Employment momentum remains an obstacle for the Fed

Link

-

While the US economic data since mid-April have been weaker than expected, the latest have been more favourable. This was the case for employment in May. Job creation was well above expectations, with 272,000 new positions created, according to the business survey. This once again led to a sharp rise in long-term interest rates, as the market's expectations of Fed rate cuts diminished. This was also reflected in the fall in risky assets.

-

The market paid less attention to the fact that the unemployment rate, calculated using the household survey, rose to 4%, the highest level since the end of 2022. Once again, the household survey was sending out a message that the labour market was less robust. In part, this can be explained by the difficulty of taking migratory flows into account. The market was also focusing, partly correctly, on the business survey, which also showed an acceleration in wages.

-

We will know on Wednesday evening what conclusion the Fed's monetary policy committee will draw from this. The message is likely to be one of caution regarding the easing of monetary policy. We believe that our assumption of a first rate cut in September is at risk. The Fed could keep rates unchanged for longer in order to put more pressure on demand. The statistics for the next two months will be crucial in determining the pace of the cut, and will undoubtedly affect the decisions of the other central banks. This will obviously weigh on the markets.

-

In the eurozone, the latest estimate of GDP growth for 1Q24 was 0.3% for the quarter. However, the details of the contributions made by the various demand components were slightly less favourable. Growth was strongly driven by foreign trade, while investment was particularly weak, which is not good news for the future. We still believe that the economic recovery should continue, but these figures confirm that it should be very gradual.

-

In China, foreign trade figures showed that foreign demand remains a strong support for the Chinese economy. Indeed, in May, dollar-denominated exports grew at a much faster rate than expected, at 7.6% year-on-year. It remains to be seen whether this solid pace will be maintained in the months ahead, given the customs barriers currently being put in place by many of China's trading partners. Imports also grew more slowly than expected, at 1.8% year-on-year, well below expectations. This seems to reflect the fact that domestic demand remains relatively weak.

-

The results of the European Parliament elections are unlikely to change the political balance of power within the Parliament. Nevertheless, the rise of the far right is a major development, especially in the larger countries. In Germany, the Afd is making strong gains, reaching 16% of the vote. But it is above all in France that the far right has achieved a historic result, with over 36% of the vote. In fact, E. Macron has decided to dissolve the Assembly and has called for parliamentary elections in the coming weeks (1st round on 30 June). This situation of uncertainty could create a chaotic movement in the markets over the period. Nevertheless, the uncertainty of the far-right coming to power in France could be put into perspective by the policies pursued by Mrs Meloni in Italy, whose party collected the highest number of votes in the European elections. At this stage, however, Ms Meloni's actions seem a long way from the proposals of the French far right.

In the United States in May, according to the business survey, 272,000 jobs were created, including 229,000 in the private sector, well above expectations. This figure seems to show that the labour market remains very robust. It is this statistic that has attracted most of the market's attention.

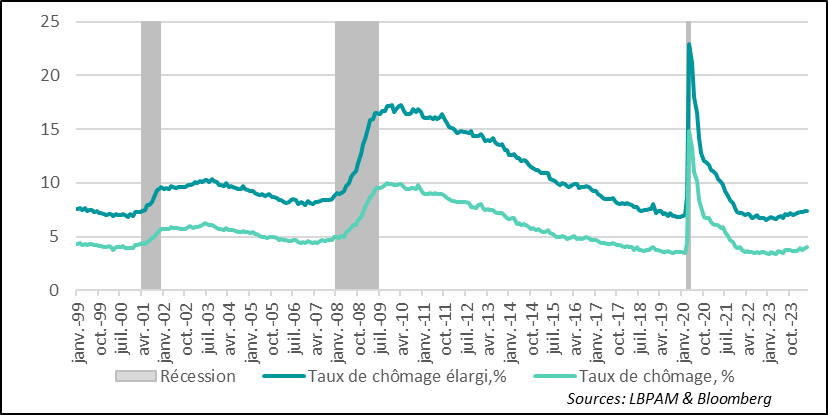

Nevertheless, the household survey, from which the unemployment rate is determined, shows that it has continued to rise, reaching 4%, the highest level since January 2022. This level remains historically low and is only 0.3 points higher than a year ago. The extended unemployment rate, i.e. including people in very insecure jobs, remained unchanged at 7.4%, the highest since the end of 2021.

