Central banks reduce short-term uncertainty a little

23.09.2024

Link

In the September 23, 2024 market review, Xavier Chapard presents an analysis of central banks.

In summary

►The September meetings of the major central banks brought a little more clarity to the key rate paths for the end of the year. The return of support from the Fed, which wants to avoid at all costs being late in its support for the economy, is rather positive for risky assets and is conducive to a steepening of the yield curve. That said, uncertainties over the pace of rate cuts next year remain high, with both upside and downside risks depending on the extent of the US economic slowdown and the pace of normalization of global inflationary pressures.

►The Fed cut rates by 50bp last week, and its members are forecasting a further 50bp of cuts by the end of the year. The Fed justifies these aggressive rate cuts at the beginning of the rate-cutting cycle by saying that recalibration was necessary now that the risks between inflation and employment are “broadly balanced”. But the Fed does not indicate that this is the new normal pace of rate cuts, since it is planning “only” four rate cuts next year. This is also our central scenario, although we believe that rates could fall more sharply in the short term in the event of a recession, and less sharply in the medium term if inflationary pressures do not fully normalize next year.

►Other central banks are maintaining a more cautious approach. The ECB and the Bank of England (BoE) are still advocating slower rate cuts. After their 25bp rate cut at the beginning of the summer, they kept rates unchanged in September, and their rhetoric suggests that they should cut rates by another 25bp by the end of the year. They justify this caution on the grounds that labor markets are easing less rapidly in Europe than in the US, and that core services inflation is more persistent. This approach seems reasonable to us, even if they may have to accelerate their rate cuts next year if the downside risks to the economy materialize.

►Questions about the European economy are important, given the slowdown in the recovery this summer, the malaise in the German economy and political uncertainties in France. In this context, the September PMIs published this morning will be important to watch in order to judge the solidity of our limited recovery scenario.

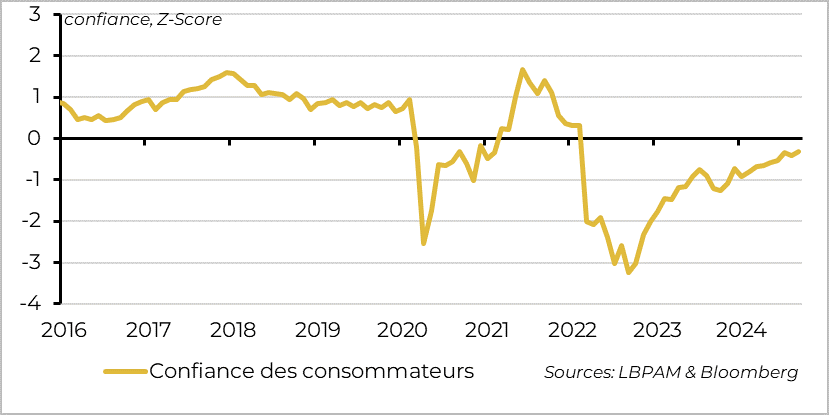

►The rise in consumer confidence in the eurozone in September is reassuring in this context, after having fallen in August. Indeed, we are counting on consumer spending to underpin slight growth in the eurozone over the coming quarters.

►The BoJ remains the only major central bank to raise rates, although it was more cautious in September. It wishes to avoid recreating market volatility, as it did at the beginning of August. However, continued progress towards a sustainable inflation rate of 2% should, in our view, enable it to raise rates again by the end of the year, probably in December. This should continue to support the yen in the medium term and, on the contrary, weigh a little on Japanese equities.

►In any case, it's not politics that offers more certainty in the short term. The new French government is fragile and will have to present its priorities and a budget at the beginning of October, which will not be easy. The risks of escalation in the Middle East continue to rise after the weekend's retaliation between Hezbollah and Israel. And all this as the American elections draw near...

Go deeper

Euro zone: consumer confidence recovers slightly in September

In September, consumer confidence in the Eurozone reversed its unexpected fall in August, reaching -12.9pt. This is its highest level since the start of the war in Ukraine, although it remains below its long-term average.

This first confidence indicator for September is reassuring, given that we are counting on consumer spending to underpin slight growth in the eurozone over the coming quarters. Indeed, buoyant labor markets and wages outpacing inflation are supporting household purchasing power. Now that monetary restraint is easing with the ECB rate cut, this should support consumption. That said, consumption disappointed in Q2, falling by 0.1% after rising by 0.3% in Q1, and political uncertainties in several of the zone's major countries could prompt households to remain cautious and maintain a high savings rate. Against this backdrop, the continued normalization of the consumer confidence indicator is a positive sign, in line with our scenario of limited but positive growth in the eurozone over the coming quarters.

