The U.S. government is heading toward a new record-breaking shutdown.

Link

What should we take away from market news on November 7, 2025? Answer with the analysis of Xavier Chapard.

Overviews

► Markets are showing signs of mild consolidation at the start of November, following a strong performance in October. This movement appears to reflect a technical pause rather than a shift in trend. Despite persistently high levels of uncertainty, the global macroeconomic backdrop remains supportive, sustaining growth prospects.

► On the uncertainty front, the U.S. government shutdown which has paralyzed part of federal services became the longest in history this week. No budget agreement has yet been reached between Republicans and Democrats in the Senate. However, conditions for a compromise appear to be emerging, particularly following Tuesday’s local elections won by the Democrats and in light of the growing impact of the shutdown: a 10% reduction in domestic flight capacity at airports, a sharp increase in the number of unpaid federal employees, including military personnel, and limited access to food assistance.

If the shutdown ends in the coming days, its economic impact should remain contained estimated at around one percentage point of growth in Q4 and temporary, with a recovery expected in Q1. However, the longer it lasts, the more its effects intensify, especially on the publication and reliability of official macroeconomic data, which could be disrupted through the end of the year.

► Another source of uncertainty this week: the legality of certain tariffs imposed during the Trump administration, which were reviewed by the Supreme Court on Wednesday. The discussions focus in particular on reciprocal tariffs and those related to fentanyl, which account for nearly half of the tariff increases recorded this year. A decision is expected by the end of the year. Early reactions from the justices, including some conservatives, suggest the possibility of tighter regulation of these measures.

This context is reigniting uncertainty around U.S. trade policy. However, even in the event of a partial reversal, the impact on the overall economic outlook would likely remain limited: the administration could turn to other legal mechanisms to uphold its tariff strategy.

►On the economic front, PMI indicators rebounded in October, offsetting the decline seen in September. At 52.9 points, the global composite PMI reflects a growth momentum close to overall potential. This cyclical recovery at the start of the fourth quarter is relatively broad-based, with a particularly notable improvement in Europe.

► On the economic front, PMI indicators posted a rebound in October, reversing the decline observed in September. At 52.9 points, the global composite PMI signals activity in line with overall growth potential. This early fourth-quarter recovery is relatively widespread, with particularly strong momentum in Europe.

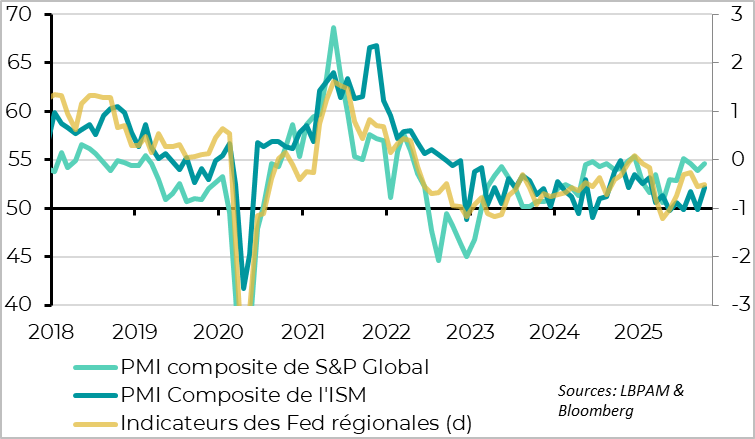

► In the United States, the ISM index rebounded in October after stagnating in September, indicating that economic activity remains resilient despite the shutdown context. On the employment front, private sector data remains mixed, pointing to modest but relatively stable conditions. In this environment, and in the absence of official statistics, the Federal Reserve’s next decision in December remains uncertain. Our baseline scenario continues to be a status quo, though another rate cut cannot be entirely ruled out.

► The Bank of England held its policy rate at 4% during yesterday’s meeting, likely awaiting the upcoming budget presentation scheduled for late November. However, the tone adopted by the institution was noticeably more dovish than in its September meeting. If the budget proves sufficiently restrictive, it could pave the way for a rate cut as early as December, or by early 2026 at the latest. In this context, UK short-term rates appear particularly attractive to us.

Going Further

October PMI: Solid Global Growth at the Start of Q4

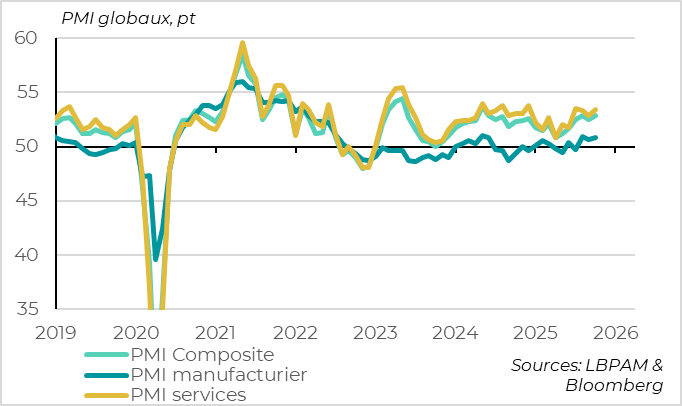

After a dip in September, global PMI regained strength and remains on a positive trajectory.

