A new world is emerging, but the old one still beats the markets

Link

What are the key takeaways from the market news on January 27, 2026? Sebastian Paris Horvitz provides some insights.

Overview

► Last week, the Davos Forum offered us a disturbing picture of the state of the world. Several heads of state took the floor to describe the state of the world and how it might evolve. The US president certainly reassured the markets by de-escalating the situation regarding Greenland (notably by renouncing tariff reprisals against European countries). But he reaffirmed his vision of a world based on “America first,” with the United States dictating the rules of the game.

►European leaders, notably German Chancellor Friedrich Merz and Emmanuel Macron, emphasized the sudden change that the world order is undergoing. Merz argued that Europe must face up to this new context and respond by charting its own course. This course must be based on the three pillars that make Europeans strong: security, competitiveness, and unity. But above all, Europe must invest heavily in its defense capabilities.

► The speeches given by European leaders echoed those of Mr. Carney, the Canadian Prime Minister. His description of today's world: “an era of great rivalry between powers, where the rules-based order is fading, where the strong can do what they want and the weak must suffer what they must suffer.” The Prime Minister then declared that Canada will not submit to this new world order and invited other nations to follow suit.

► The harsh rhetoric and differing views are cause for concern. Some may wonder why what appears to be an implosion of alliances and a rise in brutal antagonisms is not reflected more strongly in the markets. The reason is that markets are a “machine” that determines the value of an asset by incorporating all available information. For now, the shocks coming from the United States have not broken the economic momentum. This does not mean that other shocks, in this tense world, cannot change the situation. On the other hand, the market has already taken considerable changes into account, such as the evaporation of the dividends of peace enjoyed in past decades and a powerful effort to build a European defense.

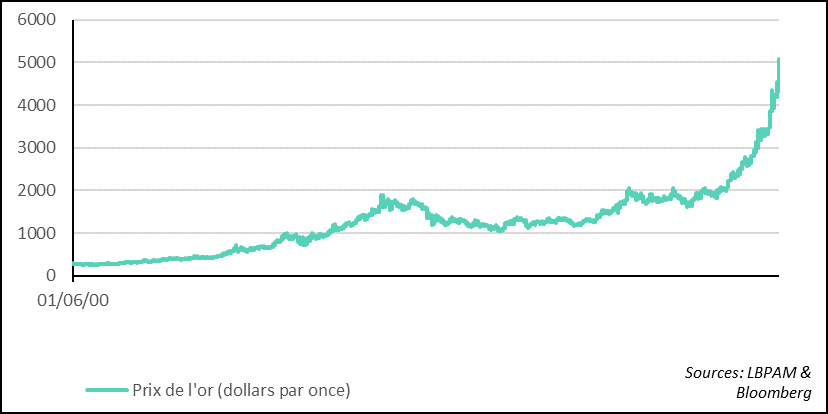

►For now, only precious metals, including gold, which has reached a new all-time high in dollar terms (over $5,000 an ounce), seem to reflect concerns about the uncertainty of the world's trajectory. Perhaps the persistence of high interest rates is evidence of this more dangerous world, which is putting pressure on budget spending, with military spending on the rise almost everywhere.

►However, at this stage, it is difficult to determine whether the dollar's renewed weakness reflects a lack of confidence in the supremacy of the US currency, prompting some to seek refuge in “alternative” assets such as precious metals, which are seen as more immune to geopolitical changes. In any case, the weakening of the dollar is helping the US stock market by automatically supporting companies with the greatest international exposure. On the other hand, the appreciation of the yen, which has been very sharp in recent days, particularly since rumors of intervention by the authorities, has weighed on the Japanese stock market. Although we believe that the Japanese currency should tend to appreciate in the medium term, particularly with the normalization of monetary policy, it is likely that an overly abrupt adjustment in the short term will also lead to intervention by the authorities.

►More generally, markets continue to be buoyed by economic prospects that are expected to improve in early 2026. As we have repeatedly emphasized, these prospects will be largely driven by fiscal stimulus, particularly in the United States, Germany, and Japan.

