Economic outlook impacted by political crisis

Link

-

The situation in France remains unclear as to the direction the country will take after the parliamentary elections. Market concerns about fiscal balances and future economic measures continue to put pressure on French assets. The yield spread between French sovereign bonds remains at its widest, at almost 80 basis points, or just under double the level prevailing before the announcement of early parliamentary elections.

-

Nevertheless, at this stage, the markets are far from anticipating a worst-case scenario. In other words, the implementation of policies that would severely handicap growth and lead to a major slippage in public finances. As details of the programs emerge, we can't rule out further significant volatility affecting French and European assets. As far as France is concerned, the risk premium that has emerged on the country is likely to remain in place for some time. We remain cautious on Europe and France, but without giving in to any panic.

-

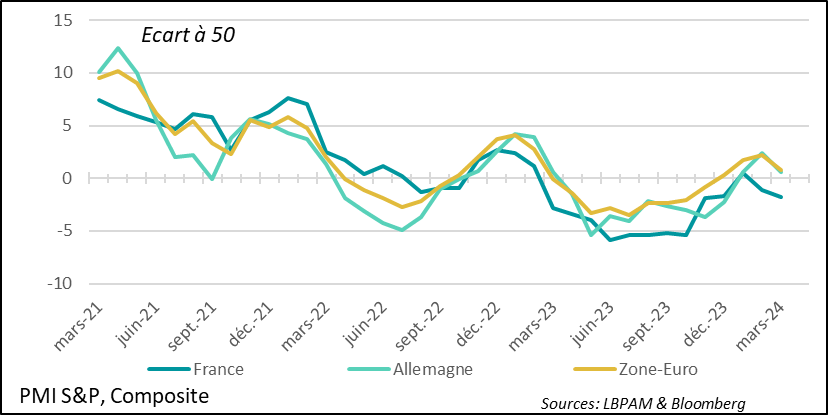

Eurozone PMIs for June have been published. First of all, they seem to show that the impact of the outcome of the European elections in the major countries has somewhat affected confidence. Indeed, it was in France that the PMI fell the most. Nevertheless, other factors also seem to have affected the zone's growth prospects, notably in the manufacturing sector. However, some peripheral countries, including Spain, still seem to be enjoying a more buoyant dynamic. All in all, thanks to services, we can take comfort in the fact that the recovery dynamic still seems to be in place, even if it seems to have slowed down.

-

The fact that the deterioration in activity as indicated by the PMIs was due to the political situation is clearly visible in INSEE's survey of the business climate in France for the month of June. In fact, this survey, which was carried out before June 10, shows stability, whereas the PMI survey, which was largely carried out afterwards, clearly shows a deterioration in the economic climate.

-

In the United States, S&P's PMI survey once again surprised on the upside. In both the manufacturing and services sectors, both indices rose. For the manufacturing sector, this contrasts with the last ISM survey, which indicated a clear weakening in industrial activity. On the other hand, this survey confirms that the services sector remains buoyant, with the index reaching its highest level in over 2 years. These surveys point to more robust activity than we had expected.

-

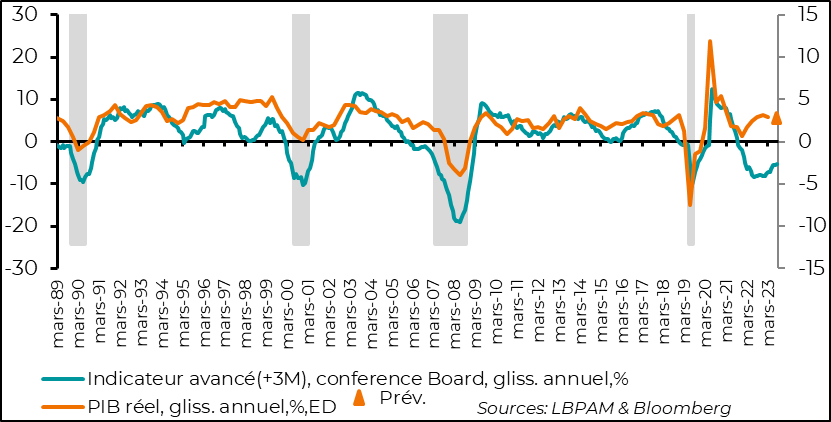

In addition, the Conference Board's leading indicator continued to recover, showing a less sharp deceleration in activity over the coming months than in previous months. Nevertheless, the indicator has so far been much more pessimistic about growth dynamics than is actually the case.

