Enough is enough!

Link

- Following the ECB's decision to raise its key interest rates, while signaling that this hike was likely to be its last, the bond market was quick to anticipate the need for a faster-than-expected cut in 2024. The idea is surely that this additional hike could further degrade growth, necessitating monetary easing, at a time when inflation is showing signs of weakening. Bruno Le Maire, France's Finance Minister, while emphasizing the ECB's independence, summed up the central bankers' message and relief by declaring that enough is enough! According to the Minister, the ECB is right: the level of key rates reached is sufficient to tame inflation. We think so too. Nevertheless, it remains to be seen how long monetary policy will have to remain restrictive. We believe that the start of key rate cuts in 2Q2024 is quite possible, given the increased risk of a worsening economic situation.

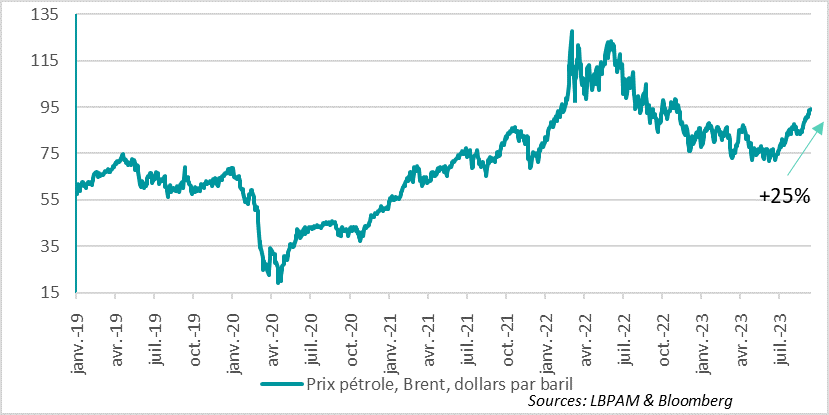

- In addition to monetary tightening, the economic situation could suffer far more than anticipated from the continuing rise in oil prices. Last week, we highlighted the resumption of an upward price trend, following Saudi Arabia's decision to maintain its production cuts. The good news for Europe is that, despite this increase, which will weigh on purchasing power and hence growth, gas prices remain contained. This is partly due to low consumption, which is keeping stocks high. In addition, fears of a strike in Australia have dissipated. Unfortunately, from the point of view of financial conditions, the rise in oil prices has made them more restrictive, as it has pushed up interest rates, particularly on the longest maturities.

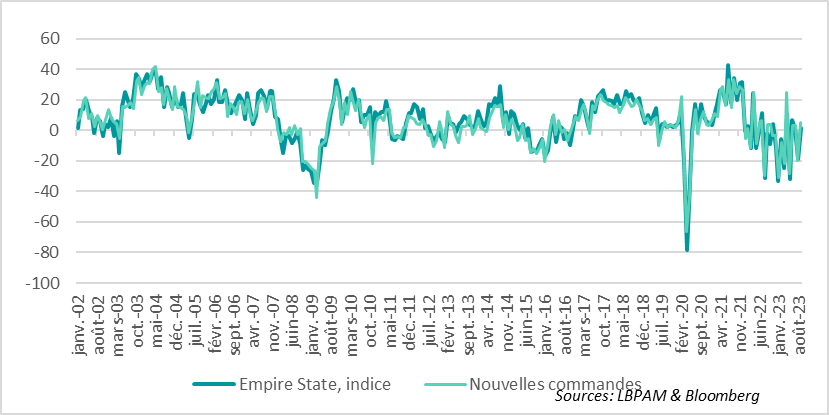

- In the United States, activity data continued to give a message of resilience. Industrial production continued to rise in August, though moderating markedly compared with the previous month. The moderation was partly due to the correction in automobile production, which had risen by almost 5% the previous month and fell by the same amount this month. At the same time, the Fed's indicator of manufacturing activity in the New York region (Empire State) showed a marked increase in September, following the collapse of the index in July. Unfortunately, since Covid's release, the index has been extremely volatile, disrupting its predictive ability on sector activity beyond the New York region. We'll have to wait and see whether activity in the industry is indeed stabilizing or not, as the ISM index recently indicated.

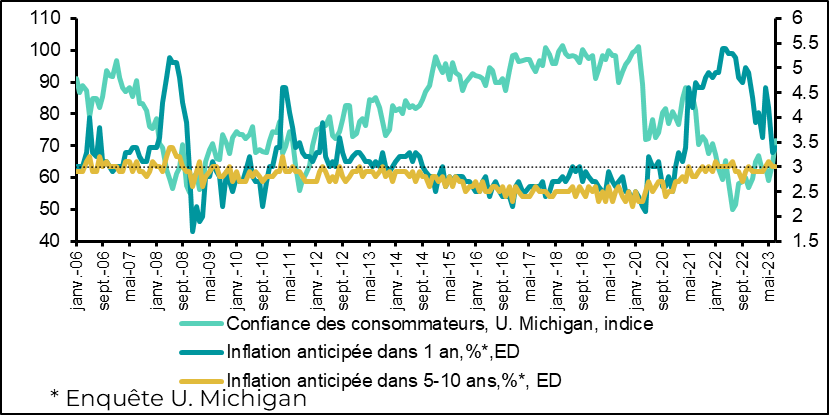

- The University of Michigan's preliminary US consumer confidence indicator lost ground in September, although it remains well above last year's level. Surprisingly, inflation expectations fell for both the short term (1 year) and the long term (5-10 years), reaching their lowest level since early 2021. Nevertheless, this development is surprising in a context where energy prices have continued to rise. Households are also pointing out that they could restrict their consumption of durable goods, due to high prices. The moderation in inflation expectations will be seen as good news by the Fed, and should contribute to the decision not to raise key rates this Wednesday. Nevertheless, the resilience of domestic demand, and the latest inflation data showing that disinflationary momentum is easing, should push central bankers to maintain their restrictive rhetoric and the possibility of a further hike.