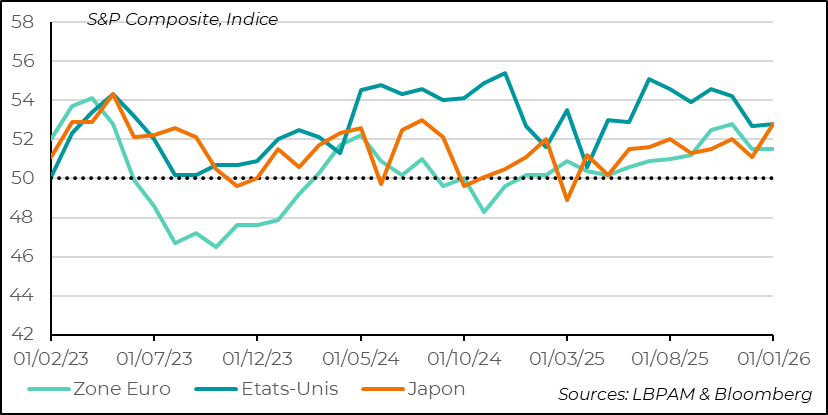

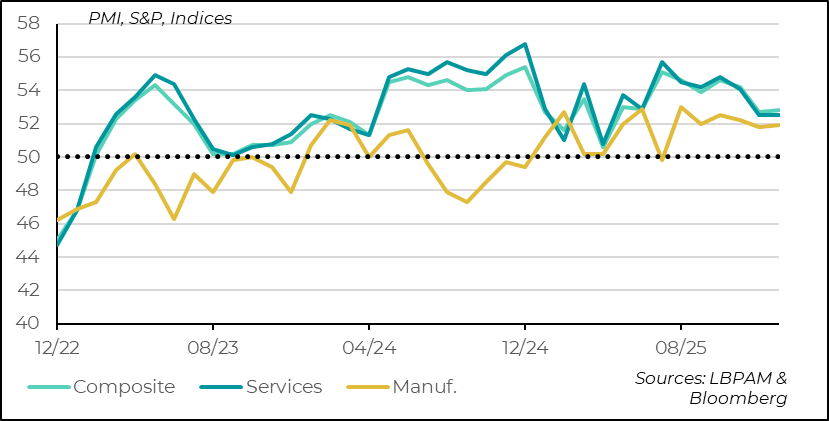

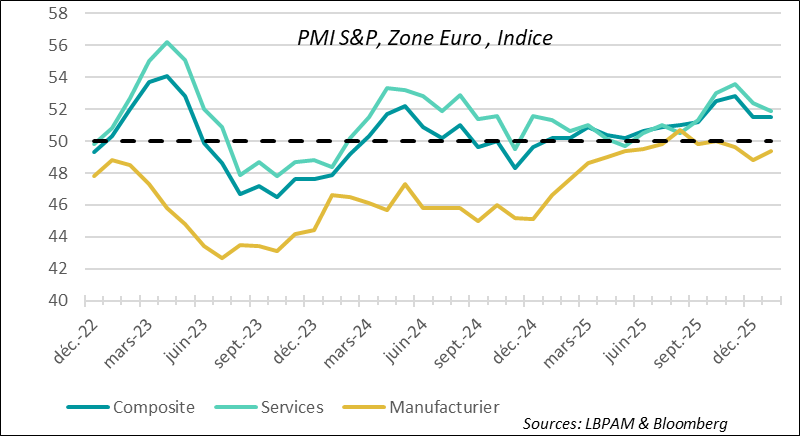

►S&P's preliminary PMI figures for January 2026 for certain major countries show that the outlook remains favorable, although there are generally no signs of a marked acceleration in economic activity, except in Japan.

