Despite doubts about its reliability, US inflation is supporting the markets

Link

What are the key takeaways from the market news on December 19, 2025? Sebastian Paris Horvitz provides some insights.

Overview

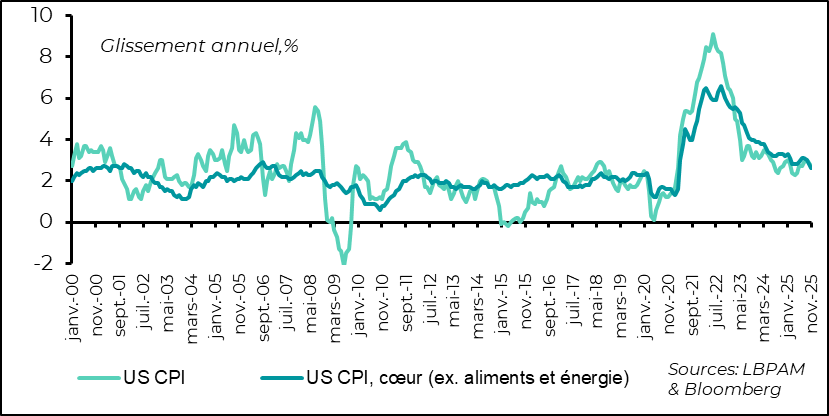

► In the United States, inflation figures (CPI) for November came in much lower than expected. These data were eagerly awaited as they were expected to provide an indication of the impact of customs tariffs on consumer prices. Overall, the sharp decline was well below most economists' forecasts. Year-on-year, the price index fell to 2.7%, compared with an expected 3.1%. Core inflation also slowed sharply to 2.6% from 3% in September.

►In fact, we find it very difficult to take these figures at face value. The data appears to be marred by the significant collection difficulties associated with the government shutdown. It is not only the absence of data for October that is problematic, but also the quality of the data collected in November. One of the notable paradoxes in these figures is that almost all of the underlying indices showed a marked downward trend over the month, contrasting with much more divergent trends previously. Above all, they may have been distorted by late collection, and therefore prices altered by heavy Black Friday discounts. As with the employment figures, we will therefore have to be patient to obtain more reliable figures. Let us hope that the December and January figures will dispel any skepticism about the inflation data.

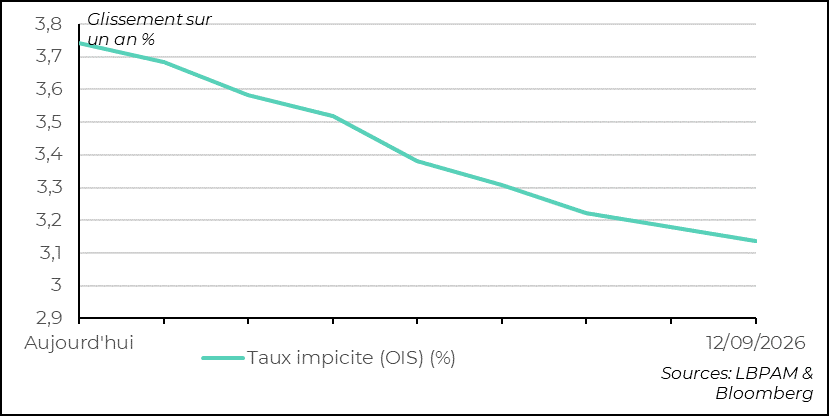

►Nevertheless, the market has decided to bet on faster-than-expected disinflation, fueling the idea that the effects of tariff increases are already behind us. This has led to a decline in long-term rates and pushed stock markets higher in anticipation of a Fed that could prove more accommodative. We believe that the Fed, as indicated at its last monetary policy meeting, will remain cautious, unless, of course, the labor market continues to deteriorate or disinflation accelerates. For now, the improved growth outlook for 2026, which is positive for risky assets, seems consistent with a convergence towards a neutral Fed stance rather than a highly accommodative one, hence our target of a key rate of 3.5% in 2026.

