A historic, but very gradual, exit from Japan's

ultra-accommodative monetary policy

Link

-

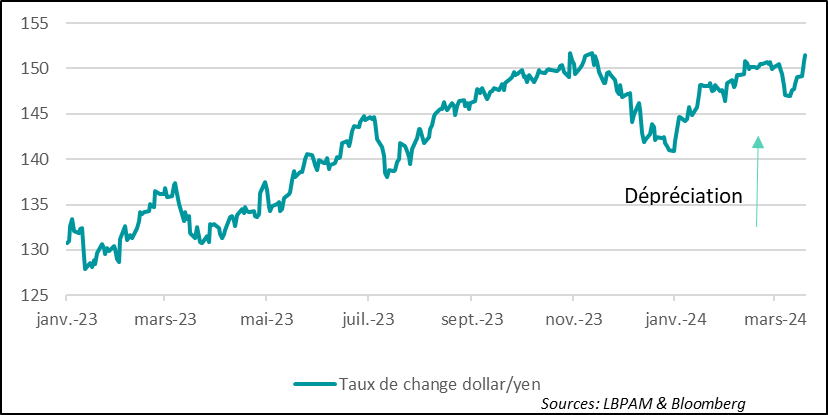

As expected, the Bank of Japan (BoJ) has announced the end of negative key rates, control of the yield curve and asset purchases other than government bonds. A historic moment after 20 years of this ultra-accommodative policy. Nevertheless, the BoJ's statement and the comments made by its Governor, K. Ueda, were very cautious. There is no new cycle of rate hikes. As a result, the market has turned its attention instead to maintaining a policy that will remain accommodative. The first result was a fall in the yen.

-

Obviously, the markets are awaiting the Fed's speech and projections today. Few changes are expected. Nevertheless, the market will be focusing on the Fed's new projections. Already, expectations of rate cuts in 2024 have come back close to what central bankers were thinking last December (only 3 cuts in 2024), and long rates have corrected upwards. But these movements have not deterred risk-taking. It also remains fairly concentrated, benefiting in particular US large caps and the AI craze. All in all, the Fed will have to take account of the fact that financial conditions remain much more accommodative than they were at the start of 2023.

-

As we have already said, in addition to bets on AI, risk-taking is also based on the resilience of the US economy. For example, new data on the health of the housing sector, with activity rebounding in February, has again shown the resilience of the economy. For the Fed, this should fuel its fears that the disinflation process is too slow, and perhaps lead it to be more cautious in its desire to ease monetary conditions a little in the months ahead.

-

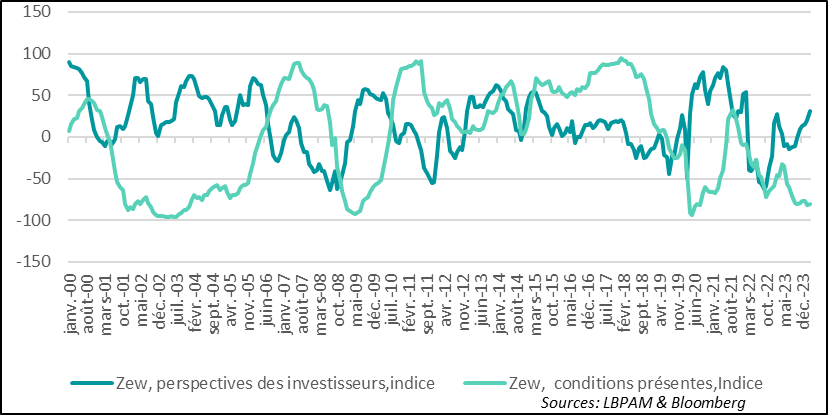

In the eurozone, the better news on the state of the eurozone economy, even if growth remains stagnant, seems to have reassured market operators, including in Germany. The ZEW survey saw a clear rebound in confidence about the future prospects for the German economy, especially given expectations of rate cuts by the ECB. Nevertheless, views on the current state of the economy remain mediocre.

Japan has moved away from the ultra-accommodative policy that was introduced in 2016. The BoJ has raised its key rates, which are expected to fluctuate between 0 and 0.1%. There are therefore no longer any negative key rates in the world. Control of the yield curve has also been abandoned. Similarly, purchases of private assets (including private equities and bonds) will cease.

Nevertheless, the BoJ will continue to buy government bonds (JGBs) close to the current amount, i.e. around 6,000 billion yen per month in gross terms. The BoJ could also intervene in the market in the event of abrupt rises in long-term interest rates, in order to avoid market overreactions.

Despite these changes, Japanese central bankers remain cautious about the outlook. Indeed, they note that the economy has shown signs of weakness, and the international economic environment remains fragile, while inflation expectations are not yet fully anchored around the 2% target. As a result, as K. Ueda, the Governor of the BoJ, monetary policy is likely to remain accommodative.

In fact, Japanese monetary policy will remain the most accommodative in the world. It is this sentiment that seems to have dominated the market reaction, as expectations of sharp rate cuts in Europe and the United States have been greatly reduced for 2024.

