Europe reeling from US strategic shift

Link

Read Sebastian Sebastian PARIS HORVITZ's market analysis for February 17, 2025.

Summary

►Over the weekend, Europeans were plunged into confusion and consternation after various statements and announcements from the US authorities. First of all, President Trump initiated unilateral negotiations with Vladimir Putin, without the involvement of any European partner and leaving the Ukrainian authorities out of the equation. To the latter, he proposed an agreement that would oblige the country to cede half of its reserves of certain minerals on Ukrainian territory in exchange for US protection. This offer was rejected by V. Zelensky, the Ukrainian president. Furthermore, at the Munich Conference, which was to have dealt with security in Europe and the situation in Ukraine, JD Vance, the American Vice President, shocked the participants with his scathing criticism of European democracies, particularly Germany.

►These American statements and initiatives prompted E. Macron to call for an emergency meeting on security in Europe on Monday. At the same time, confusion grew over yesterday's remarks by the US President that the Ukrainian President would finally be involved in peace talks. But, still preserving his mercantilist approach, he called on Europeans to buy more American weapons, including to supply them to Ukraine to ensure its security.

►At this stage, it is difficult to clearly identify the real foreign doctrine that D. Trump, beyond his mercantilist objectives. What is certain is that his unilateral positions seem to be undermining decades of cooperation between allies. Such a radical change in US policy, if it holds, will surely prompt Europeans to adapt their international strategy.

►But the challenge will be considerable. Europe is deeply divided. So defining common economic strategies, including military spending, will not be easy. We'll soon see how markets react to what looks like a fairly radical shift in the global balance of power. But it has to be said that, so far, the markets have been little affected by D. Trump's announcements and about-turns.

►Already, the market had little reaction to the new document presented by President Trump last Thursday. The document aims to re-establish “fair foreign trade with our partners”. The document develops the concept of “reciprocity”, meaning that customs duties per product must be the same as those applied by the United States. But his administration extended the concept to all types of national tax that would be applied, including VAT, to American products.

►It's difficult to understand the coherence of these analyses and to know where all this is going to lead, but obviously this is likely to create a great deal of uncertainty, particularly in Europe, as the region is particularly targeted in the document. Decisions should be taken at the beginning of April, according to the indications given by D. Trump. These will surely have the greatest impact on the markets, if they are actually implemented.

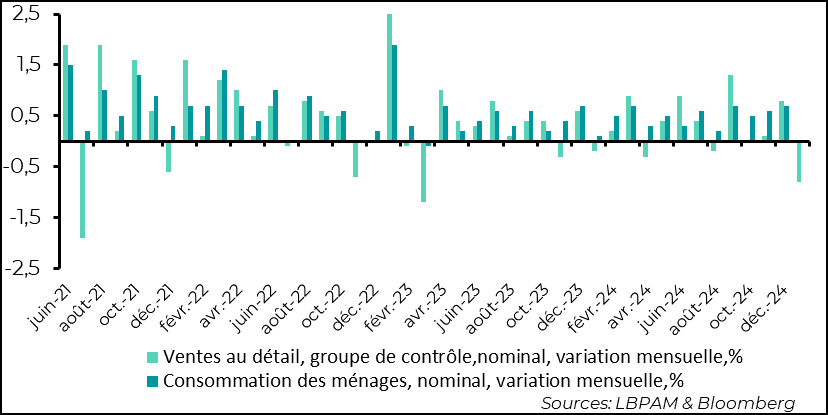

►Furthermore, economic data continued to disappoint in the United States. This was the case for retail sales, which contracted sharply in January. The so-called control group, which is used to calculate the consumption of goods within consumption, fell by 0.8% over the month. This was the sharpest fall since the beginning of 2023. The contraction in real terms is even greater than the rise in inflation over the month of January. This is partly explained by the effect of the California fires and adverse weather conditions, but it is also a correction after the strong figures at the end of the year. It also reflects a halt to the decline in the savings rate.

