Consumer resilience remains key to the U.S. economy.

Link

Key takeaways from the september 16 , 2025 market update insights from Sebastian Paris Horvitz

Overview

► As feared, Fitch has decided to downgrade France’s sovereign debt rating by one notch, from AA- to A+. The decision is based on several factors. First and foremost, the level of public debt, which, according to the agency’s projections, will rise to 121% of GDP by 2027, compared to 113% in 2024. This reflects a very slow reduction in the public deficit, which Fitch expects to remain around 5%. The agency also believes that the current political fragmentation is unlikely to allow for a more ambitious and sustainable fiscal consolidation. With relatively low potential growth (1.1%) and the highest tax burden in the EU, Fitch argues that further fiscal tightening becomes increasingly difficult.

► Overall, the pressure is high on the new Prime Minister to quickly find a path toward a 2026 adjustment budget that can secure a majority in the National Assembly. Given the current uncertainty, we remain cautious on French sovereign debt.

► In the United States, the Federal Reserve is expected to announce a 25 basis point rate cut this Wednesday, after a 9-month pause. In our view, this cut is unlikely to be larger and does not necessarily signal the start of a new rapid easing cycle. While the Fed is expected to respond to the deterioration in the labor market, it must also consider that inflation is once again drifting away from the 2% target.

We believe another rate cut may occur by the end of the year. However, a faster pace of easing would require a more significant rise in unemployment and a clearer decline in inflationary pressures.

►The sharp drop in job creation since April and the rise in the unemployment rate to 4.3%—still relatively low—could indicate a more pronounced downturn in the U.S. economic cycle.

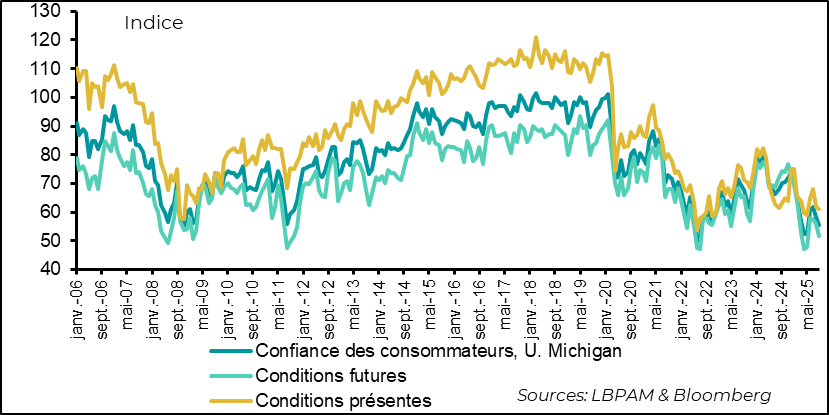

Indeed, the University of Michigan’s preliminary consumer sentiment survey for September shows growing concerns about the job market. Confidence fell in June to 55, the lowest level since the beginning of the year, following the sharp drop in April triggered by the announcement of steep tariff hikes. At the same time, household inflation expectations have risen again. These elements highlight the dilemma the Fed will face in the coming months.

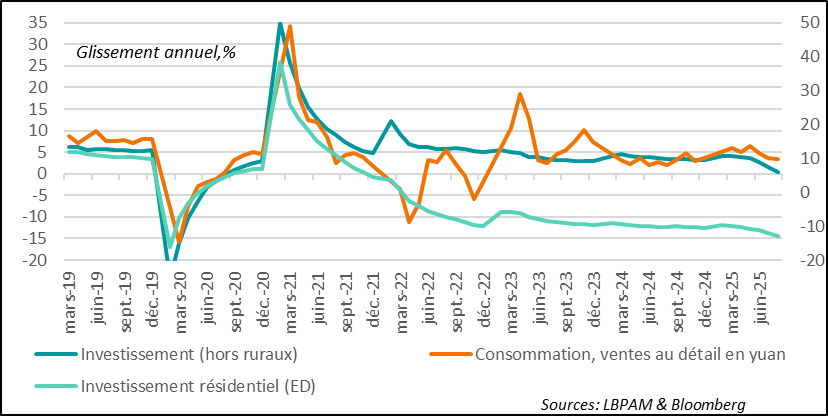

► In China, August data on domestic demand dynamics showed signs of weakening.

Home sales continued to collapse, at a much faster pace than expected, as did residential investment. Meanwhile, both consumer spending (via retail sales) and overall investment grew much more slowly than anticipated. These disappointing figures are likely to push authorities to step up economic support measures in the coming quarters—especially if exports weaken significantly due to U.S. tariffs.

In-Depth insights

United States: The American consumer may weaken

Consumer confidence deteriorated in September

In the second quarter, consumer spending picked up slightly, and the July figures were rather reassuring.

However, the data continues to send mixed signals regarding consumer appetite. For instance, the preliminary September survey on consumer confidence from the University of Michigan shows a deterioration in sentiment. Confidence is once again approaching the lowest point of the year, reached last April following President Trump’s announcement of reciprocal tariffs.

Whether in terms of current conditions or future expectations, the indices are declining and now sit well below their long-term average.

According to the survey, one of the factors weighing on household morale is concern about the labor market outlook. The perceived probability of losing one’s job within the next five years has returned to its highest level of the year, and remains historically elevated.

