A little peace of mind

Link

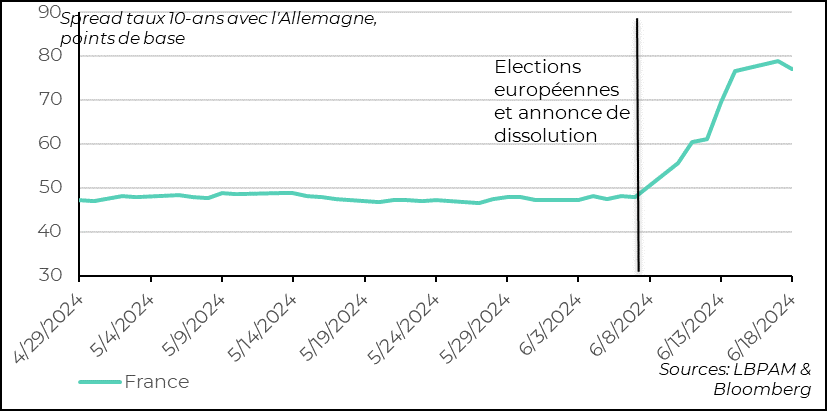

Since the decision by the President of the Republic, E. Macron, to dissolve the National Assembly and call for early general elections, anxiety has gripped the markets, particularly negatively affecting French stocks. Nonetheless, the market now seems to be breathing easier and avoiding extreme risks. Of course, risks do exist, as visibility on the possible application of the economic programmes of extreme parties on both the left and the right remains very low. This being the case, during this election period and given the high level of uncertainty, it seems reasonable to us to remain cautious in positioning our asset allocation, without giving in to any panic.

Today, the European Commission is expected to announce the list of countries expected to enter the excessive deficit procedure, i.e. those with deficits in excess of 3% of GDP. This rule was put on hold during the Covid period. France will certainly be one of them, but it will not be alone. This decision will come as no surprise, with a deficit of 5.5% of GDP in 2023. One way of comforting the markets would be for the various political forces to commit themselves to reducing the deficit by at least 0.5% of GDP over the coming years, as required by the new European Stability and Growth Pact.

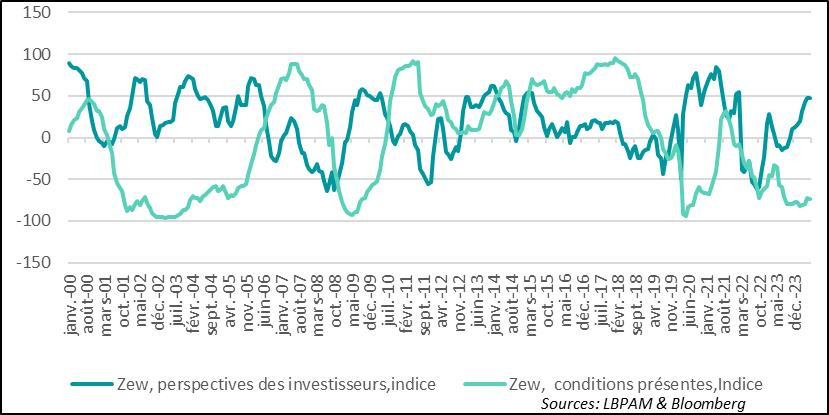

At this stage, it is difficult to determine what will be the economic impact of the anxiety caused by the outcome of the French elections. We had the ZEW survey for June, which reflects the sentiment of market operators in Germany. It partially incorporates current political concerns. Nevertheless, it came out less favourable than expected. Favourable views on the future rose only slightly, and sentiment on the present situation fell, remaining at a very low level. This remains consistent with our forecast of a very gradual economic recovery in Germany.

