D. Trump's inauguration postpones uncertainties, but doesn't cancel them out

Link

Read Xavier Chapard's market analysis for January 22, 2025.

Summary

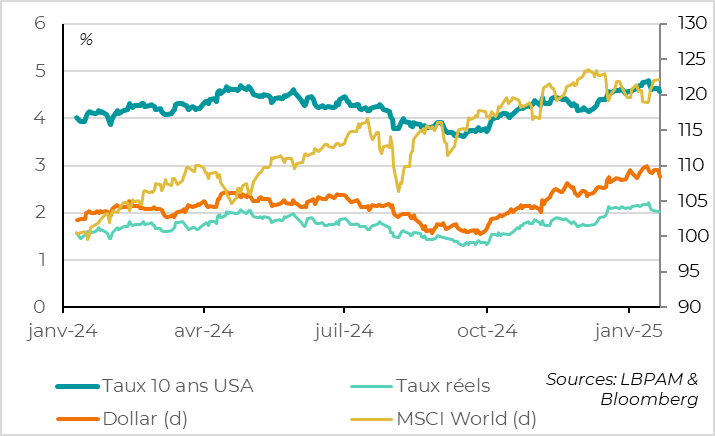

►The absence of big surprises, immediate tariff hikes and the rather measured tone on China at D. Trump's inauguration gave the markets some relief. The dollar and long yields have retreated slightly since the start of the week, returning to their levels of the beginning of the year, which has taken some pressure off equity markets, which are stable overall.

►That said, uncertainty about the next administration's economic policies remains high, and the threat of a trade war persists for the USA's various partners, even if it has been slightly delayed (to early April?).

►All in all, the inauguration has not significantly altered our central scenario, which incorporates US policies that are (1) targeted and moderate in terms of protectionism, (2) significant in terms of reducing immigration but without massive deportation, and (3) only slightly expansive in fiscal terms. Against this backdrop, we still believe that long yields have some downside potential, particularly in the Eurozone, and that risky assets should remain well oriented in trend.

►But we remain convinced that it will be necessary to adjust our scenario and be very nimble in our asset management in order to adapt to the turbulence that will most likely be caused by the decisions of the new US administration.

►On Europe, Trump has only indicated that it needs to buy more American oil and gas if it wants to avoid tariffs. This allows us to focus on the economy for the time being.

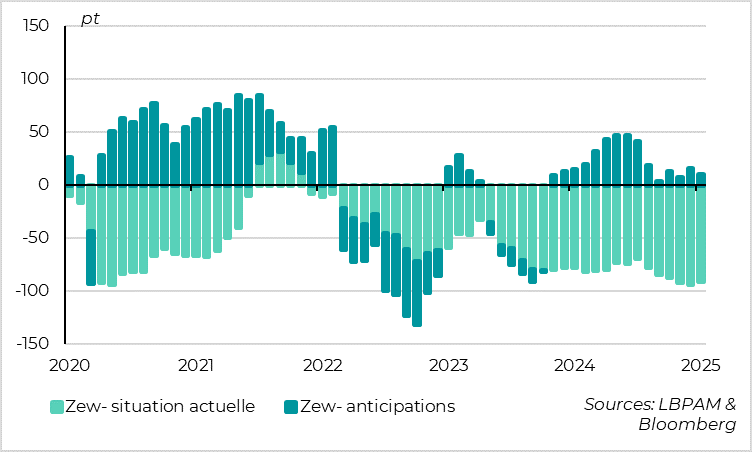

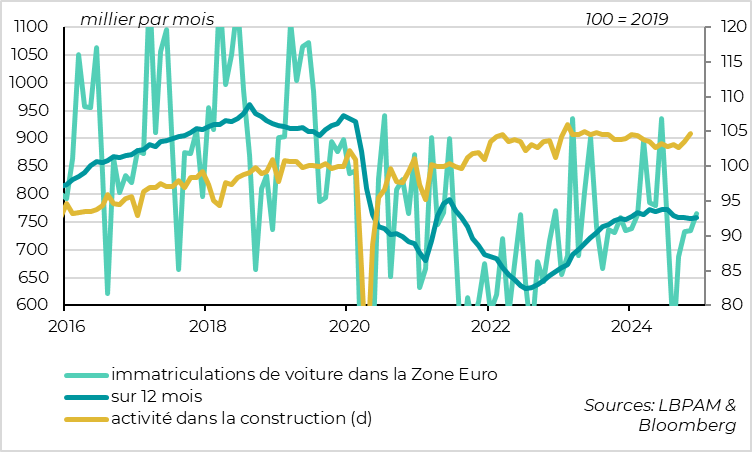

►For the Eurozone, the first survey for 2025, the ZEW, shows that confidence remains very low ahead of the German elections in February. That said, some cyclical and interest-rate-sensitive sectors seem to be starting to stabilize in late 2024, following the ECB's first rate cuts. For example, car sales stabilized in Q4 and construction activity picked up a little. This is in line with our scenario, which predicts a slight recovery in the eurozone during 2025, despite weak confidence and political risks, thanks to further ECB rate cuts.

