D. Trump semble prendre de l’avance dans la dernière ligne droite

Link

Market Analysis for October 23, 2024 by Sebastian PARIS HORVITZ.

In summary

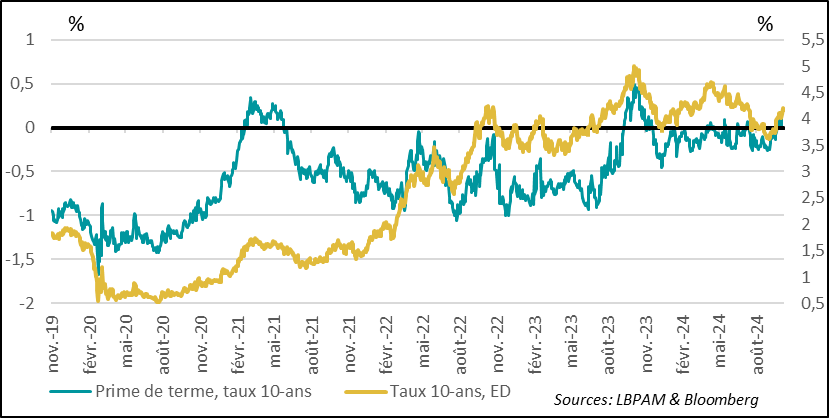

►Sovereign bonds continued to suffer at the start of the week. US 10-year bond yields have risen by over 60 basis points (bp) since mid-September. The same trend, albeit on a lesser scale, can be seen in Europe, with German 10-year yields up by almost 30bp since the end of September. This rise reflects, in part, an adjustment in expectations of key rate cuts. Indeed, they now seem more reasonable. At the same time, we feel that the surge in long rates has already gone far enough.

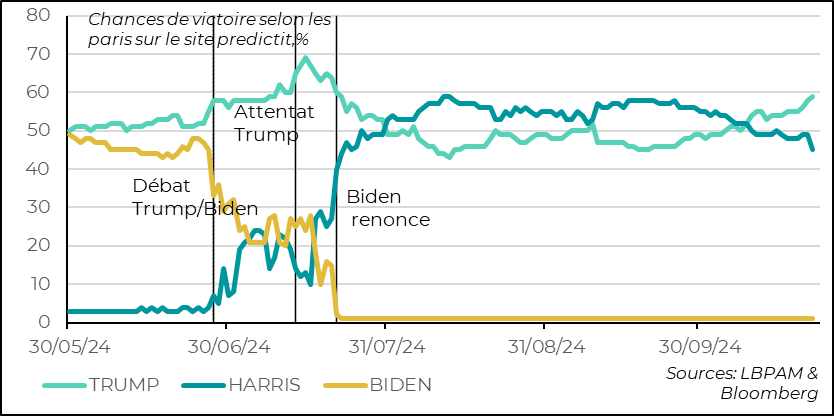

►Nevertheless, it is important to stress that this rise in long-term rates also seems to reflect a little more uncertainty regarding the trajectory of monetary policy and the evolution of the economy in the future. This is particularly true in the United States, with the term premium, which represents the “remuneration” demanded as compensation for the risk of holding a bond for a long period. This premium has returned to positive territory for the first time since autumn 2023. Another factor that seems to have contributed to this movement is D. Trump's renewed advantage over K. Harris in the presidential race, according to some polls and online betting.

►The more favorable dynamics of the US economy have been acknowledged in the IMF's latest forecasts, which have just been published. Indeed, it has been revised upwards by 0.2 points to 2.8% year-on-year in 2024, and to 2.2% in 2025. At the same time, unsurprisingly, it has been revised slightly downwards in the Eurozone to 0.8% in 2024 and 1.2% in 2025. These figures are fairly close to our own.

