A few healthy breaths

Link

- After the very sharp rise in stock market indices since last autumn, buoyed in part by the prospect of cuts in key interest rates, but also by the potential promise of artificial intelligence (AI), it is not unusual for people to be concerned about the emergence of bubbles. As is often said, the surest way to predict them is once they burst. At this stage, it is not trivial to describe the recent movement as a bubble, even if valuations in the US remain relatively high by historical standards. What can be comforting, however, is to see corrections where risk-taking calms down. Like at the moment.

- At company level, we have seen Apple suffer as iPhone sales have fallen sharply in China. This has dampened the appetite for the so-called "magnificent 7" stocks that have buoyed the US stock market, which is healthy. At the same time, we should not forget that the macroeconomic news since the start of the year has been rather reassuring. Industrial activity, like that in services, is picking up, including in the Eurozone. Growth that is recovering or remaining resilient is a positive factor.

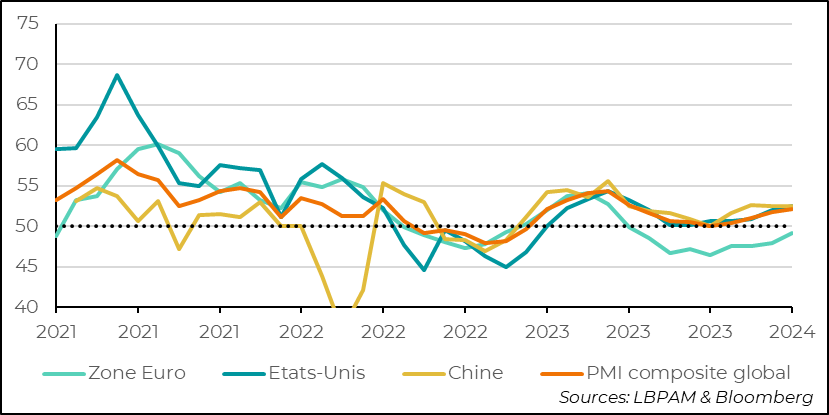

- Indeed, the composite global PMI (industry and services), calculated by JP Morgan on the basis of S&P surveys, reached its highest level since June last year, and remains in expansionary territory at 52.1. This level suggests moderate economic growth. Also, new orders, an indicator of the outlook, particularly in industry, improved markedly.

- Of course, there are still regional differences. Not all countries are expanding at the same pace. The Eurozone is still lagging a little behind, with Germany still in a weak position, while some countries in southern Europe, such as Spain, are doing well.

- In the United States, although the S&P composite indicator showed a gain, there were pockets of weakness in the ISM surveys for both the services and manufacturing sectors. In particular, for both segments of the economy, we saw that employment momentum was clearly slowing. We are expecting a deceleration in job creation, but not a collapse at this stage. It is important to bear in mind that, in addition to support from public spending, financial conditions remain relatively accommodating across the Atlantic, which should help the economy.

- The report presented by Premier Li Qiang to China's National People's Congress offered no surprises. The authorities' strategy still seems to be to maintain moderate growth (the 5% target has been maintained). Thus, there was no real announcement of additional stimulus, even though large bond issues to help the provinces and invest in "strategic" projects have been budgeted for. Some will point to the continued expansion of military spending, at 7.2%, even if there is no acceleration in this. All in all, nothing is likely to change the mistrust that persists over the outlook for the Chinese market.

The markets seem to be taking a breather after a sequence of very solid gains, boosted in part by the promise of AI. At the same time, economic data has confirmed the resilience of the global economy at the start of the year. This remains an important anchor to support risk-taking. Nonetheless, fears of a runaway recovery and exaggerated valuations for certain stocks are likely to prompt corrections.

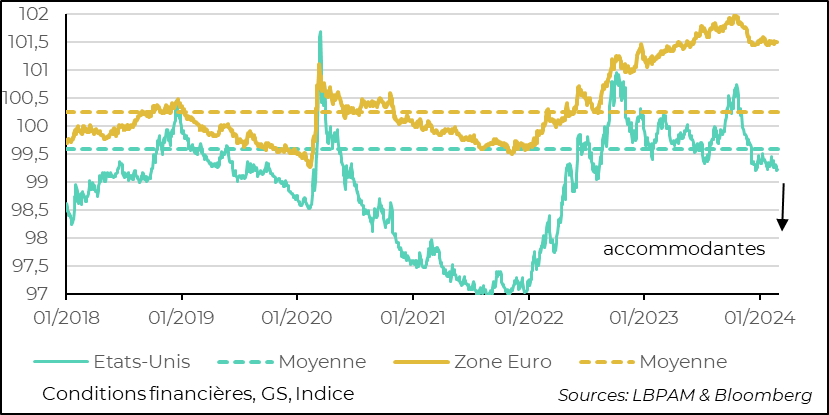

For the time being, in the United States, despite signs of a slowdown in growth at the start of the year compared with the exceptional rebound of 2H23, the economy continues to benefit from a buoyant environment. Indeed, despite the persistence of a restrictive monetary policy, financial conditions remain relatively accommodative. They are at their most accommodative level since the beginning of 2023. This reflects, firstly, expectations of interest rate cuts, even if these have moderated sharply since the start of the year, and, more importantly, the rise in the stock market.

Fig.1 United States: financial conditions remain relatively favourable

These favourable financial conditions should support the US economy, although from the point of view of public spending, given the data published so far and the stated intentions of the authorities, we are still a long way from a policy of moderation, as might have been expected.

This situation could continue to keep the Fed waiting to act if the economy does not show more signs of slowing and, above all, of a lull in wage growth, which is still putting pressure on certain prices, particularly in services.

