End of the Shutdown: A Fragile Reprieve for the U.S. Economy

Link

What should we take away from market news on November 14, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overviews

► In the United States, President Trump has signed the bill passed by Congress, allowing the government to resume its activities. However, this measure is only valid until the end of January 2026, which will require another vote and keeps the risk of a new shutdown alive. In the meantime, normalizing the publication of official economic statistics will still take some time.

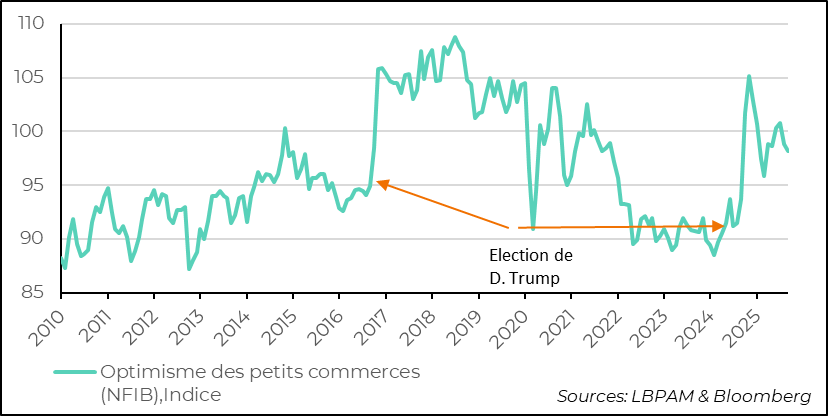

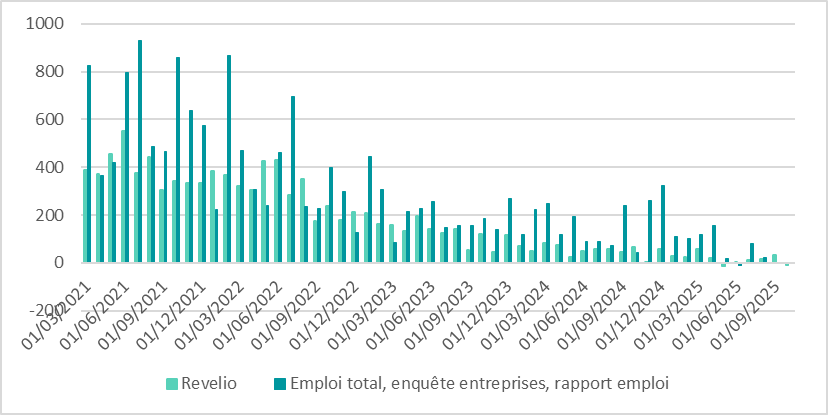

► Although data from private sources on the labor market (such as ADP or Revelio) continue to indicate a weakening job market, other indicators, such as PMIs or ISM surveys, show that the economy remains resilient. However, certain segments reveal vulnerabilities, as evidenced by the decline in small business confidence (NFIB) in November.

► Regarding inflation, pressures linked to tariff increases remain difficult to assess. Revenue from these tariffs is still well below expectations, averaging 11% of total imports compared to the anticipated 16%. This suggests that the full impact has not yet been fully realized.

► The absence of economic statistics, particularly on inflation and employment, is likely to complicate the monetary policy committee’s decision on December 10. Even though these data may show weaknesses, we believe the Fed will remain cautious, as several members fear acting too quickly. A pause seems very likely. However, we anticipate continued cuts in policy rates during the first half of 2026, with a terminal rate above 3%, which is higher than current market expectations.

► Adding to the current uncertainty is the expected Supreme Court decision on the legality of the historic tariff increases imposed by President Trump on most of the United States’ trading partners. According to many constitutional scholars, and given the judges’ skeptical comments during hearings, the likelihood that these increases will be deemed excessive is high. Such a ruling could trigger confusion and volatility in the markets. However, part of these increases could still be maintained through other legal avenues.

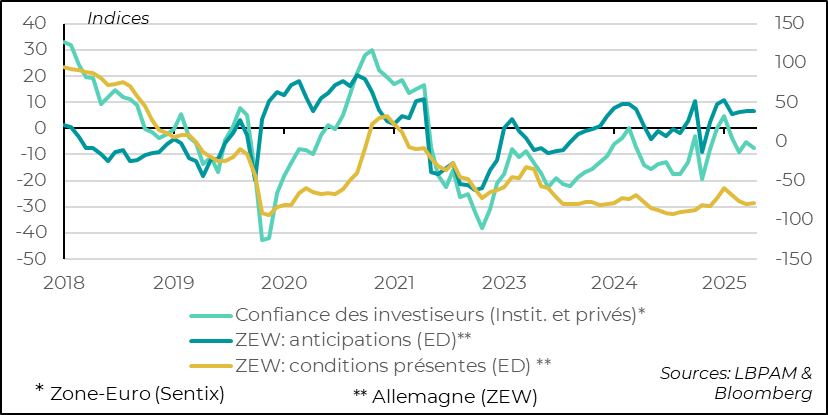

►In the Eurozone, October’s PMI surveys, which were better than expected—particularly in services—provided some reassurance. However, investor confidence remains fragile, as revealed by the November Sentix surveys for the entire region and the ZEW survey for Germany, which declined. We continue to expect a recovery driven by Germany, but it will need support in the face of pressures on foreign trade linked to U.S. tariffs. In this context, we believe the ECB could still opt for further easing, especially as inflation may fall below 2% in 2026 and 2027.