►In the United Kingdom, as anticipated by us and the vast majority of the market, the BoE lowered its key interest rate to 3.75%. This is the sixth cut since August 2024. As expected, it was A. Bailey who swayed the majority of voters in favor of this rate cut (5 to 4). In his view, the latest inflation figures, budget announcements, and continued rise in unemployment justified this decision. Nevertheless, the governor stressed that inflation expectations remain somewhat high and that patience is needed. Although the direction is clearly towards further monetary easing, he sees more limited cuts as key rates approach neutrality.

►We maintain our projection of two further rate cuts by the BoE in 2026, with a significant probability of a third if expectations ease more quickly, particularly if wage growth shows a more pronounced downward trend.

►As expected, the ECB maintained the status quo. President Lagarde reiterated that the ECB is still on track to meet its inflation target and can therefore keep monetary policy unchanged. However, she insisted that monetary authorities must retain full flexibility to act, stressing that the future path is by no means predetermined. Supporting her comments, she highlighted the fact that the ECB economists' growth forecasts had been revised upwards, notably to take account of stronger productivity gains, while headline inflation is expected to converge towards the target in 2028, after falling slightly below 2% in 2026-2027.

►Today, our central scenario is that the ECB could maintain the current status quo throughout 2026. Nevertheless, we continue to believe that a further cut in key interest rates is not unlikely. Indeed, keeping inflation below 2% for too long could negatively affect expectations. Furthermore, inflation that is too low relative to the target could be exacerbated by a strong euro.

►To conclude with the central banks' decisions at the end of the year, as expected, the BoJ raised its key interest rates today by 25 basis points to 0.75%, the highest level since 1995.

Going further

United States: Inflation surprises on the downside in November

Core inflation at its lowest since 2021, but data appears fragile

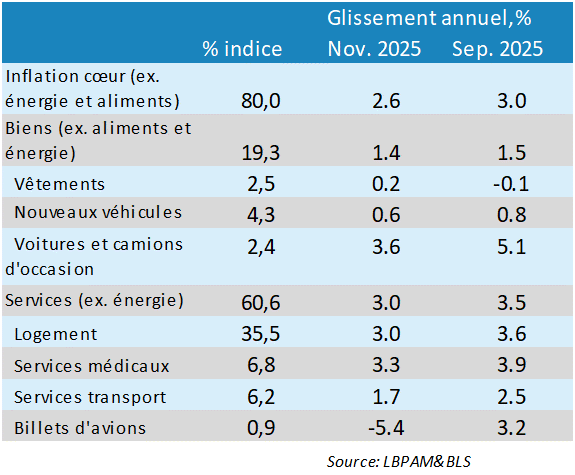

US inflation figures for November came as a big surprise on the downside. Not a single economist had anticipated such a sharp slowdown in prices. Headline inflation slowed to 2.7% year-on-year, down from 3.0% in September. Core inflation saw an even more remarkable change, falling to 2.6%, its lowest level since early 2021.

These figures are quite surprising and seem to reflect a very sharp adjustment in demand, which would have pushed companies to lower prices significantly. However, the various statistics available to us on the state of economic activity are far from reflecting such a trend. Furthermore, the largest component of the consumer price index, rents, has shown a very surprising trend, rising extremely slowly over the last two months.

In fact, these data still seem to bear the scars of the shutdown.

Inflation statistics severely disrupted by the shutdown

In addition to the fact that data for October could not be collected, there are still gaps in the data collected for November. Above all, the later than usual and extended collection period seems to have significantly distorted the figures. It is reasonable to assume that the sharp price reductions typical of the end of November (Black Friday) may have exaggerated the behavior of certain prices.

It is particularly noteworthy that almost all components of the price index experienced substantial year-on-year declines during the month. This is very surprising given the disparate price trends to date, particularly for services. So-called super-core services, i.e., excluding energy and rents, slowed from 3.2%, a rate of increase that has prevailed since July, to 2.7%.