In any case, it will not be easy for central banks to navigate in an environment where inflation, while decelerating, remains above target, while economic growth remains resilient.

We can be pleased to see that the final verdict of the PMI surveys for February gave a rather reassuring message about the short-term outlook for activity. Indeed, the JP Morgan composite PMI, which combines S&P's manufacturing and services surveys for the world's major economies, showed a continuation of the trend of recent months, namely an improvement in economic conditions.

In particular, although the Eurozone is still lagging a little behind, the trend towards stabilisation in activity is fairly clear and reassuring.

Fig.2 Global: PMI surveys continued to show, at global level, a further improvement in economic conditions

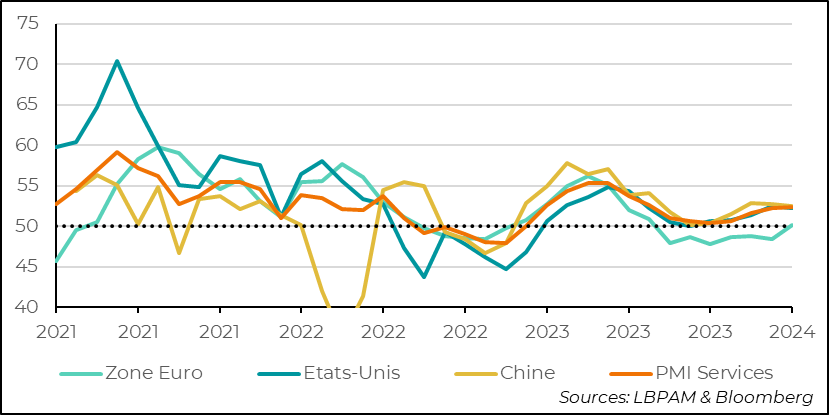

The latest round of statistics, published yesterday, concerned the services sector. In the Eurozone, for the first time since July 2023, the index crossed the 50 mark, which separates expansion from contraction. In China, the index was relatively unchanged, but still in expansion territory.

Fig.3 Global: Activity in services improves at the start of the year at global level

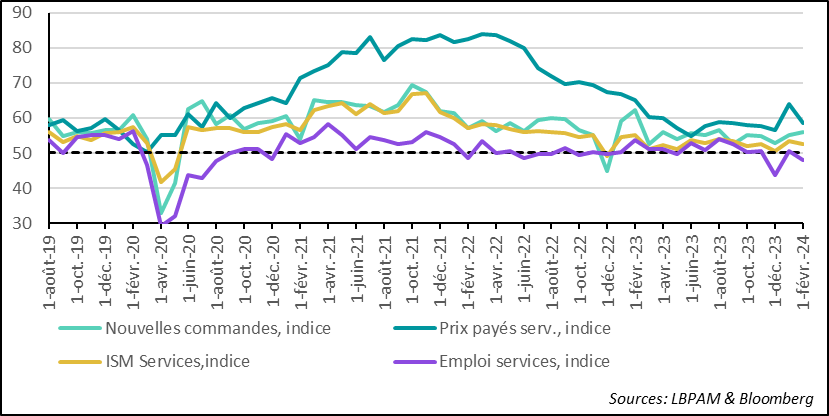

In the US, the picture was a little more mixed, although activity remains in slight expansion territory. While the S&P survey shows a slight acceleration, the ISM survey shows a slight deceleration. Nevertheless, the important point is in the underlying indicators of the ISM survey. In particular, employment took a less favourable turn in February. At the same time, this indicator has not really been a good guide to the robustness of job creation in services in recent months. We shall see what the employment report for February tells us this Friday.

More favourably, the trend indicator, new orders, picked up, indicating a favourable climate for activity in the month ahead.

Fig.4 United States: Activity in the services sector is holding up well, even if the momentum in job creation seems to be weakening

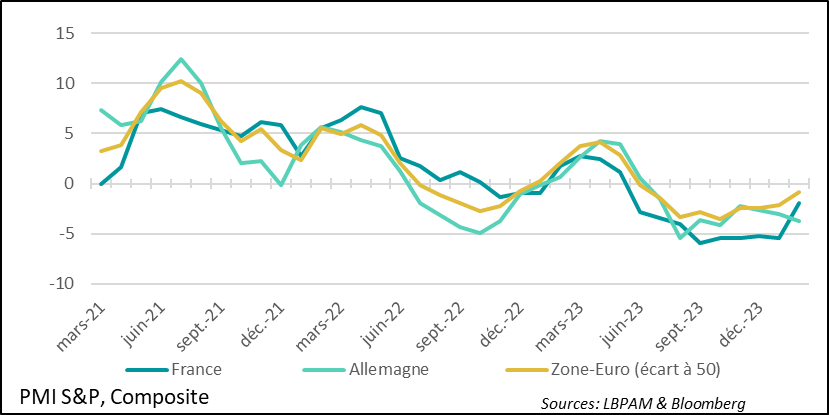

In the Eurozone, the good news was that activity continued to stabilise, even though the general message from the PMI survey was still that activity was stagnating.

Above all, we noted the great contrast that persists in the economic dynamics within the Zone. The major countries continue to have a negative impact on activity, particularly Germany. On the other hand, France, which had shown marked signs of weakness at the end of 2023, seems to be doing better at the start of the year, with a rebound in industry and services. Nevertheless, overall activity remains constrained and has yet to return to expansionary territory.

In fact, it is still the southern countries that are holding up well, with Spain in particular continuing to see activity improve in both major sectors. Italy, too, remains in expansion territory overall, even if activity in industry is lagging behind.

Fig.5 Eurozone: An economic situation that is stabilising, even if activity is still stagnating and there are major contrasts between countries