D. Trump's policies continue to weaken U.S. assets

Link

Find the market analysis for March 19, 2025, signed by Sebastian PARIS HORVITZ

What to remember

►Despite President Trump's incantations of a brighter economic future for the United States, or Treasury Secretary S. Bessent's repeated attempts to reassure on the economic objectives pursued, markets remain dubious if not worried. US stock market indices are struggling to rebound, and the dollar continues to weaken. While the gamble was to see the implementation of pro-business policies bolster growth, the paradox would be to lead a hitherto very solid US economy into a marked weakening. Economic statistics since the start of the year point to a fairly marked slowdown in activity.

►Nevertheless, at this stage, the risk of recession is low. The economy remains robust, thanks in particular to an unemployment rate still close to historic lows. The strength of employment is still protecting consumption. But we still don't know what the final impact of the protectionist measures put in place will be. An excessively inflationary effect would put consumption at great risk, at a time when confidence is deteriorating. As a result, uncertainty remains high, affecting investors.

►The continuing resilience of the US economy was reflected in the construction statistics for February and March. Although building permit applications fell, as did homebuilder sentiment (NAHB), there was no sign of a collapse. However, these data point to weak activity in the short term. In particular, the deterioration in homebuilder sentiment seems to stem from fears about rising prices for the raw materials needed for construction.

►For the Fed, as J. Powell has already pointed out, the economy remains robust. But we'll have to analyze today's decision: what tone will the central bankers adopt on the uncertainties weighing on the outlook? In our view, the message of patience should continue to dominate.

►D. Trump also appears to be heading for a showdown with the judiciary. Indeed, certain court rulings blocking decrees issued by the president are not being respected. The president even called for the impeachment of a judge who had questioned the legality of the deportation of suspected criminals from the country, ordered by the White House. The impeachment of this judge led to a statement by J. Roberts, Chief Justice of the Supreme Court, criticizing the President's remarks. A rare occurrence.

►In Europe, as expected, the historic program of capital and military spending, together with the reform of budgetary rules, was approved by the Bundestag, with 513 votes in favor out of a total of 733. The draft must now be approved by the upper house, the Bundesrat, this Friday, where all 16 federal states are represented. It should be approved before the new parliament is sworn in next week.

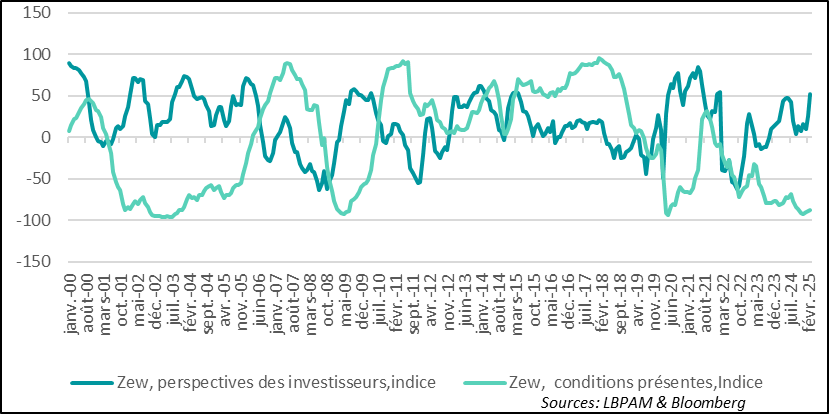

►The optimism generated by this historic change in the German government's capital spending, particularly on the military, was reflected in a strong rebound in the ZEW investor survey, with the outlook indicator returning to its highest level since early 2022. Nevertheless, investors remain pessimistic about current conditions.

To go further

In just two months of his presidency, it's undeniable that D. Trump has implemented policies that aren't exactly pro-business. Apart from the almost total reversal of policies aimed at the energy transition, in other words a boon for the fossil fuel production sector, it's hard to see any initiatives that would stimulate investment and growth. On the contrary, through essentially protectionist measures, Trump has created a situation where uncertainty reigns.

