American households remain very confident despite political uncertainty

Link

After digesting the weekend's surprises, the market is stabilizing in anticipation of next week's U.S. elections. For more details, check out our market analysis from October 30, 2024, by Xavier Chapard.

In summary

► After digesting the weekend's surprises (Israel's restrained response to Iran, the absence of a downgrade in France's Moody's rating, and the defeat of the Liberal Democratic Party in the Japanese elections), the market is stabilizing in anticipation of next week's U.S. elections. Trades related to D. Trump, pro-dollar and U.S. stocks, and rising long-term rates indicate that the market has factored in a fairly high probability of Trump's victory in October, in line with online betting.

►Until the elections, the macroeconomic calendar is very busy with the release of U.S. and Eurozone GDP for the third quarter today, the Fed's and the European Central Bank's preferred inflation measures tomorrow, and the U.S. employment reports on Friday. These data should confirm the strength of the U.S. economy and somewhat reassure about the weakness of the Eurozone economy. However, it would probably take major surprises for these data to significantly impact the markets in the face of uncertainty related to the U.S. election.

► Moreover, the U.S. employment reports will be difficult to read this month due to temporary distortions related to strikes and hurricanes. This is already the case with the employment market flows for September, which indicate a drop in the number of job vacancies centered on the southern United States - impacted by hurricanes - and layoffs in the northeast - impacted by strikes. Flows less affected by these distortions are mixed, with an increase in hires but a decrease in resignations.

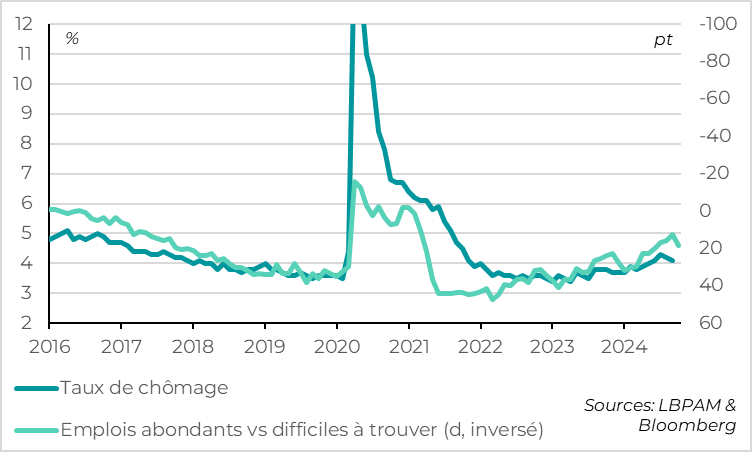

►During periods when macroeconomic data are distorted by temporary shocks, it is interesting to look at what surveys say. In this context, the Conference Board survey of American households is reassuring, as they indicate in October that the labor market is stabilizing after its summer weakness. This is consistent with an unemployment rate that would remain quite low in the short term.

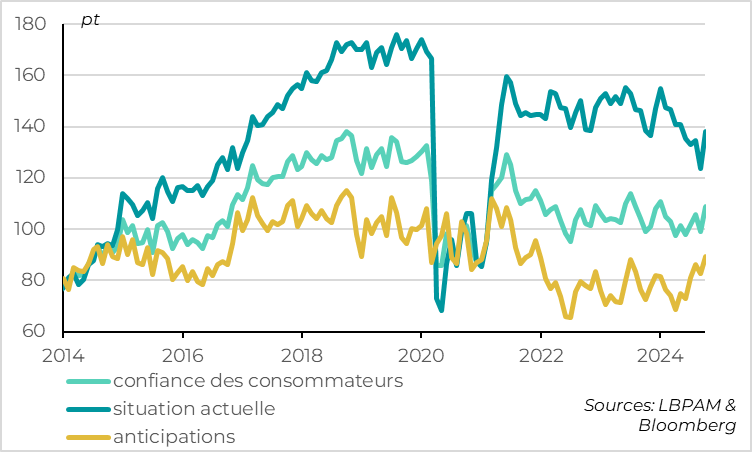

►Beyond the labor market, American household confidence rebounded strongly in October, reaching a high since January. This is encouraging for a consumption-driven economy and reassuring about the impact of political uncertainty on activity. Again, the American household is special. Indeed, budgetary uncertainties in the United Kingdom and political uncertainties in Japan seem to be pushing households to be more cautious in the short term, as evidenced by the decline in confidence indicators in these two countries in October.