Fig.1 United States: The unemployment rate continues to rise slightly, reaching 4% in me. This is still a historically low level

Recession

Extended unemployment rate (%)

Unemployment rate(%)

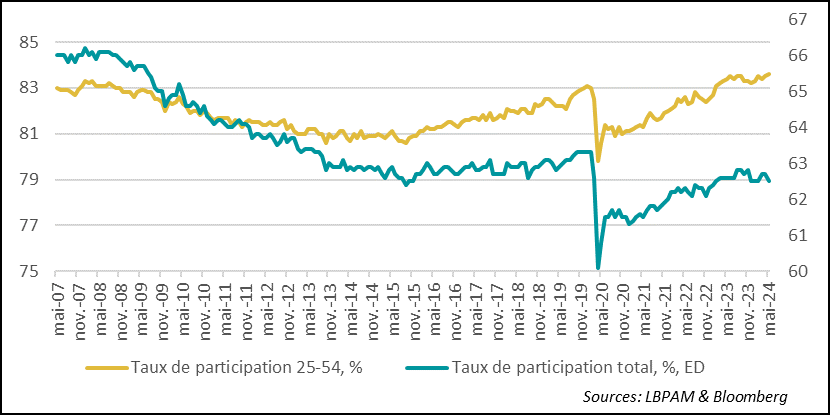

The household survey also reveals that the participation rate fell slightly, to 62.5%, still below the pre-Covid level. This drop is mainly due to a decline in participation among younger people. In fact, the participation rate in the largest age category, the 25-54 age group, has continued to rise, and is now just below the record level of the early 2000s.

Fig.2 United States: The total participation rate fell slightly in May, due to the younger age groups. Nevertheless, turnout in the 25-54 age group was close to an all-time high

Participation rate 25-54 ,(%)

Total participation rate, ,(%) ED

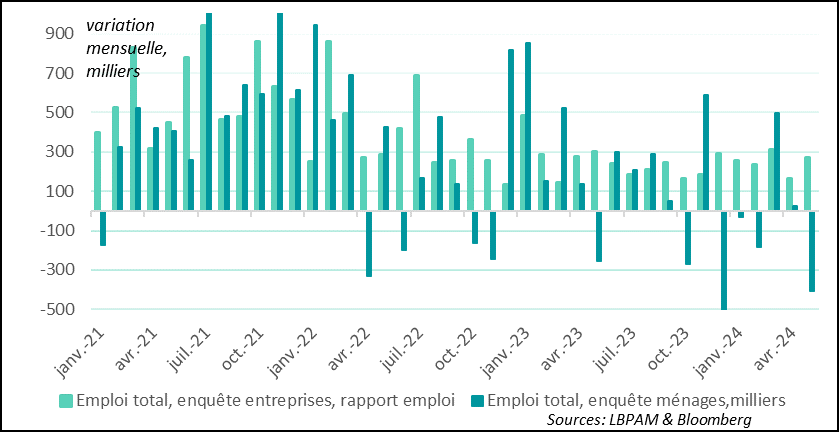

Despite this strong participation in the broader category, it is clear that the household survey gives a much less robust message about the state of the labour market than the business survey. Indeed, while over 270,000 jobs were created according to the business survey in May, 408,000 were destroyed according to the household survey. In fact, over a year, the contrast is very marked, with only 376,000 jobs created according to the household survey, compared with almost 2.8 million according to the business survey.

One of the explanations for this considerable difference is attributed to the large migratory flow, which is poorly taken into account by the household survey.

Fig.3 United States: Another sharp contrast between job creation according to household and business surveys

monthly variation, (thousand)

Total employment, business survey, employment report

Total employment, household survey, (thousands)

We are inclined to give more weight to the business survey, although we must remain cautious. It is likely that this survey may still overestimate job creation.

