A week of doubts for France

Link

Check out our market analysis from December 02, 2024, by Sebastian PARIS HORVITZ.

In summary

► In a weekend truncated by the Thanksgiving holiday in the United States, the reopening of the markets favored almost all assets, both risky and defensive. It would be presumptuous to attempt to draw any conclusions from these flow movements. Nevertheless, following D. Trump's latest appointments, notably as head of the Treasury, the market seems to be moving towards a more measured view of the policies his government might implement. Our scenario for the coming quarters is one of “reasonable” implementation of trade and immigration policies.

►But we are well aware of the risks. For example, we need only take at face value D. Trump's message this weekend, threatening the leaders of the BRICS countries with a 100% tariff hike, should they continue to seek to weaken the dollar's role as the world's main reserve currency. This tariff hike surely won't happen, but it shows the risks and volatility we could be facing as we get closer to D. Trump taking power.

►Paradoxically, the flow into various asset classes at the end of the week also led to a sharp reduction in the spread between French and German sovereign debt. The spread between French and German 10-year yields fell from a high of 86 basis points (bp) to 80 bp. At the same time, the cost of financing French debt is now almost in line with Greek debt, with the same interest rates. At the same time, on Friday evening, the S&P rating agency maintained France's debt rating at AA-, while leaving its outlook unchanged at stable. Some had feared that the rating would be downgraded.

►The agency has obviously stressed the fragility of the political situation and the delays in approving the 2025 budget. Nevertheless, like us and a large majority of the market, it favors a scenario where a budget adjustment is approved by the National Assembly, putting the public deficit on a downward trajectory, with a reduction of just under one point of GDP next year. Nevertheless, we remain very cautious about our position on French debt. Volatility could remain high, especially as the government could face an unfavorable vote of no confidence this week.

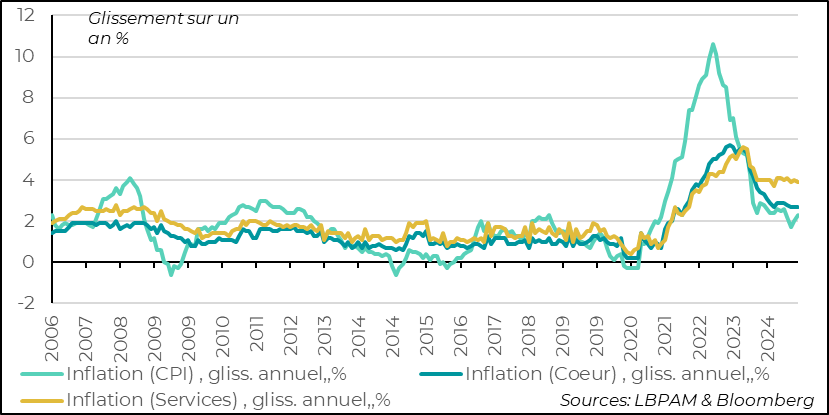

►We all know that to defend and stimulate growth in the Eurozone, the ECB will play a considerable role. In this respect, inflation figures for November were a little better than expected. They followed on from the positive surprises in German and French inflation. Total inflation for the Zone accelerated year-on-year to 2.3% from 2% the previous month. This was largely due to the base effects of energy prices. Core inflation, on the other hand, remained unchanged at 2.7%, although it was expected to rise. Inflation is likely to remain high for a few months due to base effects, and then decline.

►Even so, the ECB is expected to cut rates on December 12, insisting that convergence towards 2% should be well underway by the start of the year, thanks in particular to the deceleration in wages which should facilitate a decline in inflation in services.

