Awaiting the outcome of the US elections

Link

Check out our market analysis from November 04, 2024, by Sebastian PARIS HORVITZ.

In summary

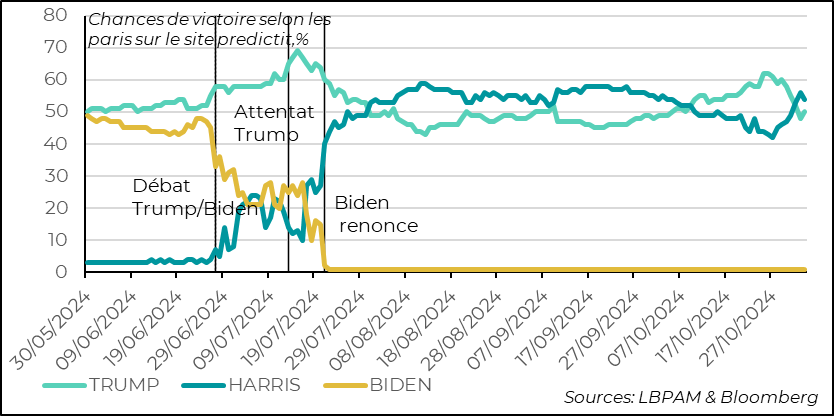

► As we all know, the presidential election could have far-reaching consequences for the global economy and international relations. American voters are extremely divided. The volatility of online betting is proof of this anxiety and uncertainty. With one day to go before the election, they have just swung in K. Harris's favor. On the markets, US government bonds continued to suffer, with rates on 10-year Treasuries returning to their level of early July, at nearly 4.4%. By contrast, the major stock market indices remain close to their all-time highs.

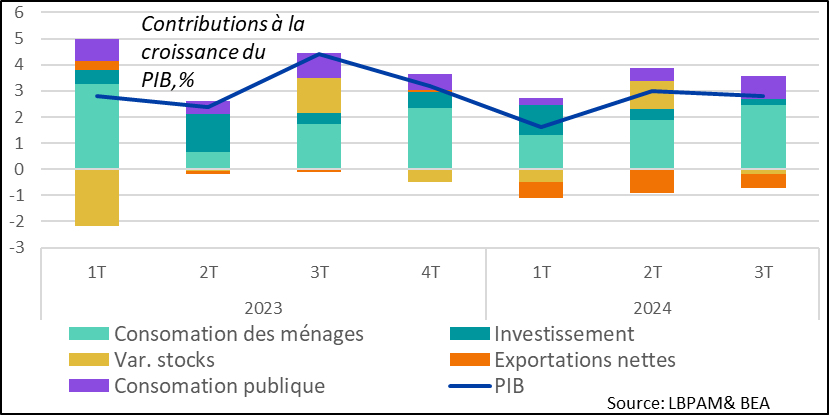

►The gamble of a D. Trump victory is often associated with rising interest rates and rising stock prices. Today, however, it's hard to distinguish between a political gamble and the surprising resilience of the US economy. In 3Q24, US GDP grew at an annualized rate of 2.8%. Consumer spending in particular remains the driving force behind the economy.

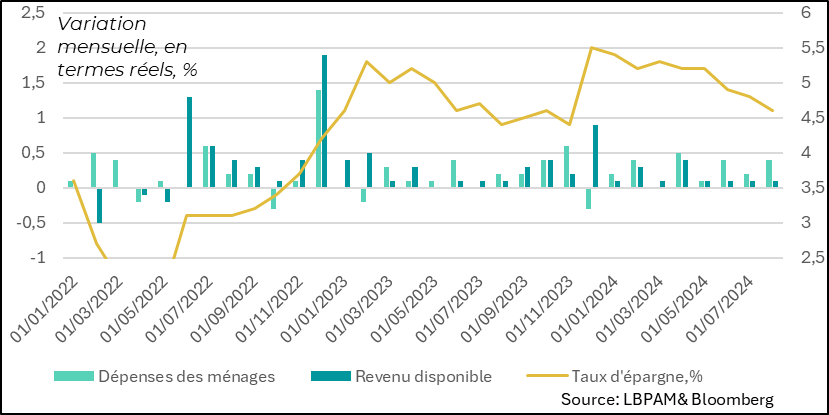

► Households continued to draw on their savings to support consumption. We believe that, with the job market slowing, the savings rate should rise again, calming consumption and ensuring more moderate economic growth in 2025. Obviously, these forecasts suffer from political uncertainty.

