Donald Trump destabilizes world trade and introduces more uncertainty

Link

Read Sebastian PARIS HORVITZ's market analysis for January 29, 2025.

Summary

►President Trump floated the idea of increasing tariffs on Mexico, Canada and China on February 1, and he's done it! Exports of goods from Mexico and Canada will be taxed at 25%. Canadian oil and gas and goods from China will be taxed at 10%. Until the end, many expected much more moderate measures, or even no tax at all and the opening of negotiations.

►Donald Trump annihilated the treaty he had signed with two of these major partners in 2018. To do so, he invoked an emergency reason affecting the security of the United States. The main criticism levelled at his partners is that they do not have sufficient control over immigration and, above all, the entry of drugs into the United States. At this stage, it is difficult to understand what is negotiable and when a return to normality can be envisaged.

►If the measures taken were to be maintained for an extended period, the impact on inflation and growth in the United States would be significant. The greatest impact would obviously be for Mexico, given its very high level of integration with the United States. The gross ratio of Mexican exports to the US is almost 30% of GDP.

►At this stage, it's hard to understand what the economic objective is. The United States would lose out in the current situation, especially as Mexico and Canada intend to take retaliatory measures. Canada has already done so, and Mexico is expected to announce measures today.

►What is already certain is that one of D. Trump's major objectives, which is to bring inflation down, will not be achieved but will get worse in the short term. Following Fed estimates made in the past (in 2018), Bloomberg estimates that the impact on US GDP of the announced measures could cost 1.2 percentage points on US growth and 0.7 points of inflation more in a full year.

►Depending on the announcements we receive over the coming week, we'll be able to better calibrate the effects and thus adapt our economic scenario. At this stage, because of the economic impact and the uncertainty they may create, the consequences should be negative in the short term for risk-taking on the markets. Despite the effects on inflation, government bonds should benefit, particularly Treasuries and German bonds.

►While the introduction of customs duties is likely to have a negative effect on consumption, notably through price rises, the message from the last month of 2024 was rather very favorable. Household spending rose by 0.4% over the month in real terms, after 0.5% in the previous month. At the same time, income grew at a much slower pace. This resulted in a further fall in the savings rate. This decline is unsustainable, and we expect consumption to moderate by 2025.

►On the inflation front, the consumer deflator, the Fed's preferred indicator (PCE), came in as expected at 2.6% year-on-year, versus 2.4% the previous month. The core PCE remained unchanged at 2.8%. These figures confirm the slow pace of disinflation and the Fed's cautious stance. At the same time, the quarterly indicator of changes in labor costs accelerated slightly in 4Q4, but year-on-year rose to 3.8%. The deceleration in wage growth is a key factor in the fall in inflation.

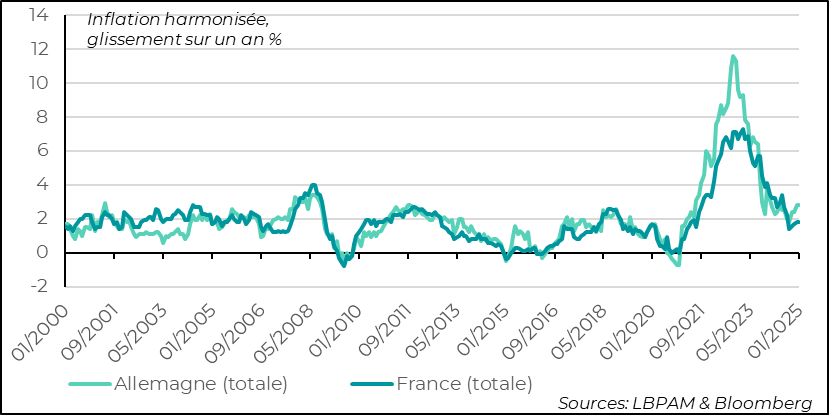

►In the Eurozone, inflation in the region's two major economies, France and Germany, came out somewhat mixed. Although energy prices had a bullish effect in both countries, the inflation dynamic in France still seems more favorable. In Germany, inflation is still stagnating at 2.8%. However, this is not likely to change the ECB's trajectory of key rate cuts, but is consistent with its prudence.

►In China, we had the private PMI survey (CAXIN) for China's manufacturing sector for January. Unfortunately, activity is reported to have stagnated at the start of the year. In particular, in the details, the survey highlights weak demand as one of the factors behind the slowdown. This could put even more pressure on the authorities to stimulate domestic demand, especially in the wake of Donald Trump's tariff hike.

