China promises further support

Link

Sebastian PARIS HORVITZ decrypts the market on December 11, 2024.

In summary

►As domestic demand remains sluggish, investors continue to await decisions by the Chinese authorities to support growth in the year ahead. Measures have already been taken to ease monetary policy and, more broadly, financial conditions. But on the fiscal policy front, action remains timid and the outlook unclear. Nevertheless, the Politburo issued a statement this week which seems to indicate that decisions will be taken. In particular, the Politburo gave guidelines for future economic policy, indicating that monetary policy should be “moderately accommodating”, while fiscal policy should become “more proactive”. What this means is difficult to quantify. This should keep hope alive, but also uncertainty.

►The two-day meeting of the economic body that draws up plans for the Chinese economy over the next year could provide more precise indications by the end of the week. But nothing is less certain. We still expect the authorities to do more in the coming months. However, it remains difficult to determine the timing and scale of the budgetary effort that might be deployed, as well as the recipients. Also, it's likely that President Xi will want to wait until he has more clarity on the policies that will be implemented in the US before taking action.

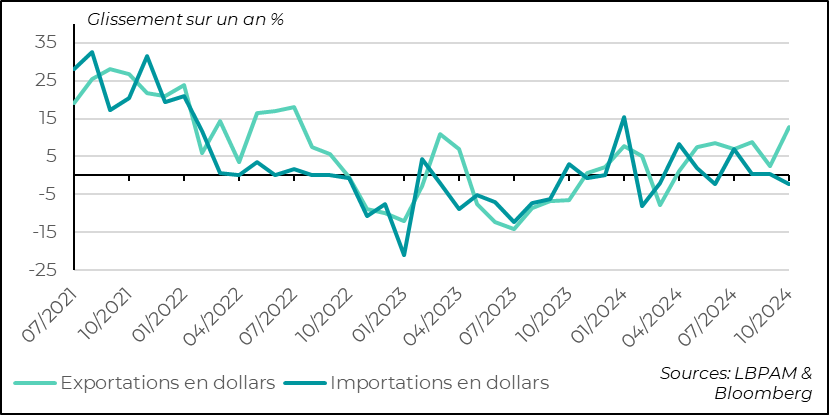

►One certainty is that domestic activity remains weak, notably due to real estate and the loss of household confidence. This was reflected in import figures, which fell again in November, to 3.9%, just as the market was expecting a rebound. Exports, on the other hand, continued to grow strongly year-on-year (6.7%), albeit less than in the previous month due to the rebound in exports in October following the previous month's bad weather, which had blocked ports. What emerges from these statistics is that foreign trade remains a strong engine of growth.

►In France, we still don't have a Prime Minister. President Macron is in talks with the political parties to build a stable majority in the Assembly. At the same time, on a slightly more reassuring note, recent statistics for the French economy have been a little less mediocre than S&P's PMI results. In fact, the Banque de France (BdF) business survey remained a little more optimistic than the PMI surveys might have suggested.

►In fact, after very solid growth in Q3 2024 (0.4% quarter-on-quarter), French growth is set to decelerate in Q4 2024. The French central bank believes that growth will be close to zero. Indeed, the impact of the Olympic Games is likely to cost 0.2 percentage points, neutralizing the momentum that still exists in some sectors. All in all, the BdF's economic analysis highlights the fragility of the economic situation in France and the high level of political uncertainty weighing on confidence. Tomorrow's ECB rate-cutting decision should also highlight the weakening of the European economy.

