Donald Trump's budget bill passes the Senate

Link

Market Update for July 03, 2025: Insights by Sebastian PARIS HORVITZ

Key Takeaways

► Yesterday, the US Senate struggled to pass the budget bill championed by D. Trump. Vice President JD Vance was forced to vote in favor of the bill, as several Republican senators opposed it. In particular, the cuts in social spending were seen by them as too great, and above all the increase in the future debt of the United States was considered unsustainable. Now it's up to the House to vote.

► It won't be easy in the House either. In particular, the more orthodox Republican members are calling for more spending cuts, including social spending, to limit future deficits. The more moderate ones see cuts to the social system as too aggressive. But we think the bill will probably pass. Nevertheless, it will be one of the most regressive budget laws in terms of the distribution of fiscal gains and losses in recent decades. Indeed, the poorest will largely finance the tax cuts of the wealthiest. It should also be noted that efforts to promote the energy transition will be significantly slowed down, in favor of support for fossil fuels.

►The political consequences of this legislation could be significant for Republicans. Indeed, according to polls, less than 30% of the population supports this legislation. Its implementation is likely to increase the number of dissatisfied voters. This could result in the Republicans losing their majority in one or both Houses of Congress in next year's elections. At the same time, in the relatively short term, the higher-than-expected public deficit should stimulate growth in 2026. Investment tax credits could have the biggest multiplier effect.

►This should not alter our scenario for the second half of 2025. The tariff shock and deteriorating confidence with great uncertainty about the future should continue to weaken business, in our view.

► This is an important reason why we are a little cautious on US equities, especially during the summer months. We prefer to keep a good exposure to corporate bonds (credit). Also, lately, risk-taking has been fuelled by speculation that the Fed would act more quickly. More than two rate cuts are expected between now and the end of the year. We expect only one.

►Despite President Trump's continued intimidation of J. Powell, the Fed Chairman continues to repeat that it is the data of the next few months that will dictate monetary policy decisions. At the opening of the ECB's annual seminar in Sintra on Monday, his rigor even earned him high praise from Mme Lagarde for his courage.

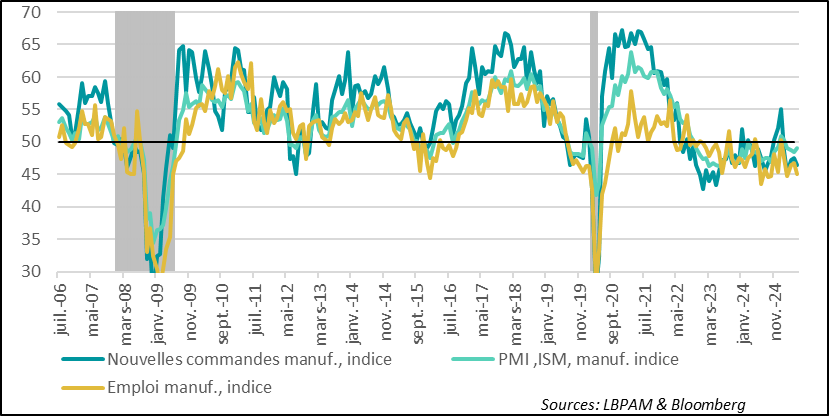

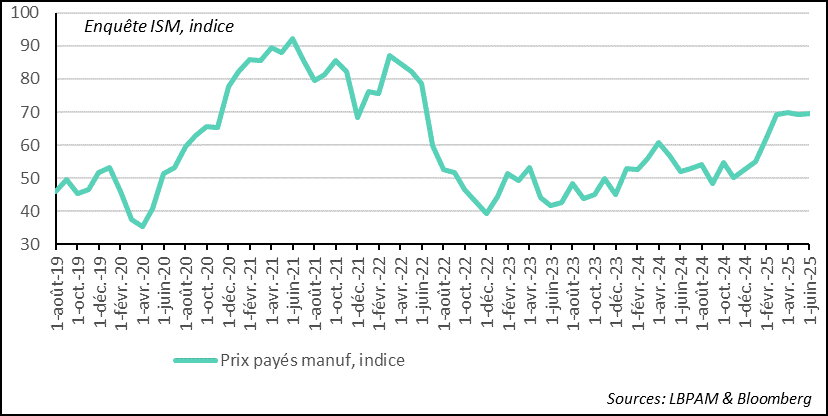

►On the subject of US economic data, we continue to receive mixed messages. The ISM manufacturing index for June showed that activity was continuing to contract, even though production was accelerating slightly. Indeed, new orders were contracting, and notably, prices paid by companies continued to rise sharply, also reflecting disorder in production lines.*