To go deeper

Donald Trump has decided to follow through on his threat to raise tariffs on these major trading partners, with the exception of the European Union. But, based on the President's comments, announcements to this effect could be made soon.

In total, imports of Mexican goods will face tax hikes of 25%, as will goods from Canada, excluding energy products, which will be taxed at 10%. China's exports will be taxed at 10%. Given the size of these countries in US trade, the average tariff rate will rise from 3% to 10.7%.

The introduction of these taxes, according to D. Trump, is to force these countries to better control migratory flows and the entry of narcotics products, in the case of Canada and Mexico, but also to reduce US trade deficits.

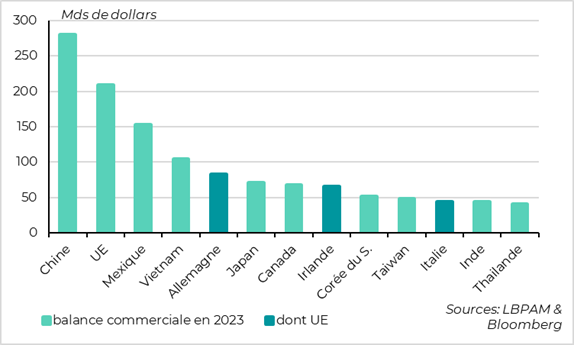

United States: the close integration of certain economies with the United States has in some cases resulted in significant deficits

It's hard to say what gestures the American president expects from the Mexican and Canadian authorities. In fact, Canada has already responded with trade retaliation, raising tariffs on a significant number of products. Mexico is expected to follow suit today.

In particular, regarding trade relations, it was D. Trump himself and his team renegotiated NAFTA during his first term. The president did not point out any weaknesses in the agreement.

So, by appealing to a reason of urgency and a national security problem, it's American President Trump who has come to cancel the agreements signed less than 6 years ago.

The impact of these measures will depend enormously on how long these tax hikes are maintained. Nevertheless, it is clear that the impact on the countries affected, but also on the United States, will be inflationary and negative for growth if these measures are maintained.

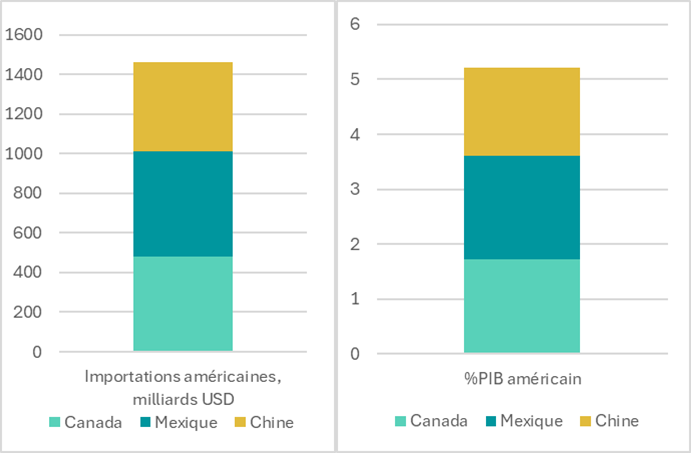

Total US imports from these countries exceed $1.4 trillion. This represents 5% of US GDP.

United States: Rising tariffs on its three main non-EU trading partners will have a major impact in the U.S.

This week, we should have more clarity on the strategy to be followed by the US administration. What is certain is that our scenario of gradualism and moderation does not seem to be respected for the time being.

As a result, the moderate tax hikes we were expecting, and therefore the relatively low impact on activity and inflation, are being undermined.

Based on calculations made by Fed economists in 2018, Bloomberg economists estimate that 1 percentage point of additional tariffs translates into a 0.14 percentage point drop in GDP and raises core PCE (inflation) by 0.09 points. Thus, the measures just taken, if maintained, would cost the US economy 1.2 points less in growth and 0.7 points more in inflation.

The impact on the markets, and in particular on risk-taking, is likely to be negative, in our view, as it introduces a great deal of uncertainty. However, caution must prevail. Indeed, especially with President Trump, we can expect very rapid reversals of his policies. So, being too negative may prove premature.

What is certain is that for the smaller economies, Mexico and Canada, the impact can quite quickly be very negative. For both countries, their currencies are already suffering quite markedly, but not in a brutal way.

D.Trump announced these protectionist measures at a time when the latest U.S. economic data remained very solid, particularly as regards consumption. These measures are unlikely to be good news for the American consumer.

