After-shocks from the regional bank earthquake

Link

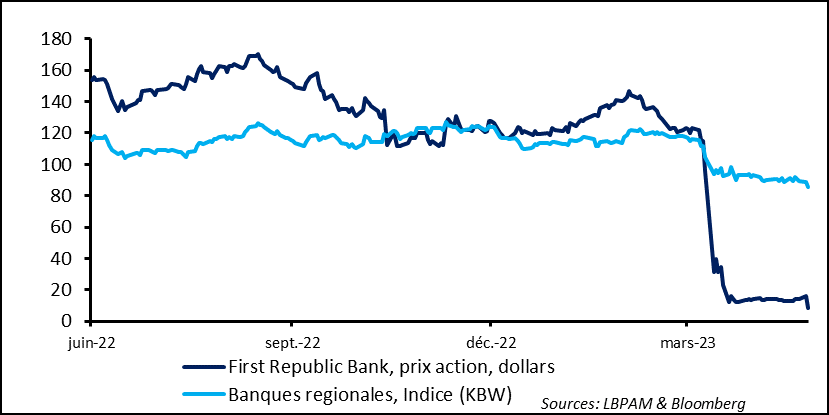

- A little more than one month ago, investors felt an earthquake whose epicentre was three US regional banks. However, prompt action from the US authorities kept the crisis in check and significantly lessened the possibility that it would turn into a system risk. Meanwhile, the markets discovered how shaky regional banks were, among other reasons because of lighter supervision than with very large banks, such as JP Morgan and Bank of America. An after-shock is now being felt, with fears for the financial health of First Republic Bank (FRB), a California-based bank. When unveiling its quarterly results, bank officers painted a picture that was far from reassuring on its viability as a going concern. In particular, they reported that 100 billion dollars in deposits had been withdrawn from the bank in the past month. In the hours or days to come, we’ll know more on how viable the bank is. At this point, like one month ago, a systemic risk is unlikely. Even so, the market’s reaction was immediate, with a steep drop in the risk premium, a falling share price and a rush into government bonds.

- While remaining cautious on a possible spread of FRB’s troubles to other regional banks, particularly as regards deposit flight, which could undermine some of them, we believe that the US authorities have all the means necessary to restore calm and re-establish confidence. However, as we have already noted, it is hard to imagine that this episode will have no consequences on credit distribution in the economy. Accordingly, we believe that likely tougher credit conditions will accelerate transmission of the ongoing monetary tightening. It is with this in mind that we reiterate our scenario of a recession, albeit a moderate one, in the US by yearend.

