AI still fuels risk-taking

Link

-

The momentum associated with the development of capabilities aimed at harnessing artificial intelligence (AI) continues to be a powerful factor underpinning certain market segments, and fuelling risk appetite. NVIDIA's financial results, with stratospheric sales surprising analysts, have propelled the Nasdaq, America's leading technology index, to new heights. This craze is also benefiting the main technology platforms, which are also Nvidia's main customers. Nevertheless, given the recent rise in long-term interest rates and doubts about monetary policy trajectories, risk-taking in general has lost some of its strength on most stock markets.

-

Economic data releases continue to give mixed messages, particularly across the Atlantic, with overall data disappointing expectations. After the rather favorable S&P PMI surveys for May, on the demand side, the final May reading for the U. of Michigan consumer confidence index came out a little better than expected, but still well below the previous month's level. We'll see if this is reflected negatively in the consumer figures. Also, investment seems to be slowing down in the light of durable goods orders.

-

In Europe, after much stronger-than-expected core inflation figures in the UK in April, which should prompt the Bank of England (BoE) to exercise caution, retail sales came in much weaker than expected in April. Continuing to lose momentum, with a year-on-year fall of 3%, excluding petrol, this could therefore point to a lull in demand. At the same time, this drop may be explained by somewhat unfavorable weather conditions, and the trend could therefore pick up again in June. In fact, household confidence picked up slightly in May, which could reflect a potential slight upturn in demand.

-

The meeting of G7 finance ministers and central bankers ended with a communiqué, which for the first time stressed the need for a better understanding of the implications of AI's irruption. While pointing out the potential benefits, the G7 representatives want to coordinate better to mitigate the negative effects, particularly on the labor market, but also on possible risks to financial stability. The communiqué also fueled trade tensions. Indeed, it underlined the G7 countries' concerns about China's perceived anti-competitive policies, which lead in particular to overcapacity.

US growth will be decisive in determining the path of monetary policy and financial markets. Since the start of the year, economic data has been relatively weaker than expected. Nonetheless, S&P's latest survey on business dynamics showed that PMI indices have regained strength, pointing to an upturn in economic activity.

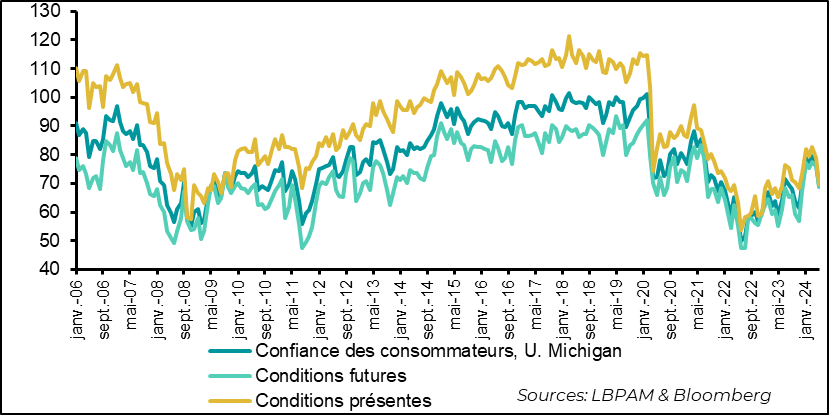

On the demand side, however, the statistics remain more disappointing for the time being. Clearly, consumption remains the decisive factor in determining the trajectory of growth. In this respect, the final result of the U. of Michigan's May household confidence survey, while better than the preliminary result, was still down sharply. Indicators of both the present and future situation were well down on the previous month.

In detail, almost all components are down, whether it's household sentiment on the state or prospects of their financial situation, or on conditions for making purchases.

Fig.1 United States: Consumer confidence plummets in May and remains at depressed levels compared with historical data.

- Consumer confidence, U. Michigan

- Future conditions

- Present conditions

Obviously, as we know, the relationship between confidence and consumption is not unequivocal, and US households' appetite for consumption could remain robust despite the deterioration in their perception of the state of the economy. Indeed, the job market continues to show signs of robustness, notably through unemployment claims, which remain at relatively low levels, even if they have recently resumed a slight upward trend.