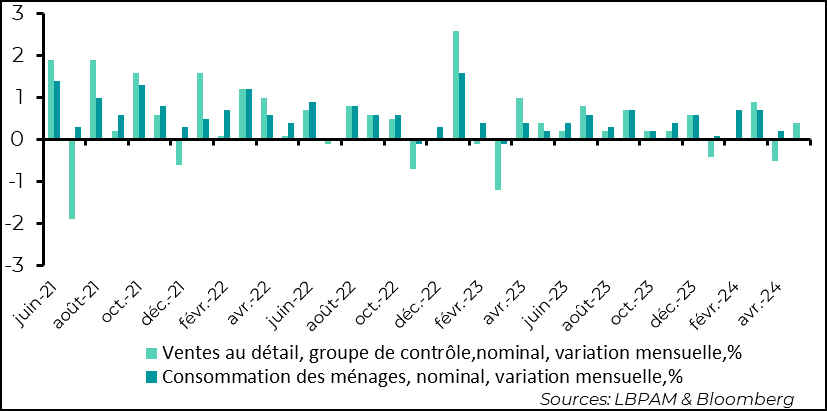

In the United States, retail sales statistics disappointed in May, with a much weaker rise than expected. In addition, growth for the previous two months was revised downwards. All in all, this suggests that consumers seem to be continuing to adjust their spending downwards, at least as far as goods are concerned. It could be that the few signs of a slowdown in the labour market that are appearing are weighing on consumption, while inflation is decelerating only slowly. This is in line with our forecast of a deceleration in US growth and should reassure the Fed.

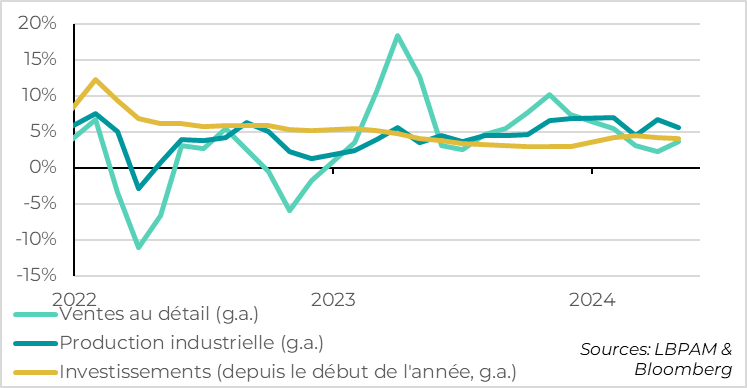

At the same time, there was better than expected news on the industrial production front, with a rebound in output in a number of sectors, particularly manufacturing. This rebound comes after a contraction in activity in the previous month, and follows a period of stagnation over the past year. This result therefore comes as a pleasant surprise, given that the ISM manufacturing survey had fallen sharply in May, indicating a contraction in activity. Nonetheless, it is difficult to say whether there is a solid recovery trend at this stage.

In Australia, the central bank has decided to keep its key rates unchanged. What's more, unlike most other central banks in the other major developed countries, the bank has been much more cautious, stressing that inflation is declining far too slowly. In fact, the possibility of a further increase in key rates was even raised by the Monetary Policy Committee. Despite the specific characteristics of the Australian economy, the central bank's caution demonstrates the difficulty of getting inflation back on target quickly.

After the great anxiety caused by the announcement by the President of the Republic of the organisation of early legislative elections, with the parties representing the extremes in a position of strength, a little calm seems to have returned. However, turbulence is still likely, given the many uncertainties surrounding the political balance in France and the direction the country will take after the elections.

This calm is reflected not only in the very slight rebound in the stock market, but also in the stabilisation of the spread between long-term interest rates on French and German sovereign debt. This spread is obviously high and close to that reached during the 2017 presidential elections, when the Front National, qualifying for the second round of the election, advocated leaving the euro.

Today, the extreme parties are not advocating leaving the single currency, but the economic policies they are proposing are seen as potentially damaging to public finances in particular, at a time when France's budgetary situation is already very poor.

Fig.1 France: France-Germany spread stabilises at a high but not extreme level

France

Today, the European Commission is expected to announce the list of countries facing the excessive deficit procedure. This procedure requires these countries to implement corrective measures aimed at reducing the country's structural public deficit (i.e. the public deficit adjusted for the economic cycle) by at least 0.5%. Remember that this rule was suspended at the time of the Covid crisis and it is only this year that it has been reintroduced, with a slightly more flexible revision of the adjustment constraints.

