Activity in the eurozone looks set to improve in December

Link

Read Sebastian Paris Horvitz's December 18, 2024 market review, which includes an analysis of activity in the eurozone.

Summary

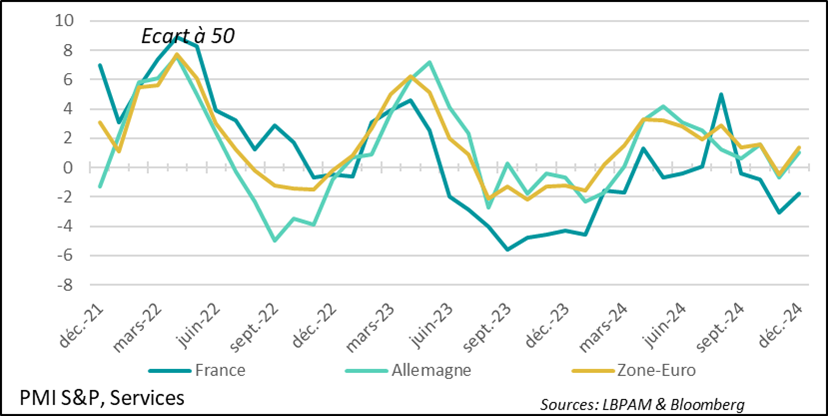

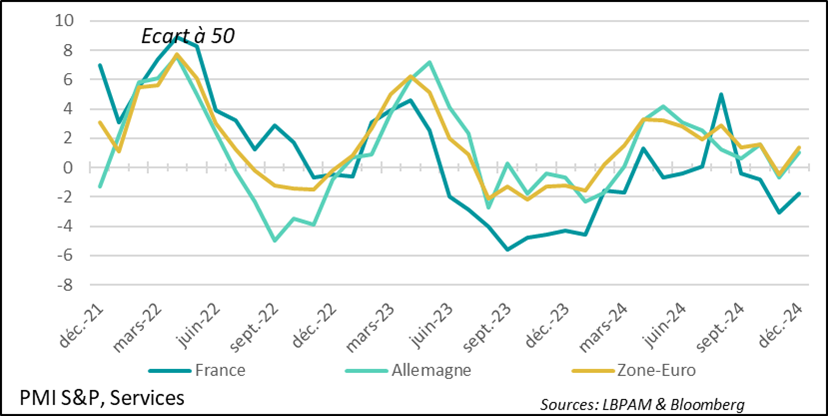

►The preliminary results of S&P's Eurozone PMI survey were, for once, better than expected. This is good news, as the downward momentum left by the previous month was worrying. Once again, it was service sector activity that recovered, with the index returning to expansion territory at 51.4. The industrial sector remains in contraction, but the situation is not deteriorating any further.

►At the same time, the situation varies within the euro zone. France is currently experiencing the worst economic climate, affected by political uncertainty, but Germany is not far behind. In France, although the services index rebounded slightly in December, it remains in contraction territory. In Germany, on the other hand, activity is returning to growth. As for industry, in both countries and in the zone as a whole, activity is still contracting. We still expect a gradual rebound in this sector next year, particularly if more political stability is restored.

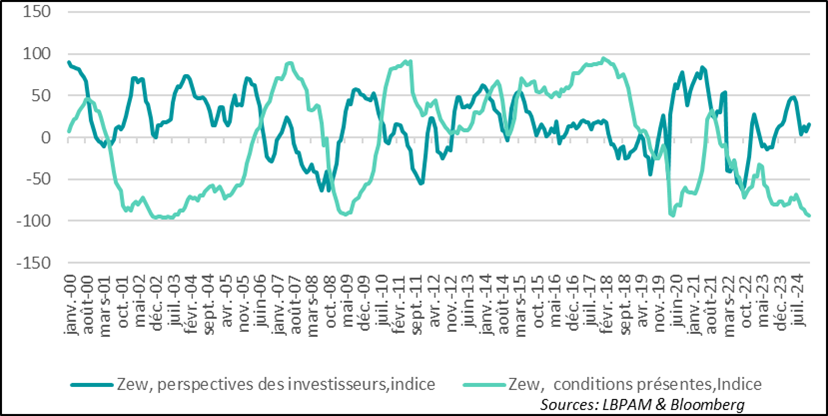

►In Germany, the message of stagnating PMI activity was confirmed by the IFO survey. Indeed, the general business climate index returned to its lowest level since 2020. Business expectations remain particularly poor. It's understandable that next February's parliamentary elections are weighing on companies, while foreign demand is also weak. A similar sentiment is expressed by investors, according to the ZEW survey, albeit with a slightly more optimistic view of the future.

