On the homestretch for heading off default

Link

- Negotiations continue on preventing a possible default by the United States on its public debt. Janet Yellen, Treasury Secretary, continues to sound the alert on the disastrous consequences that failure to raise the debt ceiling could have. As she noted, quick action is essential, probably by the start of June. There are no clear signs from negotiations between the White House and Republican members of Congress. The White House is trying to strike a reassuring tone, while Kevin McCarthy, the top Republican in the House of Representatives, reported yesterday that no real progress had been achieved.

- The assumption still held by all the markets, including by us, is that the Republicans and Democrats, which usually do end up raising the debt ceiling, and with an eye on the very negative economic repercussions of failing to do so, won’t take the risk of a default. Some are mulling the possibility of setting up the theoretical plan that had been thought up by the Treasury and the Fed in 2011 during a similar episode, if ever the worst was to occur. But this plan was never adopted and, most importantly, the economic consequences would still be very serious even though it could head off a technical default for some time until the ceiling was raised. But, in fact, although the debt problem can be kicked down the road – there is no miracle anti-default plan that doesn’t hit the economy and the markets very hard.

- With the fateful day approaching, the markets seem to be somewhat inured to the risks of a potential US default. But economic data continues to affect investor behaviour, and it is worth pointing out that economic statistics have become far less encouraging than they had been on the year to date. Whereas, early in the year, economic data came in better than expected, the reverse has been the case over the past few weeks. That doesn’t mean that the economy is worsening rapidly, but, in our view, it does mean that a downward adjustment is occurring. With this in mind, and barring an unexpected turn of events, such as a US default, we expect economic activity to remain weak in the coming quarters on both sides of the Atlantic, and we still forecast a contraction, albeit a moderate one, in 2H23 in the US, due to monetary tightening.

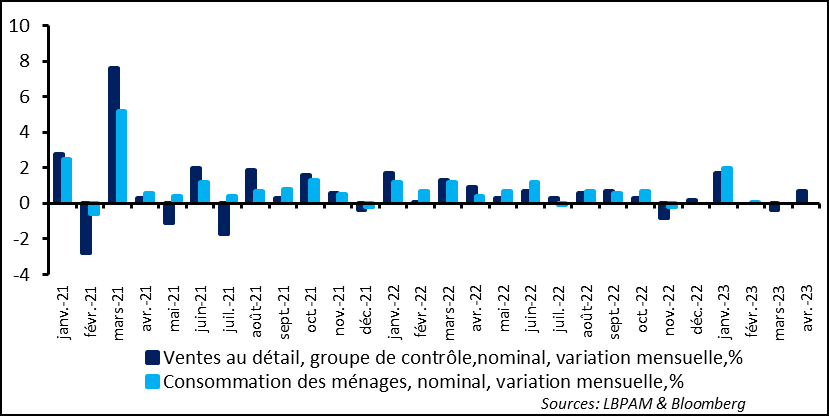

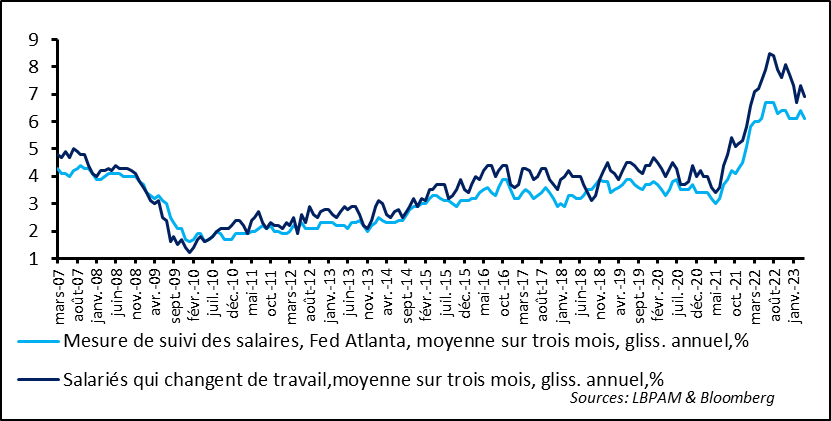

- For the moment, US consumption, which until now has been a pillar of economic growth, does seem to have slackened early in 2Q23 from its strong pace in 1Q23. Retail sales for April were slightly disappointing, although ,when stripping out car and gasoline sales, they still rose more strongly. In the group of products (excluding cars and gasoline sales in particular) that illustrates goods consumption, sales rose rather strongly, by 0.7% (in nominal terms) on the month. But this ignores a strong price effect, as goods inflation (excluding energy and food) came to 0.6% in April. As a result, growth of goods consumption of in real terms (excluding cars) should be relatively weak in April but still positive. As for growth in household incomes, based on the Atlanta Fed’s wage statistics for April, it dipped slightly, albeit still marginally (to 6.1% year-on-year vs. 6.4% year-on-year in March). This shows clearly that the job market remains tight and that current trends are inconsistent with inflation’s converging anytime soon towards 2%. Hence our unchanged forecast of monetary policy that should remain restrictive for some time to come – in contrast with the markets, which continue to price in aggressive key rate cuts by the start of 2024.