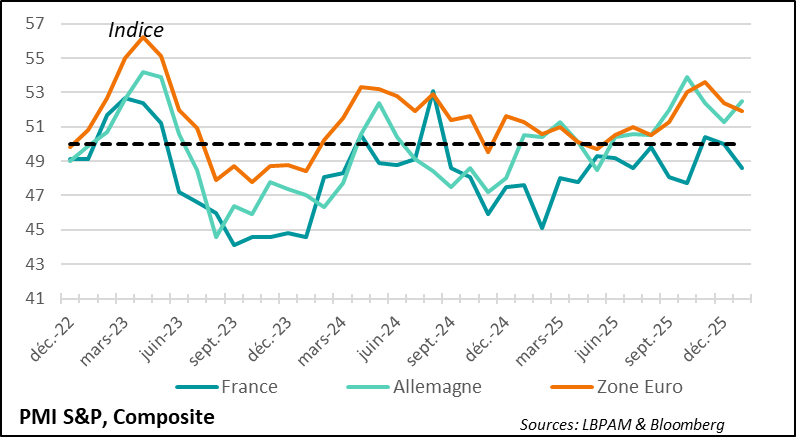

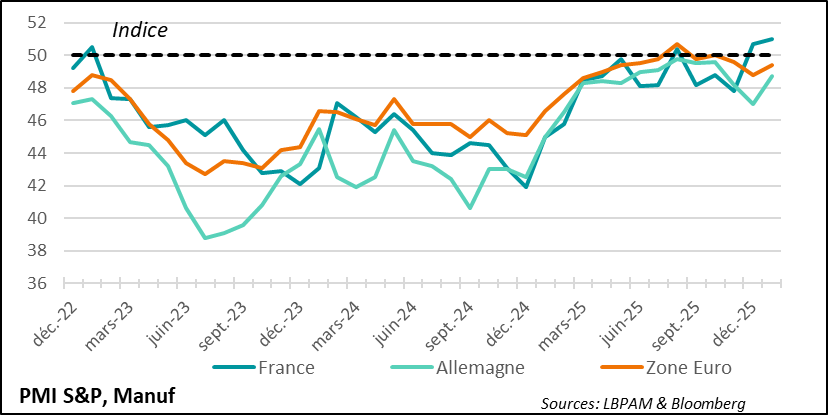

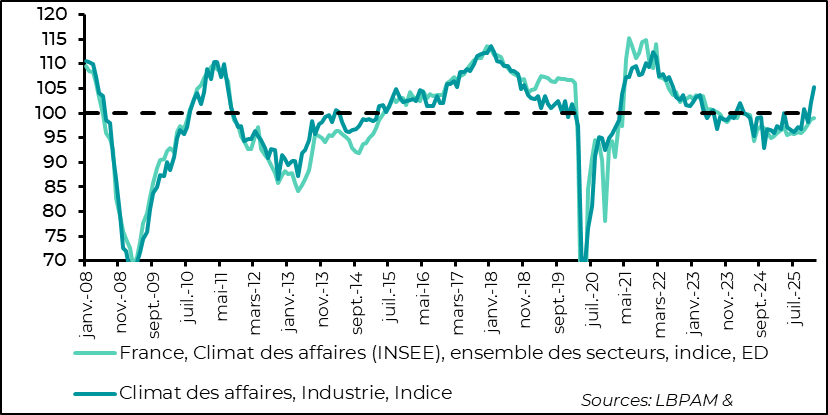

►In the eurozone, the composite PMI index (manufacturing and services) remained stable in January, but still in expansionary territory. However, momentum in services is weakening, while in manufacturing, the opposite is true. Germany is seeing a rebound, although it is still modest in industry, with the German manufacturing index remaining slightly in contraction territory. Activity in France appears to have declined significantly again, particularly in services. However, industry continues to recover. The INSEE survey confirms these trends, albeit to a lesser extent. We continue to believe that the European economy should accelerate in the first half of 2026 (H1 26).

►In the United States, although the composite index remains in growth territory, growth has lost momentum. In particular, at the start of the year, orders, especially in industry, are growing at a much slower pace than in the fall. We believe that investment support measures should boost activity in the first half of 2026 (H1 26). At the same time, confidence has improved slightly since the start of the year, although it remains very low.

Going Further

Currencies: High currency volatility at the start of the year

The dollar falls sharply and the yen strengthens

The yen, which had continued to depreciate over the past month, suddenly reversed its trend, appreciating sharply at the end of last week. This movement can largely be attributed to rumors of possible intervention by the authorities in the foreign exchange market, which would also have the support of the US Treasury.