►In the UK, the latest labor market data still point to stagflationary conditions, with a clear weakening in job creation but persistent wage pressures. This should prompt the central bank to continue its very cautious rate-cutting cycle (-25bp per quarter, with the next rate cut in February). Against this backdrop, we prefer short-dated UK debt and remain cautious on the pound.

To go deeper

Markets: slight deflation in the dollar premium and US interest rates following the inauguration

On his 1st day in office, Trump maintains the threat of higher tariffs, but announces no immediate decisions.

Trump still says he favors the concept of a tariff on all imports, but when asked if he would impose a tariff hike on all countries, he replied, “Maybe, but we're not ready to do that yet.”

Meanwhile, the new White House team has issued an official statement entitled “America's Trade Policy First”, tasking different parts of the government with reviewing trade, investment and export control policies with a view to reporting back by April 1.

On China, Trump's tone was a little more accommodating than expected, suggesting that he wishes to negotiate rather than sanction China in the short term. He did not announce any new tariffs on Day 1, and spoke of raising tariffs by 10% on Tuesday versus the 60% indicated during the campaign. On the other hand, he recalled that he had already imposed significant tariffs during his first term and that he had constructive exchanges with President Xi. Finally, he gave TikTok an additional 75 days to find American investors. But at the same time, the official White House statement shows that the US administration is clearly considering additional tariffs on Chinese imports, because the agreement signed in 2020 (“1st Phase”) is not being respected and the Chinese trade surplus remains as massive as ever.

Trump's comments on Mexico and Canada were harsher than expected, and than the official memo, probably to force these countries to renegotiate their trade agreement as early as 2025. Trump clearly threatened to impose 25% tariffs on their exports as early as the beginning of February. That said, he had made the same threats in his first term without implementing them, following the renegotiation of NAFTA. And the official White House memo makes no mention of tariffs for these two countries. Instead, the memo asks the Commerce Department to make recommendations by April on U.S. participation in the NAFTA agreement. It seems that Trump wants to bring forward the review of the agreement scheduled for mid-2026, as he did during his first term.

On other economic subjects, the first executive orders were mainly concerned with immigration and energy, with no surprises (the intention to sharply reduce immigration from Mexico and to favor drilling). There was little discussion of budgetary issues, apart from a few spending cuts such as a temporary freeze on federal hiring.

Overall, our central scenario remains unchanged, with the assumption that significant additional tariffs will be imposed during 2025 on Chinese imports and on certain targeted imports from other countries (including Europe and Mexico), but not as high or as widespread as Trump announced during the campaign (especially outside China). After Day 1 of Trump's term, the risk relative to our scenario decreases a little for China and increases for Mexico and Canada, but this is not enough to alter our central scenario. If we were wrong on this point, it would be very negative for the United States (which is highly integrated with its neighbors), but less negative for the rest of the world.

What is certain is that the uncertainty will persist, with announcements possible at any time and in any case between now and April 1, the deadline set for the various parts of the government to submit the conclusion of their investigations and their proposal for modifying tariffs.

Germany: investor confidence still very low in early 2025

German investors' confidence in the economy remains very low at the start of 2025, according to the ZEW survey. The indicator for the current state of the economy improved for the first time in 6 months, but remains close to historic lows. Above all, the indicator for growth expectations is only slightly positive, dropping in January from 16 to 10pt.

While this investor survey should be taken with caution (compared with business surveys such as PMI and IFO), it clearly does not suggest that Germany is on the verge of a return to growth. In particular, it's disappointing that confidence remains so low at a time when European equity markets have been rising sharply since December, which usually boosts investor confidence.

That said, this survey surely exaggerates Europe's torpor. Indeed, it is probably affected by the wait-and-see attitude ahead of next month's elections in Germany, as the weakness in confidence is centered on domestic sectors in Germany (services), whereas ZEW expectations for the rest of Europe are a little less deteriorated (at 18pt).

Euro zone: construction and car sales on an upward trend at the end of 2024

While confidence in the Eurozone remains very low, not everything is negative. For example, two sectors that were very negatively affected by the ECB's monetary tightening seem to be starting to stabilize at the end of 2024:

- Car sales rose by 3.6% year-on-year in December, the first increase in 6 months. This allows car sales to stabilize over 2024 (+0.5%) and end the year on a better footing.

