Activity in services slowed considerably in June, particularly in Europe

Link

- With the onset of summer, global economic activity appears to be slowing more, as the rebound in services runs out of steam and as the economy outside the US worsens markedly. This comes just as the main central banks are toughening their language even more in reaction to the risk of sticky inflation, and as yield curves are at their most inverted in the past 40 years. As the Bank for International Settlements noted, we are entering the most difficult phase of monetary tightening. Central banks must remain hawkish for as long as inflation does not converge towards their targets, and that could take several more quarters, even with slower growth. In light of all this, risk appetite points to complacency on the markets over the past few weeks and calls for greater caution.

- PMIs fell markedly in June in all developed economies after six consecutive increases, with a total decline of more than 1 point. This suggests that industrial activity continues to contract and that the rebound in services is running out of steam. We mustn’t overreact to declining PMI services numbers, as they can be volatile and as they are still clearly in expansion territory. That said, their steep, across-the-board drop does suggest that services, which had driven growth so far this year, is beginning to weaken.

- By country, the US economy is slowing but only gradually and it continues to hold up better than in the rest of the world. UK and Japanese PMIs slipped a little more, due mainly to the weakening in manufacturing activity.

- But it’s mainly the Euro Zone PMIs that fell for the first time since January, back close to stagnation territory, at 50.3 pts. This reflects the severe contraction in manufacturing at a pace never seen except in the midst of the Lehman failure and the Covid shock, but also the normalisation of activity in services after its boom of the past three months. In particular, the French PMI fell by 4 points to 47.3pt, back into contraction territory for the first time since January.

- This week, the markets could be in for a rough ride, as core inflation is expected to remain high in the US and rebound in the Euro Zone, just as the main central bankers are expected to reaffirm, at the ECB-organised conference at Sintra, that rate hikes are not quite over.

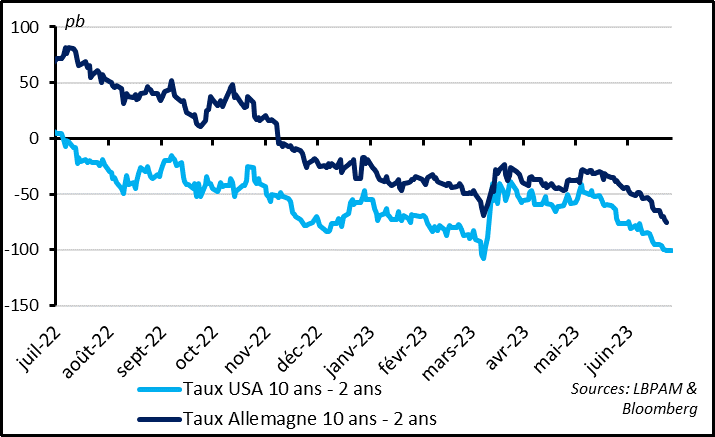

Fig. 1 – Markets: German and US yield curves are more inverted than they were prior to the March banking stress and after the tough line taken by central banks

Bps US 10y-2y yield curve German10y-2y yield curve

Jul. Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May Jun.

The extreme inversion of yield curves is not reassuring for the outlook. The markets reacted to the more hawkish-than-expected language of the ECB, the Fed and the BoE after their recent meetings, sending up short-term rate expectations. As a result, the 2-year US and German yields are close to their highs prior to the March banking stress, at 3.1% and 4.7%, respectively. Meanwhile long-term yields were stable on the whole, leading once again to an extreme inversion in the yield curves (i.e., long-term yields are far lower than short-term ones). As we know, an inversion in yield curves is one of the most reliable leading indicators of a recession, even though it has little ability to time when it will occur. This suggests that the markets expect monetary policy to be hawkish in the short term and that this will lead to a slowdown that will open the door to central bank rate cuts in the future.