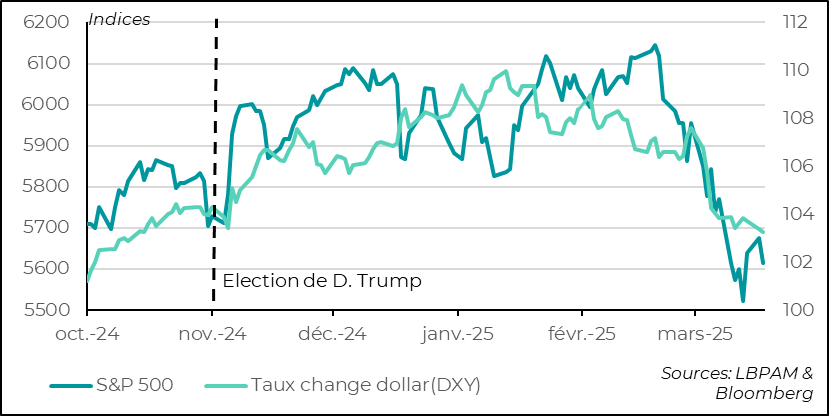

This is reflected in the market's mistrust of US assets. All the more so as US stock valuations are and remain relatively high. As a result, the US stock market has continued to underperform since the start of the year. The S&P 500 has lost over 8% since the first days of D. Trump taking office.

We could attribute the decline to a “simple” correction, as S. Bessent, Secretary of the Treasury, but it is the sharp rise in uncertainty and the possible impact of political measures on growth that investors fear.

The dollar's decline is one of the gauges of this fear about the US economic outlook. While the dollar could have risen mechanically as a result of protectionist measures, it has continued to fall.

United States: US equities fall, as does the dollar, in the face of uncertainty

All other things being equal, this fall in the dollar could exacerbate the inflationary impact of the protectionist policies in place, and further complicate the Fed's work.

Today, the central bankers' analysis of the latest economic developments and their implications for monetary policy will be rich in lessons. The Fed is likely to emphasize once again the robustness of the economy; the central bank should therefore remain patient, before pursuing the monetary easing it has begun.

The market will focus on the Fed's message on growth prospects. Some investors would already like to hear a possible message of support from the monetary authorities, should the economy falter too quickly. At this stage, however, J. Powell and the other members of the Monetary Policy Committee are unlikely to give very convincing signs in this direction. So, no real “Fed put” to support the markets for the time being.

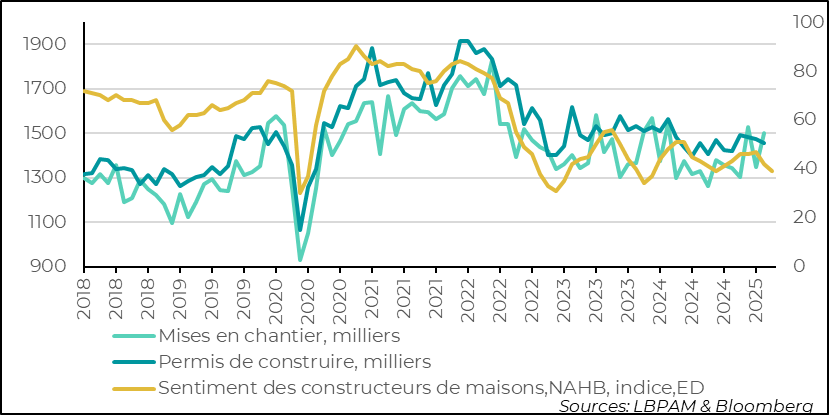

On the economic front, the salvo of data on the construction sector across the Atlantic points to a deteriorating outlook. Housing starts rebounded fairly sharply in February, but this was largely due to the sharp drop in activity in January, caused by very poor weather conditions. Nonetheless, building permit applications fell slightly again over the month, which generally indicates a downturn in construction activity in the future. At the same time, there is no collapse at this stage.

The message from homebuilders is similar. The survey by the homebuilders' association, NAHB, continued to decline in March, and continues to show a historically poor picture of confidence in the sector.

