Central bank week

Link

- The markets await decisions from the Fed, the ECB, the Bank of Japan (BoJ) and the Chinese central bank (PBoC) this week. Although expecting rather hawkish monetary policies, the markets don’t seem too worried. As of late last week, US equities were up 20% from their October lows, which is the technical definition of a bull market. And credit risk premiums had almost returned to their levels prior to the March episode of banking stress.

- The FED is expected to keep its rates unchanged on Wednesday for the first time in more than one year, after 10 consecutive rate hikes. But Powell is also expected to stress that this is a mere pause and absolutely not a pivot. Moreover, Fed members’ dot plot for late this year could suggest that the Fed is willing to raise its rates further. The markets are pricing in an 80% likelihood of one last rate hike by July. Our scenario is that the Fed has probably completed its rate hikes and that it will not cut them until next year, but that the risk is clearly in the direction of further rate hikes if the job market and core inflation do not cool off some more this summer.

- The ECB is expected to raise its rates by 25pb this week, to 3.5%, for the eighth consecutive time and suggest that it is approaching the end of its tightening cycle but is not yet there. Like the markets, we forecast one last rate hike this summer. Although inflation clearly receded in May, the ECB staff may very well raise its inflation forecasts for 2023 and 2024, owing to stubborn pressures on services prices. This does not point to a more accommodative stance in the short term.

- As for Asia, it is broadly assumed that the Bank of Japan will keep its highly accommodative policy unchanged this week. Uncertainties are high regarding the timing of its exit from this accommodative policy, and some expect it to happen as early as this summer. But the BoJ is unlikely to provide any clue on this question this week. In China, the chances rose for a first rate cut in almost one year after signs in May of an economic slowdown and weak inflation.

- The good news we see for the markets is that their monetary policy expectations now look rather reasonable. They are no longer pricing in aggressive rate cuts by the Fed or ECB for this year. This reduces bond market risk and encourages us to selectively seek out yields on certain segments of the government and corporate curves. That said, interest-rate risks are probably slightly on the upside for this summer. However, in our scenario – in which we expect growth to remain lacklustre, as monetary policies stay hawkish to relieve inflationary pressures once and for all – we feel that the equity markets are a little complacent. Accordingly, we remain slightly underweighted in equities while focusing on those companies best able to defend their margins in this cycle.

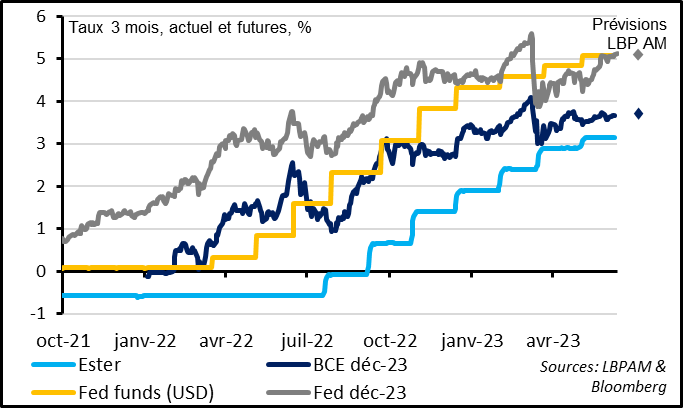

Fig. 1 – Central banks: key rates expectations for this year look rather reasonable at last

Fed key rate expectations have rebounded from their mid-March lows, when fears over regional banks were spiking. They have levelled off since the end of May, as the upside surprise on jobs was offset by weaker economic indicators in May (especially the ISM services).

In the Eurozone, ECB rate expectations have been rather stable since mid-April, as signs of stubborn pressures in service prices and on the job market offset the first signs of weaker growth in May.

All in all, market key rate forecasts for the two main central banks are in line with our scenario for yearend, pricing in a Fed rate that is stable at 5.1% and an ECB rate at 50 0,bps above its current 3.75% level.

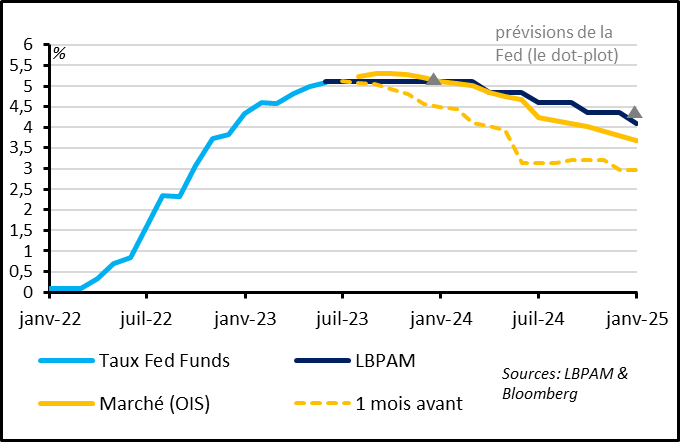

Fig. 2 – US: Fed expected to pause this week but the risk to key rates remains on the upside