The first effects of the uncertainties caused by the outcome of the European elections, but above all by the announcement of early parliamentary elections in France, seem to be reflected in S&P's preliminary PMI surveys for June. Indeed, the PMI showed a deceleration in activity in the Eurozone, with the composite PMI, which groups together the manufacturing and services sectors, falling by two points over the month. It lost two points over the month. The decline mainly affected the manufacturing sector.

The preliminary survey does not give details for all countries in the Zone, but only for Germany and France.

Given France's more pronounced loss of momentum, and the fact that the survey includes responses after June 10, it's safe to assume that the uncertainty caused by the outcome of the forthcoming parliamentary elections may well have undermined business sentiment.

This conclusion is also borne out by the fact that INSEE's business climate survey showed that the index stagnated again in June. Although business sentiment remained slightly below the long-term average, it did not deteriorate any further. However, this survey was conducted prior to the announcement of the early elections. As a result, the PMI survey, which was largely carried out after June 10, while reflecting the weakness reflected in the INSEE indicator, deteriorated further, surely reflecting the anxiety created.

At the same time, it should be stressed that the composite indicator for the Zone as a whole remains above the 50 mark, which separates expansion from contraction. This is thanks in particular to activity in the services sector in the other countries of the Zone.

Fig 1 Eurozone: Activity decelerated in June, with France down sharply, while services activity held up well in the rest of the zone.

-France

-Germany

-Euro zone

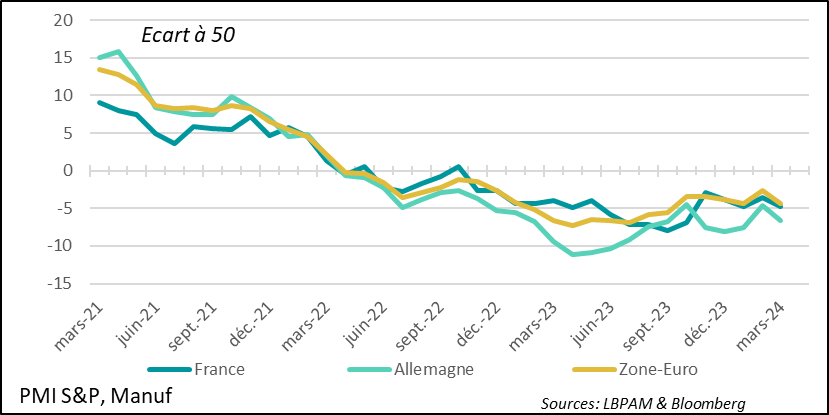

Unfortunately, although France showed a deterioration in manufacturing activity, this was even more pronounced in Germany. It is likely that the uncertainties associated with the introduction of customs barriers against China, and the possibility of retaliation, have affected business sentiment across the Rhine.

Fig.2 Euro zone: Manufacturing activity deteriorated in June, breaking the recovery momentum. Germany made a significant contribution to this decline.