This was reflected in the reaction of the yen, which depreciated despite the change in monetary policy, reaching its lowest level since the early 1990s against the dollar. The Japanese currency appears to have devalued sharply, but its future will also depend in part on the decisions to be taken by the major central banks in the months ahead.

Fig.1 Japan: The yen responded with a further depreciation to the maintenance of a still accommodative policy, despite the abandonment of negative interest rates

- dollar/yen exchange rate

As the Fed prepares to give its verdict on the state of the US economy and, above all, to guide the market on the possible direction of monetary policy in the coming months, all the economic data are obviously being closely watched, particularly as regards whether or not the US economy is still resilient.

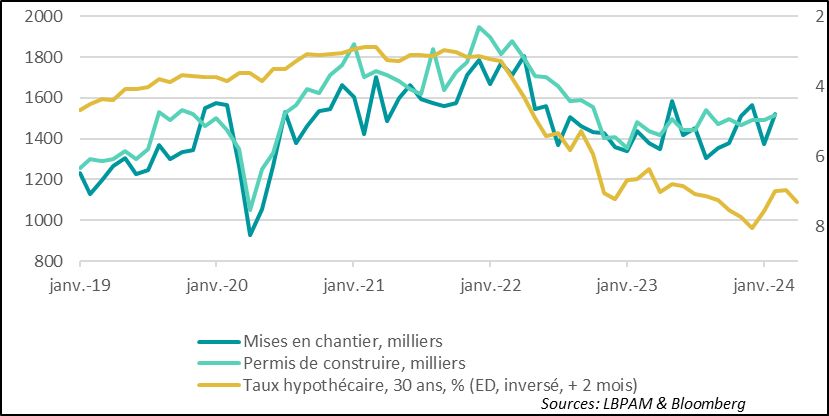

The latest statistics on the property sector, one of the most sensitive to changes in interest rates, are more robust than expected. Sentiment among property developers, housing starts and building permit applications are all stronger than expected.

Housing starts rebounded strongly in February, reaching their highest level for almost a year. This rebound partly reflects the negative impact of poor weather conditions the previous month, but also an upturn in activity linked to easier financial conditions, while the shortage of supply on the housing market persists. The same dynamic can be seen in building permit applications, which also rose sharply.

Nevertheless, the recent rise in interest rates, following upward revisions to the Fed's potential key rate cuts, could dampen this upward momentum in construction in the near future.

Fig.2 United States: Housing starts and building permits both rebounded in February,

partly thanks to a slight fall in mortgage rates

- Housing starts / thousand

- Building permits / thousand

- Mortgage rate, 30 years, % (ED, inverted, + 2 months)

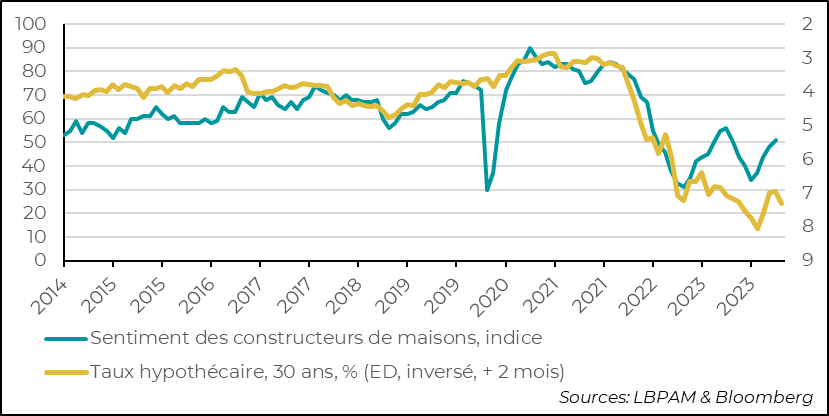

The same trend can be seen among property developers, with the NAHB index reaching its highest level since last July in early March. Here again, we could see a slight dip with the recent change in interest rate trends.

Fig.3 United States: Property developers' confidence got a solid boost in March,

showing that activity is picking up again

- Sentiment of home builders, index

- Mortgage rate, 30 years, % (ED, inverted, + 2 months)

In general, the latest economic statistics have shown signs of a slowdown in activity across the Atlantic, particularly in consumer spending. We expect this to be reflected in the figures for 1Q24, with GDP growth slowing to an annualised rate of around 2% for the quarter, after more than 3% in the previous quarter. Nevertheless, what is certain is that the construction sector remains resilient, which should fuel the Fed's caution as to the direction monetary policy should take, especially in a context where the latest inflation figures have shown persistent inflationary pressures in certain segments of the economy, notably services.

In the Eurozone, although overall activity is stagnating, economic conditions have stabilised and even improved in some of the zone's economies.

But the German economy is still lagging behind. In this respect, it is reassuring to see that the recent signs of stabilisation are being perceived by market operators with a little more optimism for the future. Indeed, the ZEW survey on the economic outlook improved significantly, gaining more than 10 points and reaching its highest point for 2 years. Unsurprisingly, however, perceptions of current conditions remain mediocre.

Fig.4 Eurozone: Survey of market operators in Germany shows

strong improvement in sentiment about the outlook

- zew, investor outlook, index

- zew, present conditions, index