Consumer spending still seems to be driving US growth

Link

-

During the Republican convention, D. Trump and J.D. Vance were officially nominated to be the presidential and vice-presidential candidates respectively. The past month has been a buoyant one for the ex-president, who is now polling as the favorite for the November 5 presidential election. As we all know, the markets view this “ticket” as highly favorable, particularly in terms of taxation and regulation. This has undoubtedly been one of the factors behind the strong performance of the US stock market in recent days.

-

Nevertheless, it is expectations of Fed action that continue to drive much of the market. Indeed, J. Powell's comments yesterday on his greater confidence that inflation would converge towards 2%, following June's inflation figures, helped boost bets on future rate cuts. Today, more than two rate cuts are expected between now and the end of the year. We are maintaining our forecast of two rate cuts, starting in September.

-

Nevertheless, in the debate on the inflation trajectory, the IMF, in updating its economic forecasts, has highlighted the risk, particularly in developed countries, of a slower-than-expected deceleration in inflation. This could mean keeping policy rates higher for longer, to ensure that inflation converges towards targets. At the same time, the Bank maintains its forecast of resilient economic growth, with a gradual recovery in the Eurozone in particular.

-

In the United States, retail sales for the month of June came in stronger than expected, indicating a strong rebound from May. Consumption thus remains the driving force behind US growth. This casts doubt on the stronger deceleration in growth that seemed to be in the offing. As a result, the Fed, while having gained confidence in the disinflation process, will also have to take account of this resilience in consumption. At the same time, homebuilder sentiment has weakened again. The strength of consumption could moderate the willingness to start monetary easing too quickly.

-

In the Eurozone, the political situation in France remains a concern. The current government has been asked to manage current affairs, in order to maintain continuity in the functioning of the state. But, in the absence of the appointment of a new prime minister and a government capable of governing, uncertainty over the conduct of economic policy remains. This should have an impact on economic statistics, but the extent of this is difficult to determine. For example, the ZEW survey of German market operators showed a weakening outlook, but sentiment on the current situation is becoming less negative.

-

The ECB's bank survey for 2Q24 shows that credit conditions are still difficult, but they clearly seem to be improving in key segments. Indeed, if we consider, for example, the anticipated trend in corporate credit demand, we could finally find ourselves in expansionary territory as early as next quarter, and join household demand for home loans, which continues to pick up. In addition, overall lending conditions are less tight. These developments are essential elements in the gradual recovery in economic growth that we anticipate.

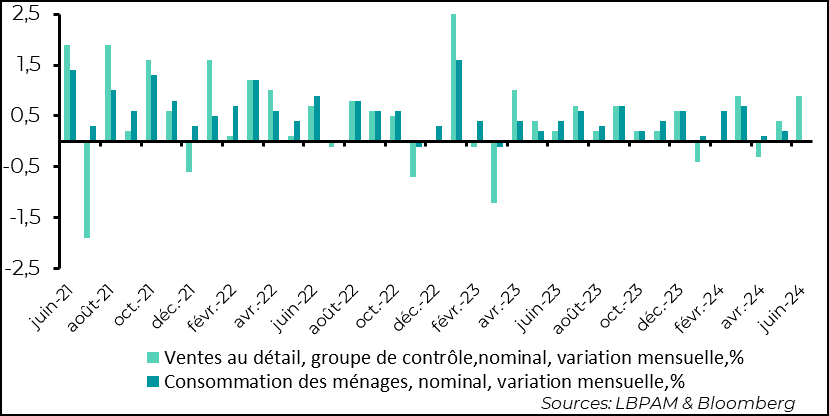

Across the Atlantic, retail sales were much stronger than expected in June. They rebounded strongly from May, which had already shown a better performance than the previous month. This clearly undermines the idea of a marked slowdown in demand that seemed to be looming for 2Q24.

In fact, consumer spending appears to remain one of the key drivers of the US economy's expansion.

Admittedly, retail sales give us an indication of goods consumption above all, but here they show that consumer appetite remains high. This rise in goods consumption also reflects the resumption of price moderation, with energy prices falling over the last two months, giving households purchasing power.

Thus, in real terms, consumption of goods seems to have grown strongly over the last two months, with an increase of close to 0.9% in June, given that inflation on goods was close to 0. This should boost consumption's contribution to GDP growth in 2Q24. We shall nevertheless see at the end of next week, with the estimate of total consumption, whether there was any arbitrage between goods and services during the month, which could reduce the overall rise in consumption over the quarter.

Fig 1 United States: Retail sales stronger than expected in June

- Retail sales, control group, nominal, monthly variation, %

- Household consumption, nominal, monthly variation, %.

At this stage, the robustness of this consumption figure should moderate the Fed's fears of a sharper-than-expected deceleration in demand, due in particular to a weakening job market. In this sense, monetary authorities can be more patient before acting.

We still believe that a rate cut in September is the most likely scenario, but of course economic statistics between now and the next meeting of the Economic Policy Committee at the end of the month could still prompt the Fed to act more quickly.

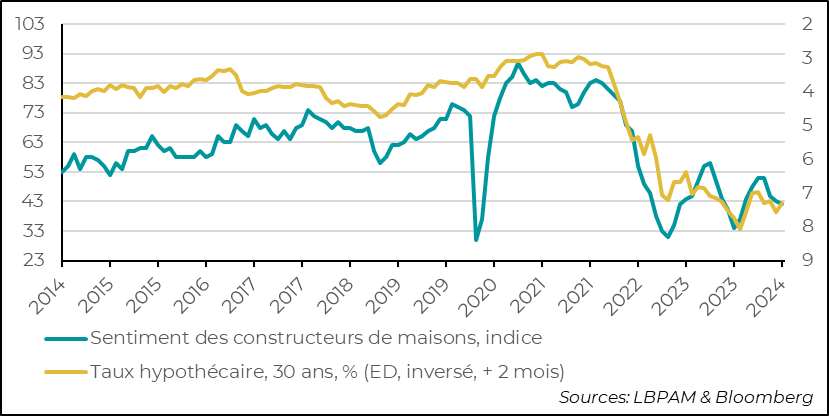

While consumer spending seems to be holding up better than expected, the real estate sector continues on a path of moderation. Indeed, the July Home Builders' Survey (NAHB) showed that sentiment among professionals continued to deteriorate. This partly reflects the upward correction we've seen in mortgage rates since the start of the year.