-France

-Germany

-Euro zone

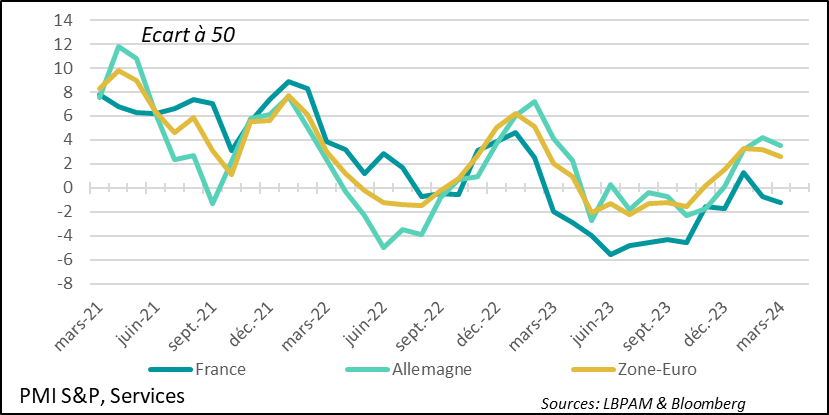

The services survey was the most favorable point, despite the deceleration. Indeed, for the Zone as a whole, the deterioration was slight and the sector continues to expand.

This is reassuring, and leads us to believe that the gradual recovery of the Zone's economy will continue. In our view, it should gain momentum with the ECB's continued, albeit gradual, monetary easing.

On the other hand, we need to remain cautious about the impact of the French elections, should political instability continue.

In the face of uncertainty, we remain cautious on European assets, and French ones in particular, but without succumbing to panic.

Fig.3 Euro-zone: Services activity continues to expand, albeit at a slower pace in June...except in France

-France

-Germany

-Euro zone

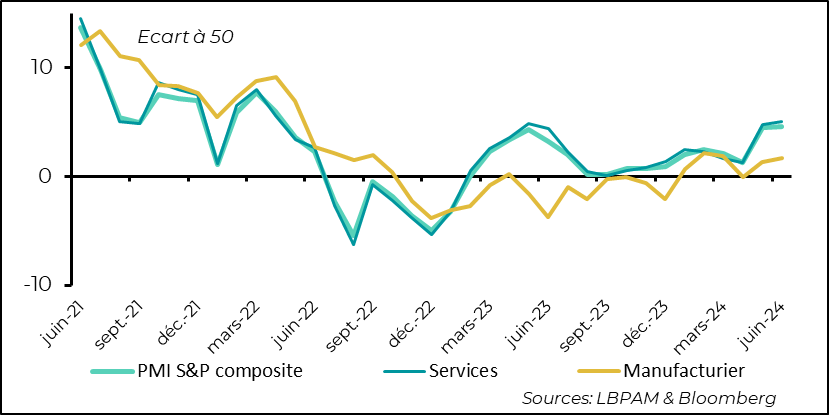

In the United States, S&P's PMI surveys came out very favorably for the US economy. In fact, the surveys show an upturn in activity in both the manufacturing and service sectors. The improvement is particularly strong in services, where the index is at its highest level in over 2 years.

The survey also underlines the continuing recovery in the manufacturing sector, somewhat in contrast to the indications given by the previous month's ISM survey, which showed a deterioration, even pushing the sector into contraction territory. Next week, we'll see whether the June ISM manufacturing survey confirms this upturn in manufacturing activity.

It should also be noted that the survey indicated that companies were seeing a moderation in price rises, which is good news for the Fed. On the other hand, hiring picked up in both sectors of the economy, which could put further pressure on wages.

Fig.4 United States: Activity appears to have accelerated in June according to S&P's preliminary June PMI survey

-PMI S&P composite

-Services

-Manufacturer

The Conference Board's leading indicator, which has historically been a good guide to the US business cycle, continues to indicate that the economy is set to decelerate in the months ahead. Nevertheless, this deceleration will be less severe than previously anticipated.

It's true that this indicator has been sending out far too negative a message in relation to the economy's true performance for over a year now. This surely underlines the specific nature of the unprecedented shocks we have experienced and the particular characteristics of the recovery we are experiencing. As the economy normalizes, it is possible that this indicator will become more in line with the reality of US growth, hence the interest in continuing to follow it, in our opinion.

Fig.5 United States: The Conference Board's leading indicator points to a forthcoming deceleration in the US economy, albeit of lesser magnitude than previously.

- Leading Indicator (+3M), Conference Board, year-on-year, %, (+3M), Conference Board, year-on-year, %.

- Real GDP, year-on-year, %ED