Chinese and European economies holding up rather well as they stand

Link

Between a prolonged trade truce between Washington and Beijing, a rebound in confidence in the eurozone and ambiguous signals on the Chinese economy, markets are navigating between hopes of recovery and persistent uncertainties. With a key Fed decision looming, investors are scrutinizing every indicator.

Key Takeaways

► While the economic calendar was rather light at the start of the week, the market focused on the US/China talks, which were “fruitful” according to both parties. We're a long way from a lasting agreement to resolve tensions between the two leading economies, but at least the truce is extending as expected, at least until August. This is enabling equities to flirt with their all-time highs.

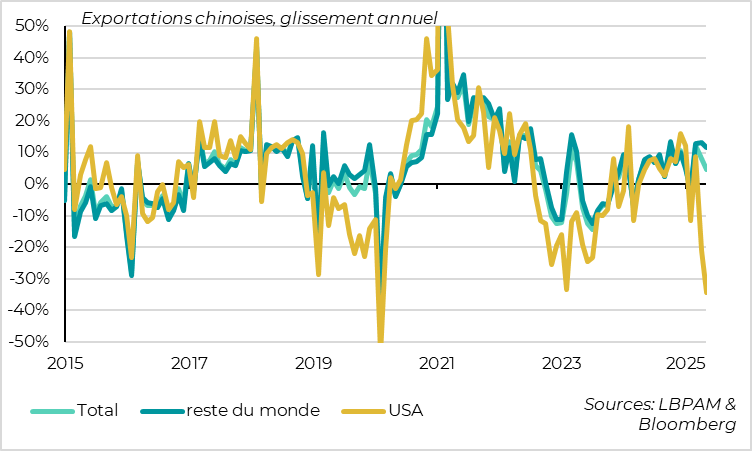

► At the same time, we learnt that Chinese exports remained resilient in May, with falling exports to the USA offset by buoyant exports to other Asian countries and Europe. Combined with the fall in imports, this indicates that foreign trade continues to drive the Chinese economy in the first half of the year, despite the trade war.

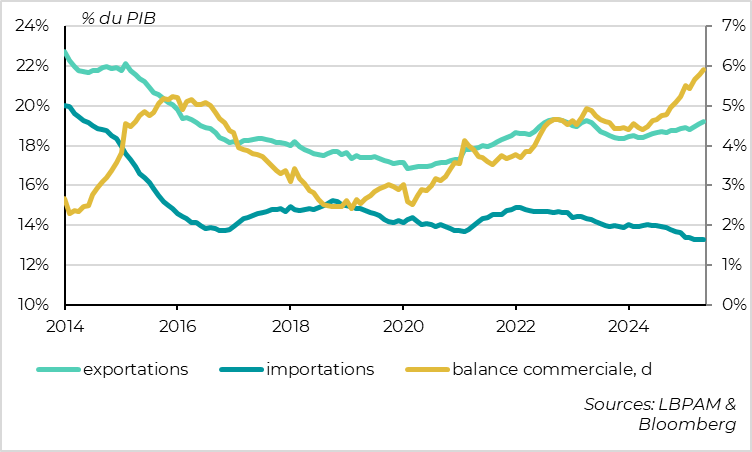

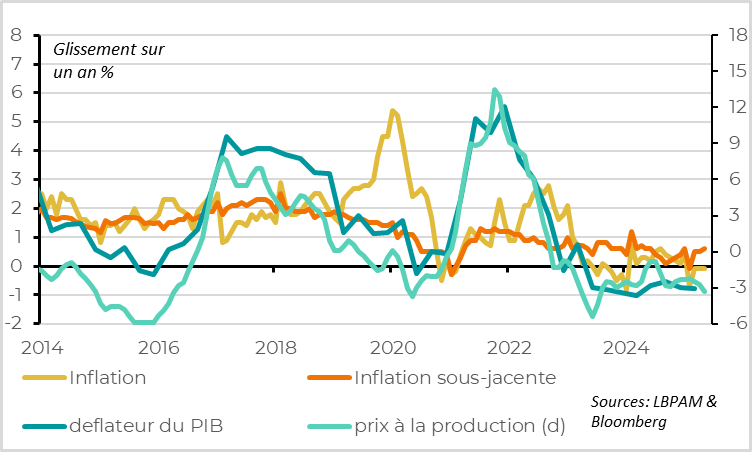

►On the other hand, the fall in Chinese imports and the prolongation of deflationary pressures indicate that domestic demand remains weak, despite the support already provided by the authorities. With foreign trade likely to be much less buoyant for China in the second half of the year, the authorities will have to do more to avoid an abrupt slowdown from the summer onwards.