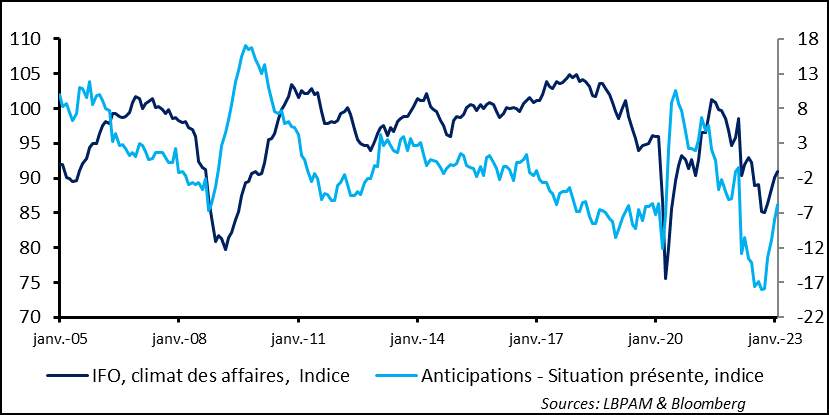

- That being said, in this highly atypical economic cycle in both the US and Europe, the resilience in activity is surprising indeed, in spite of the unprecedented speed of key rate hikes. Transmission of monetary tightening to the real economy seems to be very slow. In part, this resilience is due to objective factors that have supported economic activity in recent months, beginning with falling energy prices, which have restored some purchasing power to households and reduced business costs. This is the case in Europe in particular. In the Eurozone, fiscal shields are also in place to soften the impact of the energy shock that occurred after the war in Ukraine. And, in fact, some indicators are improving, particularly in services, as well saw with the PMI figures. In Germany, the IFO survey confirmed this trend, in spite of weakness in manufacturing. Despite the improvement revealed by the survey, the index remains low and, in our view, is consistent with stubbornly weak growth in the Eurozone. Moreover, this resilience in activity could very well maintain inflationary pressures, which would make the ECB’s task even more challenging.

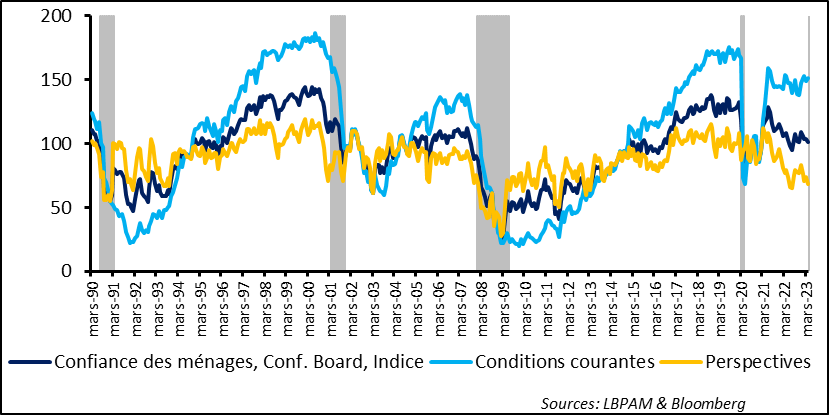

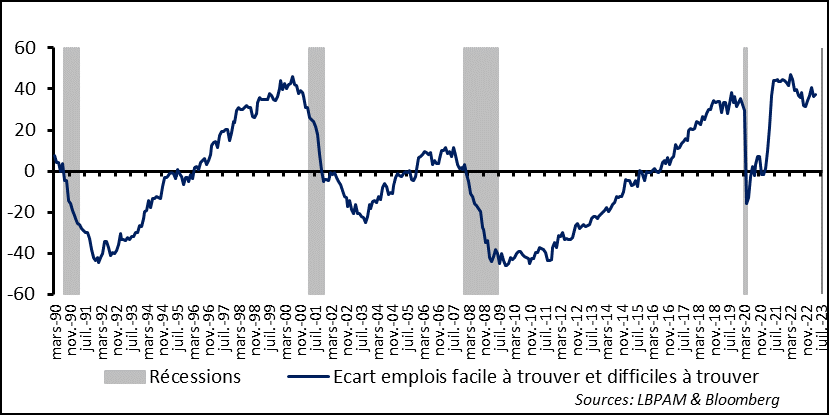

- As we know, consumption provided a boost to economic activity in 1Q23, with growth that should be 4% in annualised terms, and yet household confidence remains low. The April Conference Board survey suggests that it has even receded further. This seems to be due above all to households’ rather negative expectations, where the index is at its lows. Meanwhile, confidence remains high in the present situation, reflecting a continued strong job market, as seen in the “jobs easy to get” statistic. We expect a more marked weakening trend in employment to begin in the coming months, but it could, of course, remain surprisingly resilient. If the job market is indeed more solid, the Fed will face challenges that are similar to the ECB’s.

FRB’s poor results, including the loss of 100 billion dollars in deposits over the past month, have once again stoked fears for the banking system. Investor nervousness is even greater as bank officers refused to answer analysts’ questions after the results presentation. The market has therefore been left in the dark about the bank’s future, particularly the possibility of finding buyers or shoring up the bank’s activity.

The market obvious took a very dim view of all this, sending FRB’s share price into a tailspin, with fallout spreading to the entire regional bank segment.

