also pushes the ECB to act tomorrow by lowering its key rate again. The market expects it. Even if further monetary easing is justified, the ECB could be more patient in the face of uncertainties caused by this protectionist shock.

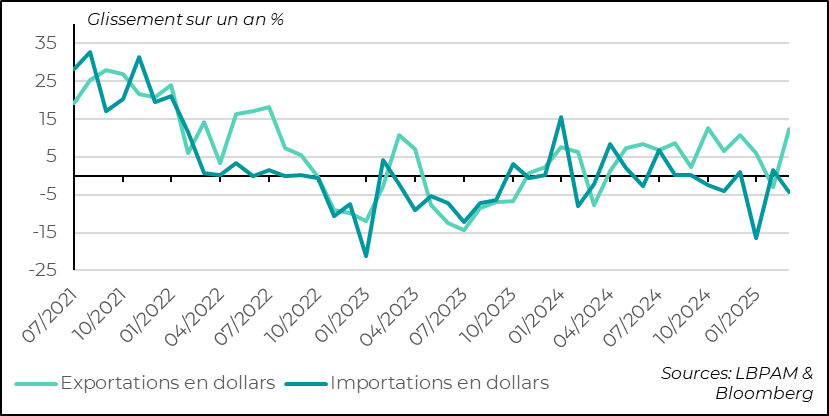

China benefited at the beginning of the year from a strong contribution of foreign trade to growth. Indeed, the anticipation of higher American tariffs seems to have significantly boosted exports at the beginning of the year.

China: Exports stimulate growth at the beginning of the year

Nevertheless, domestic demand was also more robust in March, with retail sales and investment rising, as well as industrial production.

All these elements supported GDP growth in the first quarter of 2025. With an expansion of 1.2% for the quarter, but more importantly, and crucial for the authorities, a year-on-year increase of 5.4%, well above the official growth target.

China: Solid GDP growth in the first quarter of 2025

However, the American protectionist shock will have consequences on Chinese growth. Thus, the rest of the year is expected to be much less robust. The challenge for Chinese authorities will be to properly calibrate the stimulation of the domestic economy to withstand the American shock. For now, there have been no strong announcements regarding the public support response that will be implemented.

Sebastian PARIS HORVITZ

Head of research