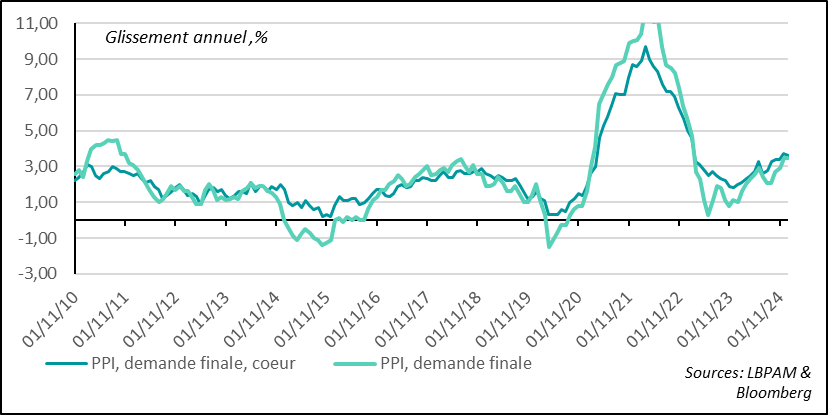

►At the same time, after January's very strong CPI inflation figures, producer prices gave a more moderate picture. In particular, the prices of certain goods and services which enter into the calculation of the consumption deflator, the PCE, the Fed's preferred measure, showed more restraint. This should translate into a more moderate evolution of the PCE than the CPI figures suggested. This is good news for the Fed, but does not alter its strategy of prudence.

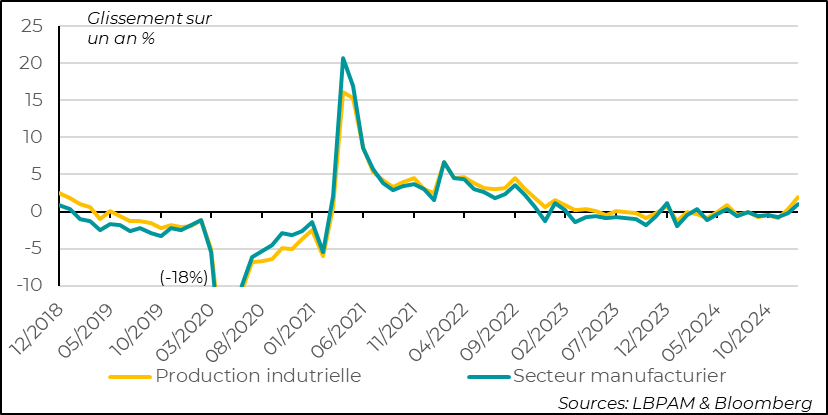

►U.S. industrial production rose sharply in January, mainly due to the cold snap that pushed up energy production. In fact, the manufacturing sector contracted, notably due to automakers, breaking the upward momentum of recent months. Nevertheless, year-on-year, manufacturing activity was well up on last year.

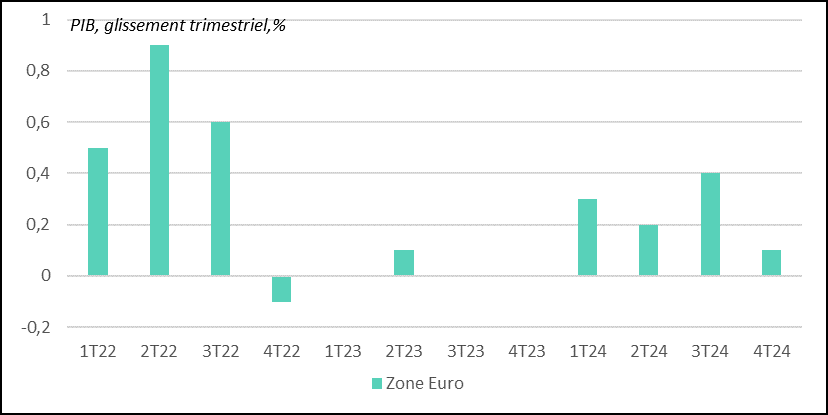

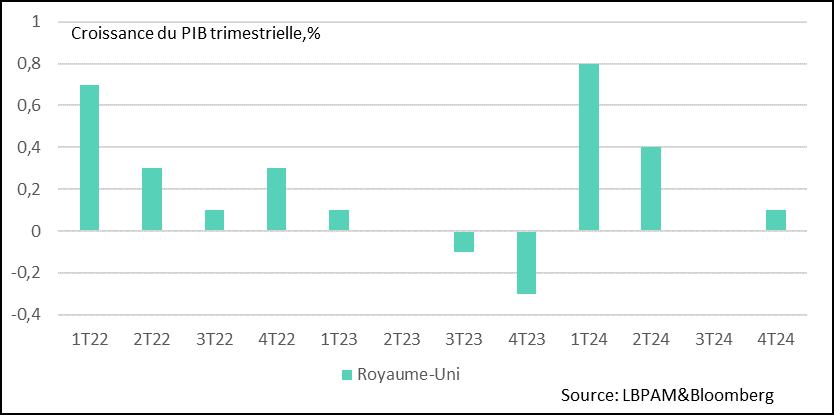

►In Europe, both the Eurozone and the UK saw their GDP grow in 4Q24. While contraction or stagnation was expected, both grew by 0.1%. In the UK, contraction was avoided thanks to stronger public spending, demonstrating the fragility of private demand.