Fig. 1 – United States: FRB’s problems are contaminating all regional banks…and undermining market sentiment.

First Republic Bank, share price in dollars KBW Regional Bank Index

The authorities will certainly seek once again to head off any risk of contagion, in order to maintain confidence in the banking sector. The Federal Deposit Insurance Corporation, which is in charge not just of insuring deposits but also overseeing the orderly unwinding of failed banks, is no doubt already at work assessing the bank’s viability.

We will also see the role that big banks will play, including JPMorgan. They had already provided FRB with 30 billion dollars in deposits when the trouble all began.

At this point, we believe that the authorities have all the means to act in restoring confidence rather soon, while dealing with the specific case of FRB.

The Fed is likely to keep its liquidity facilities wide open to the banking sector, regional banks in particular. As we know, this is crucial for keeping liquidity problems from turning into solvency ones.

The Fed’s challenge, which is not operational[H1] , is to make clear that its interventions aim at maintaining financial stability but do not affect its monetary policy strategy in combatting inflation. Indeed, the markets very quickly concluded that the Fed is ready to slow monetary tightening in the event of any problems in the financial sector. This won’t be the case here, if, as we expect, this episode does not trigger any systemic repercussions that would cause economic conditions to worsen markedly.

Even so, as we had suggested, this new episode serves as further notice that the tightening in credit, which is already underway, could get worse. This could also accelerate the transmission of monetary tightening to the real economy.

On the economic activity front, we continue to see signs of resilience in growth. In the US, we have seen in particular how services have held up well and are even strengthening. Falling energy prices have certainly played a role here. In the Eurozone, fiscal stimulus is another factor.

Accordingly, the IFO business climate survey continued to improve in April. In particular, expectations index continued to move back up.

Fig. 2 – Eurozone: Business climate in Germany is improving but is still low.

IFO business climate index– Expectations - current situation, index

Even so, the IFO index remains low, which we believe is consistent with our scenario of weak growth in the Eurozone as a whole, but is still not in recessionary territory.

The downside of this resilience in economic activity is that it could maintain inflationary pressures and make the ECB’s task more challenging.

We still believe that the ECB is approaching the end of its tightening cycle. We expect another two 25-basis point rate hikes. However, the risk for the ECB is that it will have to go even higher than expected if economic activity does not slow down. An even more aggressive move by the ECB would ultimately undermine the growth outlook.

US consumers remain a pillar of economic resilience. Indeed, the figures we now have suggest that consumption increased markedly in the first quarter, thanks mainly to January. GDP growth figures due out tomorrow are likely to show an acceleration of consumption of about 4% in 1Q23 at an annualised pace, up from 1% the previous quarter. This acceleration has been driven by heavy public transfer payments early in the year, which boosted incomes. And by the boost in purchasing power from falling energy prices, no to mention the strength of the job market.

However, consumer confidence does not truly reflect what seems to be a very robust economy. The latest Conference Board Consumer Confidence survey for April shows a slight decline, due mainly to weakening confidence in the outlook.

Fig. 3 – United States: Consumption is holding up, but confidence is still relatively low, particularly in expectations

Conf. Board Consumer Confidence Index Present situation Expectations

As we know, confidence and consumption are only loosely correlated. Even so, it is worth noting that households’ expectations remain lacklustre. In part, this still seems to be due to high inflation. This negative sentiment could end up overwhelming consumer spending attitudes in the coming months, if, as we expect, the job market begins to worsen. For the moment, only a few indices are pointing at a weakening in the job market, including the steady recent rise in jobless claims.

For the moment, as seen in the positive present situation index, households are still very optimistic on the job market, reporting very easy access to jobs.

Fig. 4 – United States: US households are still riding a strong job market

Recessions Gap in “jobs easy to get” and “jobs hard to get”

The coming months will tell us whether or not this solidity lasts. We continue to expect some weakening.