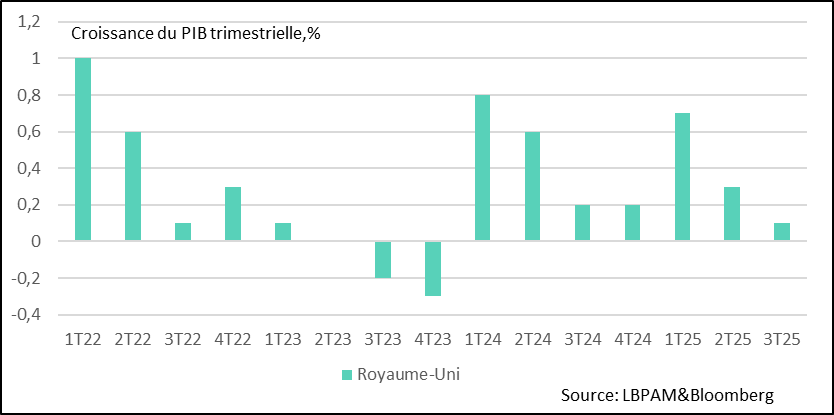

► In the United Kingdom, GDP growth in the third quarter reached only 0.1%, while the labor market continues to ease and inflation appears to have passed its peak. These factors pave the way for the BoE to resume rate cuts as early as December. If, as expected, Chancellor of the Exchequer Ms. Reeves announces tax increases to reduce the public deficit — which would weigh on growth — the BoE will have additional arguments to adopt a more accommodative policy.

Going Further

United States: ongoing uncertainty about the economic outlook

The labor market remains weak according to private surveys.

The shutdown is over. Following an agreement reached with eight Democratic senators, the spending bill was finally passed, allowing the federal government to resume operations. However, this measure only covers the period until the end of January 2026, leaving the risk of another deadlock. The 43-day halt in federal services—a record—will leave scars, even though activity should quickly return to normal, limiting the overall economic impact.

Among these scars are gaps in economic data, particularly those requiring physical collection, such as prices used to measure inflation. Public labor market statistics are also likely to remain disrupted for some time, especially household surveys used to calculate the unemployment rate.

These inflation and employment data are essential for the Fed to assess the economic outlook. Yet, by the time of the monetary policy committee meeting on December 10, the central bank will have incomplete information. October inflation figures are unlikely to be available, and November’s may be partial. Conversely, employment data from business surveys should be published for September, October, and November, but October’s unemployment rate may be missing.

Although the Fed relies on many indicators, official surveys remain crucial for refining its assessment. To monitor the labor market, it can turn to private statistics, such as those from ADP or Revelio. The latter indicates that conditions deteriorated further in October, with an estimated loss of 9,000 jobs.

Meanwhile, activity indicators, notably S&P PMIs and ISM surveys, were reassuring in October, suggesting a recovery, especially in services. These signals reinforce the caution expressed at the last committee meeting, where most members appeared to favor a measured path of rate cuts, calling into question a reduction as early as December, as the market had anticipated.

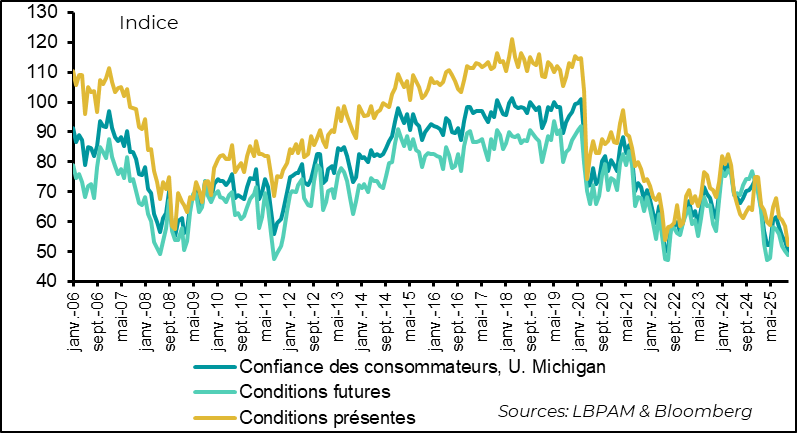

Household confidence, according to the University of Michigan survey, has hit its lowest level since 2022.

