Will uncertainty ease a little this week?

Link

The drama of the trade war continues to shake the markets, and it is probably not over.

Summary

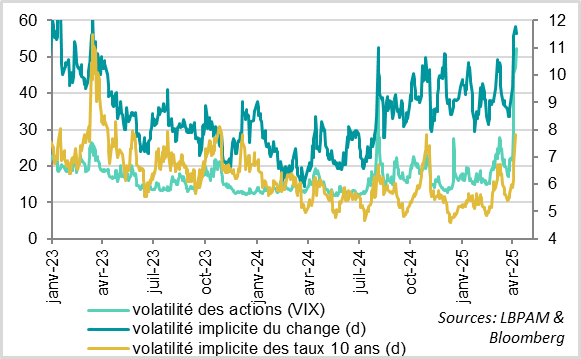

► The drama of the trade war continues to shake the markets, and it is probably not over. Although the markets tried to stabilize after their new drop at the opening on Monday, they continue to decline overall, and volatility remains extreme. In total, stock markets are nearly 15% below the level before the announcement of "reciprocal" tariffs, and volatility exceeds 50% (for the VIX, the fear indicator).

► One thing is certain: the generalized 10% tariff increase came into effect this weekend, and the "reciprocal" tariff increases come into effect today, bringing the average tariff applied by the United States beyond 20% (and close to 25% if we count the tariffs on China raised to 104%). Will they be significantly reduced in the future or increased further (on other "specific" goods, in escalation to retaliations...)? No one knows. Our central scenario is that between targeted reductions and increases, they will generally remain at their current level, but uncertainty is high in both directions.

► If tariffs remain generally close to today's levels, we estimate that this will push the American economy towards recession by mid-year and significantly weigh on the rest of the world. In this case, a sustainable market rebound seems difficult to envisage in the short term. Of course, they would rebound significantly in case of a strong reduction in tariffs, although not completely given the level of uncertainty that will persist.

► Another reason to remain cautious in the short term: American rates have stopped falling and are even rebounding strongly since yesterday, so they no longer absorb the increase in risks. Besides very short-term technical tensions, this reflects the statements of several Fed members who confirm that the latter is not in a hurry to come to the rescue of the economy due to inflation risks. We think it will be necessary to wait to see the clear deterioration of American employment in Q2 before it lowers its rates starting this summer, and that this reduction will be limited by the acceleration of underlying inflation towards 4%. Except in case of a financial shock, of course, especially in the Treasury bond market, which would force an emergency reaction from the Fed.

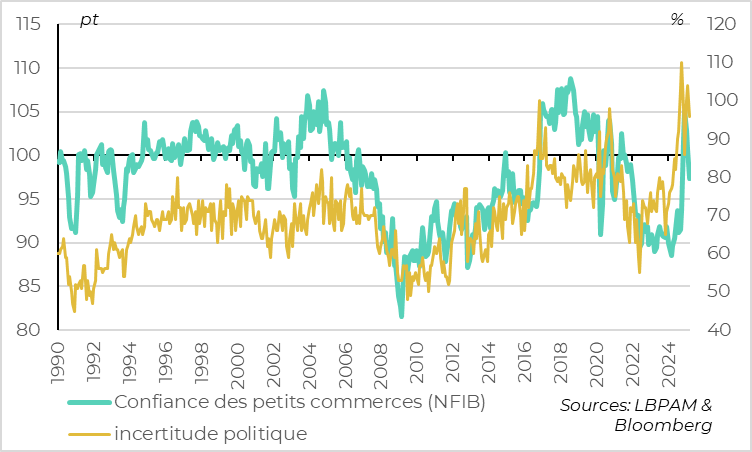

► Confidence is already significantly impacted, which will reinforce the economic slowdown, in the United States as well as in the rest of the world. Thus, the confidence of small businesses in the United States, usually strong under Republican administrations, drops significantly again in March, although the survey was conducted before "liberation day."