►Forecasts for job creation in October across the Atlantic were highly disparate, given the difficulty of accurately anticipating the impact of the hurricanes and strikes that affected the month. In all, only 12,000 jobs were created in the economy, well below expectations. The private sector shed 28,000 jobs, the first reduction since December 2020. At the same time, according to the household survey, the unemployment rate remained unchanged at 4.1%. We'll have to wait until next month to get a clearer picture of employment dynamics. Nevertheless, in our opinion, the very low job creation figure should not affect the Fed's decision this week, with an expected 25 bp cut in its key rates.

►Also, with a labor market that remains tight even if normalizing, according to the survey, wages would have risen during the month. More reassuringly, the more reliable quarterly gauge of labor cost trends in 3Q24 showed a deceleration to 3.9% year-on-year. It remains high, but is surely heading in the right direction for the Fed.

►Nevertheless, some economic statistics continue to show weakness. As in many countries, industry continues to slow down. The ISM survey for the industrial sector fell once again, to its lowest level since July 2023. New orders remain weak and hiring very depressed. At the same time, input prices have risen significantly, but it is not clear that these increases will be passed on to final prices, given the persistence of weak demand.

►On the inflation front, the consumption deflator (PCE, the Fed's preferred measure) came in as expected in September, at 2.1% year-on-year and 0.2% monthly. Nevertheless, core inflation was more recalcitrant, with monthly growth remaining high at 0.3%, as expected. This measure is important, as it is often mentioned by J Powell to indicate the progress of disinflation. At 3.9% year-on-year, it remains far too high for the Fed.

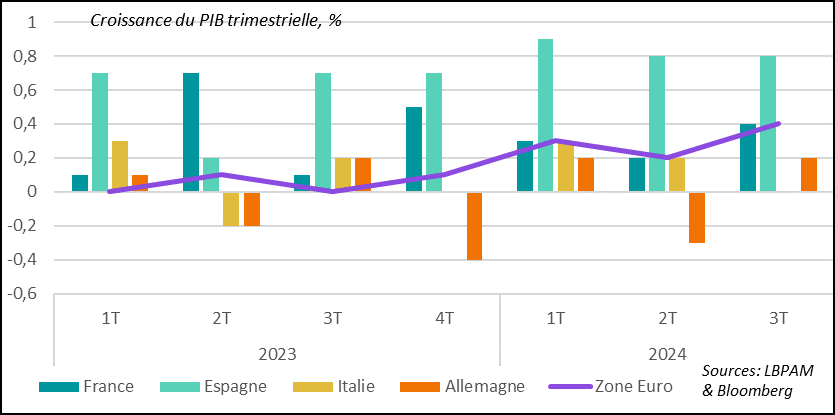

►In the Eurozone, for once, we had good news on GDP growth for 3Q24, with an expansion of 0.4% over the quarter. We knew that France would make a major contribution to this, due to the effect of the Olympic Games. On the other hand, the surprise came from Germany, with an expansion of 0.2%, whereas a contraction was expected. Apparently, this was due to the greater resilience of consumption. This gives a much stronger than expected growth record for 4Q24, and is reassuring for the future, with the expected positive effects of the ongoing easing of monetary policy.

►In this respect, inflation figures were less favorable than expected, with total inflation coming in higher than expected at 2% year-on-year, accelerating on the previous month. The combined effect of higher core inflation and energy prices is behind this rise. We continue to believe that the slow but steady easing of wage rises, which is lagging behind, should continue to push inflation down over the coming months. Although energy-related base effects should keep inflation high, the ECB should be more sensitive to the gradual decline in wages and continue to adjust interest rates downwards in forthcoming monetary policy meetings.

►The presentation of the Labour government's first budget by Chancellor Reeves was eagerly awaited. All in all, it came as no surprise. Nevertheless, it included much more spending than anticipated, financed in part by tax increases. The additional spending was mainly on investment. In addition to the impact of the government's increased borrowing requirement, what mainly affected the market were the economic revisions of the Office for a Responsible Budget, which forecast that the additional spending would strongly stimulate demand and create a bit of overheating in the economy, accelerating inflation. As a result, long-term interest rates have tightened. The BoE should take this development on board. But at this stage, we still expect it to continue its gradual rate cut, with a 25bp cut on Thursday.