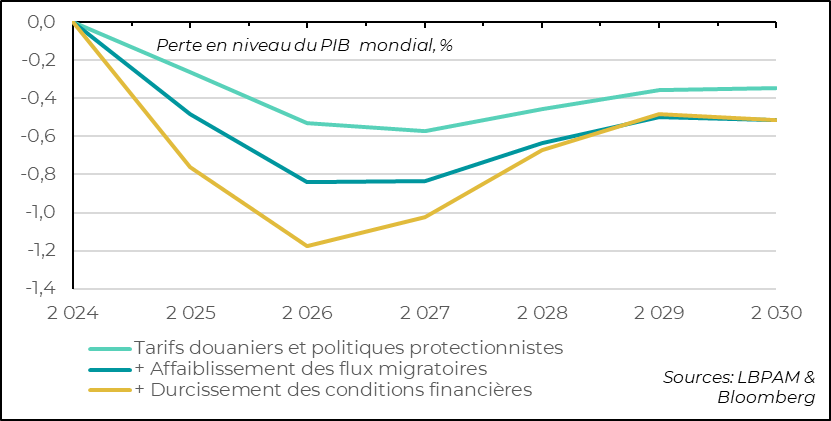

►At the same time, the IMF points to potential risks that could put the brakes on global economic expansion. Current geopolitical risks could translate into higher commodity prices, particularly energy prices, which would have a negative impact. However, the IMF report underlines one point in particular: according to their simulations, the implementation of trade constraints or migratory flows increasingly envisaged around the world, as well as a further tightening of financial conditions, could quite strongly affect global expansion.

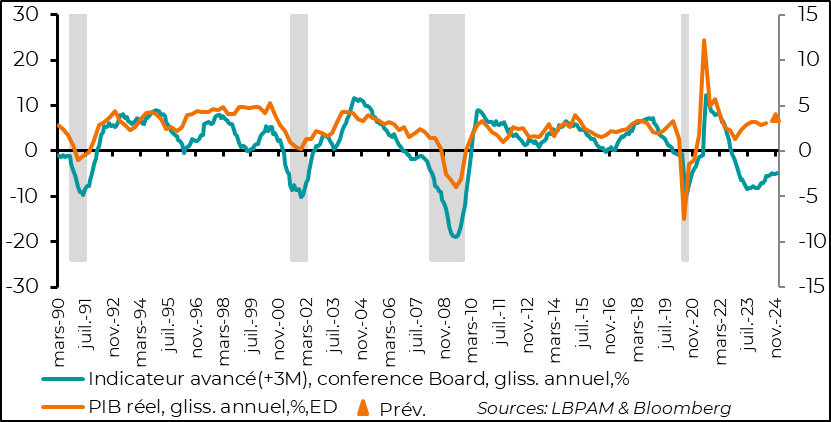

►On the economic front, the Conference Board's leading indicator for September was published earlier this week. While still depressed, it continues to rebound, suggesting that the recession signal is receding. However, it maintains a depressed trend for the US economy over the coming quarters. As we have already pointed out, many indicators which in the past have proved very useful in forecasting the economic cycle, have not given the right signals in recent years. This, in our view, demonstrates the specificity of this post-Covid cycle. In particular, the continuing depressed state of the industrial sector has not, as in the past, been a harbinger of the economy as a whole.

To go deeper

October saw a sharp rebound in long-term interest rates on sovereign debt on both sides of the Atlantic. However, it was in the United States that the rise was strongest. In fact, the 10-year Treasuries rate has risen by over 60 bp since mid-September.

This increase largely reflects the revision of the market's very aggressive expectations of a rate cut. This change has been fuelled by growing evidence of a much more resilient US economy and a slower-than-expected deceleration in inflation. In particular, the labor market remains relatively robust, and US households continue to underpin growth.

This has also led to a change in the Fed's message, after an aggressive start with a 50bp cut in key rates in September. Indeed, Fed Chairman J. Powell recently stressed that there was no need to rush into the path of rate cuts. Thus, today, the market is aligned on an expectation of 50bp of key rates by the end of the year, with zero probability of another 50bp cut at one of the two upcoming monetary policy meetings.

