A slight air pocket in the United States in early 2024

Link

- Following last week's upward surprise in consumer prices (CPI), producer prices also surprised on the upside in January. This shows that the normalization of goods prices, which accounted for last year's rapid fall in inflation, is pretty much behind us. And the breakdown of consumer and producer prices suggests that the consumer price deflator, the Fed's target inflation indicator, may also accelerate in January.

- As with CPI, we shouldn't overreact to a single month's data, especially as January prices are likely to be impacted by annual revisions. And we continue to believe that core inflation will slow further in the months ahead. That said, the risk that the slowdown in inflation will be slower than anticipated increases our fear that US inflation will stabilize at around 3% rather than 2% from the second half of the year onwards. This would be a disappointment for the consensus and the markets, which see inflation returning to target by the end of this year.

- On the growth front, US activity data for January disappointed. Retail sales, industrial production and housing starts all fell fairly sharply. This supports our view that US growth should slow a little, after an exceptional second half of 2023.

- But this weakness in activity in January is probably exaggerated and does not, in our view, represent a change in trend. January was marked by unfavorable weather, and seasonal adjustments are uncertain at the turn of the year. Above all, confidence indicators remain on course in February, with consumer confidence reaching its highest level since mid-2021 in February thanks to solid employment and easing inflationary fears.

- In Europe, UK retail sales rebounded by over 3% in January, reversing their sharp decline in December. This is reassuring after the UK entered a technical recession at the end of 2023 (with GDP down 0.3% in Q4 after -0.1% in Q3). Given the resilience of the labor market and the rise in confidence indicators in early 2024, we continue to believe that the UK is more in stagnation than recession at the turn of the year, and that growth should pick up slowly during 2024. Against this backdrop, the BoE could remain cautious and wait until early summer to start cutting its key rate.

- On the geopolitical front, the weekend brought no lull. Prospects for a ceasefire agreement in Gaza are slim, while Russia is making slight progress in Ukraine and Navalny's death does not suggest any softening of the Russian regime. The good news is that the impact on the global economy remains limited, with ocean freight prices falling slightly since early February and European gas prices back to their lowest level since tensions with Russia began.

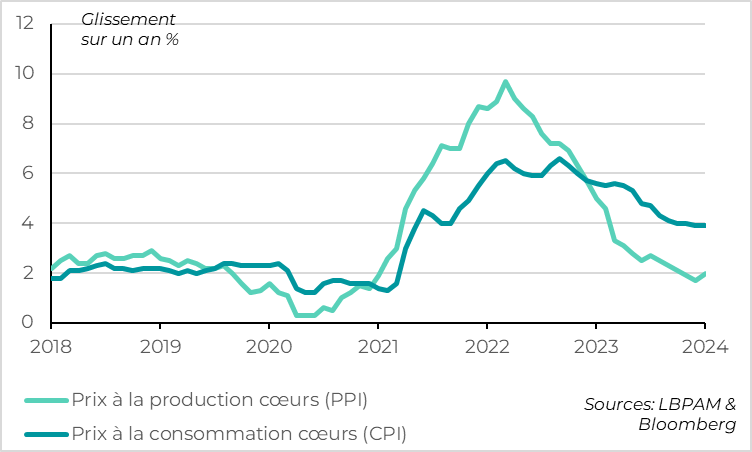

Fig.1 United States: producer prices also surprise on the rise in January

- Producer prices (PPI)

- Core consumer prices (CPI)

Following the upward surprise on consumer prices (CPI) in January, producer prices are also surprising on the upside. This reinforces fears that core inflation could slow more slowly in 2024 than in 2023, and remain above the Fed's target.

Producer prices excluding energy and food rose by 0.5% in January, after stagnating for the previous four months. Over a year, underlying producer prices rose by 2% in January, after 1.7% in December. This is the first acceleration since last summer.

The rise in producer prices in January is probably exaggerated due to the numerous price revaluations at the start of the year, as is also probably the case for consumer prices. But it does highlight the fact that the sharp fall in goods prices which led to the sharp slowdown in inflation in 2023 is now rather behind us, while services prices are still not really slowing down.

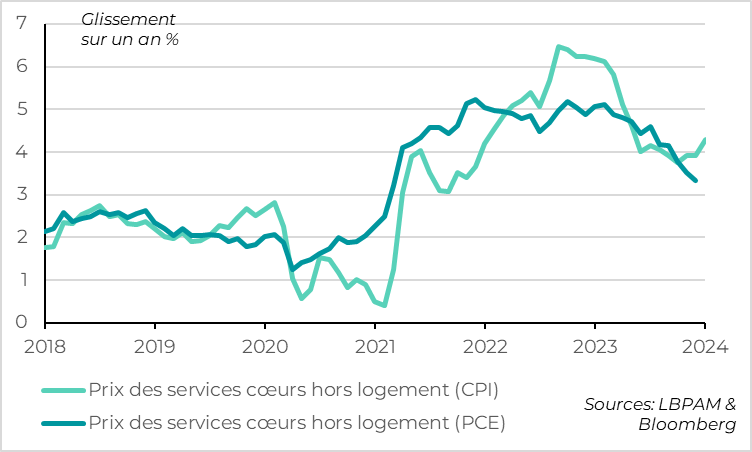

Fig.2 United States: The Fed's preferred measure of inflation should rebound fairly sharply in January

- Price of core services excluding housing (CPI)

- Price of core services excluding housing (PCE)

Above all, January consumer and producer prices suggest a marked acceleration in the consumer price deflator (CPI) in January. This is the indicator targeted by the Fed, which had slowed more sharply than consumer price inflation by the end of 2023. If this is the case, the Fed should be all the more cautious.