Like the markets, we expect the Fed to leave its rates unchanged this week after 10 consecutive hikes. While the markets for several months had been expecting rapid Fed rate cuts beginning this summer, they are now pricing in additional rate hike risks, including a 30% probability of a hike this week and 80% by July. We don’t see a rate hike this week as very likely, although that can’t be ruled out, especially in the run-up to tomorrow’s release of May inflation figures. However, we do see a resumption in rate hikes in July or even September as a significant risk, particularly if the job market and core inflation do not begin to cool off more between now and then. This risk could be highlighted by Powell at his press conference and by the updating of Fed member forecasts, given that all that is now needed is for two additional FOMC members of the 18 total to forecast a rate hike for the median of expectations to point to higher rates by yearend. And several FOMC members have recently suggested they are concerned that core inflation has so far this year failed to cool off.

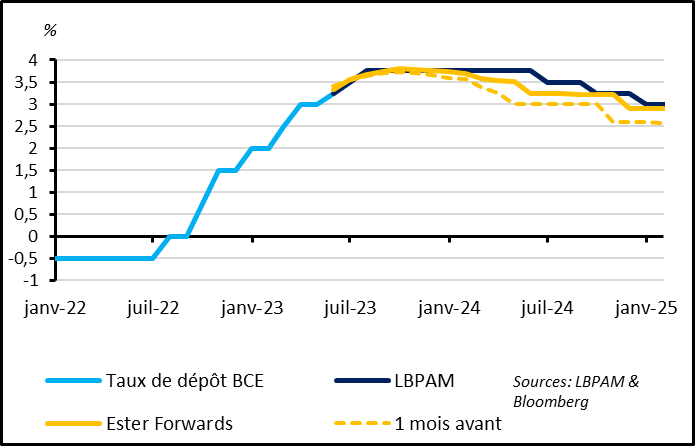

Fig. 3 – Eurozone: The ECB just keeps raising its rates, with a new hike expected for this week

We believe a further ECB rate hike is almost certain this week, and this is what the markets are pricing in. This is in line with the vast majority of ECB members’ statements to the effect that this rate hike cycle still has some ways to go. While insisting that what happens next will be data-dependent, Lagarde is expected to stick to a hard line and suggest that rate hikes are not quite over. While the decline in economic activity indicators and the greater than expected slowdown in inflation in May could cause the ECB to be more cautious, we expect it to stick to its hard line, due to fears over inflation and inflation expectations.

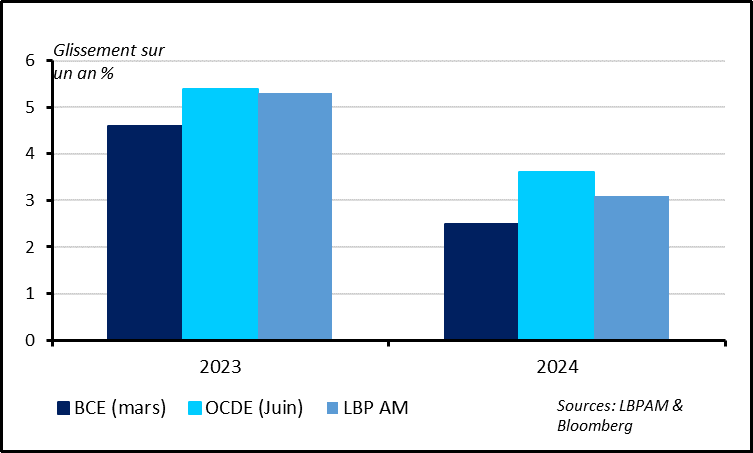

Fig. 4 – Eurozone: The ECB could once again revise its core inflation forecasts upward

The ECB staff could once again raise its core inflation forecasts, which would keep the pressure on the ECB. Total inflation expectations are closely tracking the energy price outlook, which itself is uncertain. For example, natural gas prices have risen back slightly since early June after having steadily fallen since the start of the year (to EUR 33/MWh from less than EUR 25 early in the month and EUR 75 at the start of the year). Core inflation forecasts are more stable, and ECB’s March forecasts look low. They are more than 0.5pt under our forecasts and under the forecasts the OECD released last week. If the ECB raises them, that would postpone the date at which inflation would move back sustainably towards the 2% target and would exacerbate the risk of de-anchoring expectations, which the ECB monetary policy committee would take a dim view of.