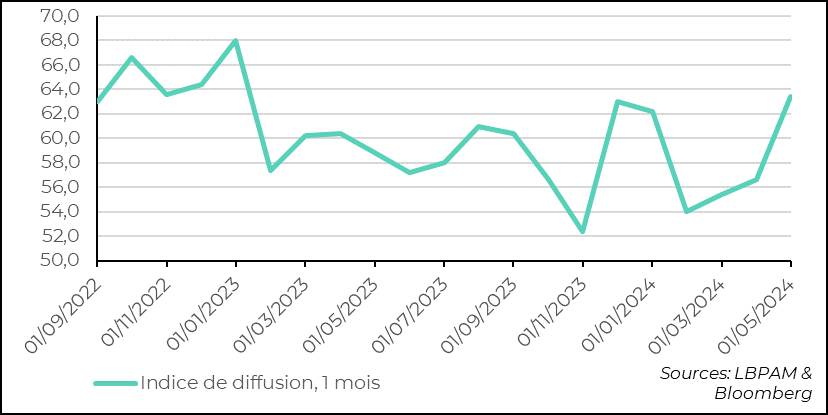

Be that as it may, supporting the robustness of job creation over the month, we can see that it was fairly widespread across all sectors. Thus, the diffusion rate, a measure that determines the number of sectors creating jobs, returned last month to its highest level since the beginning of 2023.

Fig.4 United States: The diffusion rate, a measure of the number of sectors creating jobs, reached its highest level since early 2023 in May

Diffusion index, 1 month

Diffusion index, 1 month

Also lending weight to the idea of the impact of immigration, we see that many jobs continue to be created in healthcare and also in catering.

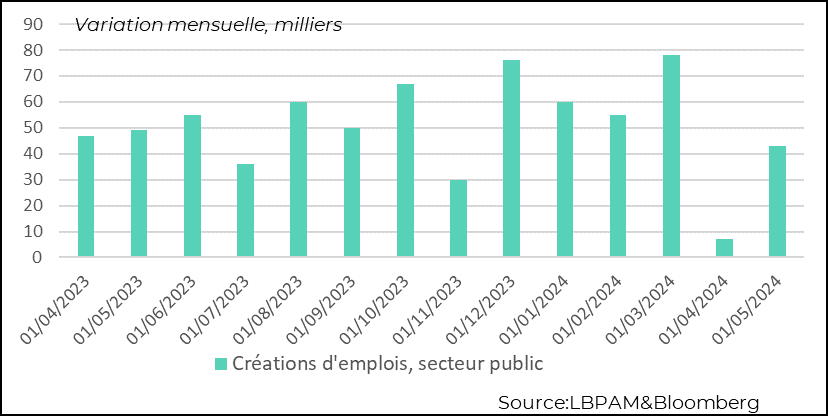

We also saw that the very weak job creation in the public sector the previous month was not a trend, with another big rebound in May, with 43,000 jobs created. This is just below the average of 52,000 over the last 12 months.

Fig.5 United States: Government job creation rebounds sharply in May

monthly variation, (thousand)

monthly variation, (thousand)

job creation, public sector

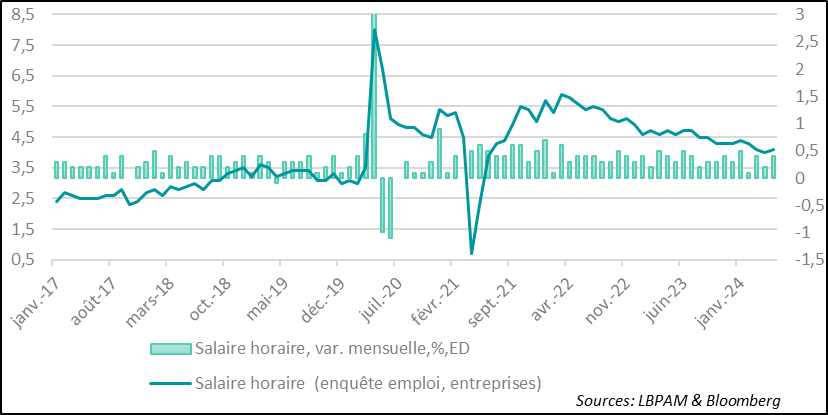

The robustness of job creation according to companies was also reflected in a further acceleration in wage increases. Hourly wages rose by 0.4% over the month, and by 4.1% year-on-year.

As we know, this statistic is subject to construction bias, as it is highly sensitive to the composition of job creation. We will therefore have to wait for the quarterly statistics on labour costs to get a clearer picture, or for the Atlanta Fed's statistics when they become available again.

Fig.6 United States : Wages accelerate in May

Hourly wage, monthly variation, %, ED

Hourly wage (company employment survey)

The Fed is certainly not going to underestimate the message given by the rise in the unemployment rate, but, like the market, it is still likely to place greater emphasis on the data from the business survey, which still show the labour market to be very robust, and the persistence of wage pressures.