- In China, the latest statistics showing the strength of the recovery were somewhat disappointing. On the consumption side, retail sales (in value terms) were not as strong as expected (18.4% year-on-year, vs. 21.9% forecast). Forecasts of a stronger surge were due to the strong base effect, given that lockdowns were still in full swing one year ago. Investment was also less robust than expected, even though forecasts had been conservative in light of PMI indications of a very moderate recovery in manufacturing (4.7% vs. 5.7% forecast). The only good news was the stabilisation of the real-estate market, with housing sales up, while construction remains lacklustre. All in all, the Chinese recovery is well on track, driven by consumption, but the expansion is still very moderate in the economy as a whole.

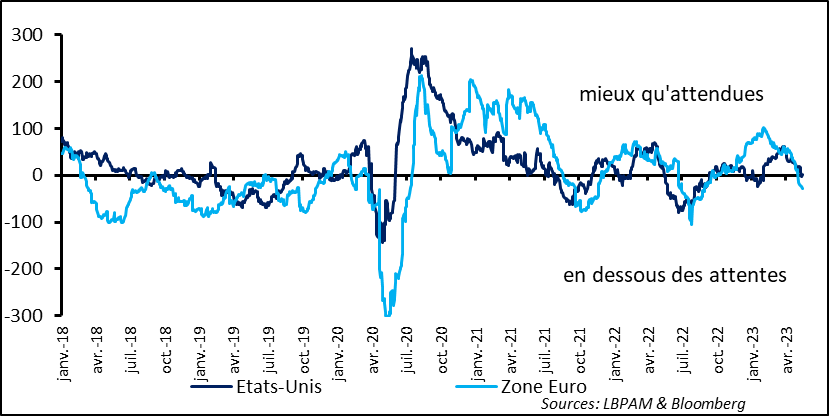

Economic data had surprised on the upside early this year, highlighting the resilience of economies, but they have disappointed over the past few weeks. Based on economic surprise indicators such as Citigroup’s, statistics have surprised less on the upside. In fact, there are no longer any significant positive surprises in the US, while the numbers have actually disappointed in the Eurozone.

Fig. 1 – Economic surprises : Disappointing statistics on both sides of the Atlantic, after a start of the year highlighted by good economic surprises

In our view, this trend is consistent with our projection of growth that should remain weak in 2H23, but without collapsing, barring an unexpected turn of events.

US retail sale figures for April painted a mixed picture. Total growth in retail sales on the month was not as strong as expected, at 0.4% vs. 0.8% forecast. One important factor seems to have been the steep drop in car prices, which lowered sales when expressed in dollars, despite rather robust volumes on the month. On the other hand, the statistic used to estimate total goods consumption (the control group, which excludes cars and gasoline, for example) rose more than expected, at 0.7% on the month, vs. 0.4% forecast. But, here again, this figure masks significant price effects. Goods inflation was strong in April, at 0.6%. So, in real terms this actually means a very moderate increase in goods consumption (excluding vehicles).

Fig. 2 – US : retail sales (control group) rebound, but inflation is masking a weak increase in real terms.

Wages continued to rise robustly in the US in April, albeit slightly more slowly than in the previous month. The Atlanta Fed’s statistics, which depict wage trends with fewer distortions than the survey of companies, show that wages rose by 6.1% year-on-year in April vs. 6,4% in March. This is obviously good news, but wage growth continues to decelerate very gradually. This is somewhat to be expected, given the robust job market, with the unemployment rate at just 3.4%.

Fig. 3 – US : An Atlanta Fed statistic shows that wages slowed only slightly in April.

These wage hikes are obviously good news for consumption, although inflation has eaten into the purchasing power of many categories of wage earners. We expect wage growth to slow only gradually and to come with more slack in the job market. We expect this to be more apparent in 2H23.

One thing that is certain is that the current trend in wages is inconsistent with inflation’s converging anytime soon towards 2%.

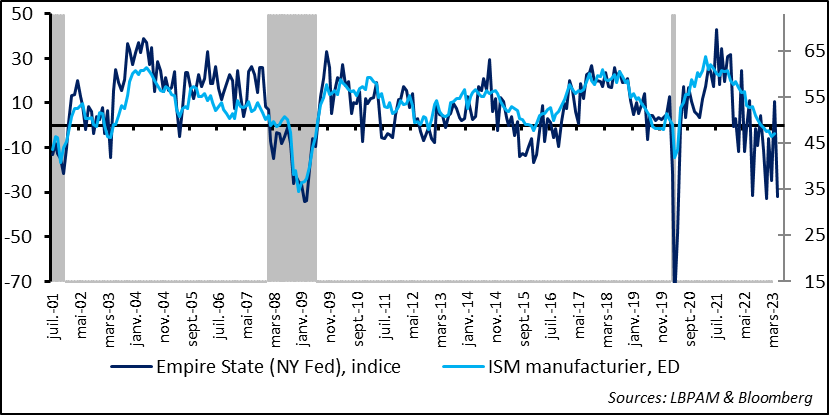

As we know, manufacturing remains weak worldwide. Manufacturing PMIs are in contraction territory in many countries. In the US, the regional Feds release separate measures to assess the state of manufacturing. The New York Fed survey painted a very negative picture of the state of regional manufacturing. This index, known as the Empire State Manufacturing Survey, was down very sharply for May.

