American exceptionalism persists

Link

Check out our market analysis from December 02, 2024, by Sebastian PARIS HORVITZ.

In summary

►Today we'll find out whether the Barnier-led government will survive the motion of censure tabled against the social security financing bill. Given the recent statements by the leaders of the Rassemblement National, the probability of a majority refusing to vote confidence in the government is very high. But this vote is still not certain. If the vote of no confidence is carried, E. Macron will have to appoint a new Prime Minister. In the meantime, government spending will be governed by the provisions of the current Finance Act. This means that the necessary adjustment of public finances will once again be delayed. Clearly, in such a situation, this will have a negative impact on confidence and affect growth, if the uncertainty persists. At this stage, we remain very cautious on French public debt, which could suffer from an additional risk premium.

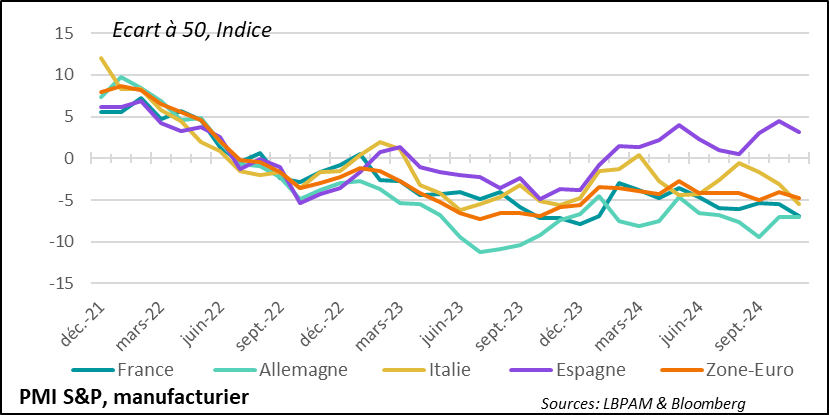

►This context of uncertainty, which can only fuel concern, was reinforced by the results of S&P's final industrial PMI surveys for Eurozone countries, for the month of November. Indeed, as expected, the activity indicator was down on the previous month, remaining in contraction territory and at a low level. Of the major countries, only Spain's industry continued to grow, while Italy's accelerated its contraction. The Italian index has lost 5 points since last August. France and Germany are still lagging behind. These figures confirm our forecast of very weak growth for the European economy in 4Q24.

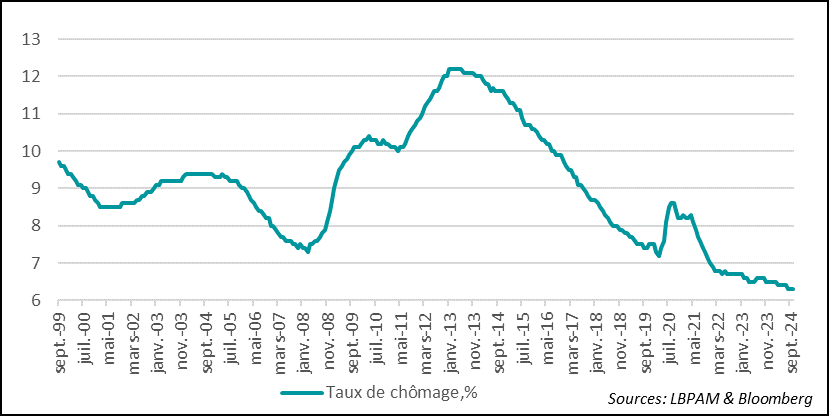

►Our forecast of continued weak growth, close to stagnation, in the Eurozone in 4Q24 is based in part on the resilience of consumption. The region's unemployment rate remains historically low, at 6.3% in October. This, together with wages rising faster than inflation, suggests that households are showing a more dynamic appetite for spending, while interest rates are falling. Nevertheless, it is clear that current uncertainties could dampen this momentum.