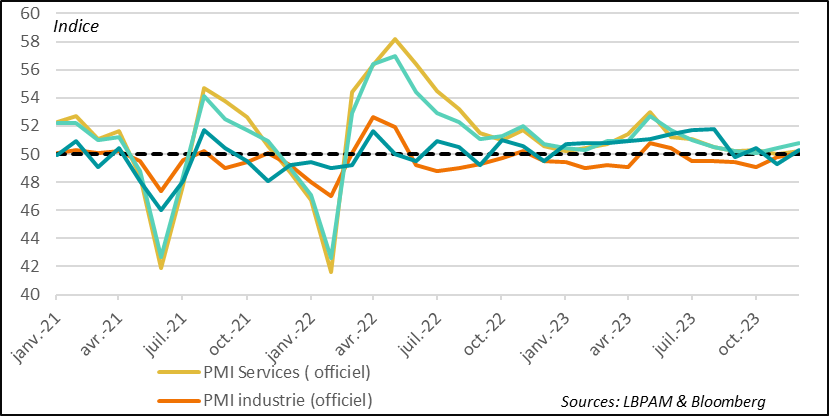

►In China, we had some good news on the economic situation. The official PMI surveys for industry and services have both improved and are now in growth territory. Similarly, the private PMI survey (CAXIN) for the manufacturing sector also returned to expansion territory. These indicators are reassuring, as they confirm a slight improvement, even if growth remains fragile. Without real support from demand, it is difficult to see any acceleration in activity beyond the sectors supported by the authorities, such as infrastructure spending.

To go deeper

The outcome of the US presidential elections should be known in 48 hours. That is, of course, if the results are not disputed by one of the candidates. D. Trump has already done so in previous elections.

What is certain is that, according to surveys and online betting, the race for the presidency remains very close. As proof of this, online betting, which was very favorable to D. Trump just a few days ago, has shifted in favor of K. Harris.

United States: the zig-zag of online betting...now to K. Harris's advantage

Whatever the victorious candidate and the majorities that will emerge from the ballot box in Parliament, the election campaign has highlighted a fairly extreme division in American society on many issues.

So, depending on who is elected, the consequences for the global economy and international relations will be very different.

It's hard to say whether the markets have really made a bet between the two candidates. Nevertheless, the general feeling is that the markets have tilted more towards a D. Trump victory, particularly in view of certain opinion polls and online bets up until a few days ago. This would explain the rise in US stock market indices, with promises of corporate tax cuts, while US sovereign interest rates have suffered from fears about future public deficits and the possible inflationary pressures that more expansionary as well as protectionist policies could provoke.

At the same time, however, US economic data showed that overall activity was far more resilient than expected, boosting risk appetite and prompting traders to revise their expectations of Fed rate cuts in the medium term.

What is certain is that, like a paradox, the main US stock indices are still close to their all-time highs, while volatility (measured by implied volatility on S&P options) has remained at a high level compared to its evolution over the past year (22 versus 16 on average since early 2023). The same is true of volatility calculated on sovereign bonds. This volatility may partly reflect political uncertainty. This higher volatility indicates a certain fear for the future.

As mentioned, the economy has been performing surprisingly well of late. The first estimate of US GDP growth for 3Q24, while coming in slightly below expectations, showed the economy continuing to grow above potential, at an annualized rate of 2.8%. This is just below the 3% posted in 2Q24.

Unsurprisingly, the main growth driver was household consumption, which grew at an annualized rate of 3.7%, making an even greater contribution to GDP growth than in 2Q24. Public spending also remained robust during the quarter. And, for the third quarter in a row, foreign trade made a negative contribution to growth.

United States: US GDP up 2.8% annualized in 3Q24, driven by household consumption

Consumer spending figures for September, the final month of the quarter, showed the strength of consumer appetite. However, they also revealed that households once again drew on their savings to support their spending.

United States: Consumption was still robust in September, with households able to draw on their savings

We believe there are limits to this decline in the savings rate, especially as the job market is normalizing. In our view, this normalization should translate into greater caution on the part of households.

The employment report for October is certainly not the best guide to the normalization of the labor market on the other side of the Atlantic. Indeed, it suffered from numerous distortions due to weather conditions (hurricanes in the South), as well as major strikes.