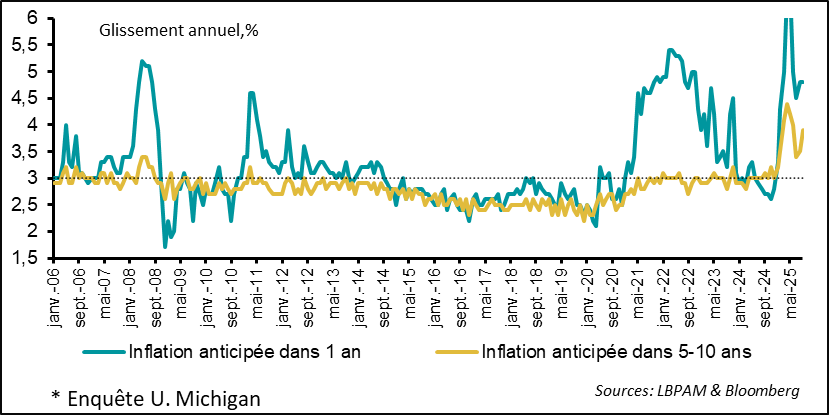

Inflation expectations are rising again and remain high

Moreover, perceptions regarding inflation dynamics remain negative.

Both 1-year and 5–10-year inflation expectations are rising again and remain at very elevated levels.

At the same time, caution is still warranted with these statistics, as they tend to be volatile and could change by the end of the month when the final survey results are published.

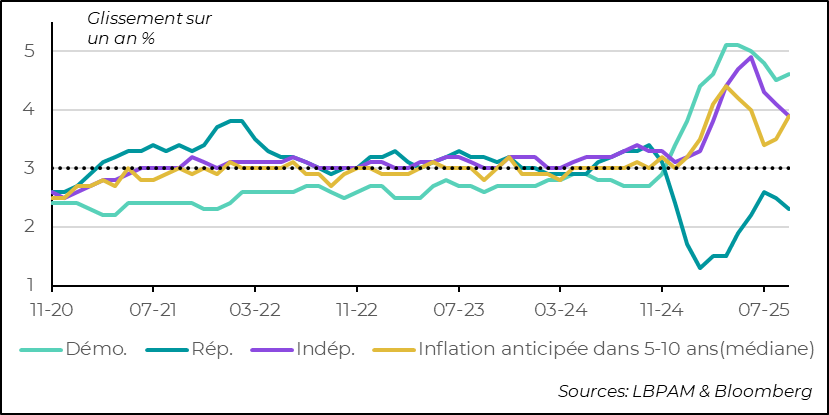

Political polarization remains historically high in these economic surveys

One of the most disruptive phenomena in these surveys is the political divide reflected in the responses.

For example, regarding inflation, respondents aligned with the Democratic Party express strong concern about price developments, while those with Republican leanings hold an opposing view. Both perspectives appear exaggerated.

A potentially more balanced view of inflation risk may come from independent respondents. Their expectations were slightly more moderate in September, but still very elevated, with 5–10-year inflation expectations at 3.9%, which remains historically high.

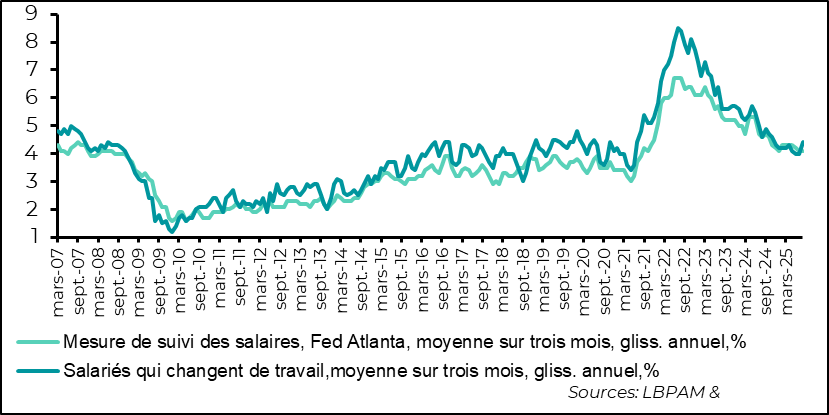

Wage growth is no longer slowing down

While inflation could erode household purchasing power, it is therefore important to also monitor wage trends in the economy.

According to calculations by the Federal Reserve Bank of Atlanta, wages in August maintained the same pace of growth as the previous month, at 4.1% year-over-year. This means wages are still rising faster than prices.

Moreover, wage growth among individuals who voluntarily change jobs—a metric often used as a proxy for labor market tightness—picked up again, reaching 4.4%.

This could indicate that, while the labor market is loosening overall, it remains tight in certain segments.

Such data would also be a signal of caution for the Fed, suggesting it should avoid moving too quickly in easing its monetary policy.

China: Disappointing economic data

Domestic demand weakened in August

In particular, residential investment and home sales continued to decline sharply. Residential investment fell by 12.9% year-over-year, comparing the first eight months of the year—a drop not seen since 2020. This clearly shows that the sector, once a key driver of China’s domestic growth, is still undergoing a deep correction.

On the expansion side, investment outside the rural sector barely grew, rising just 0.5% compared to the same period last year. Consumption, measured by retail sales, also slowed, increasing by only 3.4% year-over-year in August.

Overall, these figures suggest that China is struggling to regain solid growth momentum.

We’ll see what the upcoming export data reveals, especially with U.S. tariffs in place. Any significant weakening in the export sector—which has so far been the main engine of growth—would likely force authorities to seek new sources of domestic demand stimulus.

Such support is likely crucial to sustaining momentum in Chinese equities. For now, we remain cautious on the Chinese market, after benefiting from its strong rally since spring.

Sebastian PARIS HORVITZ

Director of Research