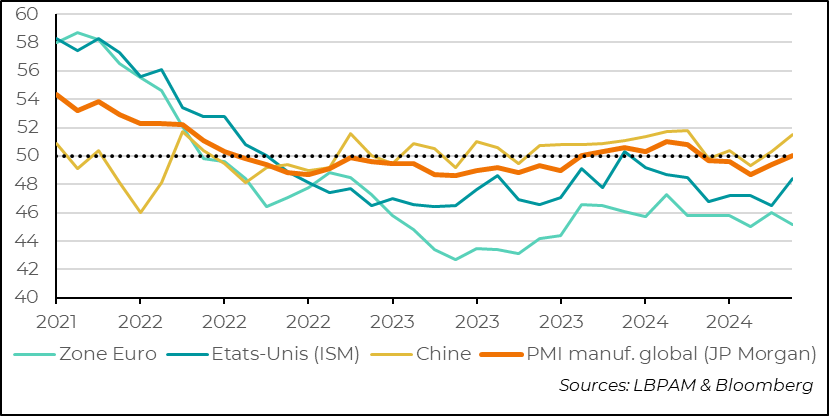

►In fact, unlike in the Eurozone, industrial activity worldwide is no longer contracting, and returned to stability in November. This improvement is due to a number of countries, including China and the United States. Industrial activity, as measured by CAXIN's private survey in China, is surprisingly rebounding. In the United States, activity is approaching stability.

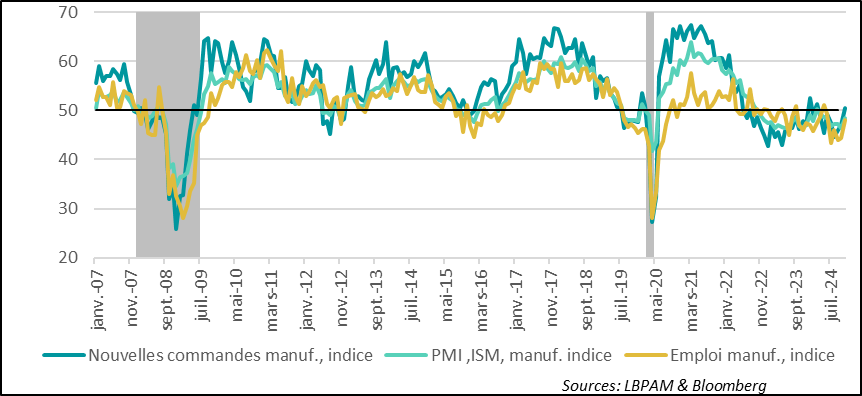

►In fact, once again, US statistics are improving, while the situation in Europe remains mediocre. We can assume that, as the craze for US assets has shown, companies in industry are also hoping for an improvement in the economic situation. Indeed, the ISM industrial survey for November revealed that new orders have returned to growth after 7 months of contraction. And although employment is still contracting, the index is approaching stability. All in all, the ISM survey continues to underline American exceptionalism. Growth is still holding up, and now seems to be underpinned by strong confidence in D. Trump's pro-business policies.

►In South Korea, chaos has swept across the country following Yoon Suk Yeol's decision to enforce martial law. This prohibits all political activities and strikes, and the media are now under state control. Nevertheless, parliamentarians met and voted unanimously to overturn the President's decision. He therefore decided to reverse his decision. In the meantime, the won has collapsed and Korean stocks have suffered somewhat since the opening. In part, despite the political chaos, the absence of panic can be explained by statements from the authorities that they were prepared to do whatever was necessary to ensure the smooth running of the market, including providing all the necessary liquidity. The political situation remains very unsettled, with calls for the resignation of the President.

To go deeper

S&P's final PMI surveys on global industrial activity came out better than expected. Indeed, global activity, as compiled by JP Morgan, stagnated over the month instead of contracting as in previous months.

Nevertheless, the situation in global industry remains difficult, and the improvement in November is due to a few countries only, and is therefore not widespread.

In fact, the strong rebound in industrial activity in China and a sharper-than-expected improvement in the situation in the United States contributed to this more favorable result.

As far as China is concerned, the rise in the manufacturing sector index (CAXIN), although partly reflecting the contribution of foreign trade to growth in industrial activity, seems somewhat exaggerated compared with the other indicators available, particularly in view of the weakness of domestic demand. Indeed, the PMI index (CAXIN) for services eased in November, albeit slightly, but remains in expansionary territory.

In the USA, on the other hand, it seems that the optimism associated with the election of D. Trump to the presidency, due to the expectation of more pro-business policies, seems to have given greater confidence to manufacturers.