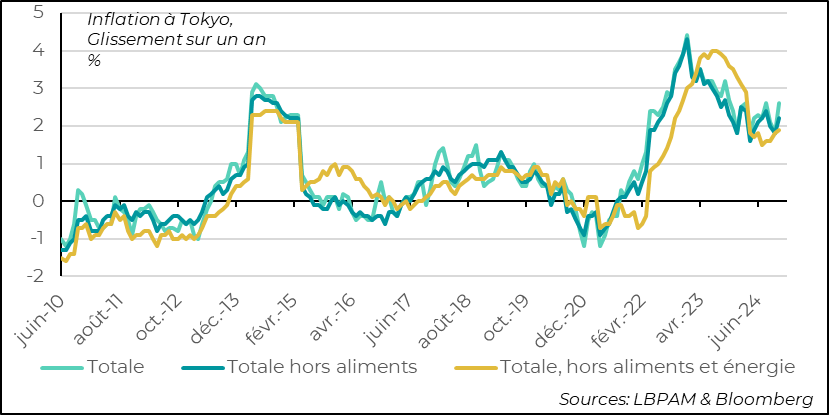

►In Japan, inflation in Tokyo in November, which gives a good indication of inflation in the country as a whole, came in slightly higher than expected, at 2.6% year-on-year, against expectations of 2.2%. In part, this was due to energy prices, with the elimination of subsidies decided by the previous government and maintained by the new Prime Minister S. Ishiba. But core inflation, excluding food and energy, accelerated slightly to 1.9%. Total inflation has been above 2% for more than two years. In our opinion, this reinforces the possibility that the BoJ may raise its key rates on December 19, at its monetary policy meeting.

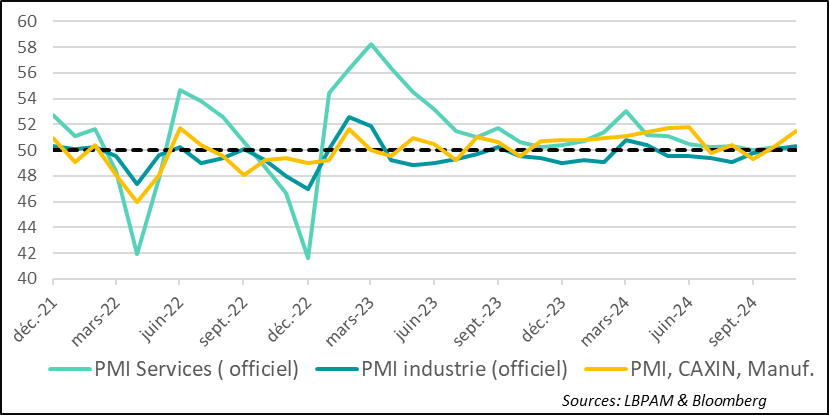

►In China, the official PMI survey for November was disappointing. Indeed, it shows that the recovery remains very slow. The services PMI returned to 50, the level separating growth from contraction. This stagnation in activity shows that the measures taken by the government remain insufficient. In the manufacturing sector, the official PMI rose slightly, while the private PMI (CAXIN) continued to gain ground, with a sharper rebound over the month. It is likely that external demand will continue to support the sector, which is benefiting more from current public policies.

To go deeper

The French government led by Mr. Barnier has continued its discussions with the political parties in order to adopt the budget for 2025. The Left Front has already announced that it will not vote for the budget, and will call for a vote of no confidence in the government if it uses Article 49.3 of the Constitution. The government is therefore seeking support from the Rassemblement National (RN). The government has already abandoned several measures, including an increase in the excise duty on electricity (3.4 billion less for the state coffers).

However, the RN would like to see no tax increases in the Finance Act. Otherwise, its leaders have declared that they will vote for the motion of censure.

We'll see in the coming hours, particularly in the discussion of the social security budget, whether new concessions are made.

What is certain is that the government remains very fragile, and its survival depends on the RN's choice of whether or not to give its approval to the finance bill.

At the same time, last Friday S&P reaffirmed its rating on French long-term debt at AA- and, above all, maintained its analysis of the outlook as stable. The rating agency stressed the political fragility, but expressed confidence that France should be able to reduce the public deficit by just under 1 percentage point of GDP by 2025, thus putting the deficit on a downward trajectory in the medium term, after the more than 6% of GDP deficit estimated for this year. Should this not be the case, the agency could revise its copy. The trajectory described by S&P is none other than that required by the European Commission as part of the criteria for France's excessive deficit procedure.

Unsurprisingly, French debt came under pressure. The spread with Germany reached a Friday high of 86 bp for the 10-year sovereign yield spread. At the end of the day, however, there was a clear reversal, with France benefiting from buying flows on government bonds in all the countries of the Zone, as well as in the United States.

