Economic improvement confirmed

Link

- After the uncertainties generated by geopolitical tensions and the adoption of much more cautious views on possible rate cuts by central banks, the markets seem to be stabilising. The technology sector is even picking up, still buoyed by demand associated with the development of artificial intelligence and... its promises.

- Surprisingly, on the other side of the Atlantic, the consensus seems to be for higher interest rates for longer, with relatively little impact on the riskiest segments of the market. We believe, however, that a degree of caution should be exercised. Indeed, it seems to us that maintaining a restrictive monetary policy for longer should still cause the economy to slow over time, albeit gradually.

- In fact, the preliminary PMI surveys for April in the United States gave a disturbing signal about the state of the economy. They showed a slowdown in activity in the manufacturing and services sectors. At the same time, the message on price trends is mixed, even if cost pressures in services appear to be easing. At the beginning of May, the ISM survey may or may not confirm this slowdown in activity, which would break the very buoyant momentum seen since the start of the year.

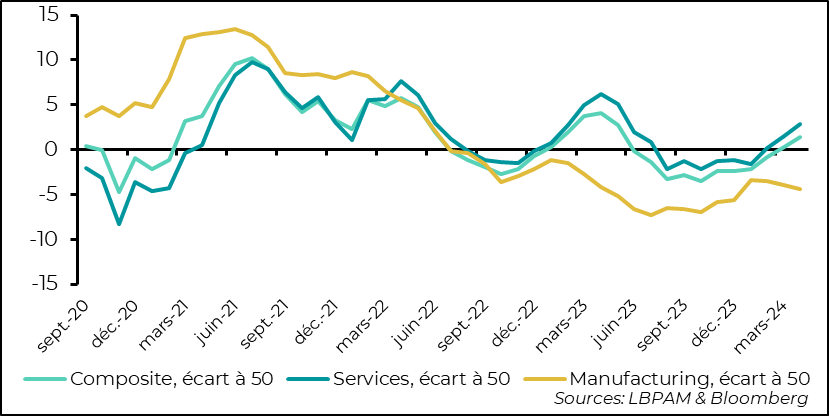

- In the Eurozone, the preliminary PMI survey confirmed the gradual improvement in activity, with the composite index in expansion territory (51.4) and at an 11-month high. Activity in the services sector is essentially behind this rebound. Unfortunately, momentum in the manufacturing sector remains mediocre, particularly in France and Germany.

- At the same time, on the price front, the news is not good, as the survey reveals an acceleration in costs and price rises by companies in the Eurozone. The upward trend is particularly evident in services. This could accentuate the ECB's cautious approach to easing monetary policy, following an initial cut in key rates in June.

- On the geopolitical front, as expected, the US Senate approved the $95 billion plan to support Israel, Taiwan and Ukraine. The US President is expected to sign the bill today, thereby releasing $61 billion to help Ukraine in its war effort. Given the deterioration in the military situation, the aim now is to be able to rapidly supply the country with the weapons it needs to defend itself.

In the Eurozone, services gained ground, with activity in Germany and France in particular continuing to recover. In industry, on the other hand, the dynamic deteriorated once again, not only in the two major economies, but almost everywhere in the zone.

Clearly, the convalescence of industry is not yet behind us. On the other hand, the good news is that services are recovering, thanks in part to a revival in demand. This is partly the result of consumption still being held up by a still solid job market and rising real wages.

On the other hand, the bad news revealed by the survey is unfavourable cost and price dynamics. This has been particularly true in services, where costs have started to rise again, albeit to a lesser extent than at the start of the year. This led to an acceleration in price rises by companies in the services sector.

In the manufacturing sector, the momentum was more favourable, with the tensions that had arisen from the diversion of shipping following the attacks on ships in the Red Sea eased.

Of course, the price pressures in services, if confirmed, are not good news for the ECB. Nevertheless, in our opinion, this should not change the central bank's decision to cut its key rates in June. On the other hand, the persistence of these tensions could well lead to a more cautious approach to rate cuts in the quarters ahead.

Fig.1 Euro-zone: Services lead the upturn in activity, while the manufacturing sector continues to lag behind.

- Composite, 50% spread

- Services, 50% spread

- Manufacturing, 50% spread

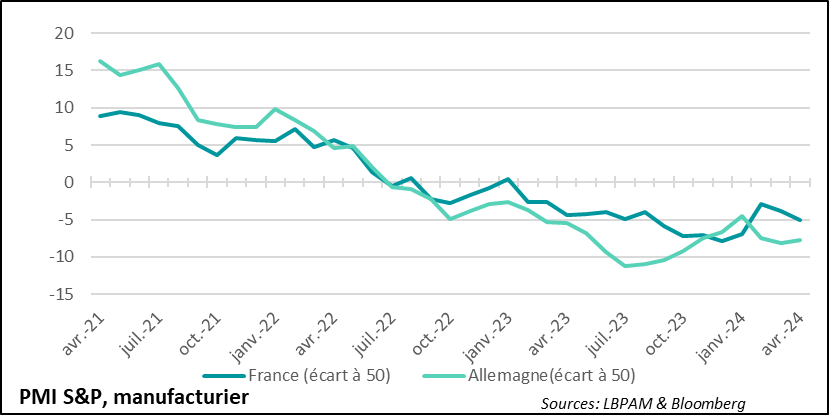

In the recovery of the Euro Zone indicated by the PMIs, it is important to highlight the continuing upturn in activity in Germany and France. However, this is essentially driven by services. The manufacturing sector is still struggling. According to the survey, activity in France contracted more in April than in the previous month. In Germany, the contraction in industry is continuing at more or less the same pace.