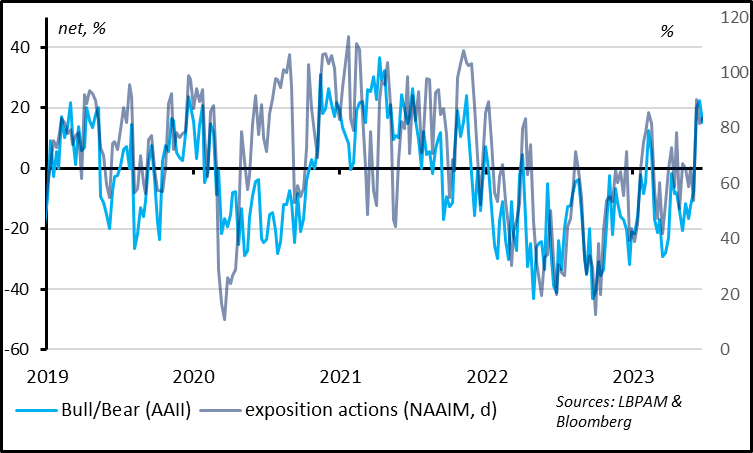

Fig. 2 – Markets: Meanwhile, market risk appetite is back to its highs since early 2022

Equity exposure (NAAIM, right scale)

Equity exposure (NAAIM, right scale)

When also considering the economic slowdown with the onset of summer (see below), it seems strange that appetite for risky assets rebounded strongly in June, to levels last seen prior to the 2022 correction. The slight pullback in equities and corporate bonds last week did not show up in any true decline in measures of risk appetite, which, while not at extreme levels, are still in positive territory and at highs since February 2022. For example, US institutional investors have been significantly more bullish than bearish since early June, and retail investors took on much more equity exposure during the month.

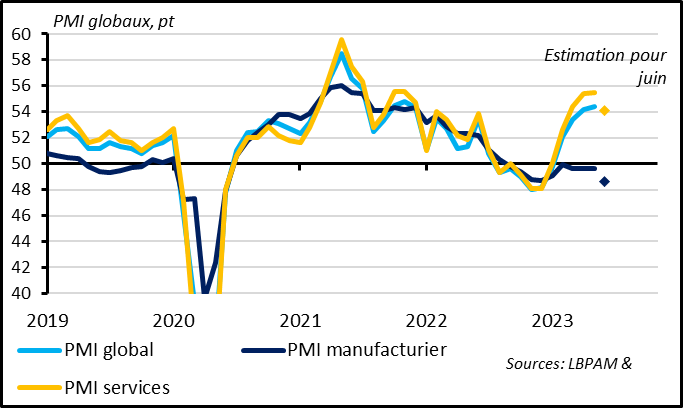

Fig. 3 – World: PMIs in developed economies fell sharply in June for the first time since November

Building starts Building permits NAHB builder confidence (right scale)

Building starts Building permits NAHB builder confidence (right scale)

PMIs fell in June in all developed economies after six consecutive increases, losing more than one point on the whole. This reflects a further acceleration in the decline of industrial activity, as well as the fact that, for the first time this year, the rebound in services is running out of steam. We mustn’t overreact to the decline in PMI services figures, as: (1) they can be volatile from month to month, more so than the manufacturing numbers; and (2) they remain clearly in expansion territory. However, the fact that they did fall sharply in June and in many countries is cause for caution. This is especially true in 2023, as resilience in growth so far this year has been driven solely by services. If they began to slow, that would validate our scenario of weak growth in the coming quarters driven by monetary tightening as stopgap supports weaken (e.g., the energy countershock, savings accumulated during Covid, fiscal boosts, etc.).

