Make way for the central banks !

Market views 1.30.23

Link

- This week the main central banks will be raising their key rates to levels not seen for the last 10 years. The primary focus, however, will be on the future direction of their monetary policy. It is virtually a given that the Fed will raise the fed funds rate by 25 basis points (bp), once again slowing the pace of its rate hikes. The ECB and the BoE (Bank of England) are expected to go a step further with 50 bp increases. Anything unexpected will come from the tone adopted by each institution. Will the Fed prove the market right and make this the next-to-last rate hike? Thus considering that its monetary policy has become sufficiently restrictive? We still think the Fed may have further to go. Will the BoE minimise wage tensions, finding a moderate rise to be more appropriate in light of recession risks? Will it take a risk on inflation? We ourselves expect to see a strong signal to be given. Might the ECB adopt a more accommodative tone compared to its last meeting? That would prove challenging, and at this point is unlikely.

- Obviously, the decisions will be based on an analysis of what level of policy restriction is right to bring inflation back to the 2% target. Inflation is trending down in most countries, influenced significantly by the decline in energy prices. In the United States, we also have to consider the falling price of goods, and particularly those that had crystallised the strongest tensions along production and distribution chains. Last week, the Bank of Canada decided that its tightening efforts had achieved their end and hit the pause button. In its view, given the time needed for monetary policy initiatives to take effect, the restrictive measures already taken should keep inflation on a downward path. Hard to say...especially since, as can be seen elsewhere, wages are climbing to levels largely in excess of productivity gains. We aren’t so sure the other central banks will agree with this analysis. The next few months are sure to be eventful. No one wants to go too far and end up stifling growth. When it comes to the economic trajectory, however, the risk of doing too little is stronger than the risk of doing too much.

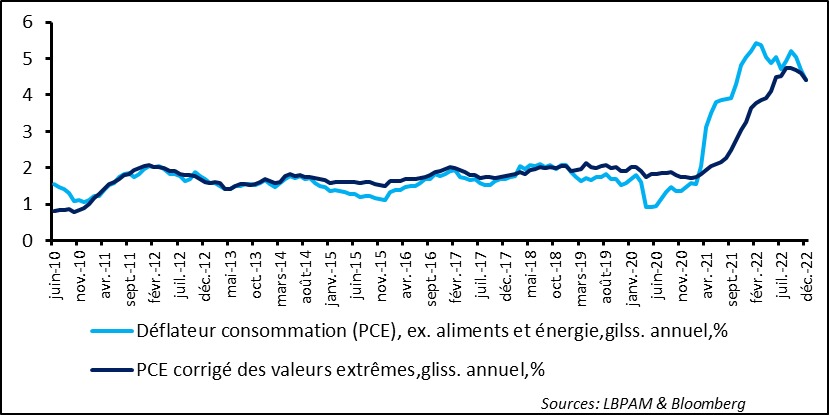

- The latest inflation figures for the US, with the publication of the Personal Consumption Expenditures (PCE) price index, the measurement most closely tracked by the Fed as expected, followed the trend of the CPI as it continued to slide in December. Core inflation dipped to 4.4% on a rolling 12-month basis, versus 4.7% last month, i.e. more than double the Fed’s target. As we see it, we are entering the most challenging phase of the price deceleration movement, which could prove slower given that the core trend is more important. After all, we can expect goods prices to fall further as supply chain bottlenecks are resolved and major comparison base effects are generated on a rolling 12-month basis. Similarly, for energy prices, the comparison base effects will be in play at least until late spring. They will be much slower in terms of service prices. At the same time, from the Fed’s viewpoint, it is more important for market inflation expectations to be rooted in reality.

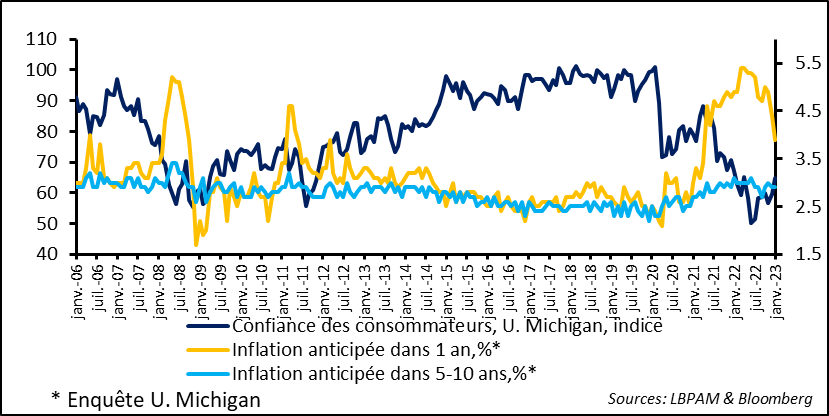

- A better supply-demand balance is necessary for inflationary tensions to ease. And that comes with less pressure on the job market. With the unemployment rate sitting at 3.5% in the US, i.e. its lowest rate in more than 50 years, this dynamic is clearly not yet in the cards. This week we’ll see what the US employment survey has to say. All signs indicate that the job market is still relatively robust on the whole, despite repeated announcements of lay-offs in certain sectors. But the job market is a delayed variable of the economic cycle. From these standpoints, consumption data for the month of December showed a sharp decline in real terms. This tends to indicate that 2023 marks the start of weaker momentum, contrasting with GDP growth in the last two quarters (+3% per quarter on average, year-on-year). At the same time, consumer sentiment is improving. These are the paradoxes that make it so complicated to interpret the economic trajectory.