Global Composite PMI: A Positive Surprise for Early Q4 Growth

The global composite PMI, widely regarded as one of the best coincident indicators of global growth, rose from 52.5 to 52.9 in October. This rebound offsets the decline seen in September and brings the index close to its historical average. It aligns with a global growth rate slightly below 3% at the start of the fourth quartera performance that would be considered a positive surprise.

This result is all the more notable given that the survey was conducted largely before the recent agreement between the United States and China, which significantly reduces the risk of trade escalation in the coming year.

The strength of the global PMI is primarily driven by the services sector, which continues to outperform with an index reading of 53.4. This reflects robust domestic demand, relatively shielded from U.S. protectionist pressures. The momentum is consistent with resilient labor markets and easing inflation, which support household purchasing power. Additionally, investment in technology and looser financial conditions are helping to sustain corporate demand.

While the manufacturing sector is less dynamic, it remains resilient with a PMI of 50.8. Though below the services level, this suggests that trade tensions have not yet had a significant impact on the global industrial cycle.

However, it’s worth noting that business confidence for the months ahead declined sharply in October, reaching levels consistent with near-stagnation in global growth. This signal warrants close monitoring, even if the drop may have been amplified by rising trade-related uncertainties during the month.

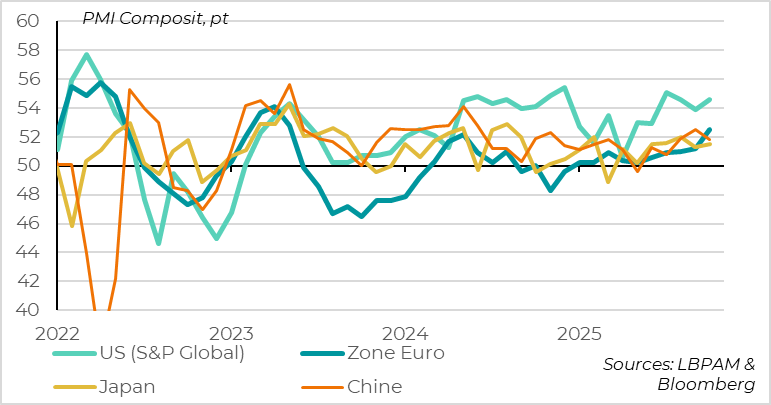

The U.S. is leading the way, but global PMI is supported by broader momentum.

The global PMI continues to be driven by the United States, with the S&P Global index climbing back to its summer levels at 54.6 in October well above other countries, except India. However, the overall momentum is broader than it first appeared. Composite PMIs have been significantly revised upward compared to preliminary estimates: the Eurozone reached a 2.5-year high at 52.5 points, Japan held steady at 51.5, and the UK saw a rebound after stagnation in September. In contrast, Chinese PMIs declined in October, pointing to subdued activity, though they remain in expansion territory.

It is reassuring to see that global PMI is not solely driven by the U.S. The signs of renewed momentum in Europe at the start of Q4 support our central scenario of a narrowing growth gap between the two sides of the Atlantic in the coming quarters.

In the United States, economic activity remains reassuring, although uncertainties in the labor market persist.

The gap between the ISM and other surveys is narrowing moving upward.

The ISM services index provided reassurance in October, rebounding to 52.4 points after signaling stagnation in September (50 points). This recovery more than offsets the slight decline in the manufacturing ISM, allowing the composite index to return firmly to expansion territory at 52.1—its highest level since the onset of the trade war in March.

Although it remains below the PMI published by S&P Global, the ISM is now converging with other business surveys, after showing notable weakness over the summer. This suggests that U.S. growth remains solid at the start of Q4, despite the backdrop of the government shutdown.

The breakdown of the ISM services index is broadly positive: strong increases in activity and new orders, and a moderate decline in employment. The only downside is the continued rise in the price component, which reached 70 points—its highest level since the inflation shock of 2021–2022. This indicates that, beyond the impact of tariffs, domestic price pressures remain elevated. That’s why we continue to believe the Fed will adopt a more cautious stance than markets currently anticipate, at least until the labor market shows clearer signs of weakening.