We all know that weakness in industry is a global phenomenon, but the situation in Europe stands out for the weakness of demand for its products. In this sense, the start of monetary easing could help to stimulate demand, particularly investment.

Fig.2 Euro-Zone: In Germany, as in France, activity in the manufacturing sector remains mediocre.

- France (spread at 50)

- Germany (gap at 50)

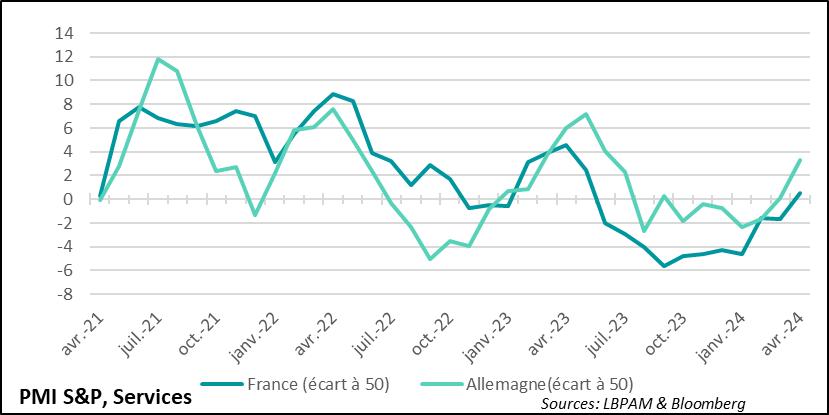

This is in stark contrast to activity in the services sector, which recovered strongly in April. In France and Germany, the services index returned to levels not seen for almost a year. In Germany, the upturn was particularly remarkable, with the index showing a sharp expansion in activity. In France, the recovery is also there, but activity seems to be regaining momentum more moderately.

Nevertheless, as the survey indicates in both countries, price pressures are still very much with us.

Fig.3 Euro-Zone: Services are leading the recovery, with a remarkable surge in Germany,

while in France activity is finally moving into expansion territory.

- France (spread at 50)

- Germany (gap at 50)

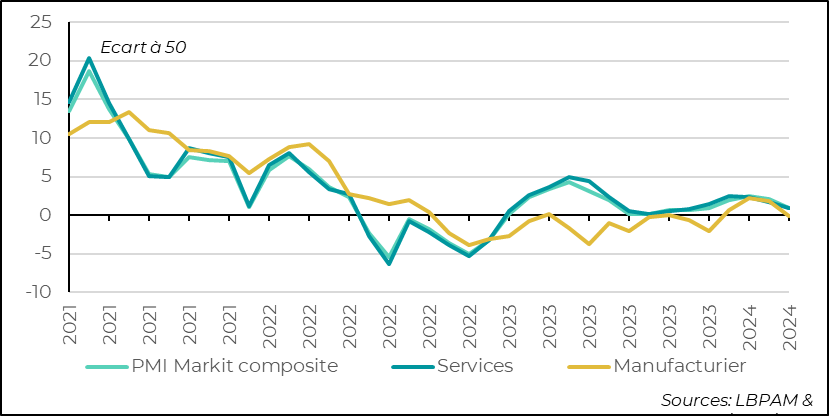

Across the Atlantic, S&P's PMI survey came as a negative surprise. In fact, it showed a marked loss of momentum in activity at the start of the second quarter in both sectors, albeit to a greater extent in manufacturing.

This contrasts with the good momentum seen since the start of the year. The survey reveals that a deterioration in demand is the main cause of this weakening in activity. According to the survey, the deterioration in business activity has led companies in some sectors to start cutting back their workforce quite sharply.

Fig.4 United States: According to S&P's preliminary survey for April,

activity in both services and manufacturing slowed markedly.

- PMI Markit composite

- Services

- Manufacturing

At the same time, this more difficult environment is likely to result in less pressure on costs, particularly in services. This seems surprising, given that the labour market remains tight, even if wages are slowing. On the other hand, in the manufacturing sector, it would appear that price pressures have increased, notably as a result of higher input costs.

If price pressures in services are indeed easing more quickly, this would be good news for the Fed, particularly if it is accompanied by a gradual deceleration in activity.

However, we will have to see whether the ISM surveys at the beginning of May confirm this slowing trend and, above all, whether the forthcoming price statistics confirm a greater moderation in price growth than we have seen since the start of the year.