Confidence recovers slightly, but uncertainties remain high

Link

Market Update for May 28, 2025: Insights from Xavier Chapard.

Key Takeaways

► Risky assets remain highly sensitive to long rates this week. They rallied a little at the start of the week as long yields eased, helped by rumors that the Japanese authorities could, as the British authorities have already done, reduce the maturity of their debt issues. Japanese 30-year yields fell by almost 20bp yesterday, and US 30-year yields fell back below 5%. But a somewhat difficult Japanese bond issue this morning is putting the tension back on.

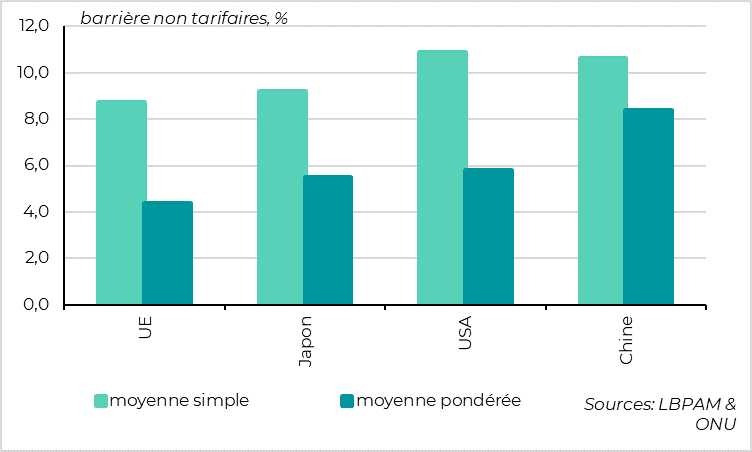

► The adjustment of issuance programs does not resolve budgetary fears, which could remain high as the US Senate could further increase the deficit provided for in the budget bill passed by the House, which is already above 6% of GDP for next year. At the same time, trade negotiations between the EU and the US are accelerating, but remain complicated after President Trump's threat over the weekend to raise tariffs to 50% at the end of the suspension of reciprocal tariffs (i.e. July 9, after having threatened to raise them as early as June 1). While the threat does not seem credible, the outcome remains uncertain. All the more so as the American government says that the Europeans are not acting in “good faith”, while putting forward spurious arguments, for example concerning non-tariff barriers, which are in reality at least as high for entering the American market as they are for entering the European market.

►Uncertainty therefore remains very high, which should encourage continued high volatility on the markets and limit directional convictions. In this context, risk diversification and a high degree of flexibility to benefit from volatility seem to us to be the wisest positioning.

►All the more so as economic data remains difficult to read, and it will probably be several months before we can accurately judge the impact of the political shocks of recent months on the real economy. That said, it's reassuring to know that, for the time being, these data are holding up better than feared.

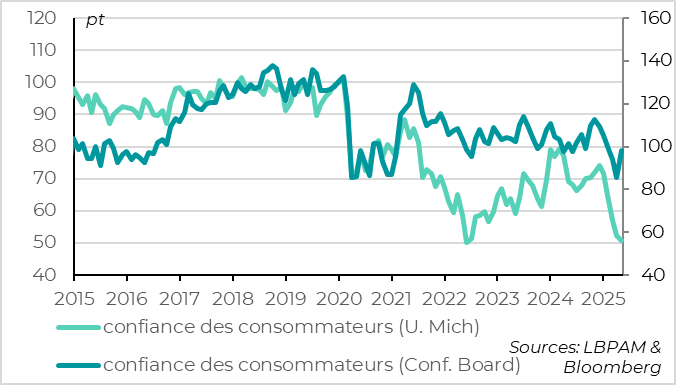

► US household confidence rebounded strongly in May according to the Conference Board survey, although half of it was conducted before the de-escalation between the US and China. That said, it remains lower than at the start of the year, and households are still indicating that the labor market is slowing, albeit gradually.

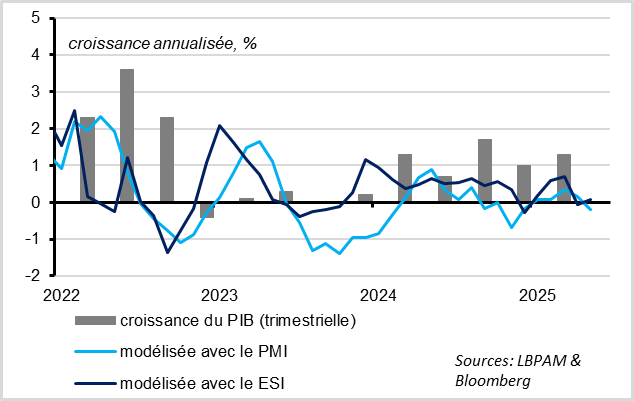

►For the Eurozone, the European Commission's Economic Sentiment indicator is more reassuring than the PMI in May, as it picks up slightly and remains consistent with a stagnation of activity in Q2 (whereas the PMI has moved into the contraction zone). This is more in line with our scenario of a postponed but not cancelled recovery, at least if US tariffs don't increase too much.