To go deeper

United States: Markets stabilize after factoring in a fairly high probability of Trump’s victory in October

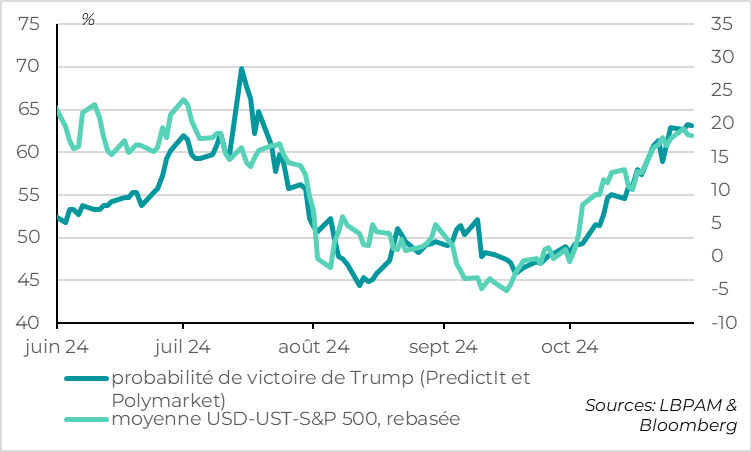

Assets reacting to Trump’s chances of victory are stabilizing this week after rebounding significantly in October, in line with online betting. Unlike in 2016, when Trump’s victory was a huge surprise for the markets, they now estimate more than a 60% chance of Trump’s victory. This is reasonable even though the election outcome remains very uncertain. This implies that market volatility could be less intense than in 2016, at least if the result is clear, but the market reaction could be bullish or bearish depending on the winner.

The main assets that react significantly to Trump’s chances of victory are the dollar (tariffs, geopolitical risk, expansionary fiscal policy), U.S. stocks (tax cuts, less regulation), and long-term rates (inflationary policies and rising public deficit). These assets have risen sharply in October, returning on average to their July levels, before Harris entered the campaign. They follow online betting, which indicates that the probability of Trump’s victory has increased from 45% to over 60% in the past month. However, polls in swing states remain almost all within the margin of error, indicating that the election remains very uncertain.

United States: Job vacancies drop significantly, especially in the South due to hurricanes

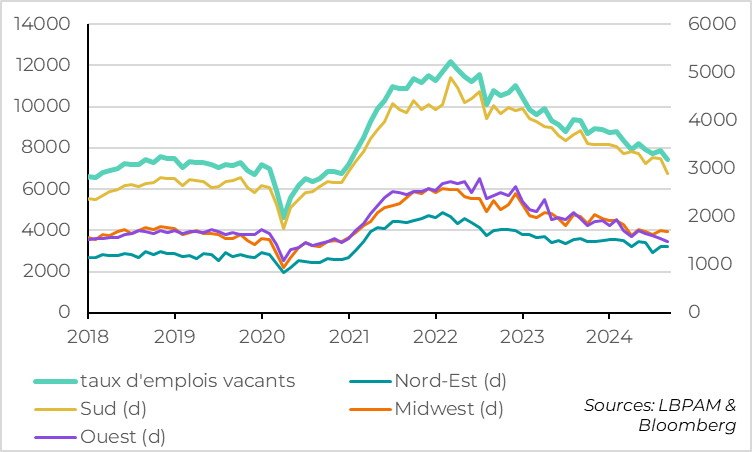

The report on U.S. labor market flows for September confirms that U.S. employment reports will be difficult to read this month due to temporary distortions related to strikes and hurricanes.

The number of job vacancies fell to its lowest level since early 2021 (-400,000 to 7.4 million) after being revised down the previous month, but three-quarters of this decline comes from the southern United States, which was impacted by hurricanes. Outside the South, the number of job vacancies has stabilized for three months, close to its pre-Covid highs.