The continuation of a downward trend, despite a sharp rise in interest rates, prompted the government to send a strong message to the market about speculative movements that could cause unwanted volatility. This threat of intervention explains the sharp appreciation. For the time being, the government has not intervened and calm seems to have returned.

We still believe that the yen should appreciate in the medium term, particularly with monetary policy normalization set to continue, albeit very gradually, over the course of the year. The Japanese currency remains significantly undervalued compared to other major currencies, but also compared to other Asian countries.

Almost at the same time as the yen appreciated, the dollar began to fall against the currencies of the United States' main trading partners. While the yen certainly contributed to this, the dollar also lost value against all other currencies.

Geopolitical tensions may partly explain this movement, but it would be premature to assume that a lasting trend of mistrust toward the dollar has taken hold. What is certain is that the fall of the dollar has given a boost to US stock markets, particularly stocks most exposed to foreign trade.

Gold prices hit new records

Geopolitical risks and fears that the dollar will gradually lose its dominant role in the international financial system are undoubtedly supporting assets that are seen as safe havens. Precious metals continue to enjoy steady demand, despite interest rates remaining relatively high across the board.

This diversification into gold may be justified given the many uncertainties surrounding us. Nevertheless, we believe that the persistence of relatively low volatility may be a sign of complacency and that it provides an opportunity to implement robust portfolio protection strategies.

Activity: SMEs send a message of continued growth

Even if there is no acceleration, activity remains resilient

S&P's preliminary PMI figures for January sent a reassuring message, even though business growth remains relatively stable. This preliminary survey, based on the major economies, shows that the start of 2026 does not yet show strong signs of an acceleration in activity. It therefore appears that the relatively accommodative financial conditions and the prospect of a synchronized fiscal policy stimulus in the largest economies (particularly the US, Germany, and Japan) have not yet had a marked impact on activity, even though business confidence remains high.

In fact, at the start of this year, only Japan has seen a strong response to the new Japanese government's stimulus announcements.

In the United States, growth continues, but is slowing slightly

In the United States, economic activity appears to be maintaining a moderate pace of growth at the start of the year. Indeed, the composite PMI remains relatively stable in expansionary territory. This stability is reflected in both industry and services. Nevertheless, demand is a point of concern, with new orders appearing to be less buoyant than in the fall.

Nevertheless, we still believe that the investment support measures included in the US budget should boost activity and create more positive momentum for employment, which in turn should support demand. The coming months will tell us whether this momentum is confirmed.

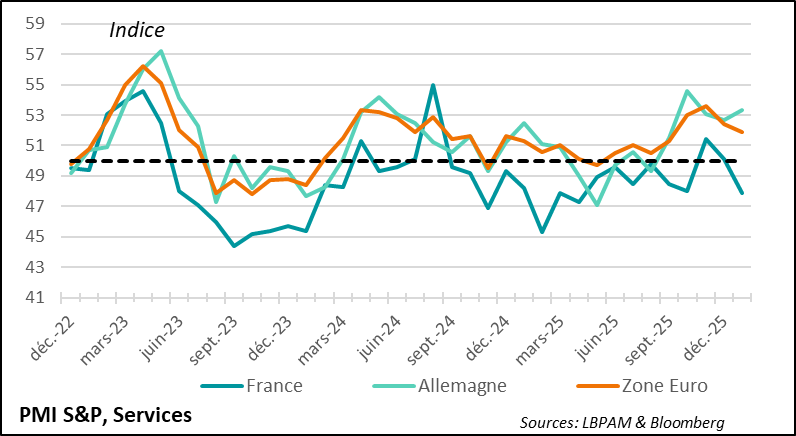

In the Eurozone, services are losing momentum

In the eurozone, the composite PMI has stagnated at the start of the year. Activity appears to be slowing slightly in the services sector, while in industry it is picking up but remains in contraction territory.

Domestic demand enters 2026 with weak momentum

The good news is that activity in Germany has recovered well at the start of the year, reflecting the German government's fiscal efforts. We still expect this momentum to continue. Indeed, the Chancellor emphasized in Davos the need to boost the German economy.