Against this backdrop, although there is little risk at this stage of the Fed changing direction, we can expect the tone of the MPC's statement this week to remain cautious about the pace at which monetary policy could be eased in the future.

We will have to wait for the figures on demand, particularly consumer spending, and above all inflation, before a clearer judgement can be made on the direction of monetary policy. However, these figures clearly weaken our forecast of a first rate cut by the Fed in September. This should also have an impact on the pace of rate cuts by the other major central banks.

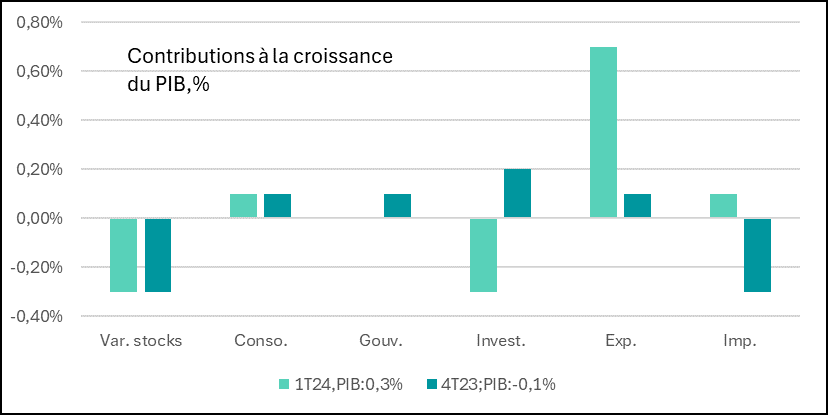

In the Eurozone, we have had the latest estimate of GDP growth for 1Q24. This was confirmed at 0.3%. However, we did receive details of the contributions of the various demand components to growth. The message, at the aggregate level for the zone, is that we need to remain cautious about the economic recovery. Indeed, as we might have expected, it was foreign trade that played a decisive role in the rebound in activity in 1Q24. Domestic demand remained relatively weak.

In particular, investment was much less buoyant than in the previous quarter, which is not very good news. At the same time, the prospect of continued, albeit gradual, monetary easing by the ECB could provide further impetus to the recovery and support investment.

We continue to believe that the recovery is here to stay, but it is likely to be very gradual. And there will continue to be differences between countries.

Fig.7 Eurozone: Contributions to GDP growth show that the recovery still lacks solid support from domestic demand

Contribution to GDP growth,%

1Q24, GDP: 0.3%

4Q23, GDP: -0.1%

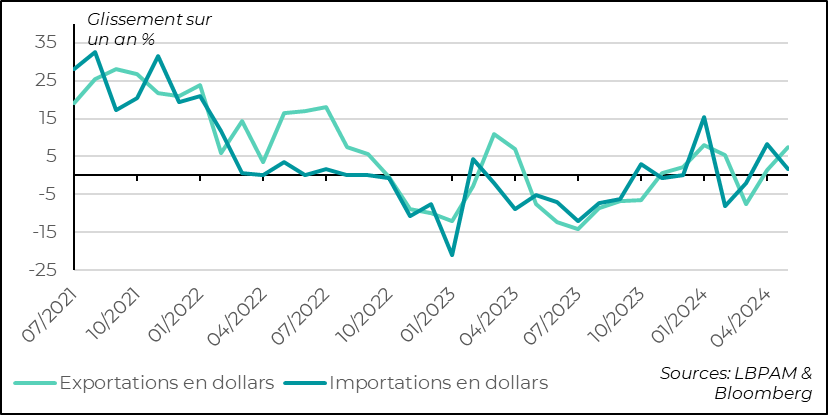

In China, foreign trade statistics for May once again highlighted the ‘imbalance’ in Chinese growth. While exports (in current dollars) rebounded more than expected, rising by 7.6% year-on-year, imports eased, rising by just 1.8%.

These figures seem to confirm that the Chinese export machine is still making a strong contribution to growth, supported as it is by public support for industry. Nonetheless, there are questions about the impact that the barriers being erected against Chinese products in many countries, which are trying to protect themselves from Chinese dumping, could have in the quarters ahead.

At the same time, the relative weakness of imports seems to be in line with domestic demand that is still stalling, with confidence still not restored and preventing a more marked recovery in consumption.

Fig.8 China: Exports continue to drive Chinese growth

One-year shift,%

Export in dollars

Imports in dollars