AI is spreading to the markets...it will be slower on the economy

Link

- It's undeniable that the wave of Artificial Intelligence has made a major contribution to the rise of the market, particularly in the USA. Nvidia, with its ultra-high-performance GPUs that sell very well, despite the $40,000 price tag of the latest version. All companies involved in data processing are participating. Not least, the behemoths that are the other members of the small "Magnificent 7" group. To really extrapolate demand, we'd need to have an idea of the speed of diffusion throughout the economy. This should be slower than Nvidia's current sales explosion.

- So, the problem of the concentration of users of these chips, who will determine who holds the power of data exploitation, is a subject for regulators, for economies... and for markets. In particular, how can we encourage competition and innovation in a field that will continue to be dominated by the position already occupied by Amazon, Apple, Microsoft, Alphabet and Meta? While there is little doubt that AI will spread and bring productivity gains, the trajectory of diffusion nevertheless remains rather uncertain.

- In Europe, we're a long way from dominating the AI infrastructure, but we do have a group of companies that have been dominating index trends of late, concentrated in pharmaceuticals (Novo Nordisk) and luxury goods (LVMH), but also in a few technology "nuggets" (ASML). Nevertheless, it is difficult to identify concentrations that are "unhealthy" for the economy and that would harm competition. It's quite possible that a little more economic upturn in Europe should enable a wider range of stocks to participate in the rise of the stock markets.

- The European PMIs, as Xavier Chapard clearly showed in his latest note, have shown us that the economic situation is stabilizing, thanks in particular to services. Nonetheless, there are significant differences between countries. Germany, in particular, is lagging behind. The IFO survey for February showed little improvement, and remains well below its historical average. In addition, details of GDP growth in 3Q24 showed investment to be weak.

- In the "battle" over the appropriate monetary policy to be followed by the Governing Council, the data from the ECB's consumer survey on inflation expectations in January gave a not necessarily positive message. On 3-year expectations, we can see that they are no longer falling and remain at 2.5%. Once again, trends vary from country to country.

- Donald Trump pocketed another victory in the Republican primary in South Carolina, handily defeating N. Haley, with 60% of the vote to his opponent's 40%, despite being the state's former governor. It seems hard to see N. Halley challenging the former president for the nomination, even if some polls show that she would be much better placed to beat J. Biden next November.

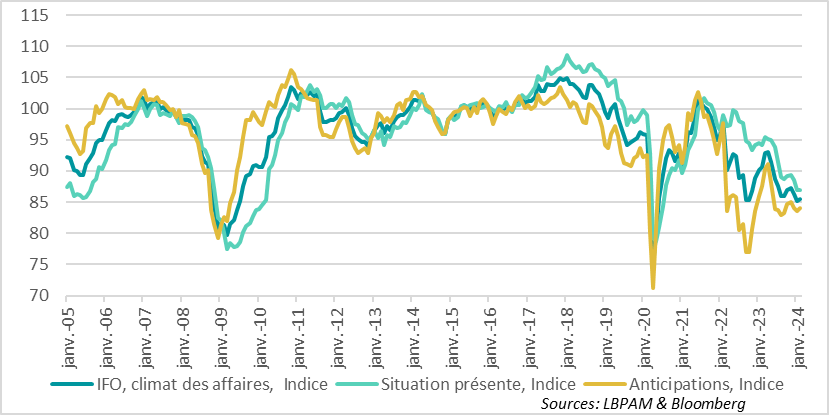

The latest Eurozone PMIs confirmed a stabilization of activity, thanks in particular to services, although the zone's economy is stagnating overall. But they also showed major differences between countries. Germany's IFO index for February confirmed the country's persistent weakness. Indeed, the index remained stable at a very low level, well below the historical average. Obviously, the weakness of industrial activity is weighing even more heavily on the country, especially as one of its key export markets is China, where the economic dynamic remains unfavorable to imports.

The only good news is that business expectations rebounded very slightly over the month, but this is scant consolation. It will surely take a much more marked cyclical change, particularly in terms of external demand, for a more noticeable upturn in activity, particularly in manufacturing, to take shape.

Fig.1 Germany: The IFO index remains at a historically low level, even though expectations are edging upwards.