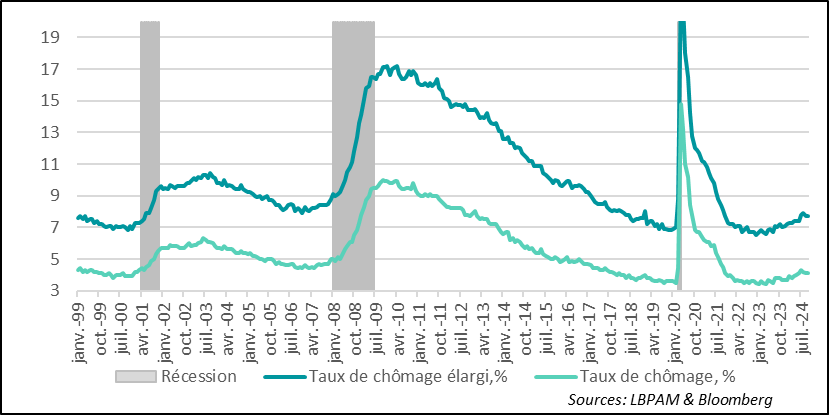

However, one of the important variables for the Fed in its decision-making, the unemployment rate, remained relatively stable at 4.1%, showing that the employment situation remains resilient.

United States: Unemployment rate stable at 4.1% in October

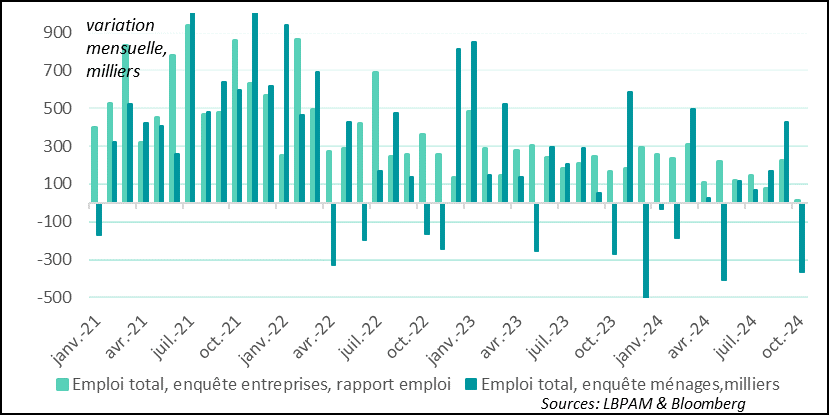

At the same time, with the distortions associated with the events reported, the flows gave a rather mediocre picture of the labor market situation. According to the business survey, only 12,000 jobs were created, mainly in the public sector, while the private sector destroyed 28,000, including 46,000 in the manufacturing sector. The household survey shows a very considerable drop, but this is partly offset by exits from the labor market, which explains a very slight fall in the participation rate. At the same time, it should be noted that the strong job creation of the previous two years has been revised downwards.

United States: With major distortions, depending on the survey (business or household), very few jobs were created or destroyed in October.

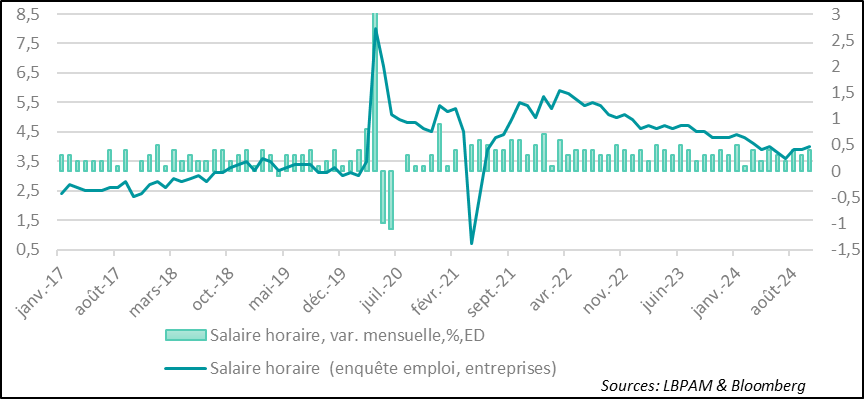

In fact, the least favorable figure in the report came from the estimate of wage growth, which accelerated over the month compared with September (0.4% over the month versus 0.3% the previous month). Year-on-year growth thus remained at 4%. This figure is still high for the Fed, in order to converge inflation towards 2%.

