China continues to withstand the trade war… for now

Link

What should we take away from market news on October 21, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overview

► Rating agency S&P has downgraded France’s credit rating to A+, from AA- previously. Following a similar move by Fitch in September, this new downgrade definitively removes France from the group of AA-rated countries. The announcement came as a surprise, as it was made outside the official review calendar — the rating update was expected at the end of November — and just after the government survived several motions of no confidence. S&P justified its decision by pointing to persistent uncertainty surrounding the trajectory of France’s public finances. The agency projects public debt to reach 121% of GDP by 2028. This downgrade has had little immediate impact on interest rates. Attention now turns to parliamentary debates to see whether “acceptable” spending cuts can be agreed upon by a majority, enabling the adoption of the 2026 finance bill. Otherwise, renewed political and economic instability appears likely.

► In Japan, following the split with the Kōmeitō party, Ms. Takaichi, the new leader of the LDP, has successfully formed an alliance with Ishin, the country’s third-largest political force. This coalition could pave the way for her to become Prime Minister, although the two parties do not hold an absolute majority. The policy she is likely to pursue appears less ambitious in terms of public spending than some had anticipated at the time of her election. However, given her convictions, increased fiscal support for the economy remains a strong possibility. We maintain our view that the Bank of Japan should continue tightening its monetary policy, albeit very gradually. A hike in policy rates before the end of the year cannot be ruled out. In this context, the yen is expected to strengthen following its recent weakness.

► In the United States, the federal government remains partially shut down, resulting in a complete halt to the publication of official economic statistics. As the shutdown nears the symbolic one-month mark — close to the record of 35 days — prospects for resolution remain limited. A court ruling has temporarily suspended the layoffs initiated by the administration. However, if these measures resume, as previously noted, the economic cost of the shutdown could be significantly higher than in past episodes.

► On the markets, concerns over potential bankruptcies at First Brands and Tricolore were amplified last Thursday by the announcement of significant provisions at two regional banks, Zions and Western Alliance. The specter of financial system fragility triggered a sharp drop in risk assets and a renewed flight to safety. The U.S. regional banks index fell by nearly 7%. However, calm returned as early as the next day. Reassuring statements from Zions Bancorp helped ease tensions, but it was above all President Trump’s surprise announcement of a potentially more constructive dialogue with China that reignited risk appetite. This rebound was further supported by strong earnings reports from several U.S. companies. Since then, the decline in U.S. indices has been almost entirely erased.

► We believe it is important to remain vigilant regarding the vulnerabilities of certain U.S. financial institutions. Existing pockets of weakness — particularly in the commercial real estate lending sector — are now compounded by emerging tensions linked to the financial difficulties of the most fragile households. These factors could lead to negative developments for several financial entities. In this context, it is surprising to see the Federal Reserve accelerating its push for deregulation of the banking system, especially for smaller institutions. This approach raises questions about the sector’s resilience in the face of potential shocks.

► The United States and China appear to be re-engaging in dialogue, following Donald Trump’s announcement of a possible meeting with President Xi next week. Meanwhile, China’s economy continues to show resilience: GDP grew by 4.8% year-on-year in Q3 2025. Although this marks a slowdown from the previous quarter (5.2%), growth remains close to the government’s 5% target. However, momentum may continue to weaken in Q4, based on September data. Household consumption remains subdued, with retail sales rising by only 3%, while investment declined by 0.5% — the first drop since 2020. Although industrial production is accelerating, this rebound appears largely driven by the strength of the export sector.

► Against the backdrop of fragile domestic growth, the 4th Plenum of the Chinese Communist Party is set to begin, expected to unveil the country’s economic roadmap for the next five years. President Xi is likely to place renewed emphasis on technological investment, aiming to strengthen China’s resilience in the face of ongoing economic tensions with the United States. Despite the current strength of the export sector, this engine of growth may lose momentum in the coming years, especially if other countries impose trade barriers on Chinese goods due to limited access to the U.S. market. In this context, the economic policy message is expected to call for stronger support for domestic demand.