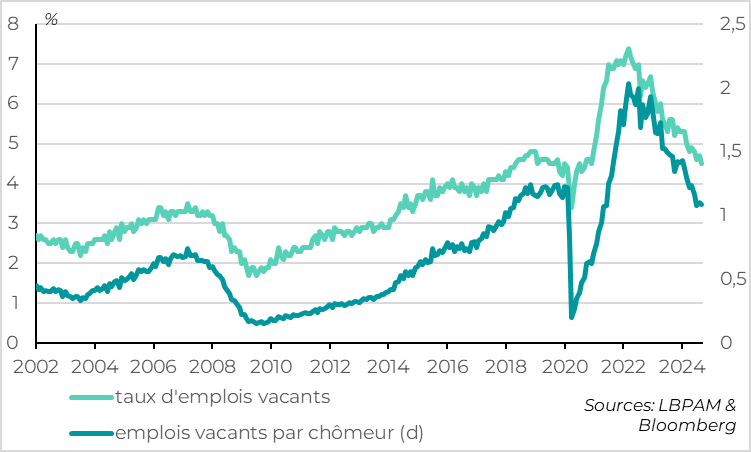

United States: The number of job vacancies per unemployed person has stabilized since the summer at a still fairly solid level

That said, beyond the distortions, it seems that the U.S. labor market continues to relax a bit while remaining solid. Indeed, the decline in the number of unemployed in August and September offsets the drop in the number of job vacancies, so the number of job vacancies per unemployed person has been stable for three months at 1.1. This measure, closely monitored by the Fed to assess labor market tensions, is far from the highs of 2022 but remains at a level consistent with a solid labor market, comparable to late 2017-early 2018.

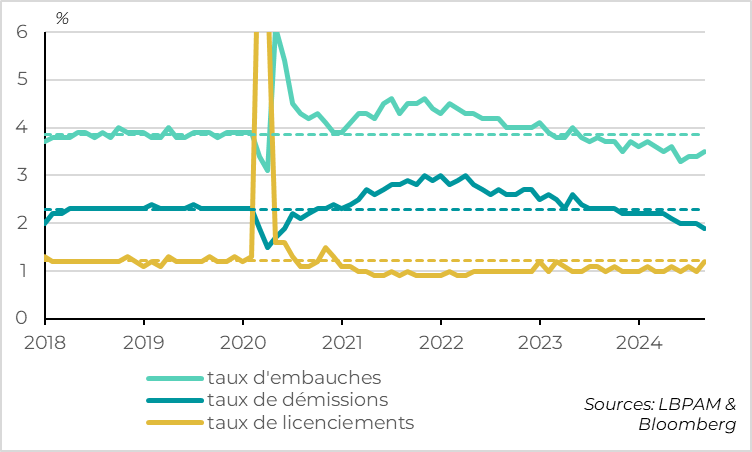

United States: The number of resignations decreases but the number of hires picks up in September

Beyond job vacancies, the number of layoffs increased in September from historic lows, but again the data may be distorted. Indeed, this increase is concentrated in the northeastern United States, which was affected by strikes in late September.

Flows less impacted by recent distortions are mixed, suggesting a labor market that is relaxing without reversing. Thus, the number of hires slightly increased after its summer decline, while the number of resignations continues to decrease quite significantly. This latter indicator should be well regarded by the Fed as it is a good leading indicator of wage pressures.

United States: Households indicate that the labor market is deteriorating less rapidly than this summer

During periods when macro data are distorted by temporary shocks, it is interesting to look at what surveys say. In this context, the Conference Board survey of American households is reassuring because they indicate in October that the labor market is stabilizing after its summer weakness. Thus, the gap between the number of households finding jobs plentiful versus hard to find rebounded in October to a high since June, after falling rapidly this summer. This indicator, historically a good measure of unemployment, suggests that the unemployment rate will not increase significantly in the short term.

United States: Household confidence rebounds strongly before the elections

Beyond the labor market, American household confidence rebounded strongly in October, reaching a high since January. This is encouraging for a consumption-driven economy and reassuring regarding the impact of political uncertainty on activity.

This rebound partly reflects the recovery in the indicator of households’ current situation, which remains at the lower end of its fluctuation range over the past three years after its sharp decline this summer. This indicator, which we consider the most important for assessing the economic cycle, suggests that the economy will slow down but in a limited way.

The indicator of household expectations also rebounded in October, reaching a high since 2021. While we take this indicator with caution, it is still remarkable that households are more confident despite the high political uncertainty. This suggests that this uncertainty does not currently have a significant impact on U.S. activity. This is different in other countries, where consumers seem to be more cautious in the face of political risks. For example, consumer confidence has significantly declined over the past two months in the UK due to budgetary uncertainties, and Japanese household confidence fell in October before the elections.

Xavier Chapard

Stratégiste