This statistic has always been more volatile than the ISM, which describes the state of manufacturing throughout the US, but it has been especially volatile since the exit from Covid.

Even so, this weak figure does shows that manufacture could remain weak.

Fig. 4 – US : A very negative May New York Fed survey on the state of manufacturing output

Keep in mind that, in contrast with the negative figures from manufacturer surveys, the Fed’s manufacturing output figures for April provided a more optimistic reading of the current situation. Manufacturing output rebounded rather strongly in April (1% on the month). As we know, automobile production, for example, is still in a catching-up phase. Even so, output is still below its level of one year ago. We don’t expect this rebound to continue, based on our reading of leading indicators.

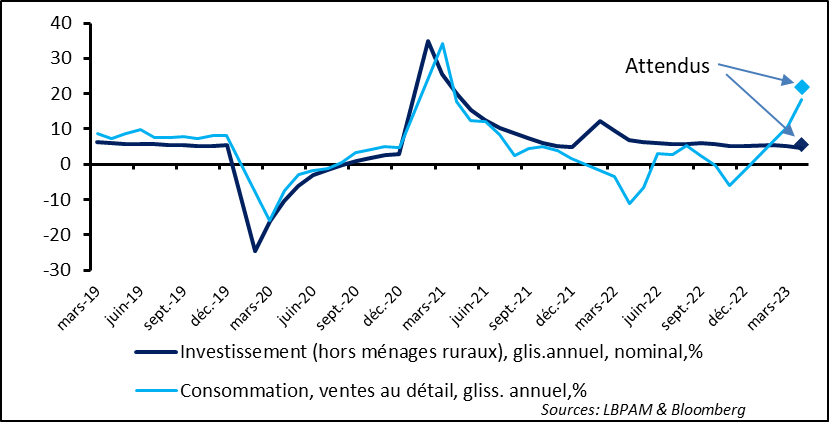

In China, the latest economic activity figures disappointed on the pace of the recovery. As expected, April retail sales showed that consumption continued to track the reopening of the economy, but they were nonetheless somewhat disappointing. Given the ground to be made up after the lockdown-caused steep drop of consumption one year ago, the 18.4% year-on-year rise (in nominal terms) was far below expectations (+21.9% forecast).

Likewise, investment is having a hard time taking off, with a 4.7% year-on-year increase. This is a clear illustration of the split between manufacturing activity and consumption. Consumption will continue to drive the recovery in 2023.

Fig. 5 – China : The recovery is on track but it is being driven mainly by consumption

The good news in the rebound of the Chinese economy is that the real-estate sector is stabilising. Housing sales are rising and housing prices with them. However, construction activity is returning only very slowly. This will continue to handicap the recovery for some time to come.

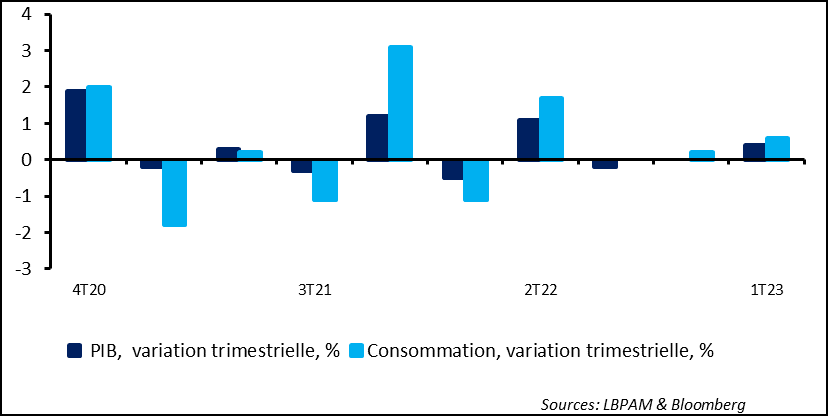

Also in Asia, Japanese GDP growth was a nice surprise in 1Q23. GDP expanded twice as much as expected, by 0.4% on the quarter. Growth was driven by consumption, but investment also fared well.

Fig. 6 – Japan : Still positive momentum in growth, driven by consumption

We have become more constructive on Japanese equities. Japan is still riding accommodative monetary policy and, obviously, the Chinese recovery.

However, the good surprise in 1Q23 GDP does not seem to point to a sustained and strong surge in growth. Moreover, despite historically strong increases in wages, they continue to lag behind inflation. We therefore expect consumption to slacken somewhat from its 1Q23 pace.