Nevertheless, declining confidence could reflect greater caution in terms of consumer appetite, especially as inflation remains relatively high in certain segments, notably services.

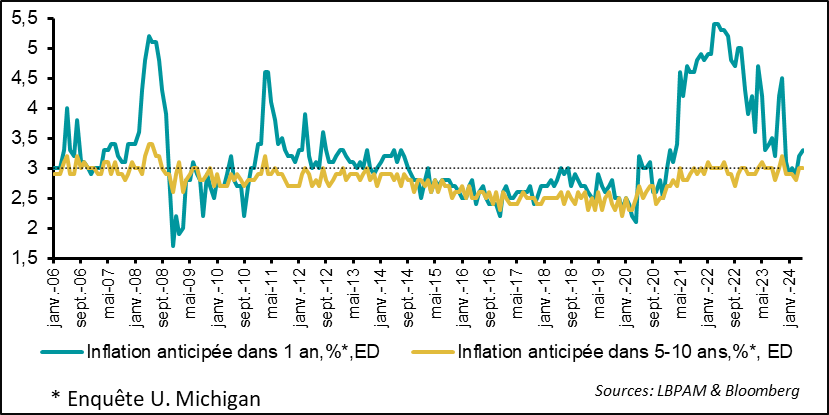

Indeed, inflation expectations are still relatively high, even if they are not drifting upwards. Medium-term expectations (5-10 years) remain close to 3%, which is the average for the last three years. So there doesn't seem to be any slippage in expectations, even if they remain slightly elevated. For the Fed, this remains relatively reassuring.

The recent downward trend in gasoline prices, which have lost almost 2% since the beginning of May thanks to lower oil prices, could translate into renewed confidence as early as June.

Fig.2 United States: Household inflation expectations jumped slightly in May, but remain relatively stable

- Anticipated inflation in 1 year, %*, ED

- Anticipated inflation in 5-10 years, %*, ED

*U.Michigan survey

In the UK, the slower-than-expected decline in inflation in April has clearly changed the outlook for monetary policy easing. Indeed, with core inflation only just below 4%, progress on inflation remains insufficient for central bankers to act quickly, despite the optimistic tone of Governor A. Bailey and with two members of the Monetary Policy Committee voting for rate cuts at the early May meeting.

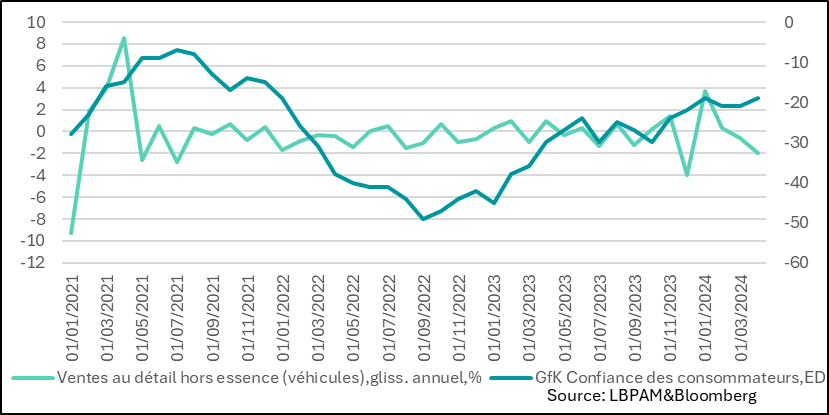

It will surely take a further easing of demand to bring the inflation trajectory more in line with the bank's objectives. With this in mind, the latest consumer spending figures, in the form of retail sales, showed a sharp drop in spending in April.

Nevertheless, this decline could be exaggerated by the somewhat unfavorable weather conditions during the month, and could therefore pick up again in June.

In fact, household confidence has risen again, reaching its highest level since the end of 2021.

These contradictory statistics therefore point to a need for patience on the part of the BoE, which will have to wait a little longer to obtain more assurance that the disinflation dynamic is indeed moving in the right direction. Wage trends over the coming months should be very important in reassuring central bankers.

Fig.3 United Kingdom: Retail sales dipped in April, partly due to adverse weather conditions, while household confidence recovered

- Retail sales (vehicles), excl. gasoline, year-on-year, %.

- GfK Consumer confidence, ED