► Inflation in France, the leading country in the Eurozone, has published its figures for May, slowing more sharply than expected, from 0.9% to 0.6%. This slowdown was mainly due to a decline in inflation in services, which had rebounded in April. This tends to confirm that the upward surprise in European inflation in April was due to a temporary Easter effect. If this is the case, inflation should also surprise on the downside in the other countries and in the zone as a whole, which should finally convince the ECB that it can cut rates again in June.

To Go Further

Non-tariff barriers: at least as high in the USA as in the EU

The American authorities say that the European proposals in the trade negotiations are not “bona fide”. Yet it's the Americans' arguments that seem more than dubious, which could be overlooked given how much they're hammered home.

Firstly, the Americans' complaint about the goods trade deficit with the EU overlooks the fact that the relationship is in fact virtually balanced if we take into account the US surplus on services. Secondly, bilateral tariffs were broadly equivalent (less than 1% higher for US exports to the EU than for EU exports to the US), and the Europeans are proposing to reduce them reciprocally. In this context, it is difficult to accept that the US has already unilaterally imposed a 10% tariff increase on European goods.

Even the Americans' complaint about the non-tariff barriers that the Europeans impose with their regulations, standards, phytosanitary rules... does not hold up in practice. In fact, these barriers, which reduce access for foreign goods due to domestic rules, are at least as high in the USA as in Europe or Japan. At least, this is what the UN estimates in its studies aimed at estimating the equivalent in terms of customs duties of these barriers.

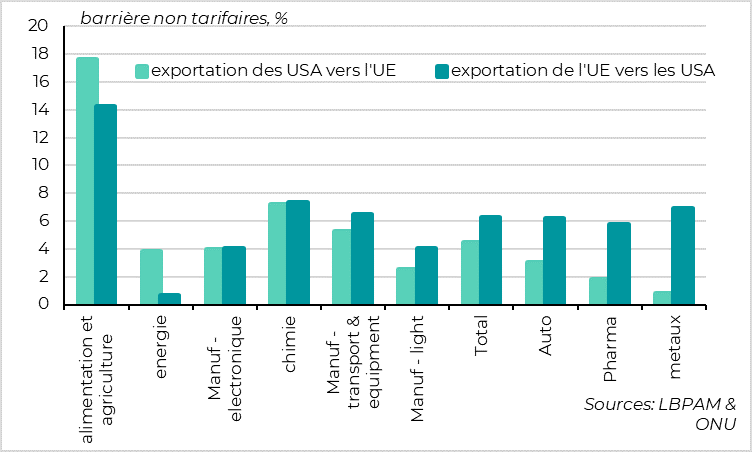

Non-tariff barriers: the EU limits more agricultural imports, but not everything else

It's true that the EU imposes higher barriers than the US on agricultural, food and energy products. These are often the examples cited by the US administration. But for all other types of goods, the UN estimates that non-tariff barriers are higher in the US than in Europe, even for automobiles and pharmaceuticals.

In total, these import-restricting barriers would be equivalent to tariffs of 4.4% for US exports to the EU and 6.2% for European exports to the USA.

Once again, checking scientific data is an interesting (but time-consuming) way of countering the US administration's rhetoric. That said, relying on economic science is probably useless for advancing negotiations with the US, and that's the problem for the Europeans.

United States: consumer confidence rebounds sharply in May

US consumer confidence rebounded sharply in May according to the Conference Board survey, rising 12.3 points to 98.0. This rebound follows 5 consecutive declines, and leaves the confidence level just below its long-term average and its level of recent years. But it cancels out April's sharp drop, which is more reassuring than the preliminary University of Michigan survey, which was still falling in early May.

What's more, the survey does not fully take into account the latest good news for households, as half the responses were collected before the announcement of de-escalation with China and before the larger-than-expected tax cuts proposed by the House of Representatives. We can therefore expect a further rebound in confidence over the coming weeks.