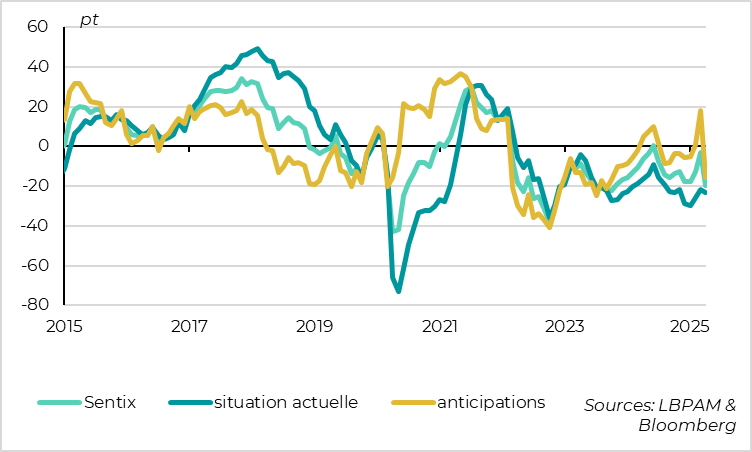

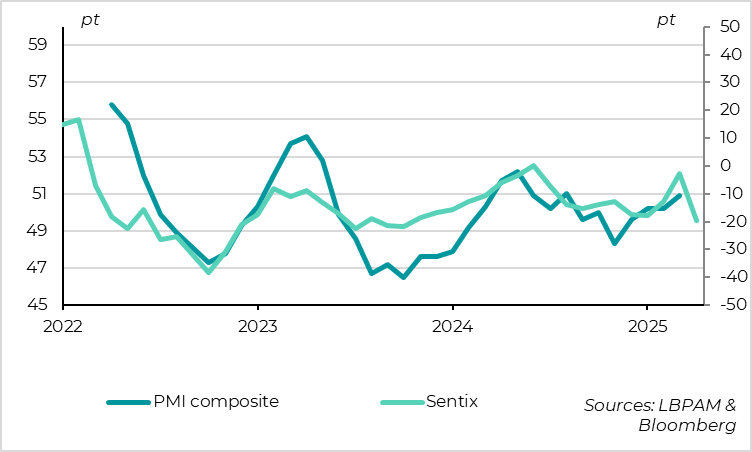

► The first survey for the eurozone conducted after the announcement of tariffs, the Sentix, drops sharply in April after improving in March, going from -3 to -22 points. This drop should be put into perspective as it is a survey of investors and not businesses, but it confirms that the risks for the zone are negative in the short term. The impact of the trade war should indeed materialize more quickly than the support linked to the increase in German investment spending. This puts pressure on our scenario of better resistance of the eurozone than the United States in mid-year, which remains our central scenario.

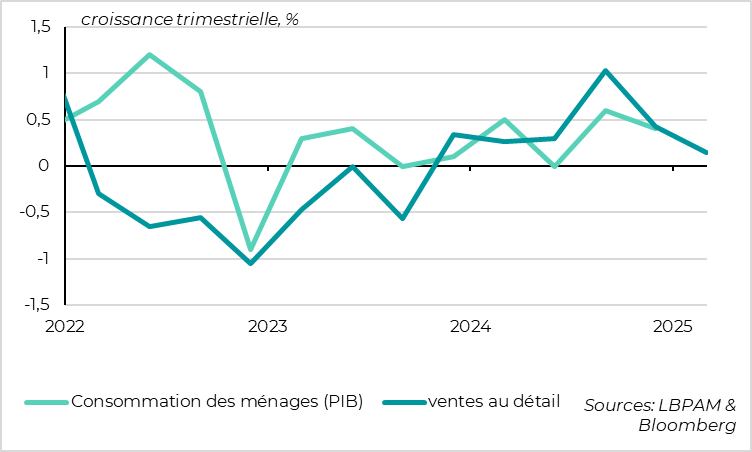

► A reassuring element for the eurozone: consumption seems to resist in Q1 after rebounding in the second half of 2024, according to the slight increase in retail sales in January/February. At least growth remained slightly positive when the trade shock hit the European economy.

To do deeper

Markets: Volatility Becomes Extreme Amid Trade War Escalation

Markets are attempting to rebound but continue to decline. After the new market drop at the opening on Monday following the strong Chinese retaliation (imposing 34% tariffs on the United States and stating they are ready to "fight to the end"), the markets tried to rebound twice on Monday and Tuesday, without success. On Monday, a rumor about a possible delay in the application of reciprocal tariffs allowed a very temporary market rebound of more than 5%, but this was erased after a denial from the White House. Yesterday, the markets slightly recovered with the hope that negotiations to reduce tariffs were progressing (Bessent said everything was negotiable and D. Trump mentioned that a deal with Korea seemed on track). But these hopes were dashed by signs that retaliations were moving faster than negotiations. Indeed, the EU began announcing limited retaliations related to American tariffs on steel and aluminum (the response to auto tariffs and reciprocal tariffs of 20% is expected later and could include taxes on digital companies) and, above all, D. Trump announced a 50% increase in tariffs on China to respond to Chinese retaliations (resulting in a tariff rate on China exceeding 100% today).