►In the United States, while industry is still suffering, with industrial production contracting in November and the manufacturing PMI also down in December, services are defying any sense of doldrums. Indeed, the PMI index reached its highest level since early 2022.

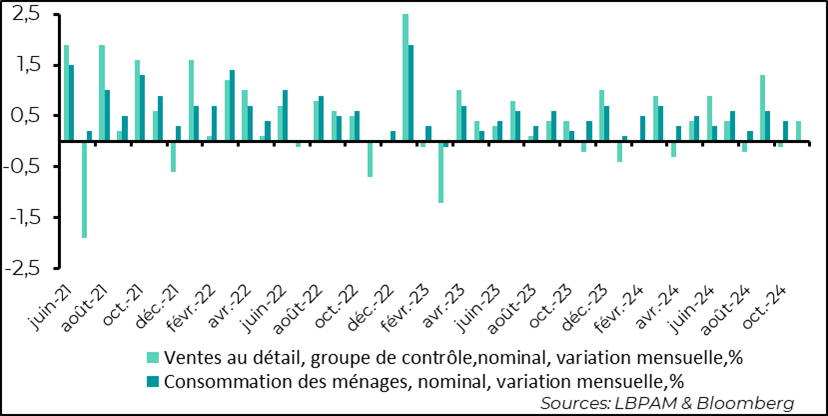

►Services are pulling the economy along nicely, but above all, demand, particularly consumer demand, is still holding up well. Indeed, retail sales have rebounded from the slight adjustment of the previous month. This resilience in demand should be one of the Fed's key considerations in giving a cautious, gradualist signal for the further exit from the current restrictive monetary policy. Like the market consensus, we still see the Fed cutting rates by 25 bp today, then slowing the pace in 2025. The market is more conservative than we are on rate cuts in 2025, believing that rates will remain a little higher than we expect.

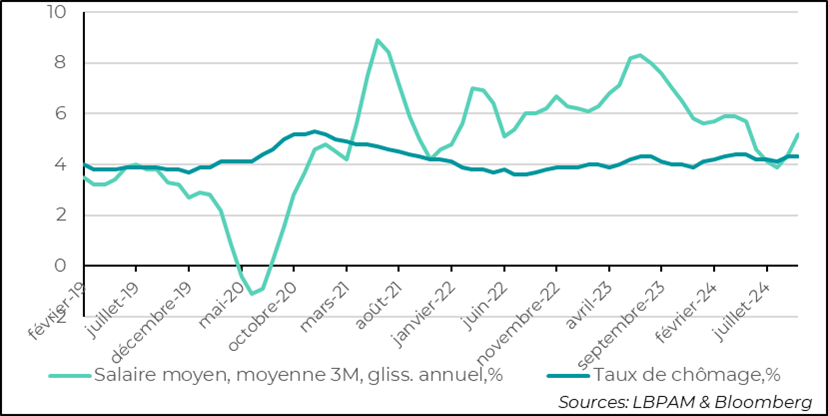

►In the U.K., data on wage trends disappointed, as wage growth accelerated from the previous month to 5.2% year-on-year, compared with 4.4% in the previous months. Obviously, such acceleration is not at all what the BoE wants to see. With inflation proving more tenacious than expected in October, these wage figures should accentuate the BoE's caution. We, like the market, expect the BoE not to change its key rates this Thursday. Today's inflation figures will also give central bankers an important signal.

►Following the defeat of Chancellor O. Scholz, the Chancellor, before Parliament in a vote of confidence, the election campaign for the February elections is officially open. Polls still show the CDU as the winner, with over 30% support, followed by the far-right AfD party with almost 20% of voting intentions. The SPD comes third with 17%. Under these conditions, it is clear that no party will have a majority. Coalitions will have to be formed. The leading party, with its leader F. Merz well placed to become Chancellor, continues to defend the constitutional rules limiting the country's debt levels. Under these conditions, the CDU is seeking to finance corporate tax cuts by cutting social spending. For the time being, the CDU's European strategy appears to be rather vague.

