A relatively favorable market environment despite rising uncertainty

Link

What are the key takeaways from the market news on January 09, 2026? Xavier Chapard provides some insights.

Overview

► Geopolitical uncertainties continue to roil markets following last weekend's historic events in Venezuela. Added to this are Donald Trump's announcements of new measures for government intervention in the US economy (to block institutional investors' access to the residential real estate market, reduce the distribution of defense companies' profits, etc.). However, the overall impact of all this on the markets remains limited. Gold has risen, but oil remains stable at just over $60 per barrel, as do long-term interest rates, and equity markets have continued to rise slightly.

►Geopolitical risks are on the rise (risk surrounding the future situation in Venezuela, risk of further unilateral action by the US in other countries, reaction from other powers such as China or Russia, etc.) and we can expect further unorthodox economic policies in the US, especially as the midterm elections approach. This could lead to periods of market volatility, prompting us to continue favoring agility and implementing hedging strategies in our allocations.

►However, this does not change our central scenario, which remains fairly positive for the start of the year, supported by the resilience of the economy, central banks that are still fairly accommodative, and fiscal stimulus in the largest countries. We therefore remain positive on risky assets and more cautious on bonds.

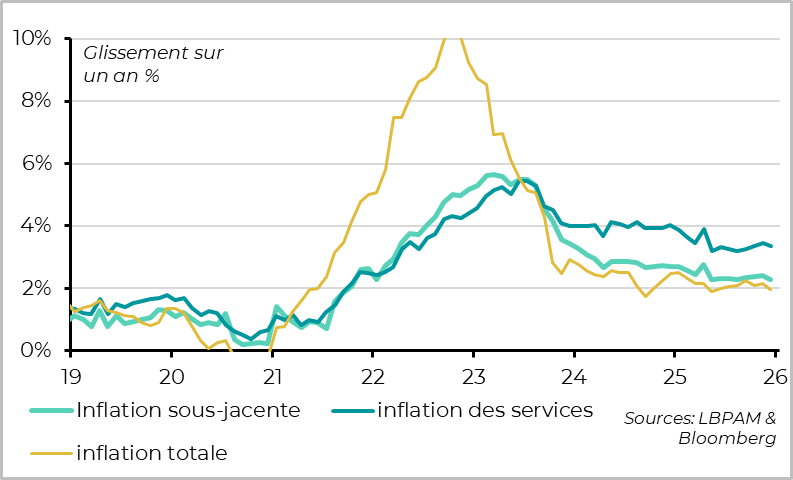

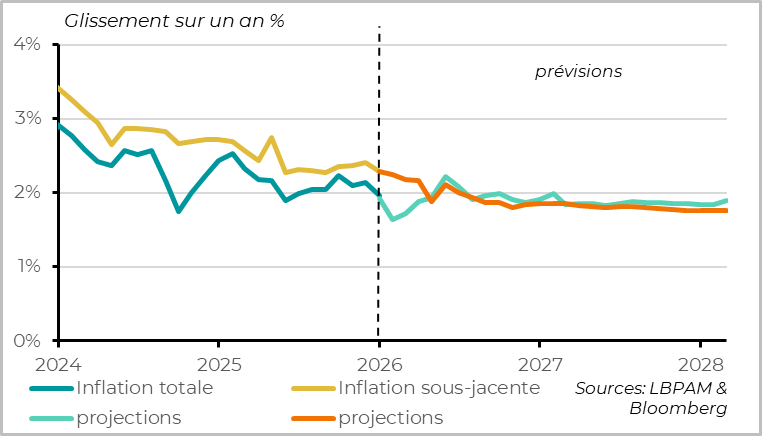

►Inflation slowed more than expected in the eurozone in December, which is reassuring after the upward surprises of recent months. Total inflation ended the year at the 2% target, while core inflation resumed its decline to 2.3%. This reinforces our view that inflation should fall back slightly below the target for the rest of the year.