To go deeper

Retail sales for January came in much weaker than expected, with a contraction of 0.9%. In fact, the control group, which includes goods used to estimate growth in consumption of goods, fell back sharply, by -0.8%, against expectations of a 0.3% increase. This monthly decline is the sharpest since the beginning of 2023.

Part of the decline in consumption over the month can be explained by unfavorable weather conditions and also the fires in California. However, they are also likely to reflect a correction of the strong rise in consumption at the end of 2024.

United States: Sharp contraction in retail sales in January, the sharpest since early 2023

This decline is also a sign of a moderation in consumer appetite, which had been reflected in a sharp fall in the savings rate.

In fact, in real terms, consumption of goods contracted much more in January, as inflation continued to rise during the month. This is consistent with our projection of a slight slowdown in GDP growth at the start of the year, with a consequent moderation in consumption. It should be remembered that consumption grew at an annualized rate of over 4% in 4Q24.

As for inflation, while CPI figures were much stronger than expected, producer price inflation (PPI) figures showed a more measured rise. In fact, the prices of goods and services listed in the PPI, and which are included in the calculation of the consumption deflator, the PCE, which is the Fed's preferred measure of inflation, moved more moderately than in the previous month, notably hospital services.

United States: Although producer prices continued to rise sharply in January, the components used to calculate PCE have moderated.

All in all, January's PCE figures, to be published at the end of the month, should show a much more moderate rise than CPI. We should see a slight deceleration in inflation, but not enough to change the Fed's strategy of patience. Indeed, the core CPI is still expected to rise by 2.6% year-on-year.

U.S. industrial production rose sharply in January (+0.5%), but this was essentially due to higher energy production as a result of the cold snap that hit the country. On the manufacturing side, the situation was quite different, with a 0.1% decline in activity, due in particular to a reduction in automobile production.

In part, this was also due to a correction of the previous month's sharp rise in manufacturing output. In fact, on a year-on-year basis, the sector showed an increase, reflecting the gradual upturn it has been experiencing for several months.

United States: Industrial output rises in January thanks to higher energy production, manufacturing output falls but rises over 12 months

At this stage, it's hard to say whether production will slow down again, particularly as demand may prove less buoyant, especially for cars, while subsidies for the purchase of electric vehicles are set to come to an end. We'll see in February's ISM if the upturn continues.

In Europe, business figures were rather disappointing at the end of the year. In fact, the first estimate of Eurozone GDP growth for 4Q24 was stagnant. The good news is that the Eurozone finally managed to post very slight growth in the final quarter of 2024, at 0.1%.

The euro zone finally managed to post a very slight increase in GDP in 4Q24

Thus, despite the contraction in France and Germany, the Zone, driven by the periphery but also by the Netherlands (which explains the upward revision of the Zone's GDP), still managed to post growth.

The beginning of the year should still be difficult in terms of growth, but continued monetary easing should give a little more impetus to activity, especially in the second half of the year, assuming very moderate measures on the part of the United States concerning foreign trade.

In the UK, while monthly GDP estimates seemed to be pointing towards a contraction of GDP at the end of the year, the estimate was a little more favorable, with a very slight expansion of 0.1%.

However, the contribution of private demand was still negative over the quarter, particularly that of consumption.

In fact, public spending was the main contributor to GDP growth at the end of the year.

United Kingdom: Despite fears, the country avoids GDP contraction in 4Q24, thanks mainly to public spending

We still expect the BoE to continue its monetary easing, albeit at a moderate pace given the unpleasant inflation surprises. Above all, as the central bank predicts, inflation dynamics will be unfavorable at the start of the year, notably due to tax hikes. This should help activity in the long term.

Nevertheless, the higher inflation outlook for the months ahead could further limit consumption, affecting growth.

At the same time, this should ultimately help to ease the pressure on core inflation and give the BoE more room to maneuver.

It also remains to be seen what the Labour government will do about the trajectory of public finances. Will the new pro-growth strategy have to be scaled back a little in order to further adjust spending? The market is still very much focused on the need to consolidate the deficit path in order to relieve pressure on long rates. This is one of the keys to determining the country's economic trajectory over the coming quarters.

Sebastian PARIS HORVITZ

Head of Research