Some also point out that we may already have reached the end of the pass-through of tariff increases to prices. This is not impossible, but we believe it is unlikely. It seems that US companies have absorbed some of the tariff increases in their margins so far, but this does not mean that these increases will not be passed on to consumers sooner or later.

We continue to believe that the spread of this protectionist shock could be much slower than initially anticipated. On the other hand, these tariff increases should not have a lasting effect on inflation, a priori.

At the same time, with growth strengthening in early 2026, particularly thanks to fiscal measures, it is likely that companies will be able to pass on cost increases more easily. In addition to the already announced tax cuts, Trump announced on Wednesday that the government was preparing to give $1,776 to all military personnel (1.4 million individuals). It is unclear where these funds will come from, as they were not included in the budget. Nevertheless, this will support demand, albeit marginally.

Overall, we find it difficult to take these inflation figures for November at face value. In fact, Fed Chair Jerome Powell, in a speech given shortly before these statistics were announced, emphasized that the effects of the government shutdown are likely to continue to distort economic statistics, particularly those relating to inflation and employment, which are crucial to the Fed's decision-making.

The market was less discerning, and these figures sparked a strong sense of optimism, with sharp declines in long-term rates and, above all, a rally in equities. The idea behind this movement is that monetary policy could become more accommodative.

Although we remain constructive on risky assets at the end of this year and in early 2026, we believe that we need to be more patient before we see the Fed providing strong support in the coming months. We still believe that the Fed is likely to remain more cautious in 2026 than is currently anticipated.

United Kingdom: BoE cuts rates but wants to be patient

Expectations of a cut in key interest rates are reasonable

As anticipated by us and the market, the BoE decided to resume lowering its key interest rate to 3.75%. This is the sixth rate cut since the start of monetary easing in August 2024. This decision was made possible by Governor Andrew Bailey's decision to join the group in favor of lowering rates. He thus tipped the majority in that direction (5 votes to 4).

Nevertheless, in his comments, Bailey emphasized that while further rate cuts were still possible, they would likely be more limited as key rates approach a neutral level.

Market expectations regarding the direction of monetary policy in 2026 seem reasonable to us at present, with two rate cuts. However, we believe that a third cut is also a distinct possibility.

Indeed, as noted by the governor, in addition to the government's announcements of a more austere budget, inflation and labor market statistics are moving in the right direction.

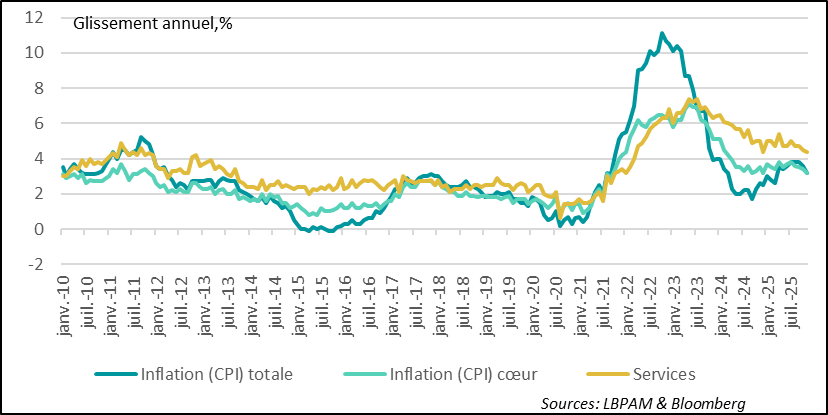

Inflation resumes a more pronounced downward trend

In particular, inflation data for November not only confirmed that we have passed the peak of inflation, but also showed that the slowdown in price growth was more pronounced than expected. Core inflation slowed to 3.2%, well below expectations, and inflation in services continued its downward trend, although it remains high.