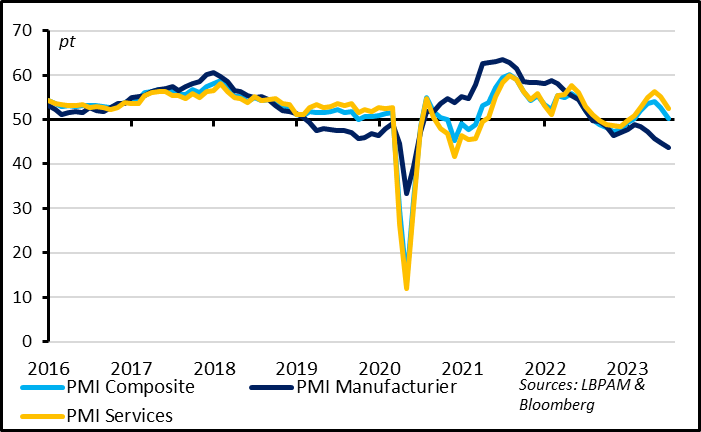

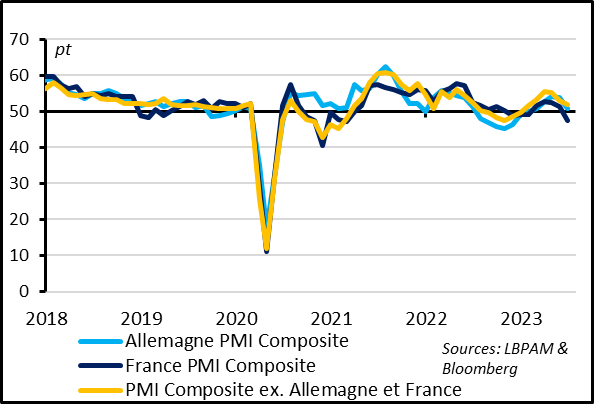

Fig. 4 – Euro Zone: PMIs are down in both manufacturing and services

‘000 New home sales Avg. monthly mortgage cost (% of income)

‘000 New home sales Avg. monthly mortgage cost (% of income)

The Euro Zone PMI fell rather abruptly, from 52.8 to 50.3 pts, back near stagnation territory (50 pts) for the first time since January. This reflects in part the severe contraction in manufacturing, at a pace never seen except in the midst of the Lehman failure and the Covid shock. The manufacturing PMI fell further in June, from 44.8 to 43.6 pts.

But the biggest surprise was the steep drop in the PMI services, from 55.1 to 52.4 pts. At its current level, the PMI services remains acceptable, but activity in services seems to be returning to normal after its strong run of the past three months. This suggests that the benefits of the recovery in tourism and lower energy prices are beginning to slacken, especially as natural gas prices have stopped falling over the past few weeks.

Fig. 5 – Euro Zone: French PMI falls further, into contraction territory

YoY % chg.

YoY % chg.

Sales (volume) Building starts Investment

PMIs fell in all Euro Zone countries, but less so than in France and Germany, which could suggest that the recovery in Italy and Spain could continue to outperform in mid-2023. The German PMI fell to 50.8 pts, with a big impact from weakness in the global industrial cycle. But the biggest surprise came from the French PMI, which lost 4 pts and thus fell back into contraction territory for the first time since January, at 47.2 pts. This may be due to the temporary impact of strikes that have remained numerous in recent months, but this figure is still worth keeping an eye on.

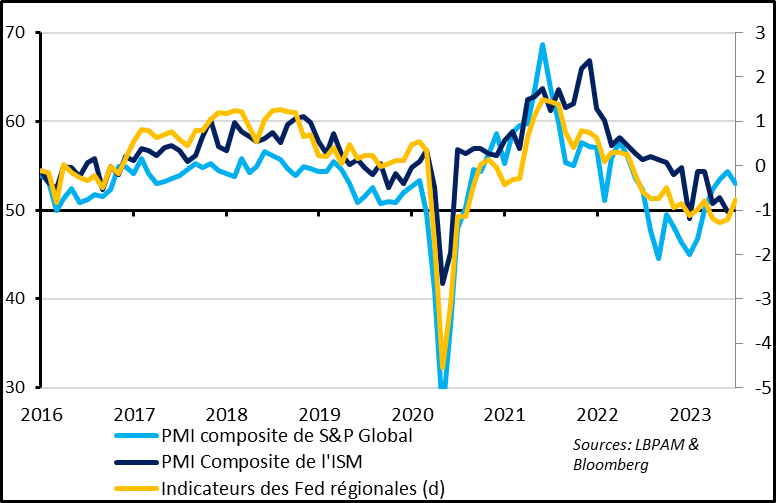

Fig. 6 – US: PMI and other surveys continue to point to a very gradual slowing in US economic activity

1-year benchmark rate 5-year benchmark rate

1-year benchmark rate 5-year benchmark rate

Elsewhere in the world, the US economy is slowing, but only gradually and continues to hold up better than in the rest of the world. English and Japanese PMIs fell a little more, due mainly to a decline in manufacturing activity.

The US PMI composite published by S&P Global fell from 54.3 to 53 pts in June, which is still in line with its historical average. The other economic indicators had in recent months been weaker than the S&P Global one, suggesting a stagnation in economic activity. But the regional Fed surveys released for June suggest, instead, a slight rebound into the zone of slight expansion. The ISM indicator, which had been the most reliable economic indicator since Covid, won’t be released for another two weeks. All in all, US growth appears to be slowing but in still gradual fashion. While we expect a slight contraction in US activity by yearend, clearly, the US economy is continuing to hold up better than expected.