Going Further

China: resilient growth, but weakening domestic demand

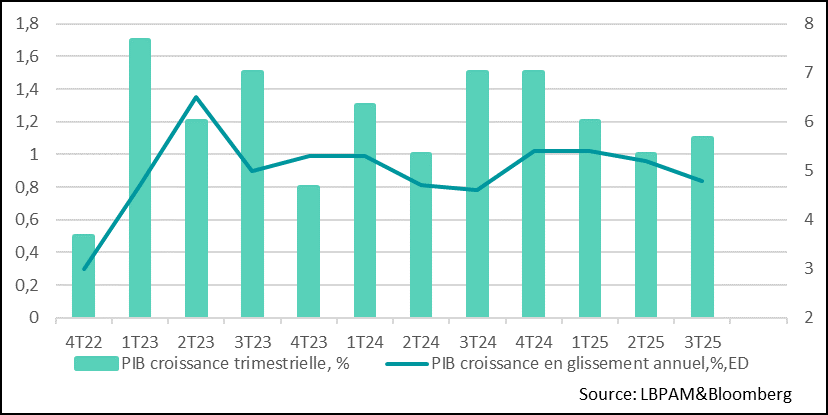

LGDP growth is slowing down on trend in Q3 2025

Following Donald Trump's threats last week to impose 100% tariffs on Chinese imports, trade tensions have eased. A meeting with President Xi is now being considered for next week. Close attention should be paid to any potential progress in the bilateral relationship, particularly regarding the strategic issue of Chinese rare earth exports, which remain a major lever of Beijing's economic diplomacy.

Meanwhile, despite a 27% year-on-year drop in Chinese exports to the United States in September — a direct consequence of high tariffs (over 30%) — China has managed to maintain exports as a key driver of its growth. This decline was offset by a strong increase in sales to other regions, notably Europe.

Thanks to the dynamism of foreign trade, China's GDP grew by 1.1% in the third quarter, slightly above expectations. However, the trend remains fragile, with a year-on-year slowdown to 4.8%.

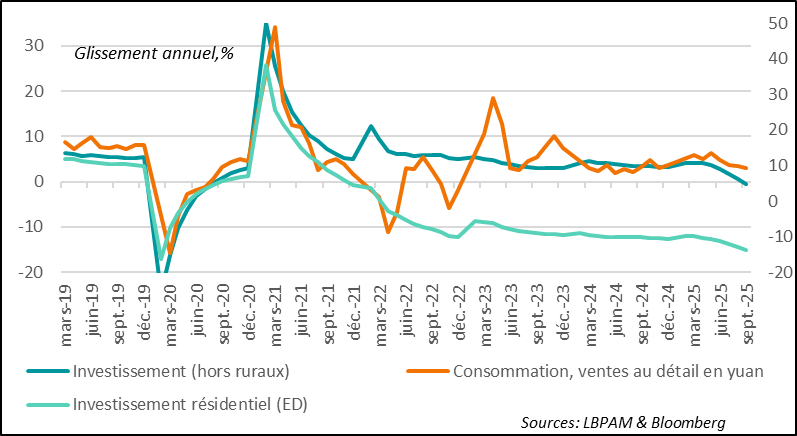

Softening domestic demand

The deceleration trend is clearly reflected in the monthly consumption and investment data, illustrating a gradual weakening of domestic demand. In September, household consumption, measured by retail sales growth, slowed to 3% year-on-year. This decline is partly due to the end of government incentives that had encouraged the replacement of household appliances and vehicles.

Without these support measures, demand is struggling to recover amid a still fragile confidence climate. The persistent slump in the real estate sector continues to weigh on household behavior: home sales have fallen by 7.6% since the beginning of the year compared to the same period in 2024.

Industrial production remains strong, in line with exports

Certainly, Chinese authorities can still rely on foreign trade to reach their 5% GDP growth target. The strength of the export engine continues to support industrial production, which rose by 6.5% year-on-year in September.

However, relying long-term on exports in the current global context appears to be a risky bet. The tolerance of some trade partners toward Chinese products is waning, as illustrated by the European Union’s efforts to strengthen protection for its own industries.

Against this backdrop, all eyes are on the 4th Plenum of the Chinese Communist Party, which opens this week. It is expected to outline the broad contours of the country’s economic strategy for the coming years. While technological development and national security will remain top priorities, attention will also turn to supporting domestic demand. Without a strengthening of internal consumption, China’s economic ambitions could be at risk.

Sebastian Paris Horvitz

Head of Search