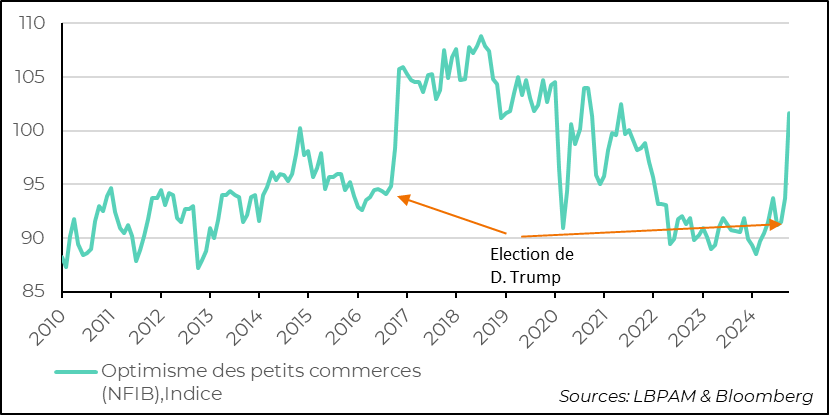

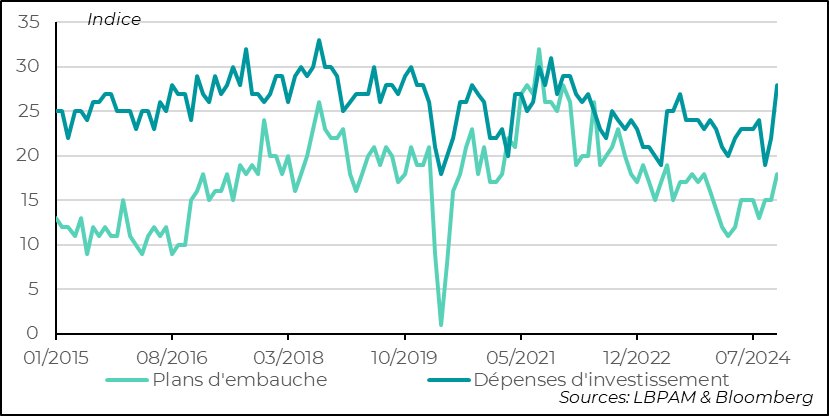

►In the United States, the NFIIB small business survey for November made a move identical to that made during D. Trump's previous election in 2016, with confidence rebounding very strongly. The hope of further tax cuts is obviously behind this upturn. Under these conditions, the sub-indicators concerning future hiring and investment are also progressing strongly.

►Today, the release of November CPI inflation figures across the Atlantic will be an important statistic for the Fed in its decision next week. The focus will be on core inflation, which has stopped falling since last July, coming in at 3.3% year-on-year for October. Total inflation, on the other hand, should continue to benefit from easing gasoline prices. Barring a very strong upward surprise in core inflation, we continue to believe that the Fed should cut its key rates by 25 bp.

To go deeper

The Chinese authorities continue to communicate their willingness to provide further stimulus to the economy. Nevertheless, although monetary policy and, more broadly, financial conditions, notably via credit, have been eased, investors are still waiting for more significant action to support domestic demand, which remains depressed. Thus, the use of the fiscal weapon remains limited.

Earlier this week, the Politburo of the Communist Party gave a further sign of support for the months ahead. In a statement, it defined the direction economic policy should take in the year ahead. Monetary policy should remain “moderately accommodating”, while fiscal policy should become “more proactive”. However, the statement does not include any specific measures associated with these orientations.

These announcements could be made this week after the meeting of the body that sets economic targets for the coming year, which began today. But nothing is less certain. Unfortunately, investors' hopes have already been dashed time and again.

It is likely that President Xi will want to wait until he has more clarity on the policies that D. Trump will pursue in the White House before implementing a fiscal stimulus plan. However, this wait may still be detrimental to the momentum of domestic demand, which remains weak.

We believe that the authorities will offer more support to the economy, but that this will remain moderate. The strategy of the Chinese authorities should continue to be to succeed in this phase of deleveraging the economy, notably by continuing to adjust the real estate sector.

Once again, international trade statistics for November highlighted the difference in momentum between export activity and domestic demand. Indeed, while dollar-denominated exports grew by 6.7% year-on-year, imports are still contracting (-3.9%) compared with the previous year's level.

Exports, although still up on 12 months ago, still grew less than had been hoped. However, this disappointment needs to be put into perspective, as exports were expected to slow down slightly in November. Indeed, the previous month had seen a very sharp rise (12.7% year-on-year), which was explained by a normalization of export flows following the difficulties in exporting in September due to bad weather.

All in all, these figures underline the fact that foreign trade remains an essential support for the country's growth. In the months ahead, this support is likely to remain high, with American importers likely to bring forward the import of Chinese products in the face of uncertainty over President Trump's protectionist measures.

Meanwhile, on the import side, we continue to see depressed domestic demand. Import figures show weakness in imports of metals, particularly iron, reflecting in part the depressed nature of the construction sector.

China: exports remain one of the engines of Chinese growth

In the United States, the NFIB survey of small businesses showed a very strong rebound in confidence. This was similar to that seen during D. Trump's previous election to the presidency.

Evidently, Trump's campaign announcements on further tax cuts for businesses are seen as a new factor of support for businesses.

United States: NFIB survey shows considerable rebound in confidence

In fact, the sub-indicators of the survey that are rising the most are focused on future business growth, with expectations of more hiring and investment projects.

United States: small businesses see business prospects improving, motivating them to hire and to invest more

These statistics show that expectations are very high regarding the policies to be implemented by the new administration, and surely, in part, these expectations are already reflected in the prices of the riskiest US assets. This should prompt a little caution. Nevertheless, even if we can expect more hesitation on the markets given the ground covered last month, in the short term, the bet on D. Trump's pro-business policies should remain a support for the US stock market.

Sebastian PARIS HORVITZ

Head of research