Enough is enough !

Link

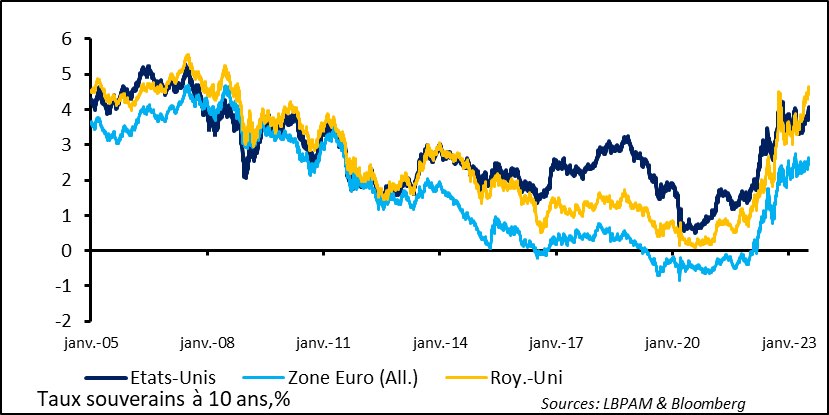

- Risky assets took a hit last week, in particular on European markets. This may have been due in part to the previously steady rise in investor optimism, which left the markets vulnerable as newsflow ultimately fell short of overly positive expectations. Adjustments or hesitations by investors who had recently embraced a brighter future ran head-on into central bank language that remained just as hawkish. Similar to her tone at the ECB’s Sintra meeting, Christine Lagarde continued to insist on the need to cool off the economy into order to bring inflation back to its target. The Fed minutes showed that, despite some differences of opinion, FOMC members intend to tighten further in order to meet their target. And particularly in the United States and the United Kingdom, the latest economic figures do seem to indicate “too much” resilience in economies, posing the risk of keeping inflation too high for too long. In a word: enough is enough! In reaction to these fears, the bond markets suffered a new bout of nervousness, carrying long bond yields to levels close to their 10-year highs.

- Although US job creations were a little weaker than expected, at 209K, the June jobs report exacerbated the upward pressures on long bond yields that had begun a few days earlier. Both US Treasury and 10-year European sovereign yields rose by more than 20 basis points (bp) in one week, as, in addition to solid job creations, the jobless rate fell back and hourly wages continue to rise fast, keeping their year-on-year increase at 4.4%.

- In addition, according to the ISM survey, activity in services rebounded in the US during June. The index thus recovered much of the ground it had lost since last February, showing that services continue to expand, even though the index remains far below its average since spring 2020. The resilience, and even improvement, in services activity is an additional factor pushing the Fed to a status quo on monetary policy. Inflation data for June, due out this week, could very well change things. We still forecast a 25bp rate hike in late July. In the Euro Zone, services activity in June weakened more than expected, particularly in peripheral countries, but continue to expand. The ECB is also expected to raise its rates in July, while keeping one eye on core inflation. All in all, continued central bank hawkishness makes us more cautious in our asset allocation.

- On the geopolitical front, the four-day visit by Janet Yellen, US treasury secretary, was seen as yet another attempt to calm relations between the US and China, following the visit by Anthony Blinken, US secretary of state. According to Yellen, more than 10 hours of meetings should help place Sino-US relations on more solid ground. In particular, she reportedly insisted: 1/ that the US was not trying to hinder China’s development; and 2/ that the strategy for diversifying production chains did not seek to decouple the US from China in terms of trade relations. Not until the presidential summit meeting, the date of which has not yet been set, will it become clear whether tensions have truly receded and, more to the point, whether foreign investors have regained their appetite for Chinese assets.

The bond markets reacted vigorously to risks that inflation would remain high for longer than expected and that monetary policies would accordingly remain hawkish for longer. These risks have been reflected in the surge in long-term interest rates on both sides of the Atlantic for at least the past week. Ten-year yields in the US, the Euro Zone and UK all rose by more than 20 bp in one week. The resilience of economic activity and the possible persistence of inflationary pressures for even longer seem to have pushed investors into requiring greater returns.