- After the Fed, towards the end of the week we have the BoE, which is likely to raise rates again, even if the temptation to wait could prevail in the face of signs of deteriorating activity. Then it's the BoJ's turn, and the market will be listening for any signals from Governor K. Ueda on the possibility of an exit from the current ultra-accommodative monetary policy in the coming months.

The rebound in oil prices has accelerated in recent days, pushing Brent well above $90. This represents an increase of almost 25% over 3 months. Saudi Arabia's production restrictions are obviously playing a part, as is the continuing reduction in the number of wells in operation in the United States. Also, the latest economic statistics from China seem to show that activity is stabilizing, particularly in industry. This is seen as a positive sign for future demand, helping to put upward pressure on the price.

We continue to believe that global growth is likely to remain weak, particularly in the developed world given the current restrictive financial conditions. This should translate into moderate pressure on oil prices.

Of course, more resilient growth, particularly across the Atlantic, could continue to push prices higher. Already, however, rising oil prices must be seen as a new "tax" on consumption, which should have a negative effect on activity.

Central bankers should take this recessionary effect of rising oil prices on board, while at the same time worrying about its impact on corporate pricing, with the risk of further complicating the disinflation dynamic.

Fig.1 Oil: The surge in oil prices continues, with Brent crude topping $94 a barrel.

-Oil price, Brent, dollars per barrel

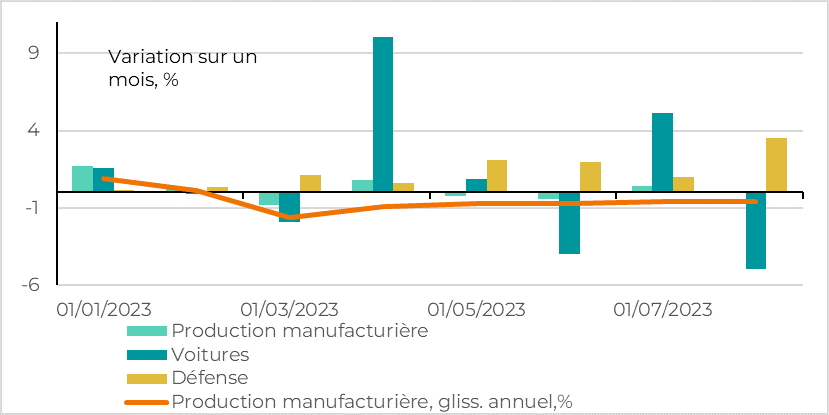

As we all know, activity indicators in the United States have been fairly positive in recent months, particularly those linked to demand, with household consumption remaining solid. On the supply side, indicators have been more mixed at times. As we know, the manufacturing sector remains one of the weakest links in the economic chain. August's data confirmed this weakness, although it is clear that the situation is no longer deteriorating. Year-on-year, industrial production is still contracting by 0.6%.

At the same time, the dynamics within industry are rather erratic. The technology sector remains buoyant, but trends in the automotive sector have been much more volatile. This is largely due to the difficulties of breaking out of the constraints created by the Covid period. In July, for example, there was a sharp rise in production, but this was largely offset by a downward correction in August. At the same time, production in the defense industry continues to accelerate.

The strikes that have begun in the automotive industry, over demands for higher wages, should complicate the situation in the very short term, but production should still be sustained by demand that was severely constrained during the pandemic period.

Fig.2 United States: Industrial production growth slows in August, mainly due to the correction in automobile production

-Manufacturing production

-Cars

-Defense

-Manufacturing production, slide, annual,%

In an attempt to forecast business trends, we follow activity indicators based on business surveys. The New York Fed's indicator of manufacturing activity, known as the Empire State, came out in September much better than expected, showing a clear rebound on the previous month. Almost all segments showed an improvement, particularly new orders.

Fig.3 United States: The New York Fed's indicator of activity in the manufacturing sector showed a clear rebound in August, even though it has been very volatile of late

-%Empire State, index

-New orders

Does this confirm a rebound in the manufacturing sector? In our view, it is possible that production will pick up slightly in the very short term after several months of inventory adjustments. Nevertheless, the restrictive financial conditions in place are likely to weigh on demand and therefore on activity in fine. It therefore seems difficult to see a very solid and, above all, sustainable rebound in these conditions.

On the demand side, the University of Michigan's preliminary household confidence survey for September revealed that the confidence index had lost ground, notably due to perceptions of current conditions. At the same time, although the level of the index remains historically low, it is well above the level that prevailed a year ago. Household concerns continue to be dominated by purchasing power. In particular, households seem inclined to reduce their consumption of durable goods in view of price levels.

Paradoxically, in these conditions, the survey reveals that inflation expectations have fallen sharply. This is all the more strange given that energy prices have risen quite sharply recently. Of course, this statistic is quite volatile, and these expectations could be corrected by the end of the month.

Fig.4 United States: Household inflation expectations fall...despite higher oil prices

-Consumer confidence, U. Michigan, index

-Anticipated inflation in 1 year, %*, ED

-Anticipated inflation in 5-10 years, %*, ED

Nonetheless, for the Fed, the fall in household inflation expectations will be seen as a good thing. This should help keep key rates stable on Wednesday. Nevertheless, we find it difficult to envisage at this stage that the monetary authorities will declare, as the ECB has done, that peak rates are here. The door should remain open to a possible further rise, given the resilience of the economy.