Economic resilience and a dovish Fed set a favorable backdrop for the fall season

Link

Key takeaways from the september 5 , 2025 market update insights from Sebastian Paris Horvitz

Overview

► Markets remained cautious this week ahead of the release of the U.S. August jobs report this afternoon, which—along with next week's inflation data—are the last two major publications before the likely Fed rate cut on September 17.

Last month’s very disappointing jobs reports marked a decisive shift in the Fed’s tone, to the point that a mid-September rate cut has now become almost a certainty.

► It would now take a major surprise in the jobs data to alter the Fed’s plans in such a short timeframe. That said, a report confirming that the U.S. slowdown remains gradual and contained could temper expectations for further rate cuts beyond September, which we believe are currently somewhat aggressive.

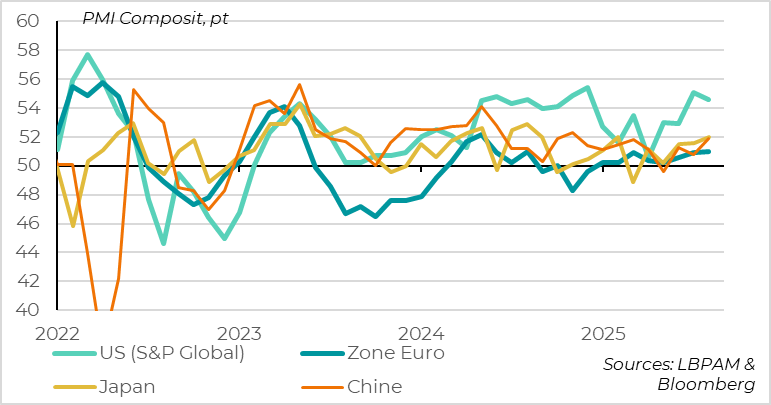

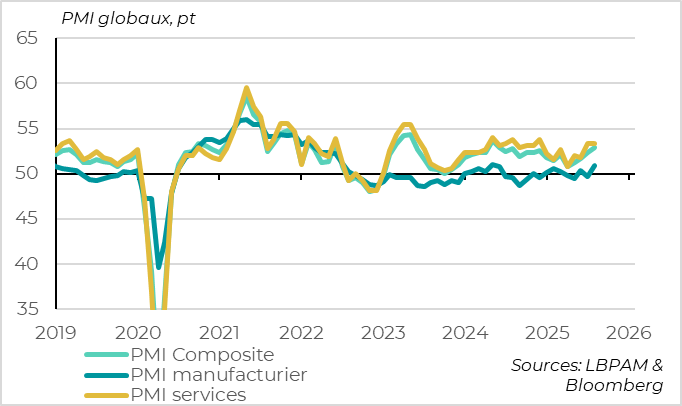

► Beyond the Fed, the market environment is supported by positive macroeconomic surprises. This week, it was the global PMI for August that surprised to the upside, rising from 52.5 to 52.9 points. In addition to returning close to its historical average, the PMI showed more widespread improvement in August across both sectors and regions. This suggests that the global economy is still withstanding the impact of tariffs this summer, and may even reaccelerate slightly faster than we anticipated in the second half of the year. That said, business confidence may have been overstated in August due to reduced uncertainty, and we still believe the negative impact of the trade war will continue to spread and limit growth through the end of the year.

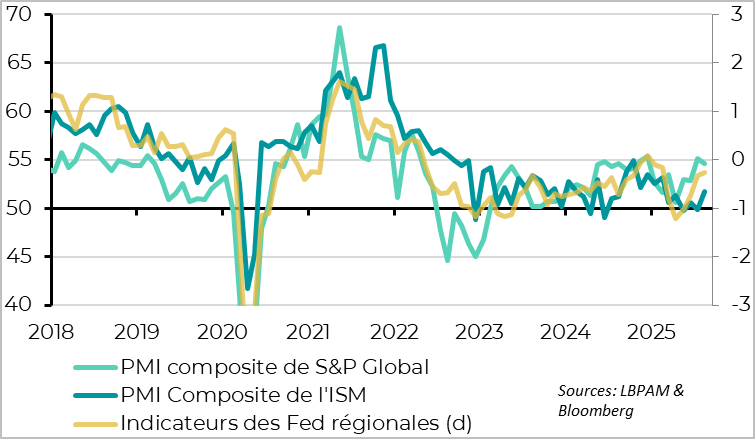

►The U.S. ISM Services Index, the best coincident indicator of the American economy, clearly illustrates our point. It rebounded more than expected in August, rising to 52.0 points after hovering near the stagnation zone since May. This reduces the short-term risk of recession. However, the details show that this increase still reflects inventory buildup ahead of further expected price hikes, suggesting that the impact of tariff increases is delayed and more gradual than anticipated — but not canceled.