Fig. 1 – Interest rates: long bond yields have moved back up, approaching or exceeding their 10-year highs

Jan US Euro Zone (Germ.) UK // 10 year sovereign yields,%

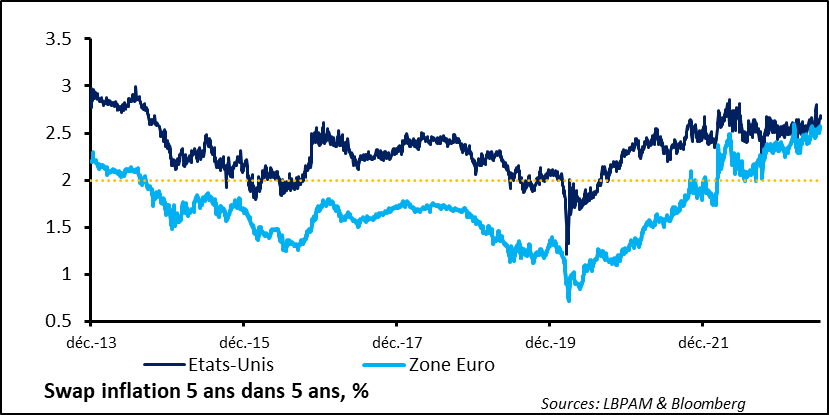

Although rising, inflation expectations remain rather well anchored, meaning that, for the moment, central banks continue to enjoy the necessary credibility on their ability to bring inflation to their 2% target. Even so, the recent trajectory could raise concerns among central banks of a possible risk of de-anchoring inflation expectations, something that can only encourage them to stick to a hawkish policy.

The good news, at least for Europe, is that we do appear to have exited the inflationary risk that had overshadowed the previous decade. But this victory must be consolidated to keep expectations from going too far.

Fig. 2 – Interest rates: despite rising, inflation expectations remain relatively well anchored on both sides of the Atlantic.

US Euro Zone // 5 year, 5 year inflation swap, % Dec.

We still believe that the ECB is close to the end of its monetary tightening cycle, albeit with a significant risk at this stage of exceeding our 3.75% terminal key rate forecast.

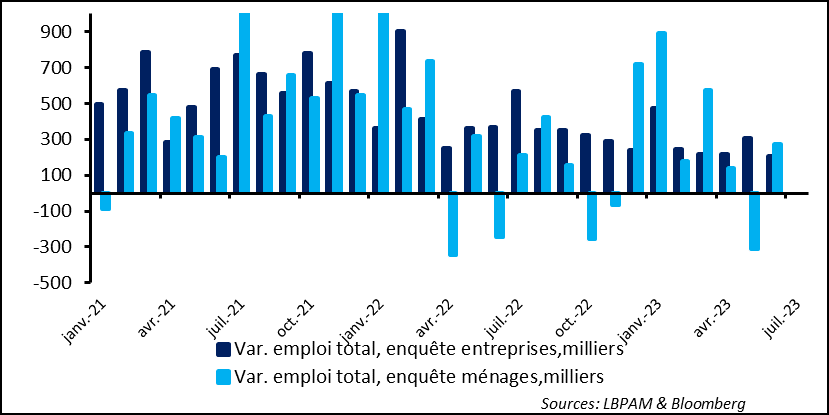

The US jobs report for June once again showed that job creations remain strong, albeit less so than in previous months. Although the US economy created 209K jobs in June, this was a bit lower than the consensus of economists and it was a more than two-year low. In fact, in the private sector, the 149K new job creations was the lowest number since the spring 2020 recovery, with the exception of December 2020.

The job market does seem to be losing momentum, albeit from a high base. At the same time, business and household surveys have once again aligned in part, with similar gains that have narrowed the previous month’s very wide gap.

Fig. 3 – US: Business and household surveys have partially realigned.

Jan . Apr. Jul. Oct

Chg. in total employment, business survey, '000

Chg. in total employement, household survey, '000.