Today's publication of the eurozone's advanced PMIs for September will be even more important indicators of whether the recovery is continuing, even if at a limited pace. The zone's composite PMI rebounded slightly in August after approaching the stagnation zone in July, but benefited from a strong JO effect which boosted the services PMI in France. It will be important to see whether, without this temporary effect, the PMI still remains in the expansion zone in September.

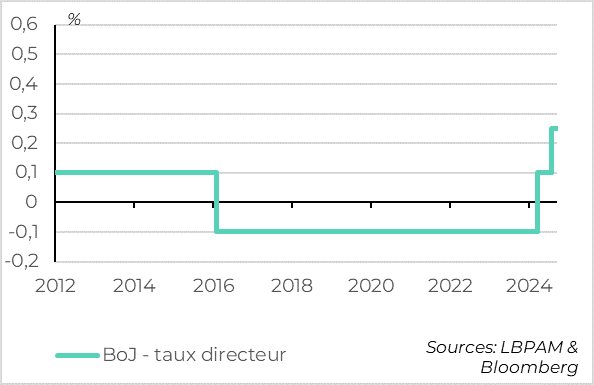

Japan: central bank keeps rates unchanged in September

The Bank of Japan (BoJ) adopted a slightly more cautious tone in September after shocking the markets in July, without however calling into question the upward trajectory of key medium-term rates.

The BoJ had encouraged volatility on the financial markets at the beginning of August after raising its key rates at the end of July, mainly because it had adopted a fairly tough stance, indicating that it was ready to continue raising rates fairly quickly.

On Friday, the BoJ was cautious. It maintained its key rate at 0.25%, as expected. Above all, it withdrew from its statement any reference to future rate hikes, and added that it was paying close attention to market and currency developments.

That said, it is not questioning the upward trajectory of its rates, indicating that it is increasingly confident that inflation will converge towards its medium-term target of 2%.

We still expect the BoJ to raise rates again before the end of the year, although it will probably wait until December to allow the uncertainties associated with the US elections and potentially Japan to pass.

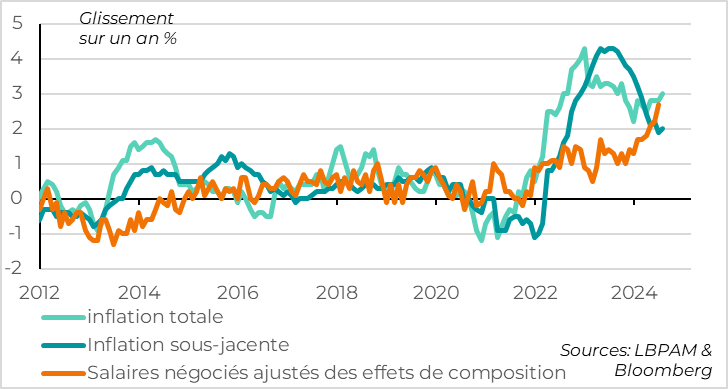

Japan: core inflation stabilizes at target in August

Japanese inflation rebounds in August from 2.8% to 3.0%, as expected. Although this is mainly due to food and import prices, it is still noteworthy that Japanese inflation has been above target for over 2 years. Above all, core inflation is stabilizing at the 2% target, after declining in recent months. And it is accelerating again at a sequential rate, with prices in the services sector in particular becoming slightly more dynamic.

Combined with the acceleration in wages and the cyclical recovery this year, this reinforces the BoJ's confidence that Japan can emerge from deflation on a sustainable basis. It should be noted, however, that inflation expectations, although rising, remain a little below the level needed to ensure that inflation remains durably on target.

All in all, the BoJ should be able to gradually raise its key rates, which remain very low at 0.25%, especially compared with other central banks. But it must do so gradually and cautiously, especially at a time when inflation is easing in other developed countries and other central banks are cutting their rates.

The market remains cautious about these rate hikes, since it only includes a 50/50 chance of a hike by the end of the year, and only includes a full rate hike for mid-2025. Given our slightly more aggressive scenario, we believe that the yen retains potential for appreciation in the medium term, which could weigh on Japanese equities, which remain highly exposed to foreign exchange.

Xavier Chapard

Strategist