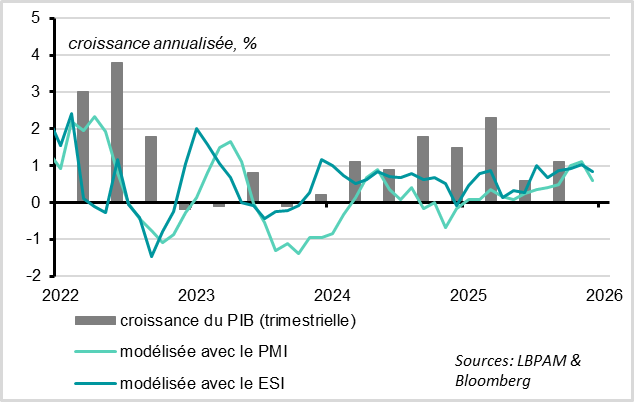

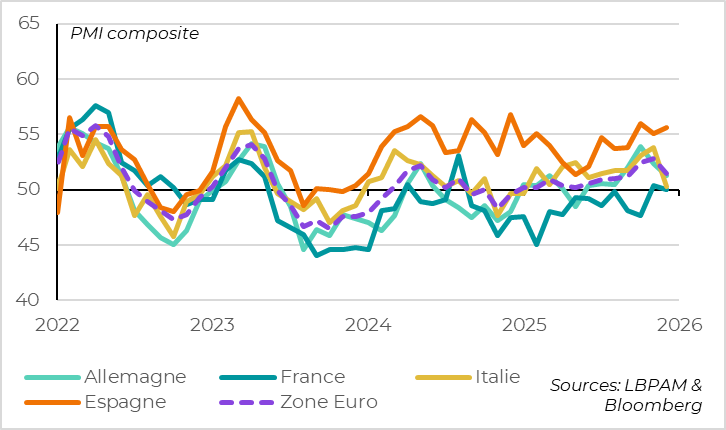

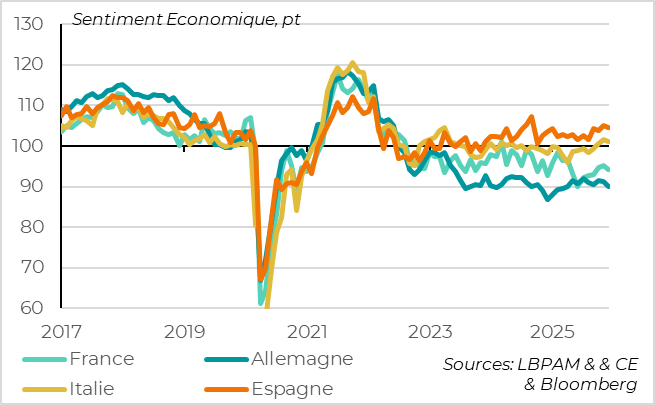

►At the same time, economic surveys in the eurozone (PMI, economic sentiment) consolidated in December after rising sharply in October and November. This does not call into question our scenario of a gradual recovery in the European economy, especially as the effects of the German stimulus package are yet to be felt, but it does suggest that the recovery will remain sluggish at the end of 2025.

►These surprises regarding inflation and economic conditions are not enough to call into question the ECB's wait-and-see stance, and we still expect key interest rates to remain unchanged this year. However, they reinforce our view that the ECB is more likely to cut rates further than to raise them in the coming months.