►D. Trump returned to the subject of Ukraine from his residence in Florida, insisting on the need for President Zelensky to reach an agreement with Russia. The US president-elect's strategy seems clearly to be to force an end to the war by halting military support for Ukraine. At this stage, there has been no comment from the Ukrainian or European authorities. At the same time, the Russian president once again stressed that the doctrine on the use of nuclear weapons could change if Russia felt threatened by the West. He also declared his intention to step up production of hypersonic missiles. We'll see in a month's time what D. Trump's strategy is, and how Presidents Putin and Zelensky respond.

To go deeper

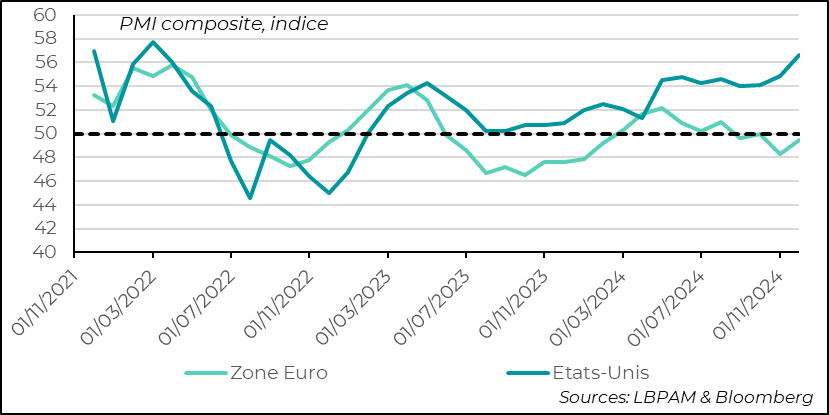

S&P's preliminary PMI surveys for December gave a more reassuring message than might have been expected for the Eurozone. Indeed, the composite index is back on track, breaking the downward trend of previous months. Nevertheless, it remains slightly in contraction territory.

In contrast to the European situation, in the United States, the same survey showed a substantial rebound in activity. The composite index even reached its highest level since the beginning of 2022, indicating that the US economy continues to show resilience.

PMI: the downward trend in activity in the eurozone halted in December, but activity is still contracting, while in the USA it has reached its highest level since 2022

It should be emphasized that within these differences in dynamics between the two regions, survey responses also reveal that the employment situation is deteriorating in the Eurozone, while in the US, more optimism is returning to business hiring intentions.

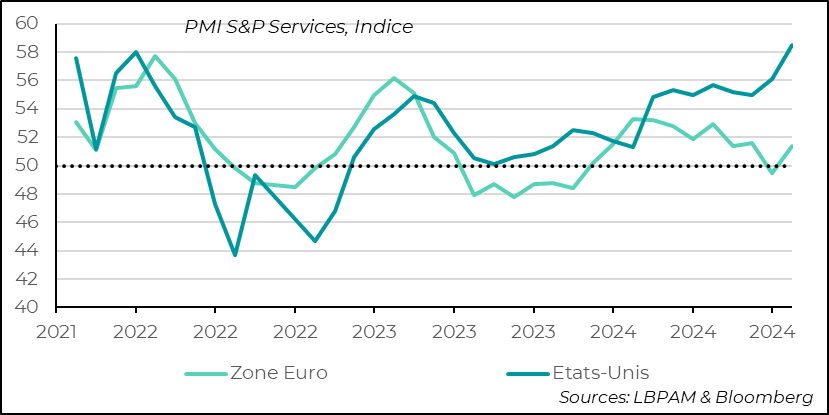

On both sides of the Atlantic, services continue to show the most dynamism. In the Eurozone, the good news is the strong rebound in activity and its return to expansionary territory. As a result, the end of the year looks less worrying than might have been expected.

Across the Atlantic, the situation is different, in that the rebound in services activity is building on already high levels. The index is now at its highest level for over two years. This rebound reflects the optimism generated by D. Trump's election to the presidency, with businesses looking forward to reforms that will benefit them, including a cut in corporate income tax to 15% from the current 21%.