The Fed’s task is also complicated by sentiment indicators that continue to reflect a less robust economy. For example, consumer confidence, as measured by the University of Michigan, declined again in early November, reaching its lowest level since 2022. However, the significance of this statistic should be put into perspective: despite weak confidence for several months, consumption has remained resilient so far. The Fed may nevertheless consider that the deterioration in the labor market is behind this weakness and that it will eventually weigh on household spending.

Small business confidence continued to decline in November.

On the business side, the November survey conducted by the NFIB (National Federation of Independent Business) also signaled a weakening, although the decline in the indicator remained moderate.

At this stage, it is clear that Fed members are paying close attention to the deterioration in the labor market. However, as J. Powell pointed out, the government’s aggressive immigration policy complicates the interpretation of statistics. It is not certain that weak job creation will lead to a rapid increase in the unemployment rate.

Moreover, most committee members remain cautious about the impact of tariff hikes on inflation. While the central scenario is still that of a temporary shock, the risk of a more lasting effect exists. The analysis is all the more complex because the total increase in tariffs has not yet been fully implemented: revenues from customs duties represent about 11% of imports, compared to the expected 16%.

In this context, we believe the Fed should remain cautious. Given the uncertainty about the state of the economy in December, the monetary policy committee is likely to keep its policy unchanged. Nevertheless, we anticipate continued cuts in policy rates during the first half of 2026, with a terminal rate above 3%, which is higher than market expectations.

We also believe that U.S. growth, although it may slow in the fourth quarter of 2025, will continue to support risk-taking. However, volatility is expected to remain high due to demanding U.S. equity valuations and uncertainties about the monetary path. Added to this is the potential challenge by the Supreme Court to the tariffs imposed by D. Trump, which could create turbulence. In this context, we favor strong portfolio diversification, with a preference for increased exposure to European and emerging market risk assets.

Eurozone: recovery is confirming, but remains modest

Investor confidence declined in November

Activity surveys for October turned out more favorable than expected, particularly in services. Only France remains slightly behind, although signs of improvement have appeared compared to the previous month. This improvement can partly be explained by the initial effects of the German government’s historic stimulus plan.

However, the first indicators for November, especially investor confidence, are less encouraging, with a slight deterioration in the indices. The Sentix index for the entire Eurozone weakened, while the ZEW index for Germany remains low.

These figures reflect persistent doubts about the Eurozone’s ability to rebound in the coming months, which is understandable. Internal political uncertainties, questions about the swift implementation of the German stimulus plan, and the negative impact of U.S. tariffs continue to weigh, even though the latter factor now seems less concerning.

Despite these reservations, we believe the recovery should gradually gain momentum, supported by the German stimulus plan and a more accommodative monetary policy. On this point, we think the ECB could go further to support the recovery.

Although several ECB members claim that the current policy is appropriate and that no additional rate cuts are planned, it is important to note that inflation forecasts for 2026 and 2027—whether from the ECB or economists remain well below 2%.

China: activity weakens in october

UK GDP grew less than expected in the third quarter of 2025

In the United Kingdom, GDP growth in the third quarter of 2025 disappointed, with an increase limited to 0.1%. This weakness is partly explained by a reduction in public spending and the contraction of the export sector, which resulted in a decline in industrial production.

On the household side, consumption slightly rebounded compared to the previous quarter, posting a 0.2% increase. This shows some resilience in spending, even though signs of weakening support for consumption persist.

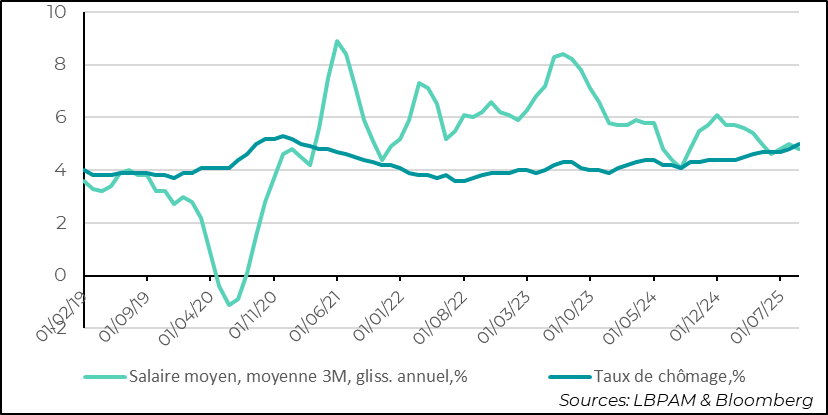

The labor market continues to show signs of weakness

Labor market figures for September confirm the deterioration trend, with job losses for three consecutive months and an increase in the unemployment rate to 5%. In addition, wage growth has resumed a deceleration path, although it remains high at 4.6% in September.

The question for markets is whether these data are enough to prompt the BoE to resume monetary easing as early as December. We believe they are.

The inflation figure expected next week should confirm that the peak linked to government tax hikes has passed. If so, the BoE will have room to act.

Sebastian Paris Horvitz

Head of search