- Construction activity rose by 1.2% in November after 0.8% in October, so that Q4 is now up 1.2% on Q3. This would be the strongest growth since early 2023, and suggests that real estate investment may be stabilizing after taking 0.2pt of growth away from the Eurozone last year.

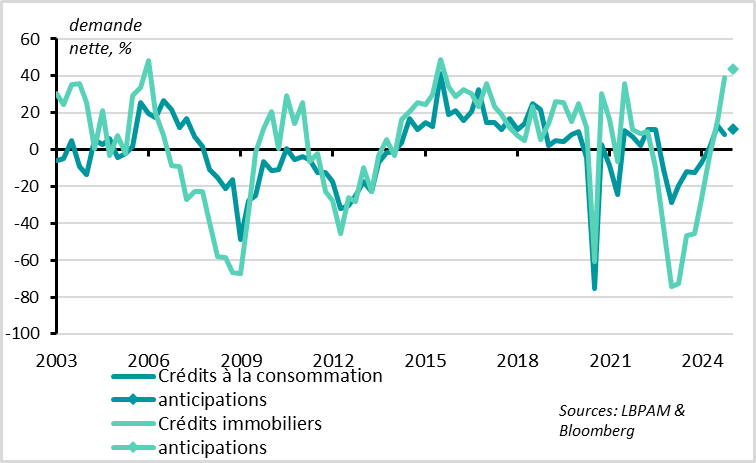

Eurozone: bank lending conditions for households improve significantly

This is consistent with the improvement in household credit conditions reported by banks since early 2024. With further rate cuts by the ECB, these cyclical sectors should return to growth in 2025, which is one of the reasons why we anticipate a slight recovery in the eurozone during 2025, despite weak confidence and political risks.

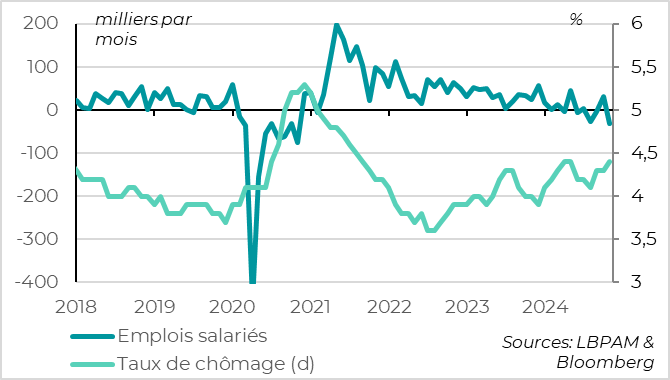

United Kingdom: the job market slows down fairly sharply at the end of 2024

In the UK, the latest labor market data still point to stagflationary conditions, which should prompt the central bank to continue its cautious rate-cutting cycle (-25bp per quarter, with the next one in February). Against this backdrop, we prefer short-dated UK debt and remain cautious on the pound.

On the activity front, the job market is slowing down quite markedly at the end of 2024, even if it is not collapsing, in line with the stagnation of the economy in the second half of last year.

Job creation is slowing and the unemployment rate rises to 4.4% in November, its highest post-Covid level, although this remains consistent with an economy close to full employment. As a result, the vacancy-to-unemployment ratio has fallen back below its pre-Covid level and is close to its historical average.

Moreover, salaried employment fell in Q4, after stagnating in Q3, and this decline accelerated slightly in December (-47 thousand). That said, jobless claims fell slightly in Q4 and were stable in December, suggesting that the deterioration in the job market remains gradual.

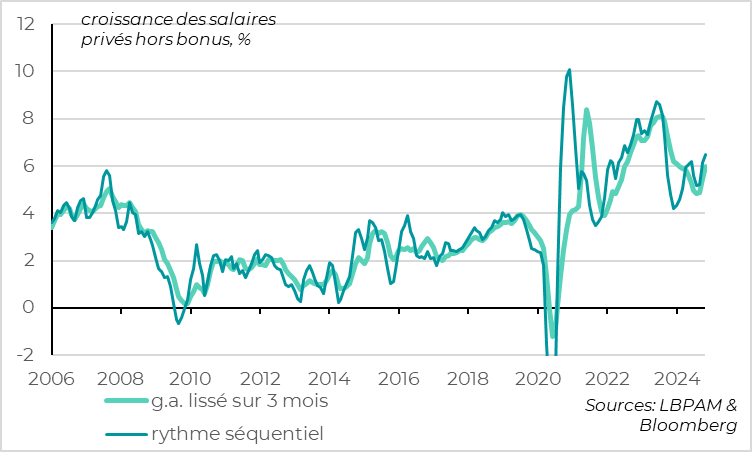

United Kingdom: wage pressures not yet abating strongly

Xavier Chapard

Strategist