PMI: services activity rebounds on both sides of the Atlantic, with the US index reaching its highest level for over two years

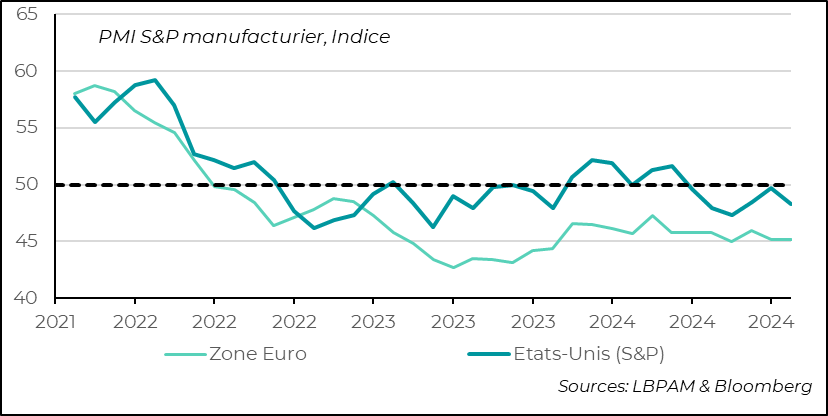

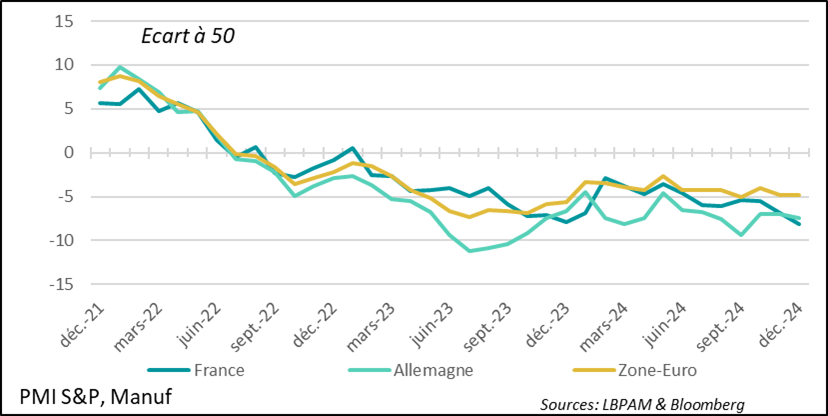

One of the weaknesses shared by both zones remains the mediocre state of the industrial sector. Indeed, the activity indicator remains in contraction territory. In the United States, the improvement seen in recent months came to a halt with a decline in December.

In the Eurozone, there is no sign of an upturn. We can only take comfort from the fact that there has been no further deterioration. Nevertheless, the sector remains in great difficulty.

The situation in industry thus remains one of the main weaknesses of the global economic cycle.

PMI: the industrial situation deteriorated in December in the USA, while it remains difficult in the Eurozone

In the US, we will await the ISM surveys in early January to see if they validate these S&P surveys. The ISMs have been relatively weaker, especially in services, compared with S&P.

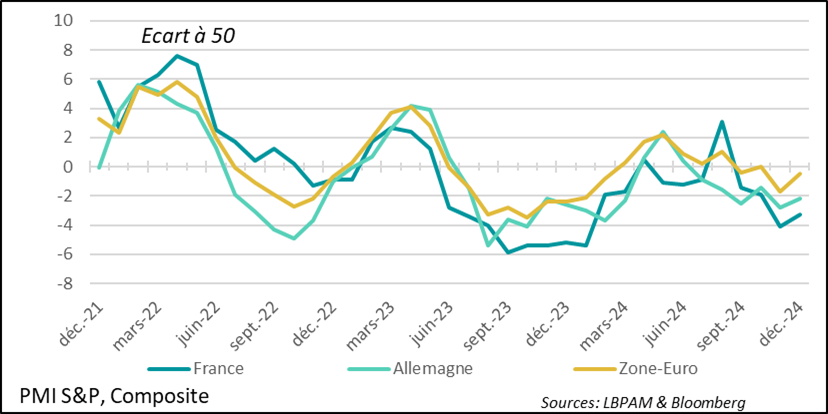

An important factor to highlight in the Eurozone is the situation of the region's two major economies, Germany and France, which are making a clear contribution to the weakness of activity in the region as a whole. Both economies have lower activity levels than the zone average.