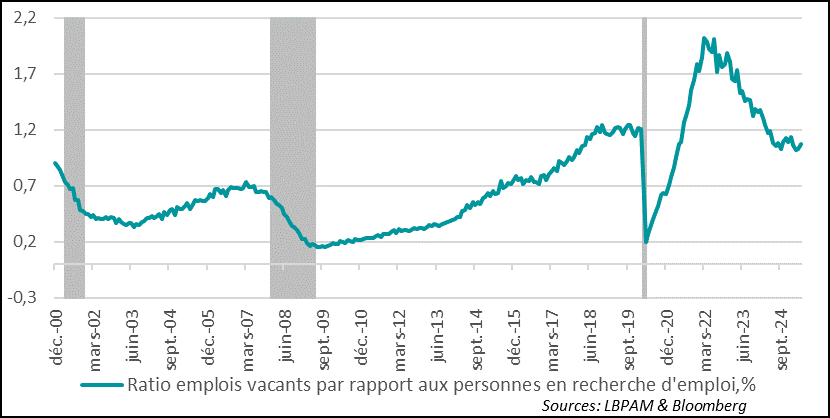

►At the same time, the employment situation deteriorated according to the ISM survey, while the JOLTS survey showed job vacancies picking up slightly in the previous month. For the moment, it seems to us that we are seeing signs of a further weakening of the labor market, but not a collapse. Thursday's employment report will tell us more, including whether there are any effects linked to the US government's migration policy.

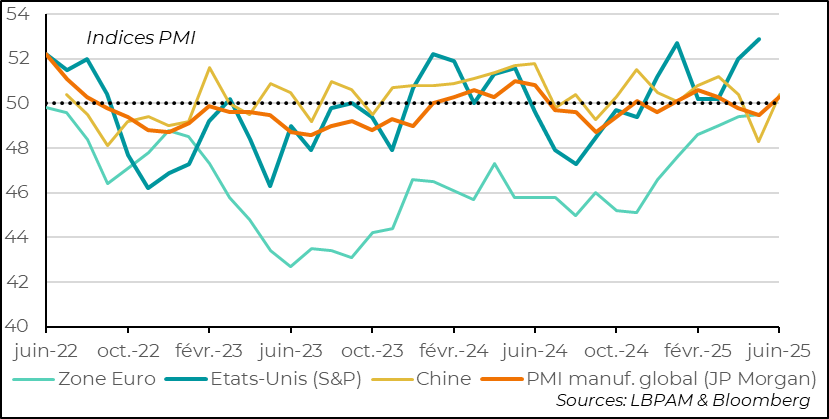

►Globally, S&P's PMI surveys for the manufacturing sector in June showed that the sector was returning to expansion territory. But this was largely due to strong activity in the USA. This seems a little too out of step with the ISM survey, which was far more negative on the diagnosis. On the other hand, industrial activity in China seemed to be performing better, while industrial activity in the Eurozone remained stagnant.

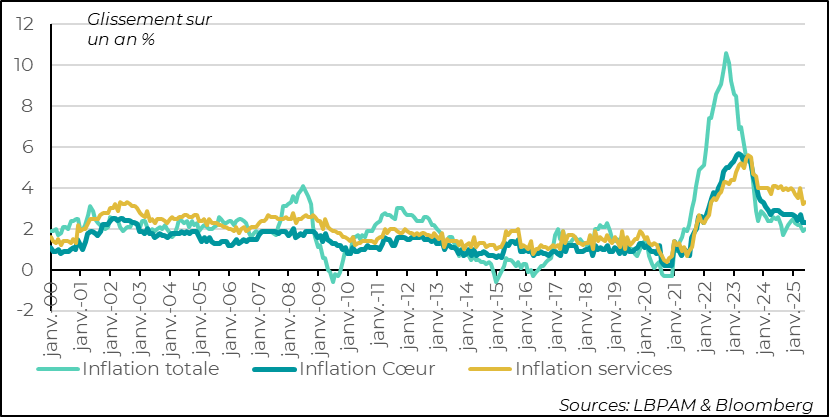

►Still in the Eurozone, continued weak growth is obviously not good news, but it does reinforce our view that inflation should remain well anchored and low. Indeed, inflation for June came in as expected, at 2% year-on-year. Above all, services continue to decelerate. We continue to expect a final ECB rate cut before the end of the year. However, the timing remains uncertain.