What remains: markets down nearly 15% over the past week and volatility at an extreme level. Thus, the VIX, the market fear indicator, now exceeds 50%. And volatility in exchange rates and interest rates is also increasing sharply, which raises the risk of a short-term financial system accident.

United States: SME Confidence Was Already Declining in March, Before the Latest Announcements

Beyond the markets, economic data from recent months provides little information on prospects given the abrupt change in the macro environment caused by political shocks. It will probably be necessary to wait until summer to begin analyzing the impact of the shock on the economy.

In the meantime, surveys show a sharp decline in confidence due to uncertainties, which, in addition to the tax increases, will weigh on the economy.

In the United States, small business confidence fell sharply for the third consecutive month in March, according to the NFIB survey. It fell below its long-term average, although it remains above its level before Donald Trump's election. But this is already a negative sign given the tendency of this survey to remain high under Republican administrations and given that it was conducted at the end of March, i.e., before the announcement of reciprocal tariffs.

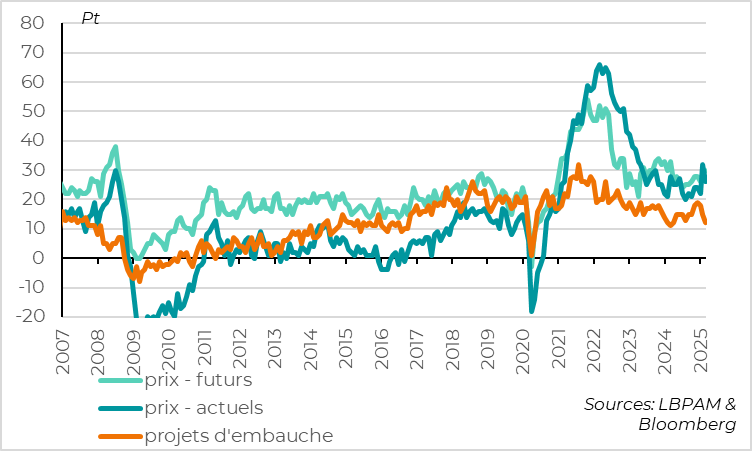

United States: SMEs Confirm the Stagflationary Nature of Tariffs

Furthermore, small businesses confirm the stagflationary nature of tariff increases. Thus, they anticipate both an increase in their selling prices and a slowdown in their hiring, which is unusual. There is no doubt that the latest tariff increases, which are much more significant than those already announced at the time of the survey, will reinforce this gap.

Eurozone: Investor Confidence Plummets After Reciprocal Tariffs

For the eurozone, the Sentix survey conducted in early April among investors (i.e., after the announcement of reciprocal tariffs) collapses in April. Confidence had rebounded to -3 points in March after the announcement of historic plans to increase budget spending in Germany. But it drops to -20 in early April, its lowest level since late 2023.

This decline stems from the drop in activity expectations for the coming months, which fell from a high since the start of the war in Ukraine in March to a low since 2023 in April. This drop is as significant as those experienced during the Covid shock (March 2020) and the war in Ukraine (March 2022).

Eurozone: A Negative Sign for Short-Term Activity

Of course, we take this Sentix survey of investors with a grain of salt, as they can overreact and it does not reflect what is really happening in businesses. But it must be acknowledged that it historically captures PMI trend changes well, and it is not a reassuring sign for the April PMIs that will be published at the end of the month.

Eurozone: Yet the Slow Recovery in Consumption Continued at the Beginning of the Year

However, the eurozone economy was holding up well in Q1 (like that of the United States according to the latest employment figures). Thus, retail sales in the eurozone increased by +0.3% in volume in February after being revised to stable in January (vs. -0.3% initially estimated). Overall, they remain on a slightly upward trajectory, even if they are weaker than in H2 2024, suggesting that consumption continued to gradually recover at the beginning of the year. At least before the recent shocks.

Xavier Chapard

Strategist