Nonetheless, one of the remarkable facts about the rise in long-term rates in the US was the revision of uncertainty regarding the evolution of the economy and the trajectory of monetary policy. Indeed, estimates of the term premium on ten-year rates largely explain the rise in rates. The term premium can be seen as the additional remuneration demanded by an investor to hold a bond for a long period.

United States: The rise in the term premium, which is once again in positive territory, largely explains the rise in long-term rates.

In addition to the more favorable economic statistics and the Fed's message, it would also seem that the more positive momentum for D. Trump in the election campaign in recent weeks has also fuelled this rise in the term premium, which is back in positive territory for the first time since autumn 2023.

As it happens, D. Trump's fairly aggressive rhetoric of late has paid off in an increasingly polarized US electorate. At the same time, K. Harris has lost considerable ground. This is particularly visible in online betting on the outcome of the election, with D. Trump now well ahead.

United States: D. Trump takes the lead in the presidential race according to online betting, but without regaining the high points after the attack on his person

In our opinion, this rise in the D. Trump “bet” is also quite present in the markets. We think that the rise in rates also reflects the possibility of Trump's election, with a mixture of the possibility of higher inflation and larger public deficits.

The D. Trump factor, in our view, has also helped to drive risk-taking across the Atlantic and support the dollar. In fact, the positives and negatives of a potential D. Trump victory for the market are pretty much priced in today. This should prompt a degree of caution. In particular, long rates may be close to a high point, which is starting to make sovereign bonds more attractive.

We also believe that, although the US economy is likely to slow over the coming quarters, and the somewhat overly favorable market positioning is a cautionary factor, growth should still remain relatively solid, providing a protective base for the riskiest assets as the year draws to a close.

The resilience of the US economy was one of the key considerations in the IMF's latest economic projections, published yesterday. Indeed, US growth was revised upwards for 2024 and 2025, to 2.8% and 2.2% respectively. At the same time, the current weakness of the Eurozone, unsurprisingly, has resulted in a downward revision of growth prospects, with GDP growth of 0.8% and 1.2% in 2024 and 2025 respectively, with the biggest revisions affecting Germany. China's growth has also been lowered to 4.8% for 2024.

The factors underpinning growth in developed countries are the same as those we have been highlighting, namely the improvement in household purchasing power, with rising real incomes, while financial conditions are improving with monetary easing.

However, the IMF is a little more optimistic than we are about disinflation, particularly in the USA.

In view of the economic policies put forward by D. Trump, but also in other parts of the world, the IMF report also warns of the negative impact that policies restricting the movement of goods, services and people could have.

Of course, the negative impact that geopolitical tensions and ongoing conflicts could have, particularly on commodity prices, is also highlighted.

Nevertheless, the IMF, in the face of proliferating protectionist rhetoric, shows, based on a number of measures proposed in many countries, what a negative impact these would have on global growth in the years ahead. So, despite today's favorable financial conditions, they could become less buoyant, including as a result of protectionist measures, and weigh on economic growth.

IMF: The institution highlights the negative impact on global growth of measures planned to restrict the movement of goods, services and people

While recent statistics have tended to suggest that the US economy remains solid, the Conference Board's leading indicator for September once again delivered a mixed, albeit still improving, message.

In fact, year-on-year, the indicator continued to forecast a moderation in growth over the coming quarters, albeit on a smaller scale than in the past.

Like other economic indicators, which in the past have provided a fairly reliable reading of the US cycle, it is clear that the Conference Board's indicator has failed to “read” the dynamics at work in the post-Covid period. In particular, the focus on the industrial cycle failed to capture the influence of services on growth resilience.

Nevertheless, despite a sluggish industrial sector, the indicator does seem to capture an improving outlook.

United States: The Conference Board's leading indicator continues to forecast a slowdown in the US economy, albeit on a more moderate scale

Sebastian PARIS HORVITZ

Head of Research