France, on the other hand, is experiencing another downturn at the start of the year, particularly in the services sector.

France contributes to the slowdown in services at the start of the year in the Eurozone

S&P's preliminary survey clearly shows that the momentum in services is deteriorating. In part, S&P reveals that companies remain concerned about the foreign trade situation, particularly in light of threats from the US. At the same time, paradoxically, French companies remain very optimistic about the future, once again buoyed by the stimulus plans currently underway.

Industry is doing slightly better in the Eurozone

Industrial activity has rebounded slightly in the eurozone at the start of this year. This rebound is most pronounced in France, contrasting with the situation in the services sector.

INSEE survey confirms rebound in industry

The message from the PMI survey is partly corroborated by the INSEE survey, particularly with regard to the rebound in activity in the services sector, but it is less pessimistic about services.

We still expect to see renewed momentum in activity across the eurozone in the first quarter of 2026 (Q1 26).

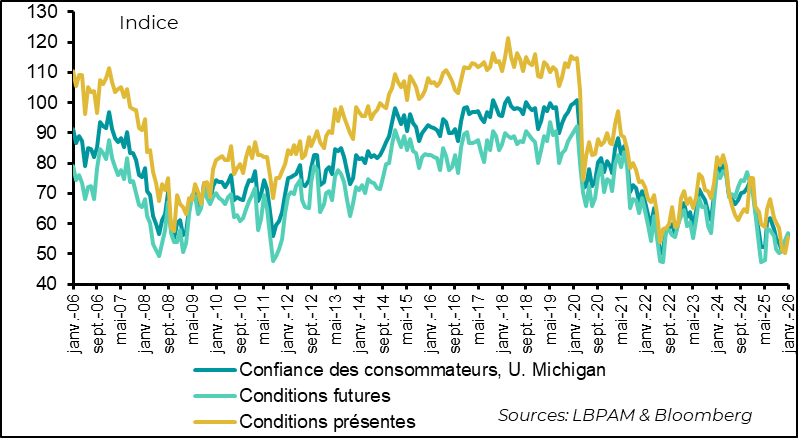

United States: Consumer confidence rebounds slightly at the start of the year

Confidence remains low but rebounds in January

According to the University of Michigan's final survey for January, US consumer confidence has rebounded at the start of the year. This is partly due to a more positive outlook on their financial prospects. This is not surprising given the stock market performance. At the same time, confidence remains at a very low level, with significant distortions in the assessment of the state of the economy depending on the political affiliation of those surveyed.

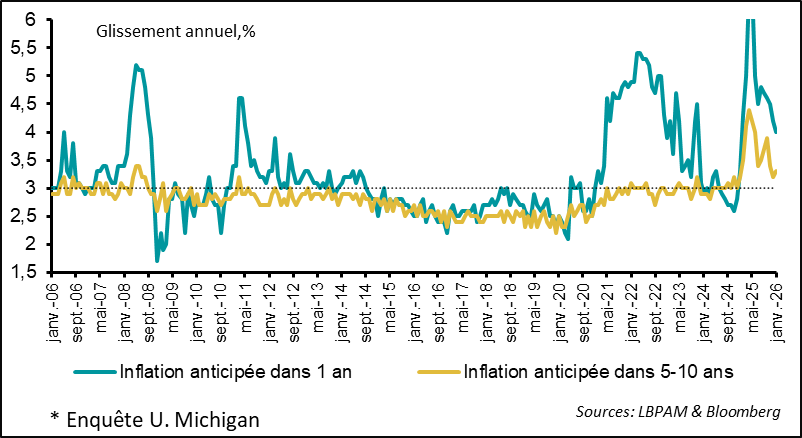

Inflation expectations remain relatively high but stable

The survey reveals that inflation expectations are easing slightly, but remain high nonetheless. In the coming months, we will see how the slow rollout of tariffs affects prices and, above all, whether the acceleration in growth that we anticipate creates new tensions.

We continue to believe that the Fed will remain very cautious in its monetary policy, which should be confirmed this week.

Sebastian Paris Horvitz

Director of Research