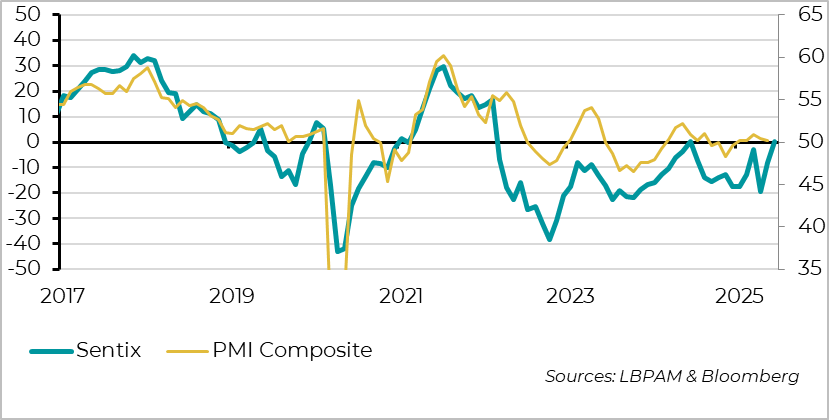

►In the Eurozone, investor confidence rebounded for the second month running in June, according to Sentix, and is even in positive territory for the first time in a year. While these investor surveys should be taken with a grain of salt, they point to resilient activity in Q2, following strong growth in Q1. This is in line with our scenario (and that of the ECB) of a delayed but unchallenged recovery for Europe this year.

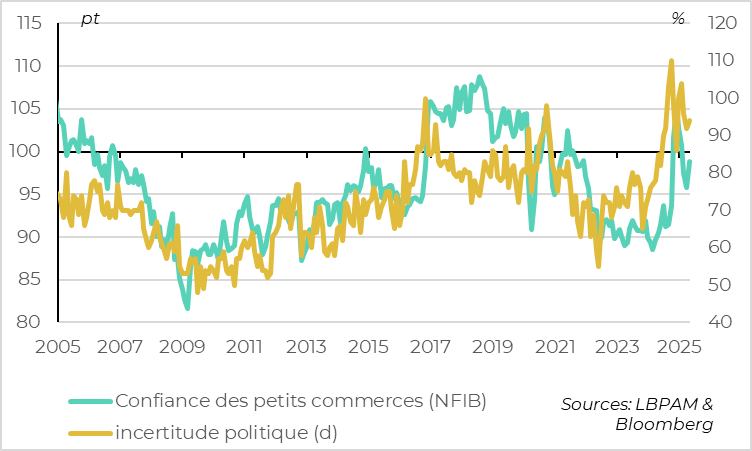

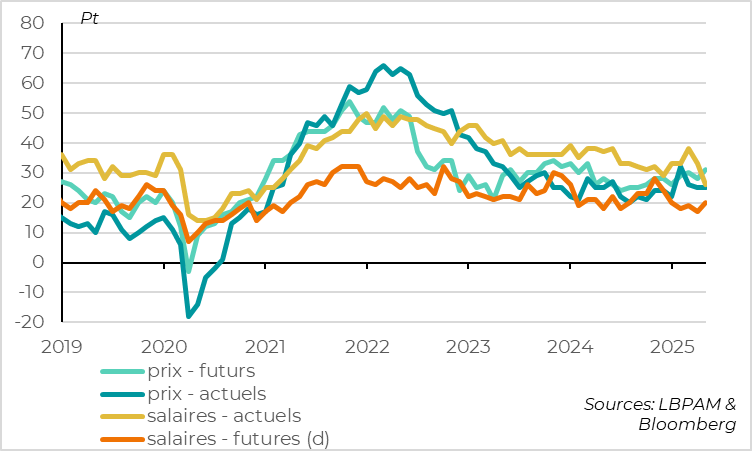

► In the USA, small business confidence (NFIB) also recovered in May after four sharp declines, albeit to a limited extent due to continuing high political uncertainty. Probably the most important finding from this survey is that SMEs are indicating that they will raise prices, but that wages are continuing to slow as the job market slows, reducing the risk of persistent inflation beyond the price shock.

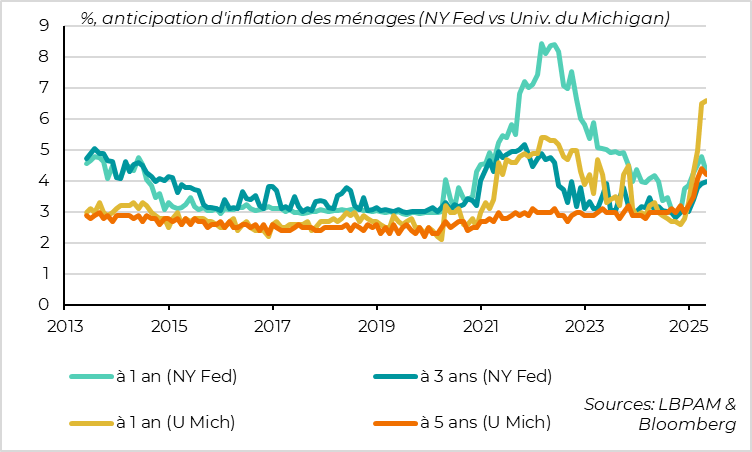

►This is also suggested by the (still partial) decline in household inflation expectations in the NY Fed survey. Firmly anchoring these expectations is vital if the Fed is to look beyond the rise in inflation in the second half of the year and maintain the prospect of resuming rate cuts in the longer term.