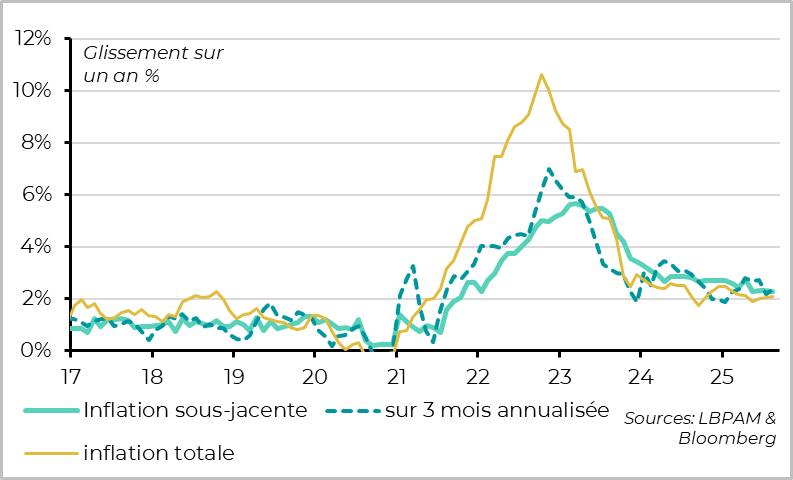

► In the Eurozone, inflation slightly surprised to the upside in August, with headline inflation climbing back above 2% and core inflation remaining stable at 2.3%. These figures do not challenge the view that inflation is normalizing in the Eurozone and could dip slightly below the 2% target over the course of next year. However, they serve as a reminder that the end of disinflation in services remains slow. This should reinforce the ECB’s intention to keep rates steady and maintain a neutral tone at its upcoming meeting next week.

In-Depth insights

The global economic outlook is delivering positive surprise this summer

The global PMI rose to its hightest level in over a year in August

The global composite PMI rose again in August, from 52.5 to 52.9 points. This fourth consecutive increase brings the index to its highest level since the first half of 2024 and close to its long-term average, after signaling stagnation back in April. This aligns with a global economy that is stabilizing following the notable slowdown in the first half of the year, and which may even be operating near its potential pace this summer.

The rise in business confidence in August may have been overstated due to reduced uncertainty following the late-July trade agreements. Still, it is noteworthy that the PMI is rebounding even as the average U.S. tariff continued to rise with those agreements. In any case, this reduces the risk that the economic slowdown seen in the first half will intensify over the summer.

From a sectoral perspective, August’s PMI increase was driven by a rebound in the manufacturing PMI, which reversed its July decline and returned to expansion territory (at 50.9 points). This suggests that the anticipated slowdown in U.S. spending ahead of tariff hikes has not yet materialized this summer. That said, we still expect it to weigh on global industrial activity in the coming months.

Meanwhile, the services PMI remained nearly stable in August after a sharp rise in July, holding at a reassuring level (53.4 points). This is less surprising for a sector less exposed to tariffs and benefiting from reduced uncertainty and looser financial conditions.

PMI growth was more broad-based in August

The global composite PMI rose again in August, from 52.5 to 52.9 points. This fourth consecutive increase brings the index to its highest level since the first half of 2024 and close to its long-term average, after signaling stagnation in April. This aligns with a global economy that is stabilizing following a notable slowdown in the first half of the year, and which may even be operating near its potential pace this summer.

The rise in business confidence in August may have been overstated due to reduced uncertainty following the late-July trade agreements. Still, it is noteworthy that the PMI rebounded even as the average U.S. tariff continued to rise under those agreements. In any case, this reduces the risk of the economic slowdown seen in the first half intensifying over the summer.

Sector-wise, August’s PMI increase was driven by a rebound in the manufacturing PMI, which reversed its July decline and returned to expansion territory (at 50.9 points). This suggests that the anticipated drag from front-loaded U.S. spending ahead of tariff hikes has not yet materialized this summer. That said, we still expect it to weigh on global industrial activity in the coming months.