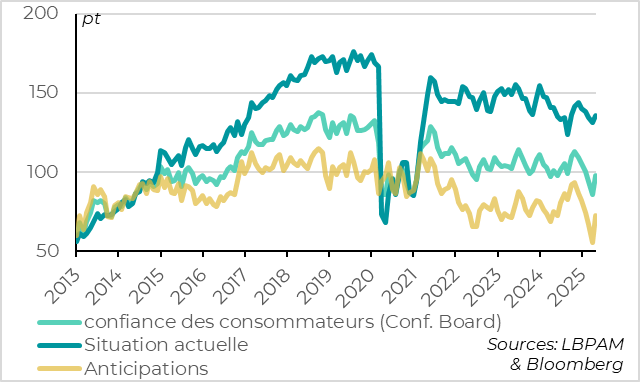

United States: households slightly less pessimistic about the future than in April

That said, the rebound in confidence stems mainly from the improvement in household prospects, in particular the slight easing in short-term inflation expectations following the US administration's initial setbacks. But this outlook is volatile, and remains below the threshold that historically indicates a high risk of recession (at 72.8pt vs. 80pt).

The current household situation indicator, a less volatile and more reliable gauge of the US economic situation, also increased in May, but to a more limited extent, and still points to a gradual slowdown in the economy.

United States: but households still point to a gradual slowdown in employment

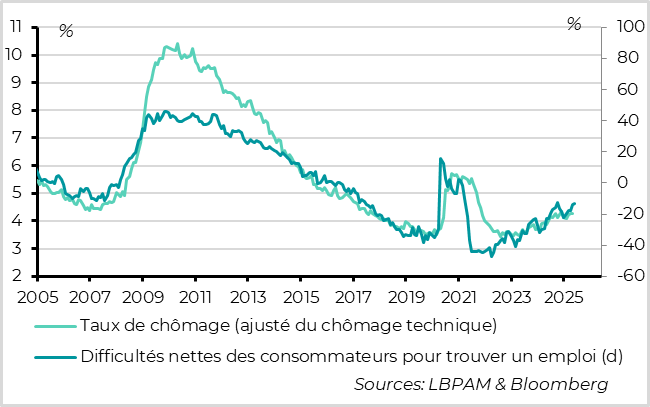

In particular, households indicate that the job market is slowing down in May, although this is far from a collapse. Indeed, the gap between the number of households indicating that jobs are plentiful versus hard to find continues to fall slightly in May, and is approaching its low point of last summer, when job creation slowed sharply. This labor market indicator is consistent with a slight rise in the unemployment rate over the coming months to a still low level of around 4.5%.

Eurozone: economic sentiment indicator stabilizes in May, while PMI does not

The European Commission's economic sentiment indicator rose slightly in May, from 93.8 to 94.8, after two sharp declines in March and April.This is more reassuring than the preliminary PMI published last week, which fell below 50pt. That said, the Commission's indicator remains below its long-term average. All in all, the May surveys suggest that activity is stagnating but not declining in Q2.

In country terms, the Commission's indicator confirms the weakness of economic conditions in France, since it is the lowest since the end of 2024 (at 93.1pt). By contrast, economic sentiment in Germany continues to pick up, unlike the PMI, returning to a one-year high even though it remains at a low level (91.5pt). Finally, economic sentiment remains solid in the southern countries, still above its historical average.

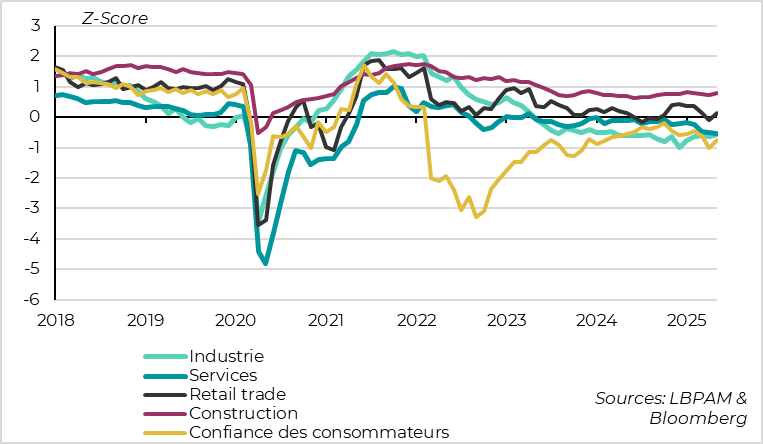

Eurozone: sentiment improves in all non-service sectors

In terms of sectors, the commission's survey confirms the continued gradual recovery of the industrial sector, which has been depressed since the 2022 energy shock. The services sector did slow down in Q2, but unlike the PMI, this has been gradual over the past two months. Finally, consumer confidence and that of the construction and trade sectors, which are not covered by the PMI surveys, rebounded slightly in May, cancelling out last month's decline.

Xavier Chapard

Strategist