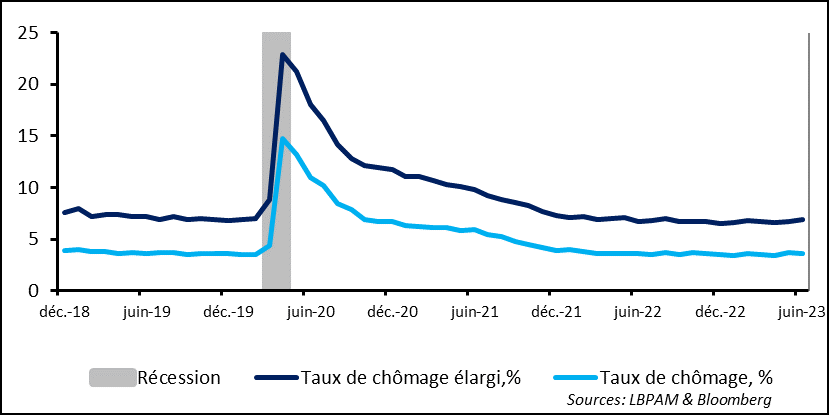

In fact, the household survey showed strong job creations and, hence, a lower unemployment rate. This partially offset May’s strong rise, which had still left the unemployment rate at historically low levels. As a result, the jobless rate slipped back to 3.6% in June from 3.7% previously. At the same time, the broad unemployment rate continues to rise slightly, reflecting something of a loss of momentum on the job market.

Fig. 4 – US: Unemployment fell to 3.6% and, hence, still close to its 50-year low

Dec, Jun ...

Recession

Broad unemployment rate, % Unemployment rate, %

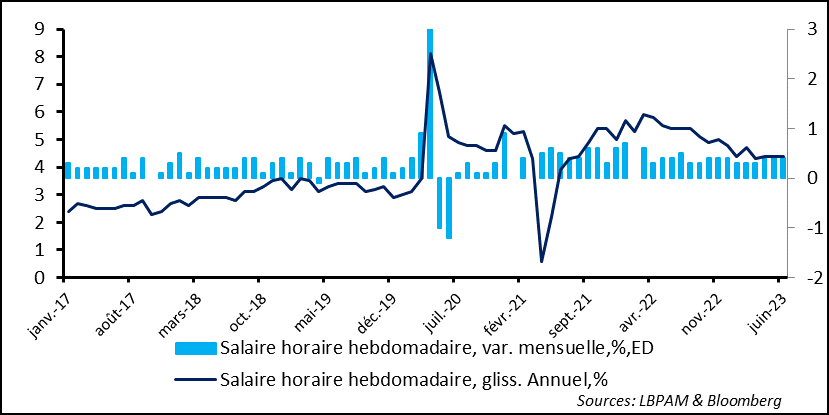

Despite some signs of slowing down, job market resilience can be seen in wage hikes. According to the business survey, the average wage continued to rise fast, by 0.4% month-on-month, as in the two previous months. All in all, wages, as measured by this statistic, which is the least precise one due to possible biases in composition, shows that they nonetheless rose by 4.4% year-on-year in the past quarter. This is a level that is incompatible with a convergence of inflation to 2%.

Fig. 5 – US: Consumption looks far less robust in 1Q23 than in 1Q23 but is being driven by services.

Weekly average wage, MoM % chg. 'right scale)

Weekly average wave, YoY % chg

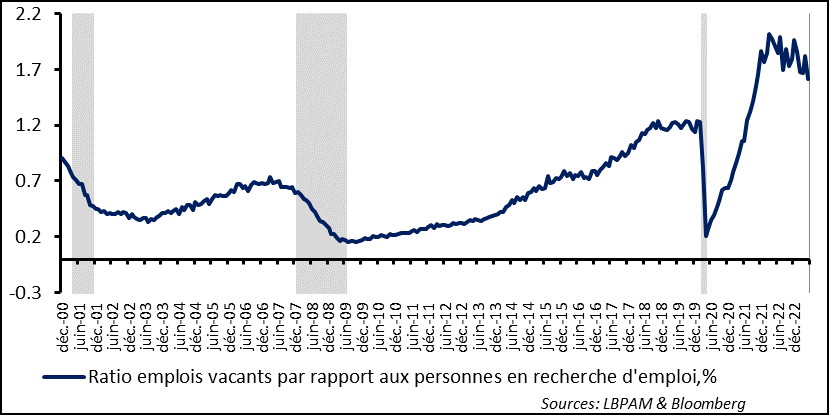

Although it has loosened somewhat, the job market is still tight enough to maintain pressure on wages. Likewise, while job offers continue to recede, they remain at high levels, suggesting that the job markets must loosen up further if the Fed wants to see inflation converge towards it 2% target.