In addition to the factors affecting weak demand, particularly for exports, the situation of political uncertainty is also weighing on confidence and therefore on activity. In the very short term, it is difficult to see a rapid upturn, but we cannot rule out the possibility of a clearer situation regarding the conduct of economic policy in the coming months, particularly in Germany. This could boost confidence and stimulate activity.

PMI: France lags behind in terms of activity in the eurozone, having lost all the dynamism acquired during the Olympic Games

As with the overall index, France has taken the less-than-honorable mantle of the economy with the weakest activity, according to the PMI survey. Political uncertainty seems to be weighing particularly heavily on the service sector. Although activity picked up in December, it still remains in contraction territory, two points away from the 50 level that separates expansion and contraction.

This contrasts with the situation in Germany, where the index for the sector rebounded, allowing activity to pick up again.

PMI: France retains a significant premium on its public debt vis-à-vis Germany, but it is not increasing and is following the trends of other peripheral countries

In industry, the region's two main economies continue to see activity in a difficult situation.

For the first time since the end of 2023, the situation in France is even worse than in Germany.

PMI: industry in the eurozone's two largest economies remains in a precarious situation

The slight upturn in Germany's PMI indicator contrasts with the IFO survey. While the latter shows that companies' opinion of the current situation has improved slightly, the outlook has fallen quite sharply. This is not surprising, given the political uncertainties in the run-up to the February parliamentary elections.

Overall, the business climate indicator remains well below its historical average.

Germany: IFO survey highlights the negative impact of political uncertainty, with a sharp drop in outlook sentiment

A return to greater stability, with a clearer economic policy path, could prove a real boost to activity in the first half of the year. This would be in addition to continued monetary easing by the ECB. These two factors would also reassure the markets.

In a way, investors are looking to the future with a little more optimism, if the ZEW survey is anything to go by. In part, this more positive outlook is a reflection of the ECB's continued monetary easing.

Germany: investors continue to downgrade their view of the current situation, but outlook rebounds slightly

In the UK, wage growth statistics showed a fairly marked acceleration in October, rising by 5.2% year-on-year, after 4.4% the previous month. Thus, the decelerating trend observed since the summer of 2023 has been completely broken.

This rise is ill-timed, given that October's inflation figures were also disappointing, notably because prices in services remained the most reluctant to fall.

United Kingdom: accelerating wage growth complicates BoE action

This situation is likely to complicate the BoE's action. In fact, like the market, we expect tomorrow's Monetary Policy Committee meeting to maintain current key rates.

For the time being, the latest activity indicators show a certain resilience, despite the contraction in GDP in October. The BoE will surely have to be more cautious in easing its monetary policy. This has been taken on board by the markets, and has resulted in a marked rise in long rates, also driven by a general upward trend in most major countries.

In the United States, after fairly favourable S&P PMI surveys, retail sales also confirmed that consumption is still holding up. Indeed, retail sales for the month of November rebounded well from the previous month's slump. We knew that car sales had risen fairly sharply in November, but retail sales show that consumption of other goods also gained significant ground over the month. The so-called control group, which is used to calculate consumption as a percentage of GDP, recovered the ground lost in October, rising by 0.4% after a contraction of -0.1% in October.

United States: retail sales show that consumption of goods is still holding up, with a rebound in November after the previous month's slump

Consumption remains the mainstay of demand, followed by public spending.

D. Trump's fiscal policies, notably the expected extension of the tax cuts he pushed through in his first term, will surely support consumption.

For the Fed, which is expected to cut its key rates today (-25 bp), with the intention of continuing to move out of the restrictive territory in which monetary policy finds itself, these resilient activity figures, along with inflation that is no longer falling, should translate, in our view, into a cautious stance going forward. We anticipate rate cuts at a more spread-out pace in 2025, with a landing point around 3.6% for the key rate.

Sebastian PARIS HORVITZ

Head of research