Central bankers give markets confidence

Link

-

Last week was a very good one for both the US and some European stock market indices (notably in the UK). In the US, it was even the best week in three months, with both the S&P and Nasdaq hitting new highs. The AI theme remains very buoyant. Nevertheless, it was the central bankers who provided the extra optimism. In particular, J. Powell, Chairman of the Fed, and A. Bailey, Governor of the Bank of England (BoE).

-

J. Powell did everything in his press conference last week to minimize the obstacles to rate cuts, which he validated as highly probable. A. Bailey, for his part, went one step further, validating the market's expectations of rate cuts between now and the end of the year. Their conviction seemed strong that victory over inflation was within reach. The Swiss National Bank's rate cut and the persistence of a highly accommodating monetary policy in Japan, despite the exit from negative interest rates, also seemed to have delighted market operators.

-

While we still believe there will be downturns, we remain much more cautious about the dynamics of disinflation, particularly in the United States, and to a lesser extent in the United Kingdom, although here too the deceleration in wages will have to continue.

-

In the UK, retail sales data for February showed a slight increase over the month (0.2%, excluding petrol), although a fall was expected after the previous month's very sharp rise (3.4%!). This upturn in consumer spending, supported by rising real wages and a resilient labor market, should enable GDP to return to growth after two quarters of contraction.

-

In the Eurozone, the IFO survey gave rather good news on the German economy. Indeed, the index reached its highest level since June last year, driven in particular by a strong improvement in the outlook. Nevertheless, these are only the first signs of an improvement, as the index remains well below its historical average.

-

Russia has suffered a horrific terrorist attack that is believed to have claimed the lives of almost 140 people and left many more injured. The attack was claimed by an affiliate of the Islamic State. The Russian authorities had ruled out the possibility of such an attack, despite warnings from US intelligence services earlier in the month. Specialists do not see any weakening of the regime, but rather the possibility of even more authoritarian measures. On the markets, few implications seem to be visible at this stage, even if oil prices are stretching a little.

Recent comments by some central bankers have given the market confidence that interest rates may be cut in the months ahead. Indeed, last week, J. Powell was the first to give a more accommodating message than the MPC's description of the state of the US economy, and in particular the trajectory of inflation, appeared to be. As a reminder, the majority of committee members believed that inflation was likely to be higher than expected in 2024, and that growth could be more solid.

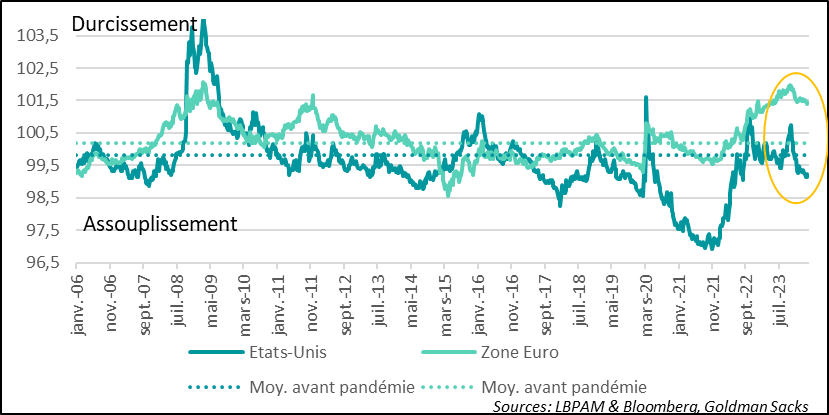

Nonetheless, J. Powell played down the poor inflation figures at the start of the year, and showed little concern about the very sharp improvement in financial conditions across the Atlantic, which could further stimulate activity and exacerbate inflationary pressures. In fact, J. Powell gave the impression that he had a rather asymmetrical analysis of the role of financial conditions in the economy's trajectory, after underlining his concern at their tightening last summer. In fact, since January, financial conditions are no longer mentioned in the Fed's press release following the Monetary Policy Committee meeting.

Fig.1 Financial conditions: They are easing sharply, particularly in the United States, with the support of a rather accommodating speech by J. Powell

-United States

-Euro zone

-Pre-pandemic average

-Pre-pandemic average

All in all, the Fed Chairman once again seems fairly confident about the disinflation process, and therefore about the possibility of rate cuts in the months ahead.

Our scenario remains one of gradual cuts in US key rates in June. Indeed, inflation dynamics remain rather uncertain, particularly given the slow reduction in tensions in certain service segments. A sharper slowdown in the economy would allow us to be more confident about the trajectory of monetary policy.

In any case, the market has taken note of J. Powell's much more accommodating tone, which has certainly contributed to continued risk-taking.

A. Bailey, Governor of the BoE, seemed equally confident. For him, the concerns of recent months about the trajectory of inflation seem to have dissipated considerably. Following last week's decision by the Monetary Policy Committee, he gave a very optimistic message on inflation in two interviews, including one with the Financial Times. Even more remarkably, he validated market expectations of possible rate cuts between now and the end of the year.

Whether it's A. Bailey or J. Powell, it seems that they have moved away from data dependence and returned to a kind of forward guidance of the future path of monetary policy. As for the ECB, although indications have been given of a possible rate cut as early as late spring, it seems to be a little cautious about its communication.

What is certain is that communications from the major Anglo-Saxon banks must be integrated into market views, as they clearly stimulate risk-taking. So, despite the recent surge in indices and the rise in valuations, which could lead us to be more cautious, we are maintaining a neutral position on equities in our asset allocation.