All in all, the deterioration in public finances and the political fragmentation of the Assembly have resulted in a relative increase in the cost of financing for the French State. The most emblematic development is the convergence of the French 10-year rate with that of Greece. Italy continues to have a higher financing cost.

It is important to emphasize that if the government fails to pass this Finance Act and is censured, the State will continue to operate on the basis of the 2024 Finance Act. But there will be no budgetary adjustment. Above all, France could be punished by the markets, and this loss of confidence would obviously be detrimental to the economic recovery. At this stage, we remain very cautious on French debt.

It promises to be a complicated week.

France: France's spread with Germany at its highest, very close to that of Greece

At this stage, as has often been stressed, further monetary easing by the ECB will be an important factor in enabling Eurozone economies to regain or consolidate growth. In this sense, inflation data are key to reassuring the ECB that it can continue its current policy.

Inflation figures for November were relatively reassuring in the Eurozone. Year-on-year inflation was expected to pick up as a result of base effects linked to energy prices. And so it proved. Nevertheless, in terms of core inflation, there was no upward effect, which is reassuring. Also, in services, inflation stagnated, although it remains high at 3.9% year-on-year.

Euro zone: As expected, due to the base effects of energy prices, inflation accelerates in November, but core inflation remains stable

Base effects should keep inflation high for another month, but these effects will dissipate.

The real issue is what will happen to service prices. The ECB, like us, is counting on a deceleration in wages over the coming months, which should accompany the decline in price growth in services. Thus, our projection remains that Eurozone inflation will converge towards 2% in the first part of 2025.

We therefore believe that, despite the acceleration in inflation in November, this should not prevent the ECB from lowering its key rates again (by 25bp) on December 12. Nevertheless, while referring to the weakness of activity, the ECB is likely to remain cautious about the future trajectory of its policy, in particular to reassure the more orthodox members of the Board.

In Japan, inflation in Tokyo for November came in higher than expected, at 2.6% year-on-year. The main reason for this was the removal of subsidies on energy prices, which were maintained by S. Ishiba's government. Core inflation, excluding fresh food and energy, also edged up to 1.9% year-on-year.

Tokyo's inflation figures are generally a good approximation for inflation in the country as a whole.

Japan: Inflation slightly higher than expected, largely due to the elimination of energy subsidies, while core inflation remains close to 2%

These inflation figures are the last the BoJ will have for its mid-December monetary policy meeting. These figures seem to us to be consistent with a further rise in key rates. K. Ueda, the governor, had already opened the door to such a decision. The market has already anticipated this possibility, even if it is not yet unanimously supported. Some believe that the BoJ will be more patient.

It's worth pointing out that, despite the fact that the market sees the Fed cutting rates less in 2025, the yen has appreciated in recent weeks. In fact, the yen is the only G10 currency to have appreciated. In our opinion, this reflects the anticipation of a further reduction in the monetary easing still in place in Japan.

This trend in the yen is a point of vigilance for Japanese equities, particularly for exporting companies, even if the yen remains very depressed.

In China, the publication of official PMIs for November was disappointing. In particular, the services PMI fell back to 50, the limit between growth and contraction. This stagnation in services shows that government measures remain insufficient to boost demand. More needs to be done on the fiscal front if the government is to revive activity.

In the manufacturing sector, the situation described by the official and private (CAXIN) PMIs is a little different. While both indices continue to recover, CAXIN showed a significant rise in November.

China: Official PMI survey shows no further acceleration in activity in November, with services stagnating in particular

On the other hand, all surveys show that the construction sector remains very depressed.

This seems to reflect the dichotomy in the evolution of the Chinese economy. In fact, the government continues to support production, which is finding outlets abroad. As a result, the external sector remains one of the most important sources of support for growth. In this sense, fears about the tariffs that D. Trump could impose could weaken the Chinese economy.

At this stage, we believe that tariff hikes could turn out to be less than the 60% often announced by D. Trump. In part, these increases will depend on the dialogue between the two countries and the possible concessions the Chinese authorities might make to offer more outlets for American products in China. On the other hand, the policy of limiting access to American technologies is likely to remain in place, or even intensify.

Sebastian PARIS HORVITZ

Research Director