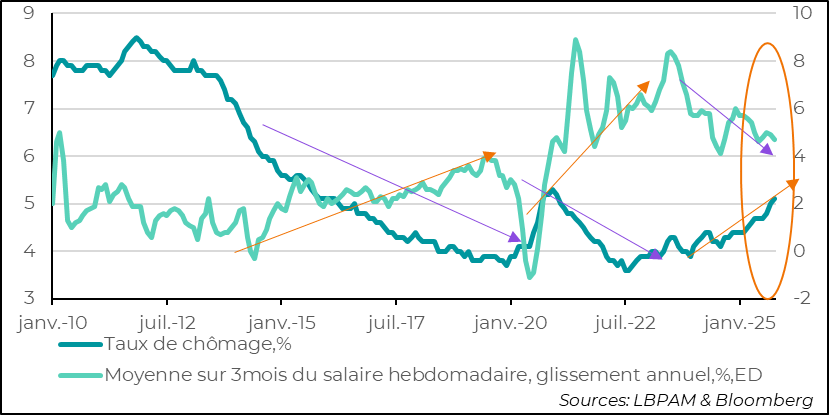

Wages are expected to slow down in light of the weakening labor market

Consumption and investment slow down

In addition, labor market data showed that the situation continued to deteriorate, with an increase in the unemployment rate, which should result in a faster deceleration in wage growth.

The persistence of high wage growth is one of the factors troubling members of the Monetary Policy Committee who advocate a much more cautious policy of lowering rates and who voted for the status quo.

A more pronounced slowdown in wage growth should be a major factor in better anchoring inflation expectations and allowing the BoE to continue its campaign of rate cuts.

Eurozone: ECB wants to maintain neutrality in its policy

A more favorable growth scenario, but inflation remaining below 2% in 2026-27

As widely anticipated, the ECB will be the only major central bank not to change its policy at the end of the year. Indeed, the ECB has decided to keep its key interest rates unchanged.

Regarding the outlook, Ms. Lagarde reiterated that the ECB remains well positioned to ensure that inflation converges fully towards the 2% target. At the same time, she remained cautious about the future course of monetary policy, stressing that it was not on a predefined path.

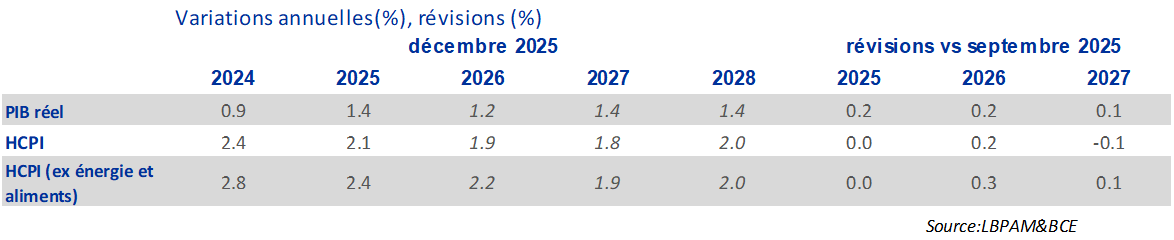

The ECB's decision was also accompanied by the publication of new economic projections by the institution's economists. Supporting the status quo, growth projections were revised upward. This revision reflects a more favorable view of productivity gains in the coming years. Inflation was also revised slightly upward, pushing core inflation above 2% in 2026.

The evolution of inflation will undoubtedly continue to be a topic of debate within the institution in 2026. Despite upward revisions in 2026, inflation is expected to remain below 2% in 2026-27. Thus, contrary to the messages from the most conservative members of the monetary policy committee, the risks to inflation are either neutral or even on the downside, rather than the opposite. Anchoring inflation at a level below 2% would be a mistake and, above all, would not be in line with the symmetric strategy adopted for inflation management, moving away from the very conservative view that prevailed previously.

Overall, we now believe that the ECB should keep its policy unchanged in 2026, but we continue to think that the risk of a further cut is far from zero, especially if the euro continues to strengthen.

Sebastian Paris Horvitz

Head of Research