United States: construction sector remains relatively stable, but prospects seem to be deteriorating at the start of the year

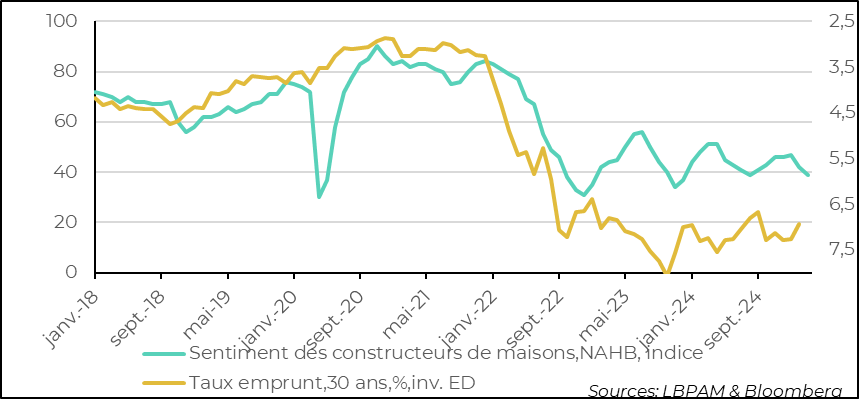

Nevertheless, for builders, this deterioration in the outlook seems to have more to do with fears of protectionist measures, with the possible increase in the cost of raw materials needed for construction. Indeed, construction activity is currently benefiting from relatively lower interest rates than 1 year ago, even if they remain high.

United States: lower interest rates haven't really boosted confidence among manufacturers, worried about rising raw materials prices

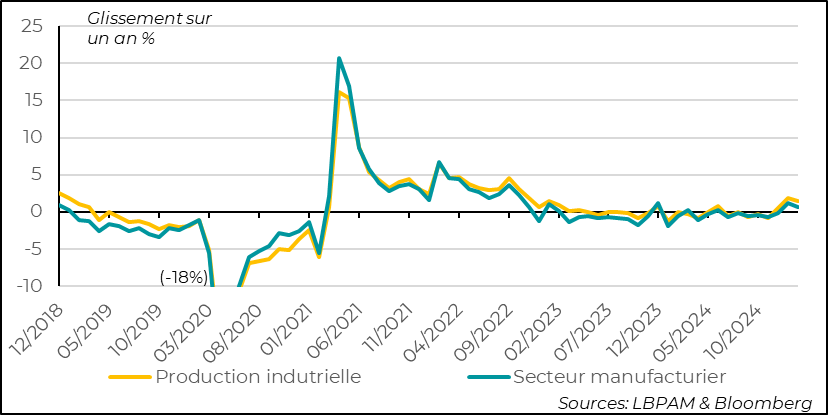

On the industrial side, we saw a further rise in activity in February (+0.7% over the month), well above expectations. This was largely driven by higher production in the manufacturing sector, particularly in the automotive sector. Production in this sector rose by 7.8% over the month!

February 2024 also saw a very strong rise in industrial production, which explains why year-on-year activity has slowed at the start of the year.

Industry seems to continue to benefit from more favorable winds than in the last two years. The PMI and ISM surveys to come will show whether the outlook remains good, after all the announcements concerning tariff hikes.

United States: industry continued to hold up well in February with a sharp rise in production, particularly in manufacturing

In Europe, the radical change in Germany's budgetary strategy has had a very positive impact on economic confidence. At this stage, these are essentially announcements. But even though the implementation of these pro-growth policies will be gradual, they should provide a new impetus to activity in the region.

This is the clear diagnosis of investors. Indeed, the ZEW survey of market participants in Germany saw the gauge measuring views on the outlook rise sharply in March. This is the index's biggest two-month rise since 2023, and the sub-index is back at its highest level for 3 years.

Of course, this sharp rise in outlook contrasts sharply with the current situation, which investors still regard as very poor. Over the coming month, we'll be watching to see whether this renewed confidence in the future is also reflected in business activity.

Germany: the historic change in fiscal policy has a strong impact on investor confidence

Sebastian PARIS HORVITZ

Head of research