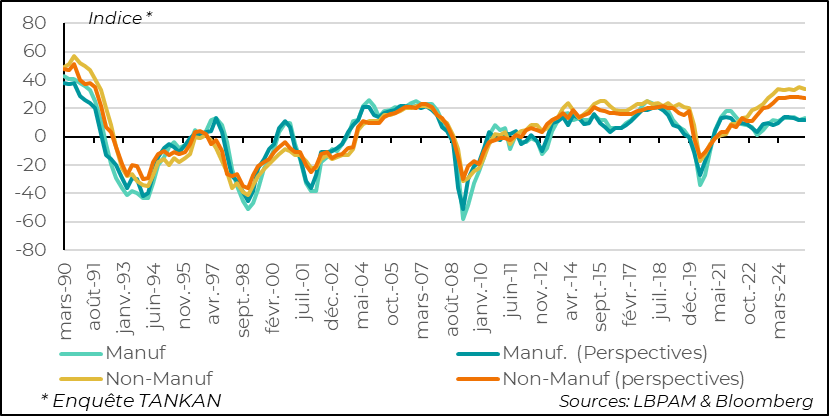

►Finally, despite all the uncertainties introduced by the trade war initiated by D. Trump, it is worth highlighting the resilience of the Japanese economy. The TANKAN survey for Q2 2025 was very solid. In particular, indices for the services sector are approaching their highest levels since the 1990s. Nevertheless, the risk of an unfavorable tariff agreement for Japan could dampen this upturn.

To Go Further

Global industrial activity gained ground in June, according to JP Morgan's global index based on S&P PMI survey data. Indeed, the index moved back into expansion territory. Nevertheless, the rise in the index is largely due to increased activity in the United States. On almost all segments of activity, from new orders to employment, the survey results give a rather different view from those of the ISM survey, which we consider more reliable (see below). We must therefore remain cautious.

Nevertheless, in June, we also saw industrial activity pick up in China, moving back into expansion territory. It would therefore appear that the US tariff hikes have not dealt China's industry too heavy a blow. In fact, despite the sharp drop in Chinese exports to the USA, these have continued to grow, thanks to the rise in exports to other destinations. It is also likely that some of these exports to other destinations are a means of circumventing US tariff sanctions. Chinese companies re-export to the USA from other countries less affected by tariff sanctions.

In the eurozone, on the other hand, despite the steady recovery since last autumn, industrial activity remains weak, with the overall index for the zone still slightly in contraction territory.

Global: S&P's global manufacturing PMI is back in positive territory, but the rise is largely due to surprisingly favorable results for the US.

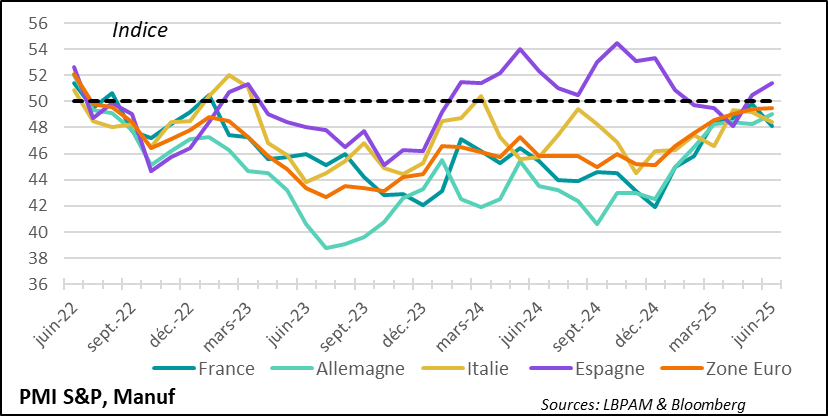

In the Eurozone, S&P's PMI surveys once again reveal quite marked differences in momentum. Indeed, while activity in Spain continues to pick up, it weakens again in France and Italy, where it remains in contraction territory. In Germany, industrial activity continues to approach expansion territory, while German business sentiment remains very optimistic for the future following the stimulus package announced by the German government.

We continue to expect a gradual recovery across the region thanks to German infrastructure and defense spending towards the end of the year. Nevertheless, in the very short term, the effects of tariffs and the uncertainties surrounding them remain a handicap for the sector.

Eurozone: S&P PMI surveys show activity still contracting in the region, but there are significant differences between countries

As previously mentioned, S&P's survey came out surprisingly positive on the state of US industry, and contrasts with the much less robust message coming out of the surveys conducted by the regional Fed.