On the other hand, the Eurozone continues to see its industry suffer, with the index declining and remaining in a zone of relatively marked contraction in activity.

World: Industrial activity stagnates in November, emerging from a period of contraction, but the improvement is not widespread

Industrial activity in the USA, as measured by the most reliable ISM survey, showed a clear improvement. The aggregate index rose by almost 2 points, but remains in contraction territory, albeit close to stability, at 48.5, its highest level since last June.

Several factors are contributing to the improvement. Firstly, there has been a strong upturn in new orders. For the first time in 7 months, they are back in growth territory. In part, this rebound can be attributed to the favorable reaction of companies to the election of D. Trump, with strong expectations that pro-business policies will be put in place. The employment situation is also improving markedly, with the index rising by almost 4 points.

United States: Industrial activity picks up in November and approaches stability, with the PMI survey index returning to its highest level since last June

However, it's still too early to be sure that a sustainable recovery is underway across the Atlantic. Indeed, industrial production is still in contraction territory.

Nevertheless, once again, the dynamics of the US economy appear to be more favorable than elsewhere. American exceptionalism continues to dominate. Rising new orders and an improving employment situation bode well for the future.

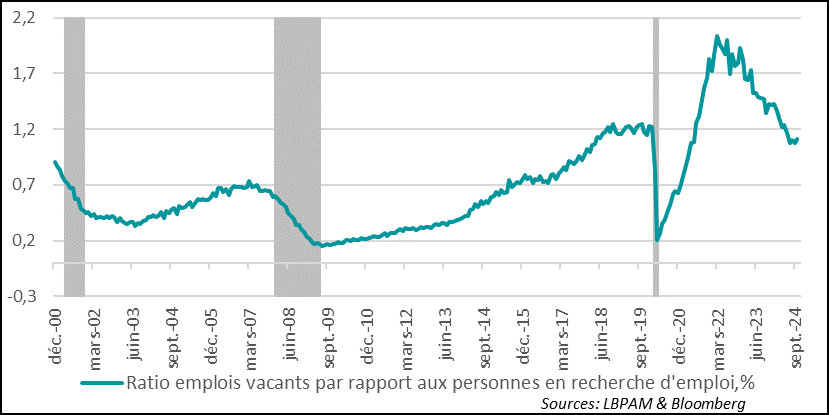

Indeed, on the employment front, we had the job vacancy figures, which rebounded sharply in October. In part, this should be seen as a correction to the sharp decline of previous months, when vacancies were affected by strikes and bad weather.

Overall, the ratio of job vacancies to job seekers is no longer falling, and is slightly below the high point reached before the Covid epidemic, but of course well below the extreme level of 2022.

United States: The ratio of job vacancies to applications is no longer falling, and remains close to the high pre-Covid level

Unfortunately, the industrial situation in the Eurozone remains difficult, with a further fall in S&P's PMI survey index for November. This drop was similar to the preliminary survey result we had just under 15 days ago.

Among the major countries, only Spain fared better. Despite a slowdown in activity in November, it is still expanding. All other countries are still in contraction territory, with Italy in particular continuing to see activity in the sector decline and sink into contraction territory. France and Germany are still at the bottom of the list, with the situation still very deteriorated, even if Germany seems to be coming out of the worst.

Euro zone: Industry remains one of the weakest links in the region's economy

Also, companies in the sector continue to report that they are reducing their workforce, but these cuts are still not massive.

In fact, the region's unemployment rate remains historically low, at 6.3% in October. The service sector continues to largely offset the deteriorating situation in industry. Nevertheless, the coming months should see a deterioration in the employment situation, albeit moderate.

Euro zone: Unemployment remains at a historically low level, despite deterioration in activity

As we continue to believe, the ECB's interest rate cut will be a crucial element in easing the pressure on businesses and giving the European economy a little more impetus. Thus, a moderate deterioration in the labor market should not prevent consumption from holding up and ensuring that economic growth does not deteriorate further, thanks in particular to improving purchasing power. Of course, a return to greater political stability in the Zone's major countries will also be crucial to ensuring a recovery in activity.

Sebastian PARIS HORVITZ

Research Director