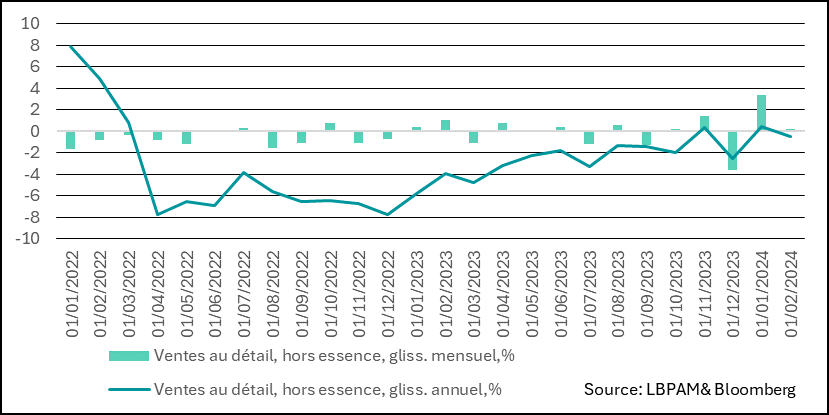

With regard to the UK economy, we have just received the retail sales data for February. They came in better than expected. Excluding petrol sales, they rose by 0.2% over the month, whereas forecasts had predicted a fall after January's very sharp rise (3.4%).

Fig.2 United Kingdom: Retail sales decelerate in February but less than expected

-Retail sales, excl. gasoline, monthly sliding, %

-Retail sales, excl. gasoline, year-on-year, %

So, it looks as though consumption is picking up, which should help the economy to return to growth in 1Q24, after two quarters of negative growth at the end of 2023. However, this recovery in growth will be slow, with inflation remaining high, and real consumption growth remaining weak.

But consumption should remain supportive, with wages now rising faster than inflation (5.3% year-on-year in January for average weekly earnings), and a labor market that remains buoyant with unemployment at just 3.9%.

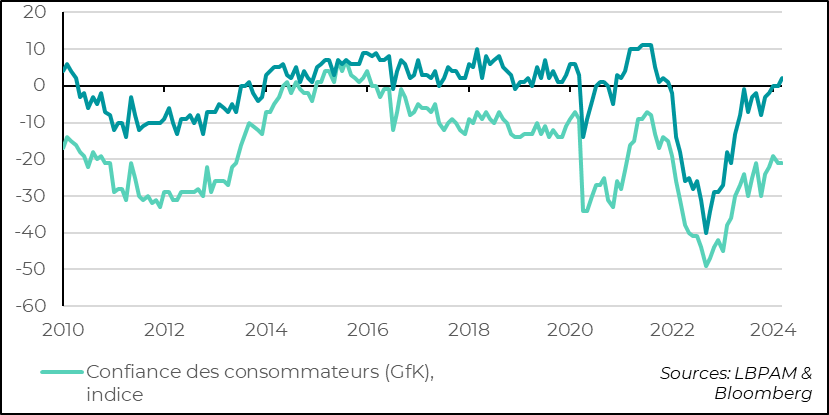

In fact, the Household Confidence Survey, although down slightly at the beginning of March, showed that British households were, for the 1st time since the end of 2021, more confident about the outlook for their financial situation.

Fig.3 United Kingdom: Household confidence stalls, but for the first time since late 2021, households expect their financial situation to improve

-Consumer confidence (GfK), index

Whether this improved demand data will maintain the downward trend in inflation is the big question for the UK over the coming months.

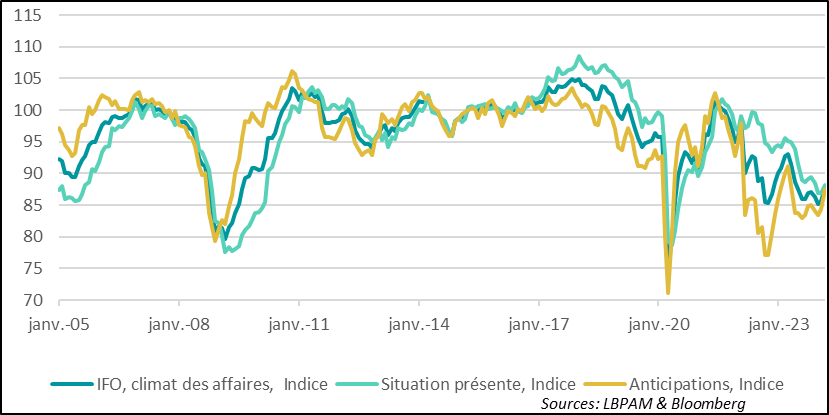

In the Eurozone, we had some good news on the German economy, in line with the preliminary PMIs for March, which showed an improvement, particularly in services.

Indeed, the IFO survey showed an improvement in the German business climate. The total index seems to have resumed an upward trend, even if it remains well below its historical average.

The good news came mainly from the outlook, which rebounded sharply, gaining more than 3 points over the month. These developments are reassuring for both the German and European economies. They are consistent with our scenario of a very gradual recovery in growth in the Eurozone over the course of the year, which should be further stimulated by a loosening of monetary policy in the second half of the year.

Fig.4 Germany: Good news, the IFO shows a gain in outlook, which should be positive for the Eurozone as a whole.

-IFO, business climate, index

-Present situation, index

-Anticipations, index