The difference is particularly marked with the ISM survey, which we consider more reliable. As in the S&P survey, the production index did indeed pick up in June, but almost all the other indicators remain in contraction territory, notably new orders and employment.

United States: ISM survey for industry in June not very encouraging, with new orders and employment down

In fact, once again, US economic data for June came in weaker than expected. The slight upturn seen in May has thus faded.

United States: US economic surprises turn negative again in June

On the other hand, both the S&P and ISM surveys have one thing in common: the continued sharp rise in costs for companies as the price index they pay rises due to higher tariffs. In the S&P survey, companies also declare that they are passing on their price increases to their customers.

We remain in the camp of those who believe that rate hikes will show up in inflation in the months ahead. Nevertheless, as we have repeatedly said, the transition may prove slow, while the scale remains uncertain, as does whether or not they will be transitory.

United States: ISM survey price index remains high

While the June employment report for the USA will be published tomorrow, we had a pleasant surprise for May with the JOLTS survey, which showed that job vacancies had increased over the month, breaking the downward trend observed since the end of last year. Unsurprisingly, it is still the two sectors that show the greatest resilience in job creation, healthcare and catering, that explain this increase. It is in these sectors that we see the most voluntary departures in search of other employment, generally a sign of the dynamism of the job market.

Over the coming months, we'll be watching to see whether the US government's restrictive migration policy has any impact on the balance of the labor market, and in particular whether specific tensions emerge in certain sectors.

USA: JOLTS survey paints a picture of a labor market that remains relatively buoyant, albeit with a strong sectoral bias

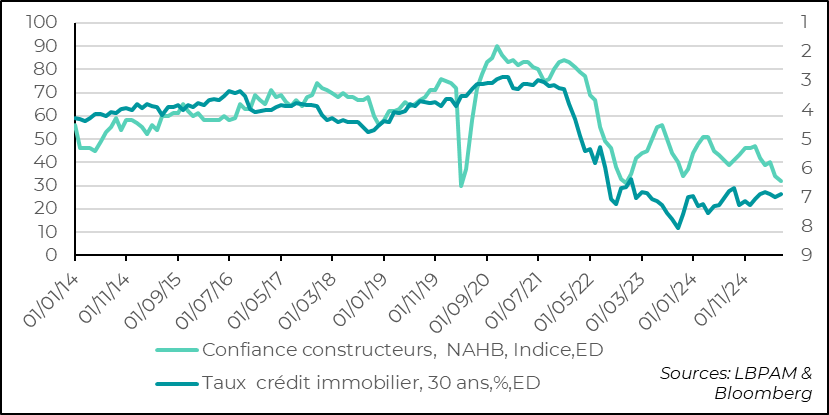

Industrial activity remains sluggish in the eurozone, but this goes beyond the sector. This weakness in activity should reinforce the moderation in inflation in the zone.

Indeed, in June, total inflation in the eurozone came out as expected, at 2% year-on-year. As we know, while inflation is moderating sharply in the major countries, it is still in the East that inflation is showing some resistance.

Core inflation remained stable at 2.3%, but above all - and this has been the highlight of recent months - inflation in services continued to decelerate. Clearly, for the ECB, the victory against inflationary pressure is here to stay.

Eurozone: a historic commitment to further increases in defense spending by 2035

Nevertheless, in our opinion, the continuing weakness in activity, despite the fiscal stimulus expected from the end of the year, should prompt the ECB to cut its key rates further, consolidating them in a slightly accommodative territory, to reinforce the recovery and inflation stability.

The timing of this cut remains uncertain, but the uncertainties surrounding growth, with the downside risk weighing on inflation, should make this latest cut necessary.

While, like other countries, Japan is in the midst of negotiations with the United States on tariffs, Japanese economic indicators remain favorable. In particular, the TANKAN survey for the second quarter was very favorable

In particular, the survey in the non-industrial sector remained very well oriented, with indices on the current situation and outlook very positive. In fact, the index remains at historically high levels, if we refer to the last 30 years.

Of course, President Trump's rather aggressive rhetoric towards Japan in recent days could have a major impact on the dynamics of the Japanese economy, should tariffs on the main products exported to the United States rise sharply. Trump has spoken of 35%. We believe that Japan should manage to stay within the average of tariffs applied to major countries, i.e. between 10% and 15%, but there is a risk of more negative treatment, particularly for the automotive industry.

Japan: the TANKAN survey of large companies for 2Q25 remained very robust

Sebastian PARIS HORVITZ

Head of research