However, the recent fall in mortgage rates, combined with expectations of further Fed rate cuts, could breathe new life into the sector if the downward trend in financing costs continues.

Fig.2 United States: Homebuilder sentiment (NAHB survey) shows further deterioration in July as mortgage rates rise

- Homebuilder sentiment, index

- Mortgage rate, 30 years, % (ED, inverted, +2 months)

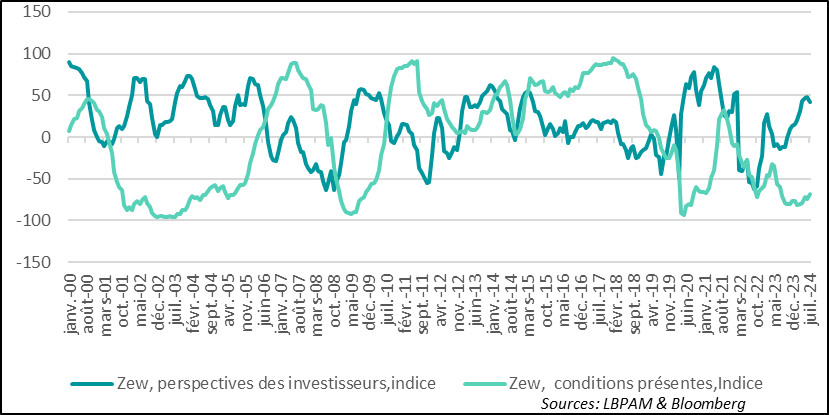

In the Eurozone, the political situation seems to have had a negative impact on economic sentiment, particularly with the uncertainty surrounding France's economic policy trajectory, which is still without a stable government. However, it is still difficult to assess the extent of this impact.

The survey of German market operators (ZEW) gives a mixed picture for July. Indeed, while we see sentiment on the outlook dipping a little, sentiment on the present situation continues to improve, moving away from the historically low points we saw last March. In this sense, optimistically, one might think that the feeling of uncertainty is fading a little.

Nevertheless, we must remain cautious in the face of a situation that is still uncertain. At the same time, the gradual loosening of the monetary policy straitjacket should, in our view, continue to support the zone's economic recovery.

Fig.3 Germany: German market sentiment (ZEW) gives a mixed message, partly affected by the political situation

- Zew, investor outlook, index

- Zew, present conditions, index

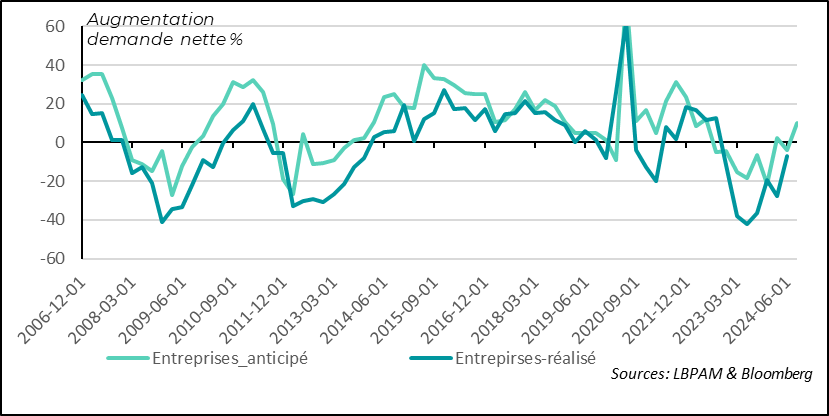

In this sense, the latest ECB survey of banks gave a rather reassuring message, even if, as the report indicates, current conditions on the bank lending market still show an unflattering situation. In particular, the commercial real estate lending sector continues to experience difficulties.

Nevertheless, the survey gives a rather optimistic message about the future, particularly as far as businesses are concerned. Indeed, although credit demand continued to contract in 2Q24, the outlook continued to improve, with growth expected to pick up next quarter.

Given the European economy's dependence on bank credit, this is a key factor in the Zone's continued gradual economic recovery.

Fig.4 Euro zone: Business credit demand could return to positive territory as early as next quarter

- Anticipated companies

- Companies-realized

At the same time, bank lending conditions are easing further, which also bodes well for the future.

Fig.5 Euro zone: Banks tighten lending conditions less

- Anticipated companies

- Companies-realized

On the household side, we can see that demand for home loans continues to pick up, with 2Q24 clearly in expansion territory.

The expected easing of monetary policy should continue to stimulate demand, with long-term interest rates gradually continuing to fall.

Fig.6 Euro zone: Home loan demand continues to recover

- Anticipated real estate (next 3 months)

- Real estate

As for businesses, bank lending conditions continue to ease, in marked contrast to the last two years.

This trend is helping to bolster our view that the zone's recovery is set to continue, even if there are still areas of weakness in the economy as a whole, notably in industry, which is still struggling to find its way back onto the path of sustainable expansion.

Fig.7 Eurozone: mortgage conditions become more favorable

- Anticipated real estate (next 3 months)

- Real estate