►Today's US inflation figures are the last major data point before next week's Fed meeting. It should show the first tangible signs of the impact of tariff hikes on goods prices, although inflation should only accelerate more clearly from the summer onwards. In any case, the resilience of last Friday's jobs reports will push the Fed into a wait-and-see stance on rates for the time being. We continue to believe that the Fed will wait for signs of a clearer slowdown in the jobs market and the end of rising inflation before resuming limited rate cuts, which could happen towards the end of the year.

To Go Further

China: exports to the United States hold up despite slump

Chinese exports slow, but still resilient in Q2. In May, Chinese exports rose by 4.8% year-on-year in dollar terms, marking a clear slowdown on April's +8.1%, but still a high level despite the extremely high US tariffs still in place at the beginning of the month. In fact, exports to the USA are falling, by more than a third year-on-year. But this fall was offset by the dynamism of exports to the rest of the world, which rose by over 10% again in May. Exports to ASEAN countries were particularly dynamic, probably reflecting indirect exports to the USA via third Asian countries, but also to Europe, suggesting that part of China's supply is finding new buyers in other developed countries.

China: imports fall and trade surplus rises again in Q2

At the same time, Chinese imports fell by 3.4%, so that China's trade surplus continues to grow.

The upside for China is that foreign trade should continue to drive growth in Q2, after contributing 40% of growth in Q1 and 30% last year. This should keep growth above the 5% target in H1 despite the trade war, although it may be more difficult to rely on this growth engine in the second half of the year.

On the downside, the weakness of imports indicates that domestic demand remains weak, despite measures taken by the authorities to stabilize real estate and support consumption. More fiscal support from the authorities will therefore be needed in the second half of the year to prevent an abrupt slowdown in growth.

China: deflationary pressures persist

The weakness of Chinese domestic demand relative to production is also reflected in prices. Consumer prices remain negative (-0.1% in May), while producer prices are slowing again to -3.3%. The GDP deflator is therefore likely to remain negative in Q2, as it has been for the past 2 years, increasing the debt burden and reinforcing domestic recessionary pressures.

Euro zone: investor confidence positive in June

European investors became slightly optimistic again in June for the first time in a year, according to the Sentix survey. The Sentix for the Eurozone rebounded for the second month running, moving slightly back into positive territory in June. This reflects a renewed optimism in the outlook, thanks to the truce on tariffs and hopes of fiscal easing particularly in Germany, but also a slight improvement in the current state of the economy from degraded levels.

It's hardly surprising that investors are more confident after the market rebound of the last two months, and we'll be waiting for the business and household surveys to give us a more concrete idea of the state of the Eurozone's real economy in June.

But the Sentix rebound is stronger than expected, and this survey has been a good leading indicator of PMI trend changes since the Covid. As the PMI finally held up above 50pt in May, this reduces the risk of Eurozone activity contracting in Q2 after its 0.6% growth in Q1. This is in line with our scenario, which calls for a delayed, but not jeopardized, recovery in the Eurozone over the course of the year.

United States: SME confidence stabilizes despite extreme uncertainty

In the US, small business confidence (NFIB) also recovered in May after four sharp declines since the start of the year.

But while confidence is close to its historical average, this is still a fairly low level for the start of a Republican presidency. Above all, SMEs report that political uncertainty remains stable at a very high level in May, due to uncertainty over tariffs as well as fiscal policy (taxes have moved back ahead of inflation as the top issue cited for the past 3 months).

Overall, US companies are not in panic mode, as evidenced by the limited number of layoffs, but they are in a wait-and-see mode, as evidenced by the weakness of hiring plans.

United States: prices are set to rise but wages continue to slow down

Nearly 1/3 of small retailers say they intend to increase their prices in the coming months, compared with the usual 20%. This is consistent with the expected acceleration in goods inflation in the second half of the year due to tariffs, but remains well below the shock of 2021-2023.

Above all, in contrast to the post-Covid inflationary shock, SMEs indicate that wages are continuing to slow as the labor market gradually weakens. This suggests a temporary rather than persistent rise in inflation due to tariffs.

United States: household inflation expectations ease slightly in May

The best news for the Fed is the fall in long-term household inflation expectations in May, although these are still too high for the Fed to be completely reassured.

The NY Fed survey, which had indicated a more limited rise in household inflation expectations than the 2021-2022 survey and this year's University of Michigan survey, confirms that these expectations stabilized or even declined slightly in May.

This is crucial if the Fed is to look beyond the mechanical rise in inflation in the second half of the year, without having to raise rates in the short term, and if it is to start cutting rates when the job market shows signs of weakening, even though inflation will by then be well above target.

It's too early for the Fed to resume rate cuts, when inflation has yet to accelerate and the job market is still holding up well. But at least it shouldn't close the door on possible rate cuts between now and the end of the year. We continue to believe that the job market should slow more markedly from the summer onwards, and that inflation will peak in Q4, which could pave the way for slight rate cuts in late 2025/early 2026.

Xavier Chapard

Strategist