Fig.1 United States: Core inflation continues to fall

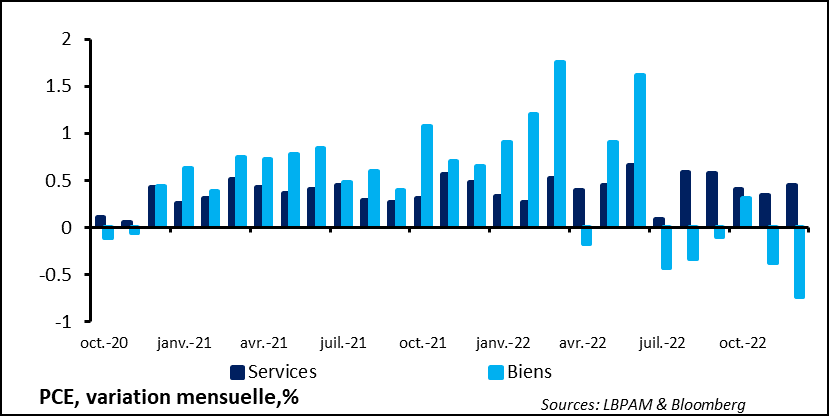

Even so, core inflation has been slow to decelerate. True, we know that goods prices are falling fast while service prices are easing much more slowly. In fact, they even accelerated in December. In addition to rent prices (which do not carry the same weight at all in the PCE as they do in the CPI, a major share of these increases can be traced to wage rises.

Although wages appear to slowing, the persistence of a highly tense job market suggests that wage rises will only fall gradually, likely in conjunction with a deterioration in the job market. We think this will happen within the next two quarters. Will it be enough to cause wages to fall quickly? This is one of the questions central bankers will have to ask.

Fig. 2 United States: The dichotomy between service prices and goods prices is expected to continue

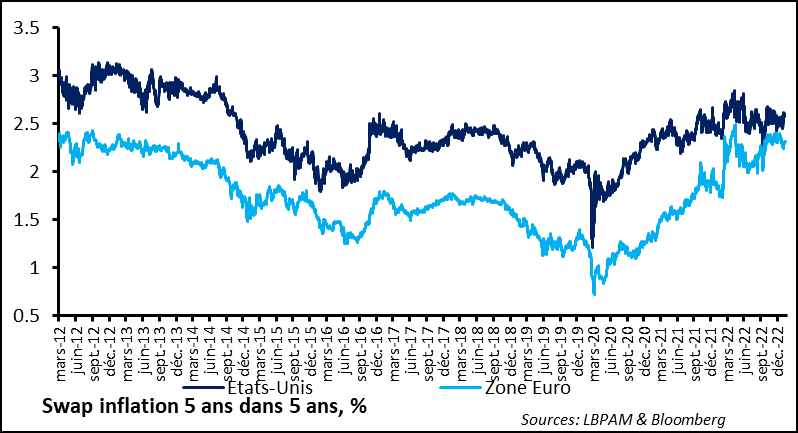

The good news for central banks is that the market’s medium-term inflation expectations are still relatively well-rooted, ranging from 2% to 2.5% in the US over the course of 2022. It's up to the Fed to successfully keep them stable. At this point, it is important to stress that the credibility of being able to return inflation to the 2% target remains valid.Note that the euro zone has seen a sharp correction in inflation expectations. One of the biggest changes in the last two years is that, at least from the market’s viewpoint, the euro zone is no longer at risk of deflation. That said, we can understand the ECB’s trepidation of losing this highly sought-after goal after finally achieving it. Hence Lagarde’s determination to maintain a hard stance on the importance of keeping current inflation pressures under control.

Fig. 3 United States: Market inflation expectations are relatively firmly rooted

Looking at changes in US economic conditions, we can see that consumer spending lost momentum towards the end of the year, falling more than expected (by 0.3% in real terms) over the month of December, despite a 0.3% rise in disposable income in real terms. The savings rate picked up slightly as a result. Is this a sign of deterioration, triggered by fears of a less buoyant job market? Hard to say at this point. Especially when the University of Michigan Consumer Sentiment Index for the month of January showed that consumer sentiment improved, though remaining at a historically low level. This improvement is attributable in part to disinflation triggered in particular by the drop in energy prices. As a result, inflation expectations for 2023 have fallen. One this is for sure: US consumers hold the keys to the trajectory of the global economy for the coming quarters.

Fig. 4 United States: consumer sentiment has improved slightly, while inflation expectations have fallen

Sebastian Paris Horvitz