Indeed, the Fed is targeting the Core PCE, not CPI. However, while a large proportion of PCE components are taken from CPI, some core service components are taken from producer prices (PPI). This is the case for the price of air transport, financial services and hospitalization. And these components had contributed to making core PCE slow more sharply than core CPI at the end of 2023, which had probably contributed to the Fed's more accommodative stance. But January's figures suggest that core PCE should rise at least as strongly as core CPI over the month, which would be a first in four months.

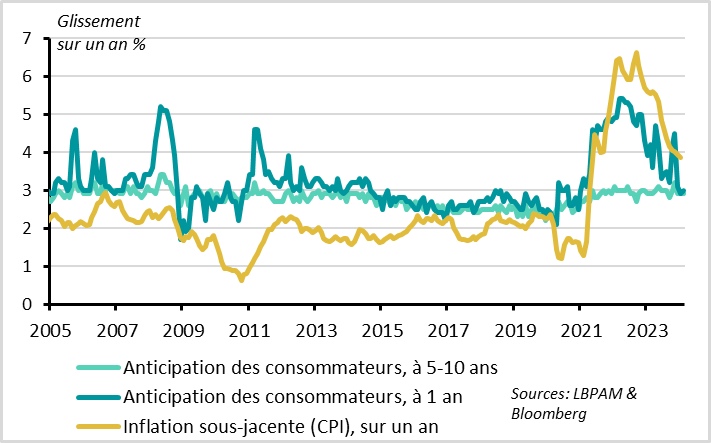

Fig.3 United States: But inflation expectations remain well anchored, allowing the Fed to be patient

- Consumer anticipation, 5-10 years ahead

- Consumer anticipation, 1 year ahead

- Underlying inflation (CPI), year-on-year

As is often the case in the United States, the good news once again comes from consumers. Consumer confidence continued to rebound in February according to the University of Michigan survey, reaching its highest level since mid-2021 (at 79.6pt). This is reassuring after the drop in retail sales in January, as it suggests that consumption remains buoyant thanks to a strong job market and easing inflation fears.

The Fed should be reassured by the fact that household inflation expectations remain well anchored, despite currently high inflation. Indeed, household inflation expectations are stable at the start of 2024, after their sharp fall at the end of 2023, at levels in line with their historical averages (3% at 1 year and 2.9% at 5-10 years).

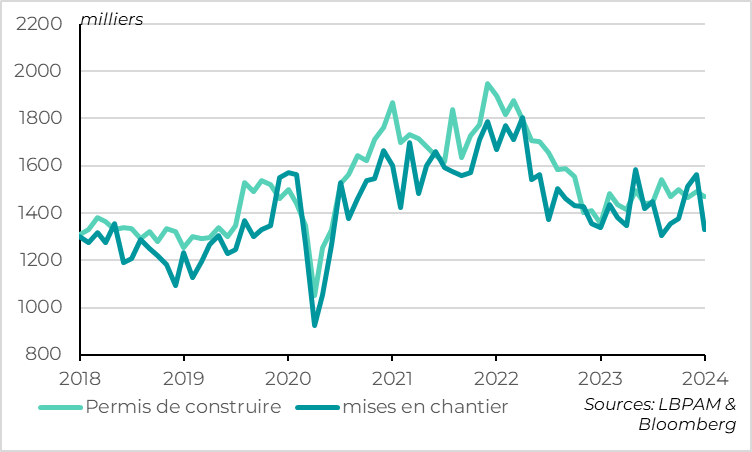

Fig.4 United States: Construction activity disappoints in January

-Driver's license

- Housing starts

US housing starts fell by 15% in January, reversing the strong rebound at the end of 2023, with starts at a 6-month low. That said, this partly reflects a sharp drop in building starts, which are always highly volatile, and the impact of unfavorable weather in January. Single-family housing starts, on the other hand, fell by a more limited 5%, while building permits, less affected by the weather, have remained broadly stable over the past 5 months.

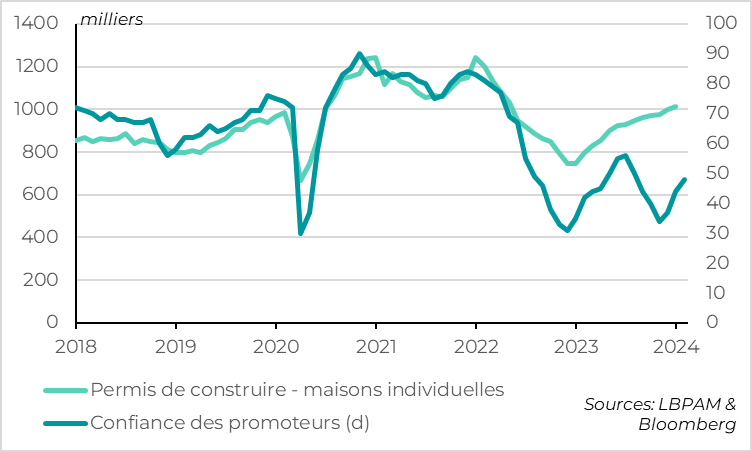

Fig.5 United States: But the outlook for real estate remains slightly favorable

-Building permits - single-family homes

- Promoter confidence (d)

In fact, building permits for single-family homes, the series that best reflects the trend in real estate activity, continue to pick up gradually in early 2024. Furthermore, promoter confidence continued to rebound in February despite the further rise in mortgage rates since the beginning of the month, while remaining close to neutral.

All in all, in our view, the disappointing US activity figures for January (retail sales, industrial production, construction, etc.) reflect more a temporary breather after several months of strong activity than a change in trend. Especially as January's figures are likely to be impacted by residual seasonal effects and by inclement weather. But it also shows that US growth is likely to slow after an exceptional second half of 2023, and that the risk of a more abrupt slowdown cannot be totally ruled out for the coming months.