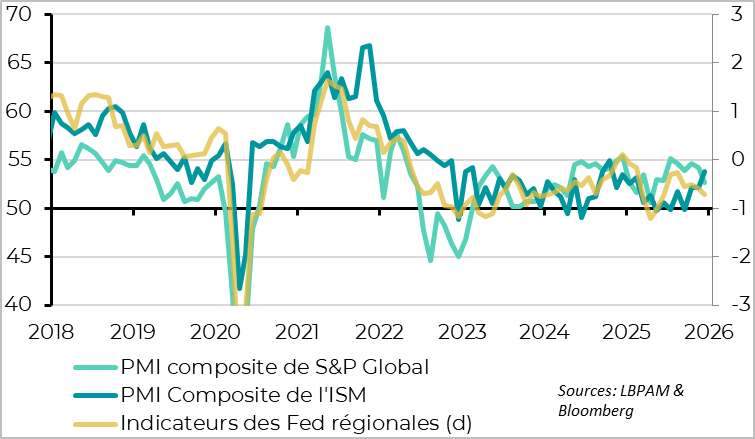

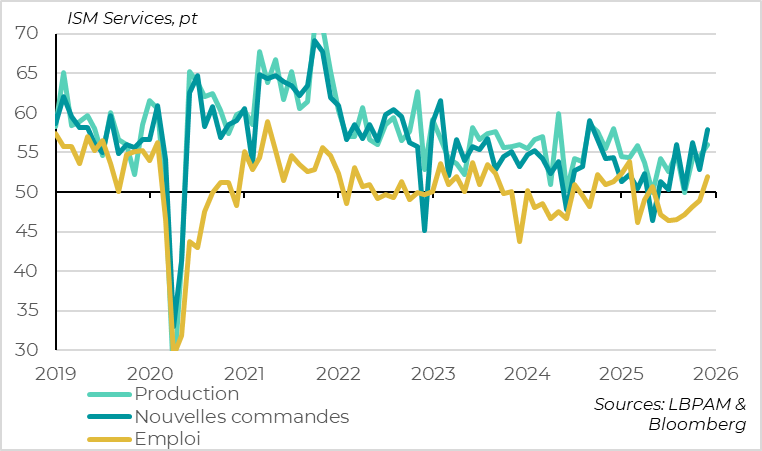

►In the United States, the latest data remains mixed, maintaining uncertainty about the short-term economic outlook, even though we anticipate a slight re-acceleration in the first part of the year. While the S&P PMI and regional Fed indicators fell in December, the ISM services index rebounded to its highest level since Donald Trump's election (54.4 points). The sharp rise in orders and employment in the ISM survey is particularly welcome, as it suggests that business confidence is finally recovering. This afternoon, we will see whether the official employment data for December provide a little more clarity on the state of the US economy at the end of 2025.

Going further

Eurozone: Inflation to resume its slowdown at the end of 2025

Inflation returns to target and core inflation resumes its decline in December

Inflation returned to target in the eurozone at the end of 2025, slowing from 2.1% to 2.0% in December. This was expected, as base effects on energy prices were favorable. On the contrary, food inflation remains slightly high at 2.6%.

Above all, core inflation is surprisingly down slightly, slowing from 2.4% to 2.3%. It remains slightly above target but is resuming its downward trend after eight months of slight increases. And the rise in core prices is slowing more sharply on a sequential basis (+0.12% per month over the last two months). This is reassuring in that core inflation remains on track for a full return to the 2% target in the coming months.

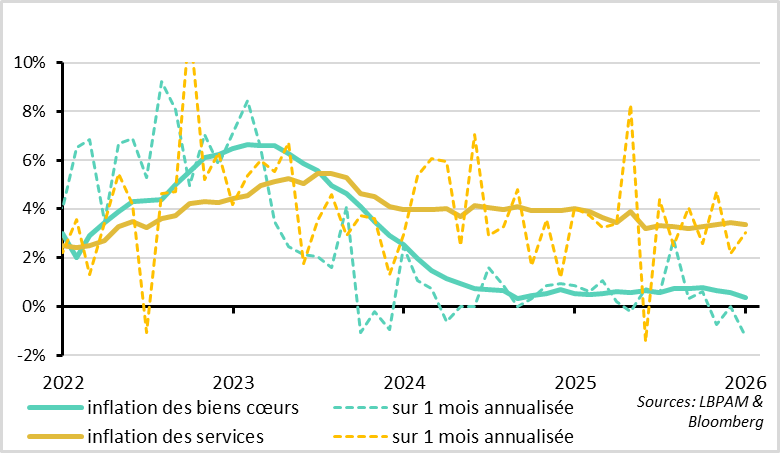

Unlike goods, inflation in services continues to slow very gradually

That said, the slowdown in core inflation is probably somewhat exaggerated in December and should remain gradual in the coming months.

Indeed, the downward surprise in December prices stems mainly from the decline in manufactured goods prices (-0.1% over the month), such that core goods inflation slowed from 0.5% to 0.4%. It is at its lowest level since Covid, helped by the rise in the euro. But this weakness may be somewhat exaggerated by the seasonality of winter sales.

Inflation in services, which is less volatile and more persistent, also slowed slightly in December, but still at a gradual pace. It remains a little too high at 3.4% and is still not slowing more significantly on a sequential basis at the end of 2025.

Inflation is expected to fall slightly below target this year

The renewed decline in core inflation supports our scenario of inflation slightly below target this year, although it will probably take until spring for core inflation to return fully to 2%.

For the ECB, December inflation is 0.1 percentage points below its latest forecasts (2.1% and 2.4% for headline and core inflation). This is not a big enough surprise to change the ECB's wait-and-see stance, especially as the surprise is probably exaggerated by the timing of the sales. But it reinforces our view that the risks are more bearish than bullish compared to the ECB's latest forecasts. In this context, the central scenario remains that the ECB will keep rates unchanged this year. But the risk of further rate cuts, in the event of a negative surprise on inflation or growth, still seems much higher to us than the risk of rate hikes this year.