Meanwhile, the services PMI remained nearly stable in August after a strong rise in July, holding at a reassuring level (53.4 points). This is less surprising for a sector less exposed to tariffs and benefiting from reduced uncertainty and looser financial conditions.

The rise in PMIs was more broad-based in August

From a geographical perspective, the rise in the global PMI was more widespread in August than in July, which is reassuring for the resilience of the global economy. The U.S. S&P Global PMI edged down slightly in August (-0.5 points), but this followed a sharp increase the previous month (+2 points), keeping the index at a high level (54.6). More importantly, PMIs rose in August from lower levels in other major developed economies as well as in emerging markets, moving further away from contraction territory — with readings of 51 points for the Eurozone, 52 for Japan, and 51.9 for China.

The global economic outlook is delivering positive surprise this summer

The August ISM confirms the resilience of the economy this summer

The U.S. ISM Services Index rebounded more than expected in August, rising to 52.0 points after hovering near the economic stagnation zone since May. The gap between the ISM survey and other U.S. business surveys (such as the S&P Global PMI and regional Fed indicators), which had been more reassuring since June, is now narrowing. Taken together, these indicators point to a slight recovery in activity this summer following the weakness seen in the spring, even though the ISM still signals only modest growth.

This supports our revised scenario, which anticipates U.S. growth stabilizing around its pace from the first half of the year (~1.5%). While this represents a clear slowdown compared to recent years, it remains more firmly in positive territory than previously feared.

But U.S. businesses remain cautious in the face of upcoming price increases

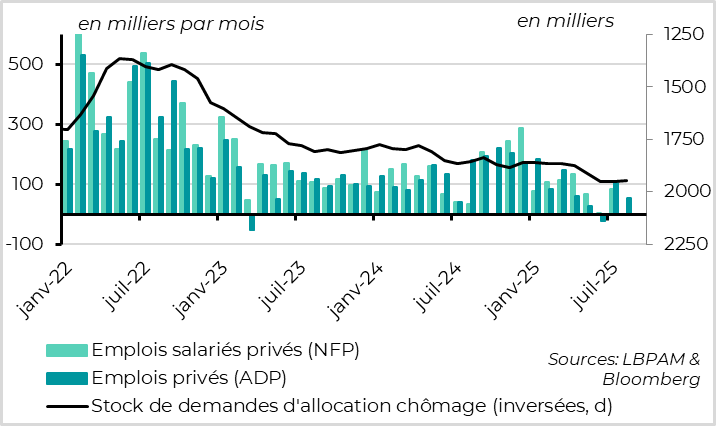

Ahead of the August jobs reports released today, recent data on the U.S. labor market remains consistent with a significant but gradual slowdown in hiring, without a marked increase in layoffs. According to ADP, private sector job creation slowed more than expected in August, from 100,000 to 50,000, although this is still slightly above second-quarter levels. Unemployment claims stabilized in August after rising in the previous two months, and they remain at relatively low levels. Finally, job openings declined more than expected in July, falling below the number of unemployed for the first time since mid-2021, although hiring and quit rates remain stable at solid levels.

If confirmed by today’s official reports, a labor market that is slowing but remains close to equilibrium would justify a slightly less restrictive monetary policy from the Fed going forward — but not aggressive or rapid rate cuts. We continue to expect cautious rate reductions from the Fed starting in September, with 25 basis points per quarter through next spring.

Eurozone inflation has normalized but is no longer slowing further

Inflation remained just above 2% in August

Inflation in the Eurozone edged slightly higher in August, from 2.0% to 2.1%, as expected. This marginal increase (from 2.04% to 2.05% year-over-year) was driven by less favorable base effects in energy prices and does not challenge the view that inflationary pressures have normalized. Inflation is still expected to remain close to the ECB’s target in the coming months.

That said, core inflation did not slow further in August, contrary to consensus expectations, and remains slightly above target at 2.3%. This is due to services prices, which have been decelerating only gradually since peaking above 5% two years ago. In August, they eased only slightly, from 3.2% to 3.1%.

We continue to believe that the risk is for core inflation to dip slightly below the 2% target in the future, due to the appreciation of the euro and the ongoing slowdown in wage growth — although this may not become evident until mid-2026. In the meantime, the only gradual decline in core inflation allows the ECB to remain in wait-and-see mode, and it is expected to keep rates unchanged and maintain a neutral tone at next week’s meeting.

Sebastian PARIS HORVITZ

Head of research