-IFO, business climate, Index

-Current situation, Index

-Anticipations, Index

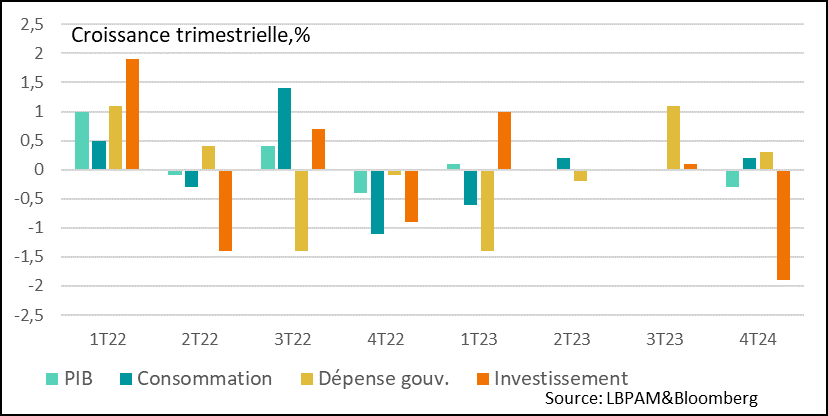

Amplifying this message of gloom, the more detailed data on demand's contribution to the fall in GDP in 4Q23 (-0.3%) showed that it was indeed investment that floundered at the end of last year, with a -1.9% decline over the quarter, the biggest drop in 2 years.

The good news came from consumption, which held up well, rebounding in the final quarter after stagnating in the previous quarter. At the same time, public spending prevented a more pronounced contraction in GDP. On this point, it remains to be seen how the ruling coalition, under the leadership of O. Scholz, can do more to support activity, including by accelerating strategic spending on the energy transition and its military spending.

Fig.2 Germany: The sharp drop in investment made a major contribution to the contraction in activity.

-GDP

-Consumption

-Government expenditure

-investment

IAt the same time, we still believe that, given the weakness of growth in the zone, inflationary pressures should continue to ease, allowing the ECB to loosen monetary policy. Nevertheless, the persistence of tight labor markets raises real questions about the dynamics of disinflation.

Admittedly, the latest statistics on wage dynamics published by the ECB showed a dip in wage growth in 4Q23, but this was slight and will need to be confirmed to reassure the ECB before interest rates can be cut.

As is well known, the debate is tense among the members of the Governing Council, between those who think that we shouldn't wait too long to start easing monetary policy and those who want to be more patient to ensure that the trend is indeed moving in the direction of convergence of inflation towards the 2% target.

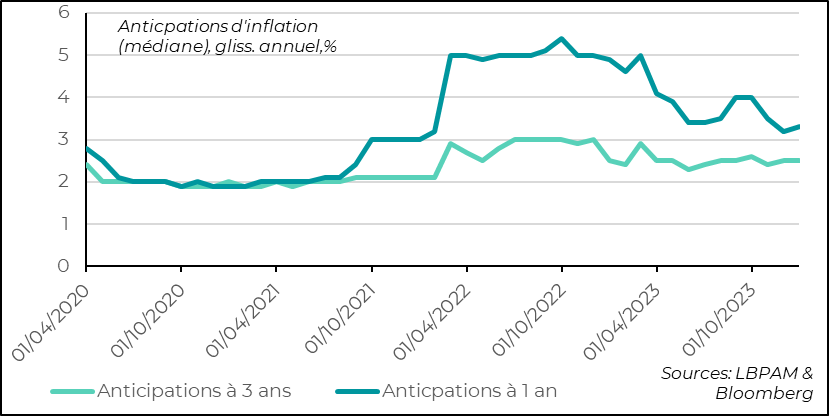

To fuel the debate, the results of the ECB's household survey on inflation expectations for January gave a not necessarily reassuring message. Expectations for the next 1 year have risen to 3.3%, but this statistic is fairly volatile and sensitive to energy prices. 3-year expectations are no longer falling, and are stagnating at 2.5%.

This indicator is not necessarily the one that will dominate the debate, but it does send a message of caution to central bankers, and is to the advantage of those who want to be more patient. Furthermore, we note that there are different dynamics between countries, where disinflation is maintaining its downward trend, as in Italy and Spain, while in Germany it is accelerating slightly for medium-term expectations.

Nevertheless, we still expect monetary policy to ease in 2Q24.

Fig.3 Euro-Zone: ECB survey of household inflation expectations for January shows 3-year forecasts stagnating at 2.5%.

-3-year forecast

-1-year forecast