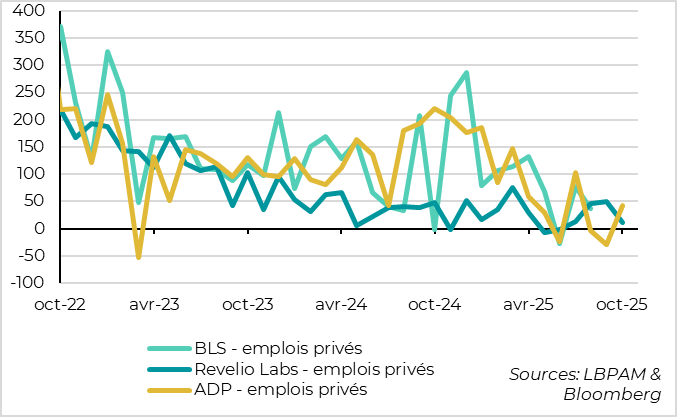

Private employment indicators for October paint a mixed picture.

With no official employment data published for two months due to the government shutdown, attention has shifted to private indicators, which remain broadly mixed.

According to ADP, private sector employment rose by 42,000 jobs in October, following a decline of 29,000 in September. This rebound is reassuring, although the three-month average remains flat, and job creation is concentrated in a few sectors—mainly large corporations and healthcare. Meanwhile, state-level jobless claims have remained stable compared to the past two years, suggesting that layoffs remain limited.

However, data from Revelio Labs show a decline of 9,000 jobs in October, after a 33,000 increase in September, contradicting ADP’s figures. Additionally, according to Challenger, job cut announcements reached a record high for the month of October since the early 2000s—even though hiring activity also surged.

Overall, these indicators do not provide a clear picture of the U.S. labor market, even for the Federal Reserve. They do suggest, however, that the market remains soft, without showing signs of a sharp downturn. In this context, the Fed may wait for the very latest data before deciding on a potential rate cut in December.

Bank of England: rates unchanged, but a more dovish tone

Consumer confidence showed a slight uptick in October.

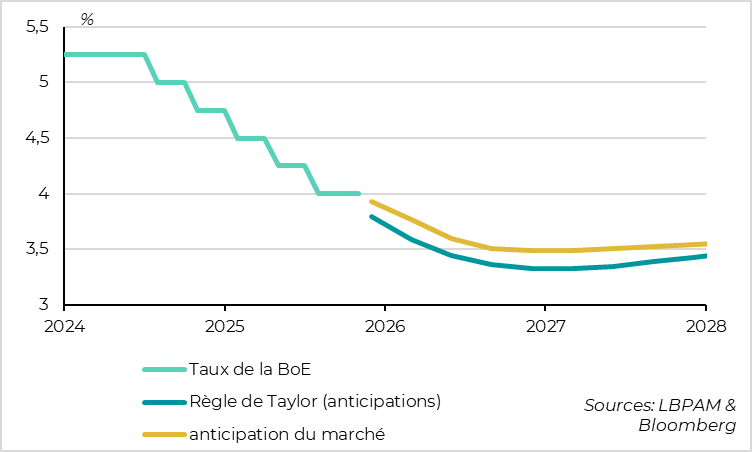

Ahead of the meeting, markets and consensus had assigned only a 20% probability to a rate cut, but the Bank of England ultimately kept its policy rate unchanged at 4% yesterday. This marks the second consecutive pause following September’s decision, breaking the pattern of mid-quarter rate moves seen over the past year. Monetary policy remains restrictive, with a high interest rate and active balance sheet reduction. Notably, the BoE is the only major central bank actively selling sovereign bonds, while the Fed, ECB, and BoJ are simply allowing securities to mature without reinvestment.

However, the meeting details reveal a more dovish tone than expected. The decision was more divided than anticipated, with four members voting for a 25 basis point cut and five favoring the status quo. The post-meeting statement was softer than in September: while the BoE still describes the rate-cutting path as “gradual,” it no longer calls it “cautious.” It also acknowledged that inflation has peaked (3.8% in September vs. 4% expected) and that risks are now “more balanced,” whereas it had previously emphasized upside risks.

Governor Andrew Bailey noted that the latest inflation data were “encouraging,” though he cautioned that it reflects only one month. He now sees downside risks as more prominent than upside ones. While he stated that market expectations align with the Taylor rule and his own views, his remarks suggest a possible acceleration in the pace of rate cuts.

Overall, this meeting supports our scenario of a pause in November ahead of the upcoming budget, followed by a potential resumption of rate cuts as early as December. This outlook remains contingent on the scale of fiscal tightening announced by the government for 2026. Beyond that, we continue to believe the BoE will lower rates more quickly than markets currently anticipate, reinforcing our interest in UK short-term rates.

Xavier Chapard

Stratégist