United States: Hourly wages are said to have risen in October according to the business survey, but this increase may be disrupted by the month's anomalies

Nevertheless, this statistic on wage growth should be treated with caution, given the distortions it entails due to composition effects. More reassuring was the trend in labor costs, which fell in 3Q24, even if the year-on-year increase was still 3.9%.

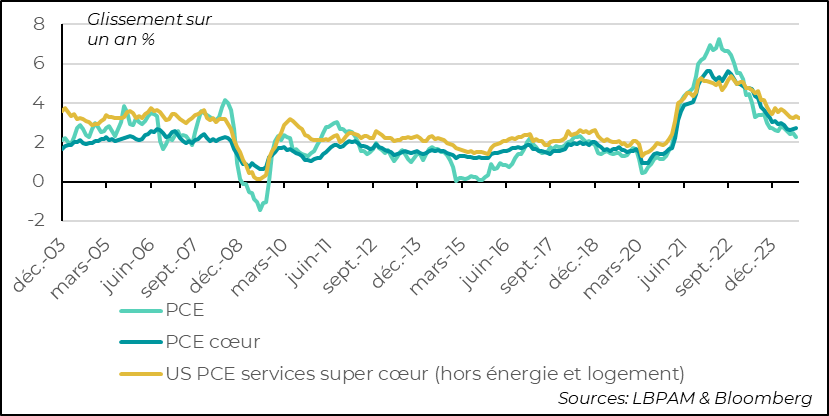

In fact, inflation figures, measured by the consumption deflator, the Fed's preferred statistic, showed that it is continuing to fall, albeit slowly. In fact, core inflation remained unchanged over the month at 2.7% year-on-year. The main factor behind this slow pace of disinflation continues to be price dynamics in services, where inflation remains relatively high.

United States: Inflation decelerates, but services inflation, while also decelerating, remains reluctant to fall

Nevertheless, there could be some good news in the months ahead, in that, when the most extreme price variations are excluded, the disinflationary trend remains intact. This remains an important factor for the Fed. This still justifies a further cut in its key rate, albeit a moderate 25 basis points on Thursday.

In the Eurozone, for once, we had good news on growth in 3Q24. Indeed, GDP growth in the Zone was stronger than expected at 0.4%. One of the surprises was the performance of the German economy, which expanded by 0.2% over the quarter, whereas growth was expected to decline by -0.1%.

The Zone's performance also benefited from the JO effect in France, which grew by 0.4% over the quarter. Spain remained among the leaders, with quarterly growth of 0.8%, also ahead of expectations. Italy, on the other hand, disappointed, stagnating over the quarter.

Euro zone: Good surprise on GDP growth in Europe with a 0.4% expansion in 3Q24

This performance gives the Zone a good base for 4Q24. Nevertheless, the backlash from the Olympic Games is likely to be negative for France, while we also expect a slowdown elsewhere. Nevertheless, this does not alter our view that growth should persist in the quarters ahead, without any unanticipated external shocks.

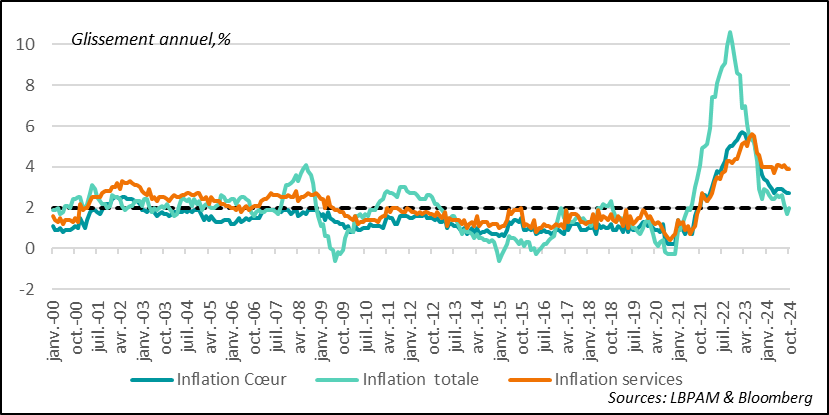

Eurozone inflation figures surprised slightly on the upside in October, with headline inflation rising to 2% year-on-year from 1.7% the previous month. Energy base effects played a part in this development. At the same time, core inflation remained stable at 2.7%. This was due to prices in services remaining stable at 3.9% year-on-year.