France, with a deficit of 5.5% in 2023, will be included, but it will not be alone, and will be accompanied by Italy in particular.

We shall see if this is included in the election campaign. If statements are made by various political parties in favour of respecting this constraint, this could reassure the markets. However, it is to be feared that at this stage of the political debate, little attention will be paid to this issue.

It seems to us that, despite the stability that seems to be emerging after the surprise call for early elections, we can still expect a great deal of volatility over the coming month.

This prompts us to remain cautious in our asset allocations, particularly with regard to our exposure to certain French stocks, but we also feel that it would be inappropriate to panic.

Apart from the adverse reaction of European markets to the situation in France, there is as yet no objective measure of the real impact on investor sentiment about the economic outlook, apart from the reaction on asset prices. In this respect, the ZEW survey of market operators for June sheds some light, albeit in a very partial way. Indeed, some of the responses to the survey were probably given before France's announcement.

The ZEW survey came out much less encouraging than expected. It is true that sentiment on the outlook has improved, but only slightly, while sentiment on current conditions remains very depressed.

Fig.2 Germany: despite depressed sentiment on current conditions, market operators still believe that the outlook is improving, albeit slowly

Zew, investor outlook, index

Zew, current conditions, Index

Although it will be difficult to identify how the political situation has influenced the opinions expressed in the survey, it seems to us that it does not call into question market participants' conviction that the German economy is continuing to recover. It is also certain that, in addition to the political issues, the increases in customs duties on certain Chinese electric car manufacturers are a cause for concern on the other side of the Rhine, while China has decided to counter-attack.

The focus also remains on growth momentum in the United States, with the US stock market continuing to hit all-time highs, driven in particular by technology stocks, led by NVIDIA.

In this respect, statistics on US retail sales were disappointing in May, coming in well below expectations and revised downwards compared with the previous month. Excluding cars and petrol, they rose by just 0.1% over the month in current dollars, compared with the 0.4% expected.

The so-called control product group, which includes the categories used to estimate consumption of goods in GDP, grew faster in May, albeit below expectations, at 0.4%, but the contraction in the previous month was revised downwards to -0.5%.

Fig.3 United States: goods consumption eases slightly in 2Q24 according to retail sales figures

Retail sales, control group, nominal, monthly change, %.

Household consumption, nominal, monthly variation, %.

Although these figures only give us a view of the consumption of goods, they seem to confirm a deceleration in consumption. This seems to be in line with the fall in consumer confidence and the slow deceleration in inflation.

Nevertheless, we need to remain cautious, as this is somewhat surprising given the robustness of the employment figures we had for May. One explanation could be that the labour market is a little less robust than the figures indicated. In this respect, it should be remembered that the household survey was unfavourable, with the unemployment rate rising to 4%, and that the latest statistics on jobless claims are up (it remains to be seen whether this trend is confirmed).

In any case, these figures are in line with our scenario of a gradual slowdown in the US economy. They should also reassure the Fed and give it a little more confidence in the need to cut its key rates, if demand is indeed slowing.

The news on the supply side was more positive. US industrial production rebounded in May, gaining 0.9% over the month, much more than expected, which translated into a higher capacity utilisation rate. This rebound in activity was also fairly widespread across all sectors.

Nonetheless, this figure sends out a different message from what could be deduced from the last ISM survey for the manufacturing sector, which had fallen sharply, accentuating the contraction dynamic.

It should be noted that, although most sectors rebounded last month, year-on-year growth in industrial activity remains fairly mediocre. We expect a moderate recovery to continue in tandem with the global industrial cycle.

It should also be noted that, unsurprisingly, some sectors remain very buoyant, such as the defence and space industries and new technologies.

Fig.4 United States: industrial production rebounded in May, but activity remains relatively weak, even though some sectors are still growing strongly

Total

Defence and space

Manuf.

Information process