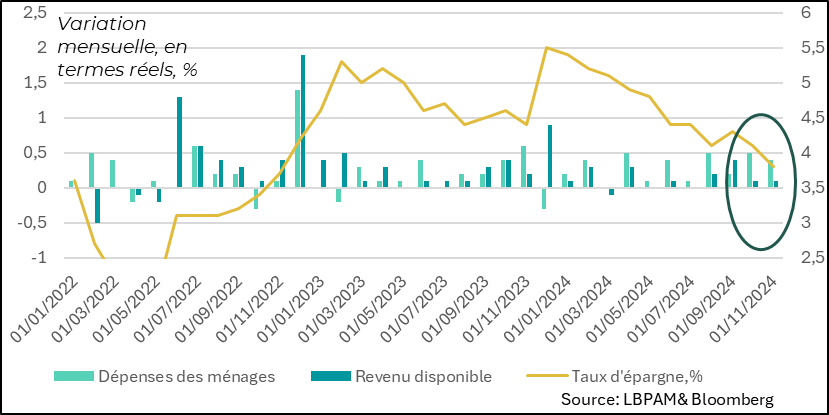

Be that as it may, real consumption across the Atlantic rose again very strongly in December 2024 (0.4%), moderating just a little after a very strong November (0.5%). This confirms the strong acceleration in consumption in 4Q24 to 4.2% annualized.

In part, this rise can be explained by the anticipation of certain purchases, notably of electric cars, in the face of the removal of certain subsidies and also the possible impact on prices of possible tariff hikes.

At the same time, incomes have grown much more slowly, resulting in a further fall in the savings rate. This decline may continue, but there are limits, especially as the labor market normalizes and the Fed is likely to keep rates unchanged for longer.

United States: Consumption on the upswing in 4Q24

Thus, we still expect consumption to moderate over the course of 2025, with the gradual normalization of wage growth and a slightly less buoyant labor market.

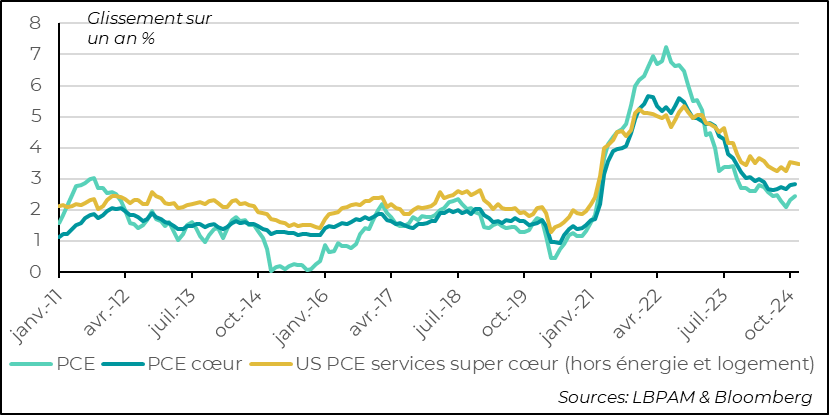

We also had the December estimates of the consumer price deflator (CPI), the Fed's preferred statistic for tracking prices.

There were no surprises, either for total inflation or core inflation, both coming in as expected at 2.6% and 2.8% year-on-year respectively.

In particular, we noted that super-core inflation in services (excluding energy and rents) is still stagnating, confirming the slow process of disinflation taking shape in the USA, unless major disruptions due to D. Trump's policies further complicate the picture.

United States: Disinflation stagnates as expected

Trend measurements give the same message, with the indicator removing the extremes and also showing a stagnation of the decline.

United States: PCE stagnates but should continue to slow gradually barring an economic policy shock

In the Eurozone, we have received preliminary inflation estimates for January in a number of countries, including France and Germany.

In France, beyond a slight upward effect from energy prices in particular, inflation is expected to remain low. Year-on-year, it came in at 1.8%, below expectations, but unchanged from the previous month.

In Germany, inflation, as expected, came in at 2.8%, maintaining the rebound seen the previous month, and dominated by base effects.

For the ECB, these figures represent no cause for concern and should not derail its plan to cut key rates in the months ahead. Nevertheless, particularly for Germany, this validates the ECB's cautious stance.

Eurozone: Inflation has not yet resumed its downward trend and remains affected by base effects. In 2025, the downward trend should resume.

Sebastian PARIS HORVITZ

Head of Research