Eurozone: Inflation surprises slightly higher in October, with services still lagging behind in disinflation

The ECB knows that base effects for total inflation are likely to be unfavorable for inflation as the year draws to a close, but we can expect to see further easing in wages and thus to start seeing a deceleration in services prices in the months ahead. It is for this reason, and against the backdrop of still-weak activity in the Eurozone, that we still expect the ECB to continue cutting its key rates at its December monetary policy meeting.

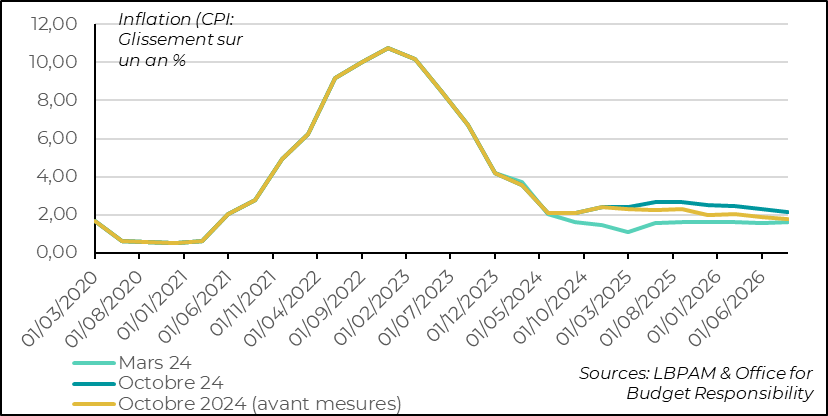

In the UK, the presentation of the Labour government's first budget by Chancellor of the Exchequer R. Reeves led to tensions on the bond market.

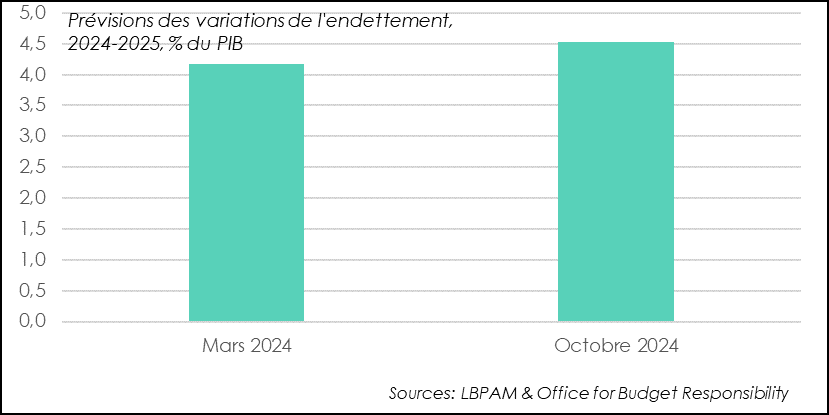

As expected, the budget should result in additional spending, particularly on capital expenditure. Some of this spending should be covered by tax increases. However, the government will have to call on additional debt. Compared with previous forecasts by the Office for a Responsible Budget (OBR), this debt would be 0.5 points of GDP higher than at the time of the March 2024 estimate.

United Kingdom: Labour government to borrow more than previously budgeted

In addition to the market impact of this additional debt, it was the revised economic forecasts associated with the new budget that caused the bond market to react. According to the OBR, the British economy will receive strong growth support over the next two years, pushing the economy above its potential. This would result in renewed inflationary pressures.

United Kingdom: Higher spending should boost growth and create inflationary pressures

These factors have pushed up UK 10-year long-term yields, which are now back above US levels and the highest in the G7. This movement seems a little exaggerated in our opinion. It remains to be seen whether the inflationary pressures forecast by the OBR will be confirmed. We still expect the labor market to ease further, and wages to continue decelerating. This should still allow the BoE to continue cutting its key rates gradually. Like the market, we expect a 25 basis point cut on Thursday.

In China, we had some good news on activity. Official PMI surveys continued to rise in October. The composite index remains in expansion territory at 50.8. In fact, activity in both services and industry is said to have grown in October. Similarly, the private PMI survey (CAXIN) also showed a rebound in the manufacturing sector, which moved into growth territory.

China: More encouraging business figures

These economic figures are encouraging and above all reassuring for the Chinese economy. The measures taken by the authorities seem to be helping to stabilize the economy, while activity in the rest of the world is surely still helping Chinese growth. It remains to be seen whether the authorities will do more in the coming weeks to support domestic demand.

Sebastian PARIS HORVITZ

Research Director