Eurozone: Accelerated growth still awaited

Surveys consolidate somewhat in December

After very bullish surprises in October and November, economic surveys for the eurozone declined in December. While they remain consistent with resilient growth, this suggests that the expected acceleration in the recovery has not yet materialized.

The decline in the Eurozone composite PMI is more pronounced than initially estimated, falling from 52.8 points in November to 51.5 points. This remains at the top of its fluctuation range since the start of the war in Ukraine, but breaks the clearly bullish momentum of the previous three months.

The other reliable economic survey for the Eurozone, the Commission's Economic Sentiment Indicator, also sends a more cautious message in December. The ESI fell to 96.7 points after reaching a high since mid-2023 in November at 97.1 points. This remains consistent with growth of around 1% but is still below its historical average.

The decline in investigations is fairly widespread

The slowdown in activity in December is fairly widespread in terms of countries and sectors, according to December surveys, except for Spain, where the PMI and economic sentiment remain high.

That said, the decline in the Eurozone PMI is mainly due to the volatility of the services PMI in Italy, which was surprisingly high in October and November and fell from 55 points to 51.5 points in December. However, in the Commission's survey, services activity in Italy continues to recover slowly. This suggests that the decline in the PMI in December is somewhat exaggerated.

Overall, Eurozone economic indicators remain clearly in expansionary territory, but December's figures suggest that the recovery will not accelerate before the end of 2025. While the October and November data pointed to upside risks to our scenario of a gradual recovery in the eurozone over the coming quarters, the December surveys reduce these risks but do not call into question our slightly positive scenario.

United States: Latest data offers no further clarity on economic conditions

US PMIs send mixed messages in December

The various surveys conducted in December send mixed messages, even though they generally still point to resilient growth at an average level.

S&P Global's composite PMI fell from 54.2 to 52.7 in December due to services, instead of the 52.5 points initially estimated. It remains in expansionary territory but has fallen to a six-month low, suggesting a loss of momentum in December after several very dynamic months. Regional Fed surveys also declined in December, but to a lesser extent.

In contrast, the ISM rose sharply in December thanks to the services sector. The ISM services index jumped from 52.6 to 54.4 points, reaching its highest level since Donald Trump's election, whereas it had been close to stagnation in the first part of last year.

The details of the ISM services are encouraging

The details of the ISM survey are particularly robust. In addition to strong activity in December, orders are at their highest level in 15 months and employment is clearly returning to growth for the first time since the start of the trade war. This suggests a rebound in domestic business confidence, which bodes well for employment in the first half of 2026.

The job market still seems weak but stable

Ahead of today's employment reports, the latest labor market data is mixed, suggesting that employment remains stagnant at the end of 2025 but is not deteriorating significantly.

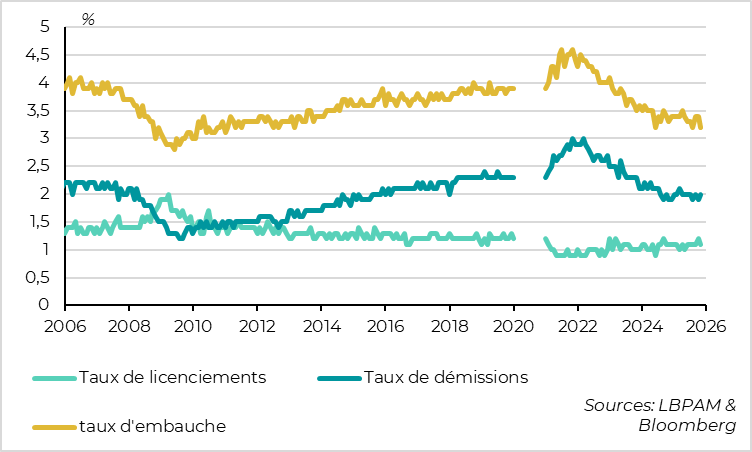

The November flow survey indicates that job vacancies and hiring are falling again, returning to their low point in the cycle. However, layoffs remain low, suggesting that the balance of few hires and few layoffs continues. For December, private job creation remains limited but is improving slightly according to surveys by ADP (+41,000) and Revelio Labs (+75,000). Is this the beginning of the expected recovery in employment thanks to reduced uncertainty and the end of the shutdown? This is necessary to reduce the risk of a downturn in the US economy, but it remains to be confirmed.

Xavier Chapard

Strategist