Fig. 6 – US: Job offers are fewer but are still running far ahead of job searches

Ratio of jobs vacancies vs job seekers, %

Dec, Jun, Dec, Jun

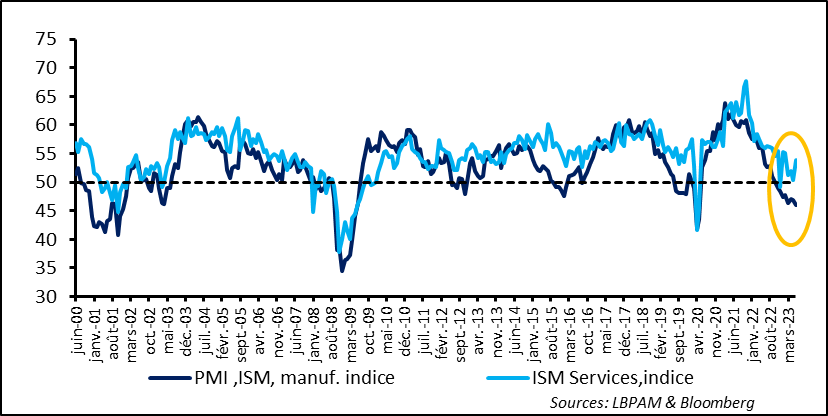

Once again, despite these rather positive signs of a soft landing in the US economy, there still seems to be excess demand which is maintaining overheating, with the risk that inflationary pressures will persist. And, indeed, the services ISM survey for June showed a rebound in activity to a four-month high at 53.9, still in expansion territory. One factor driving this trend is the solid job market, although a slower pace of job creations, with toughening financing conditions could undermine the strength of services in the coming months. This continues to be our assumption, especially as the manufacturing sector continues to suffer.

Fig. 7 – US: According to ISM surveys, activity is picking up, in contrast with a still lacklustre manufacturing sector.

Jun, Jan, Aug, Mar, Oct, May ...

PMI, ISM manu, index ISM services index

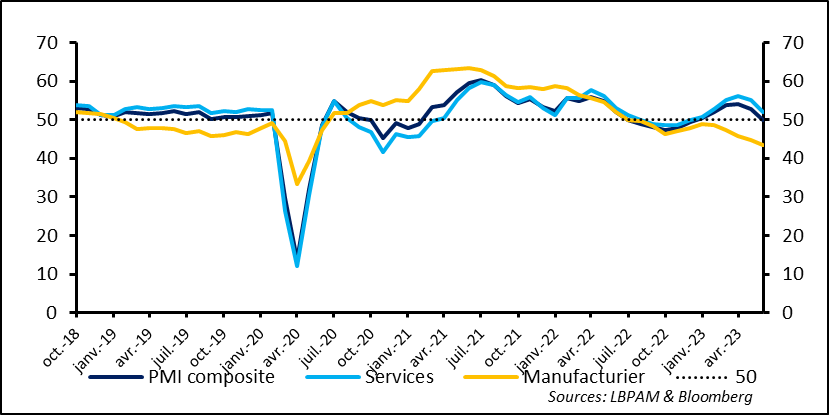

In the Euro Zone, the news in June on economic activity from PMI surveys was rather bad. While manufacturing activity continued to worsen, activity in services also showed signs of slack. In particular, peripheral countries, which until now had made a strong contribution to expansion in the European economy, showed their first signs of weakness in services activities. For example, Italy, which until now had been surprisingly resilient, saw its composite index (both services and manufacturing) fall below 50, the threshold between contraction and expansion in economic activity. Like elsewhere, Italy is also suffering from weakness in its manufacturing sector.

All in all, the PMI composite for the Euro Zone as a whole fell below 50 for the first time since December 2022.

Fig. 8 – Euro Zone: Activity slowed a little more than expected in June, particularly with the slackening in peripheral countries after strong growth

Oct, Jan, Apr, Jul

PMI composite Services Manufacturing

These signs of slack in the economy should reassure the ECB, although, beyond commodity prices, inflationary pressures are still high. Like other central banks, the ECB’s dilemma is still between the risk of not doing enough to combat inflation and the risk of doing too much and sending growth completely off the rails. We expect this uncertainty to steer the markets’ trajectory for some time to come.